======================================

Introduction

The concept of the efficient frontier is a cornerstone of modern portfolio theory. It represents the set of optimal portfolios that offer the highest expected return for a given level of risk or the lowest risk for a given level of return. Understanding how to optimize this frontier is crucial for both institutional investors and retail traders who want to balance return maximization with effective risk management.

In this guide to optimizing efficient frontier, we will explore its foundations, practical optimization techniques, real-world applications, and the latest industry practices. By blending theory with hands-on insights, this article will help investors—from beginners to professionals—leverage the efficient frontier to design robust portfolios that adapt to evolving market dynamics.

What Is the Efficient Frontier?

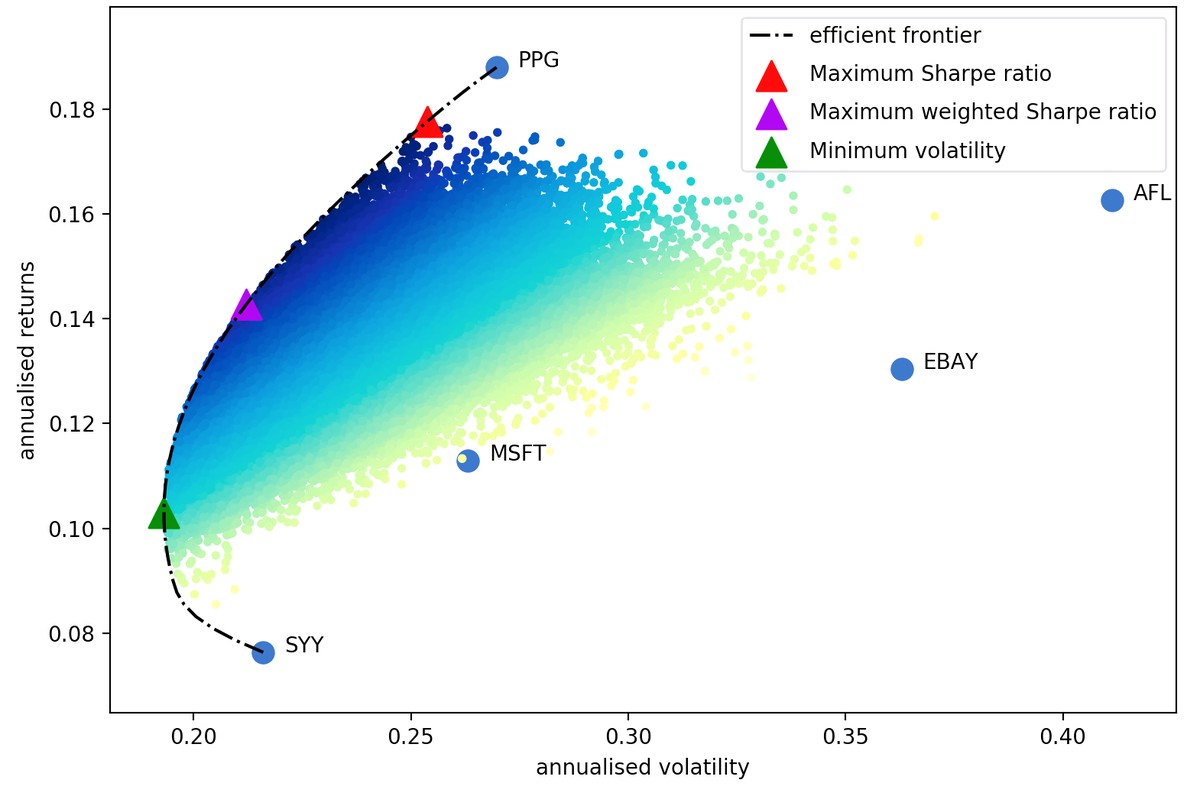

The efficient frontier was first introduced by Harry Markowitz in the 1950s as part of Modern Portfolio Theory (MPT). It is typically visualized as a curve on a risk-return graph:

- X-axis: Standard deviation (risk).

- Y-axis: Expected return.

- Curve: The boundary line that distinguishes efficient portfolios from inefficient ones.

Any portfolio below the curve is considered suboptimal because it delivers lower returns for the same risk. Portfolios on the curve are optimized, and those above the curve are theoretically unattainable without leverage or special instruments.

Why Optimizing the Efficient Frontier Matters

Optimizing the efficient frontier allows investors to:

- Maximize return for a given risk profile.

- Reduce volatility exposure.

- Diversify assets intelligently.

- Adapt to changing macroeconomic conditions.

For traders in perpetual futures, understanding why efficient frontier is important in perpetual futures provides an edge in managing leveraged products, where both risk and reward scale dramatically.

