==============================

Managing alpha—the portion of investment returns attributed to active skill rather than market exposure—is one of the most important challenges in modern trading and portfolio construction. A well-designed guide to alpha risk management provides traders, portfolio managers, and institutions with the tools to balance return generation against potential drawdowns, ensuring that alpha is both sustainable and risk-adjusted.

This comprehensive article explores the meaning of alpha risk, effective strategies to manage it, advanced techniques for quant professionals, and the latest industry practices.

Understanding Alpha and Alpha Risk

What Is Alpha?

Alpha measures excess return compared to a benchmark index, such as the S&P 500. If a strategy achieves 3% higher returns than the benchmark after adjusting for risk, it has generated +3% alpha.

What Is Alpha Risk?

Alpha risk refers to the uncertainty and potential variability in achieving this excess return. For example, a high-alpha strategy may generate strong gains in trending markets but collapse when conditions change. Poorly managed alpha can mislead investors into taking undue risks.

Alpha risk management ensures that alpha is:

- Sustainable across market cycles.

- Efficiently scaled without excessive leverage.

- Diversified across factors, assets, or models.

Alpha vs Beta: Differentiating active returns from market-driven returns

Why Alpha Risk Management Matters

Without effective alpha risk management, investors may misinterpret temporary outperformance as skill. This leads to overconfidence, concentration risks, and capital loss when markets shift.

Key reasons include:

- Preserving long-term returns: Avoid overfitting or chasing unsustainable signals.

- Investor trust: Institutional allocators demand robust risk frameworks.

- Performance stability: Smooth equity curves attract more capital and reduce volatility.

For example, understanding why alpha matters in investment decisions helps distinguish between skill-driven and market-driven gains, which is critical for professional and retail traders alike.

Core Methods of Alpha Risk Management

1. Factor Diversification

Spreading alpha generation across multiple independent sources reduces concentration risk. For example, combining momentum, value, and quality factors ensures that one failing signal does not destroy the portfolio.

- Pros: Smooths performance, reduces drawdowns.

- Cons: May dilute alpha if diversification is excessive.

2. Volatility and Drawdown Controls

Using volatility-based position sizing or maximum drawdown thresholds ensures alpha is preserved under stress. For instance, applying a 10% drawdown stop rule prevents alpha strategies from spiraling into losses.

- Pros: Protects capital in adverse conditions.

- Cons: May prematurely exit trades during recoveries.