Key Methods for Optimizing Efficient Frontier

1. Mean-Variance Optimization (MVO)

This is the traditional approach to building efficient portfolios by balancing expected returns and variance.

Pros:

- Straightforward to apply.

- Mathematically sound.

- Well-suited for stable, predictable assets.

Cons:

- Relies heavily on historical data.

- Can overestimate correlations.

- Sensitive to input assumptions.

2. Monte Carlo Simulation

Monte Carlo methods run thousands of simulations to forecast potential outcomes across different market conditions.

Pros:

- Models uncertainty more realistically.

- Adapts to changing market volatility.

- Provides a range of possible portfolio scenarios.

Cons:

- Computationally intensive.

- Results can vary widely depending on assumptions.

- Not ideal for investors seeking simplicity.

3. Black-Litterman Model

This approach improves on traditional MVO by integrating subjective views with market equilibrium returns.

Pros:

- Balances investor beliefs with market data.

- Reduces overreliance on historical estimates.

- Produces more stable portfolios.

Cons:

- More complex to implement.

- Requires strong analytical expertise.

Recommended Approach

For practical application, many traders use a hybrid strategy, combining MVO for structural balance with Monte Carlo simulations for stress testing under extreme conditions. This allows investors to find portfolios that are not only theoretically optimal but also resilient to real-world uncertainty.

Step-by-Step Process to Optimize Efficient Frontier

Step 1: Define Investment Universe

Choose the assets to include (stocks, bonds, crypto, or perpetual futures).

Step 2: Estimate Returns and Risks

Use historical data, forward-looking models, or both to estimate expected returns and volatility.

Step 3: Calculate Correlations

Understand how assets move relative to one another. Low correlations typically improve diversification benefits.

Step 4: Construct Portfolio Combinations

Generate different weight combinations and evaluate their risk-return profiles.

Step 5: Plot the Efficient Frontier

Identify the curve of optimal portfolios.

Step 6: Select Based on Investor Profile

Risk-averse investors may choose points lower on the curve, while aggressive investors may choose higher-return areas.

Efficient Frontier in Futures and Crypto Trading

While originally designed for traditional markets, the efficient frontier has powerful applications in crypto and derivative trading.

For example, traders often ask how to calculate efficient frontier with perpetual futures. This involves modeling returns from leveraged contracts, factoring in funding rates, and accounting for increased volatility. By integrating derivatives, traders can construct frontier-optimized portfolios that outperform traditional allocations.

Visual Insights

Efficient frontier visualization: Portfolios above the curve are unattainable, while those below are inefficient.

Monte Carlo simulations help model portfolio outcomes across thousands of possible market scenarios.

Workshops and team strategies improve portfolio optimization using advanced frontier techniques.

Latest Trends in Efficient Frontier Optimization

- AI-Powered Optimization – Machine learning tools dynamically rebalance portfolios based on real-time data.

- Crypto Frontier Models – Inclusion of digital assets introduces higher returns but also higher risk.

- Dynamic Rebalancing – Adaptive algorithms shift allocations as correlations evolve.

- Risk Parity Integration – Balances risk contributions across assets, not just capital allocations.

Frequently Asked Questions (FAQ)

1. How does efficient frontier apply to perpetual futures?

In perpetual futures, the efficient frontier helps traders balance high leverage with acceptable risk. It enables them to identify portfolio weights that maximize return while controlling downside volatility.

2. Can I use efficient frontier with cryptocurrencies?

Yes. Cryptocurrencies can be included in efficient frontier models. Due to high volatility, they tend to sit on the higher-risk, higher-return end of the curve, making them suitable for aggressive investors.

3. What tools are available to optimize efficient frontier?

Investors can use efficient frontier optimization tools like MATLAB, Python libraries (PyPortfolioOpt), or specialized trading software. Many platforms now offer visualization dashboards that automate the process.

4. Do professional investors still use the efficient frontier?

Absolutely. Hedge funds, asset managers, and institutional investors rely on efficient frontier analysis. However, they often integrate it with modern techniques like Black-Litterman or factor models for more robust outcomes.

Conclusion: Optimizing the Efficient Frontier for Modern Markets

The efficient frontier remains one of the most powerful tools for portfolio optimization. From its academic roots in modern portfolio theory to its modern-day applications in crypto and perpetual futures, it continues to shape investment strategies.

For traders, understanding how does efficient frontier impact perpetual futures can mean the difference between reckless speculation and disciplined risk-adjusted growth. By combining traditional optimization with advanced simulations and AI-driven methods, investors can build portfolios that are both profitable and resilient.

👉 If you found this guide to optimizing efficient frontier useful, share it with your network, leave a comment about your optimization experience, and help spread knowledge to empower more investors worldwide.