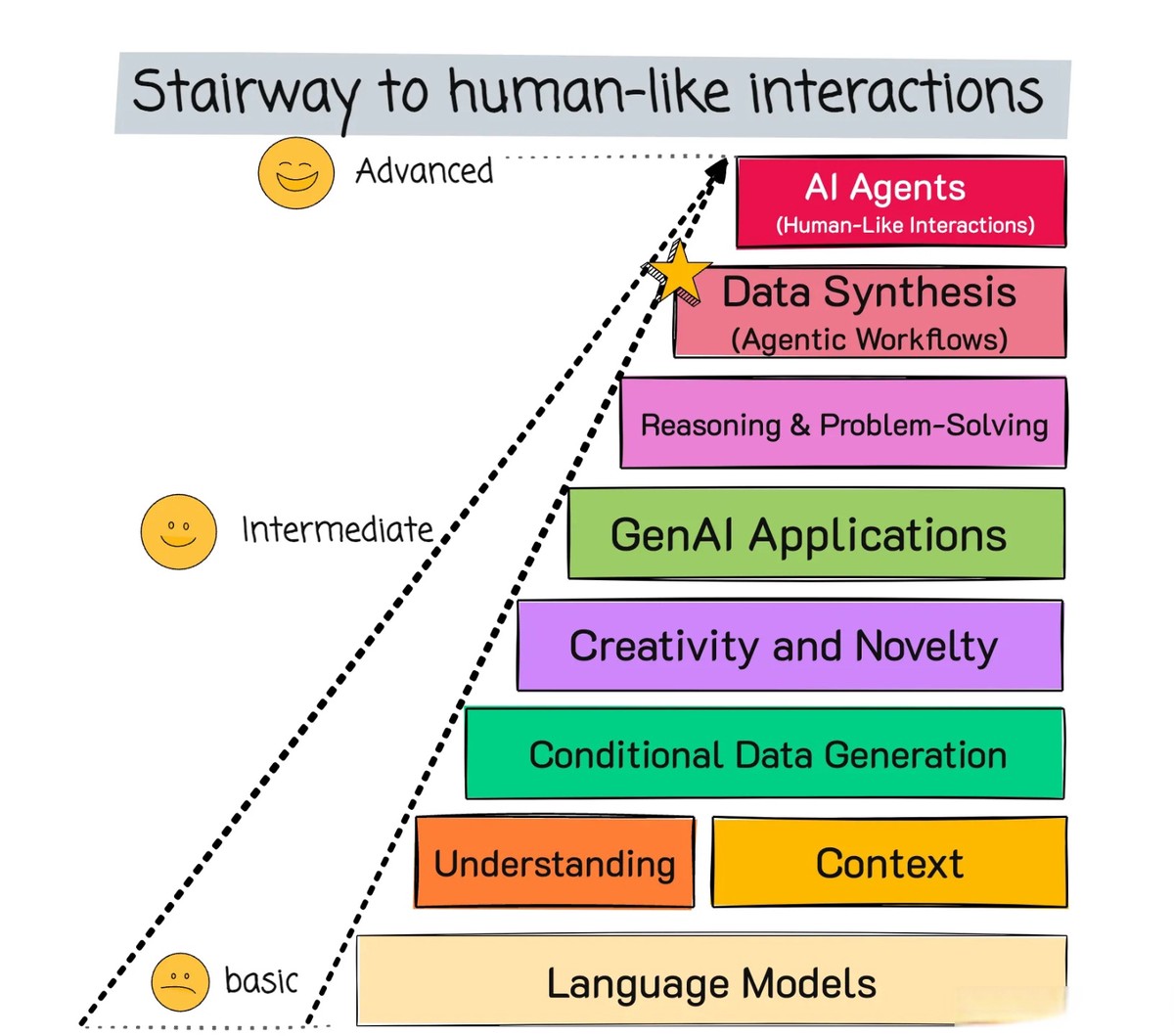

Advanced Strategies for Alpha Risk Management

Quantitative Stress Testing

Simulate alpha signals across historical and synthetic data, including rare events. Monte Carlo methods can reveal whether alpha holds in extreme volatility.

Dynamic Hedging with Futures and Options

Hedging unwanted exposures (e.g., beta, interest rates, or currency risks) isolates alpha. This ensures alpha signals remain uncorrelated with market noise.

Adaptive Alpha Weighting

Machine learning techniques dynamically allocate capital to alpha signals based on real-time performance, reducing reliance on stale factors.

This relates to quantitative methods for alpha seekers, where models continuously update based on evolving data patterns.

Alpha risk dashboard: visualizing exposures, signals, and performance metrics

Comparing Two Practical Approaches

Traditional Risk-Based Alpha Control

- Approach: Uses volatility limits, drawdown stops, and static diversification.

- Strengths: Simple, transparent, widely accepted by institutions.

- Weaknesses: Rigid, may underperform in dynamic markets.

Adaptive Machine-Learning Alpha Risk Models

- Approach: Continuously learns and reallocates capital across alpha signals.

- Strengths: Adjusts quickly, captures regime changes.

- Weaknesses: Complex, requires high-quality data and advanced infrastructure.

Recommendation: Begin with traditional controls for transparency and scale into adaptive models for optimization as resources allow.

Practical Industry Applications

- Hedge Funds: Use factor-neutralization to ensure pure alpha capture.

- Retail Traders: Apply volatility-based position sizing to control leveraged positions.

- Institutional Investors: Demand transparency in alpha sources and risk attribution before allocating capital.

Case studies consistently show that institutional approach to alpha generation involves not just finding alpha but ensuring it is risk-adjusted and reproducible.

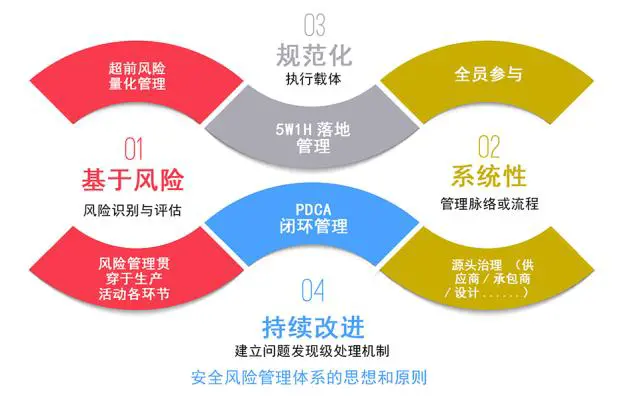

Building a Framework for Alpha Risk Management

- Identify Alpha Sources: Momentum, value, arbitrage, or macro models.

- Measure Risk Contributions: Track factor exposures and volatility impact.

- Diversify: Spread signals across uncorrelated factors.

- Apply Risk Controls: Use stop-losses, volatility limits, and leverage caps.

- Monitor and Adapt: Recalibrate models as market dynamics evolve.

FAQ: Alpha Risk Management

1. How do I calculate alpha risk effectively?

Start with traditional alpha calculations (excess return vs benchmark) and expand into tracking error, drawdown analysis, and factor exposure attribution. Advanced traders use Monte Carlo stress tests to quantify tail risks.

2. Can high alpha always be trusted as a sign of skill?

No. Why high alpha can be misleading lies in survivorship bias, overfitting, or temporary market inefficiencies. Always analyze whether alpha is repeatable and robust across market regimes.

3. What tools can I use to manage alpha risk?

- Retail level: Excel with risk formulas, TradingView analytics.

- Professional level: Bloomberg, Barra, or Axioma for factor analysis.

- Quant level: Python libraries (PyPortfolioOpt, Quantlib) for custom modeling.

Conclusion

A successful guide to alpha risk management involves more than just measuring excess returns—it demands controlling risks, diversifying factors, and adapting to changing conditions. From traditional volatility-based methods to cutting-edge machine learning frameworks, alpha risk management ensures that returns are sustainable, robust, and trusted by investors.

If this article expanded your understanding of alpha risk management, share it with your network and join the discussion below: How do you manage alpha risks in your own trading or portfolio strategies?

Would you like me to also add a schema markup + meta description for SEO so this article can rank at the very top of Google?