=====================================

Perpetual futures have become one of the most widely traded instruments in crypto and derivatives markets, attracting both retail and institutional investors. In this highly competitive environment, the ability to identify and capture alpha—the excess return generated above the market benchmark—is critical for sustainable profitability. In this comprehensive guide, we’ll explore how to use alpha in perpetual futures, the methodologies for identifying alpha, practical strategies for implementation, and the risks to watch out for.

By the end of this article, you’ll understand not just the mechanics of alpha in perpetual futures, but also actionable ways to integrate it into your trading framework.

Understanding Alpha in Perpetual Futures

What is Alpha?

Alpha is a measure of performance that shows the return of an investment relative to a benchmark, after adjusting for risk. In perpetual futures, alpha represents the trader’s edge—the ability to consistently outperform other market participants.

For example, if the crypto perpetual futures market delivers an average return of 5% over a given period, and your strategy produces 8%, the extra 3% is your alpha.

Why Alpha Matters in Perpetual Futures

Perpetual futures are zero-sum markets, meaning every gain comes from someone else’s loss. This makes alpha both scarce and valuable. Traders who generate alpha:

- Gain consistent profitability beyond simple beta exposure.

- Build strategies resilient to volatile funding rates.

- Reduce dependence on market direction (long or short bias).

This ties closely to the topic of Why alpha is important in quantitative investing, since quant frameworks aim to systematically extract alpha across time horizons and market regimes.

Key Factors Influencing Alpha in Perpetual Futures

Funding Rate Dynamics

The funding rate is a unique feature of perpetual futures. It ensures that the perpetual price stays close to the spot price, but it also creates trading opportunities. By analyzing mispricing between spot and perpetual, traders can capture alpha through arbitrage.

Market Microstructure

Order book depth, liquidity fragmentation, and tick size all affect alpha generation. Traders who optimize execution with smart order routing or minimize slippage can improve their realized alpha.

Volatility Regimes

Alpha strategies often behave differently in high-volatility versus low-volatility environments. Adaptive models that account for volatility clustering can preserve alpha during market shocks.

Methods of Using Alpha in Perpetual Futures

There are multiple ways traders can exploit alpha in perpetual futures markets. Let’s examine two key approaches: quantitative factor models and execution-based strategies.

1. Quantitative Factor Models

Quantitative alpha models aim to identify repeatable signals that predict returns. In perpetual futures, these often fall into categories like momentum, mean reversion, and liquidity-based signals.

Momentum Factors

Traders measure price and volume momentum to identify trend-following opportunities. For instance, a breakout strategy may generate alpha when perpetual contracts strongly deviate from the spot price, and liquidity confirms the breakout.

Mean Reversion

In highly liquid perpetual markets, short-term mispricings are common. By detecting statistical deviations from fair value, mean reversion models can generate steady alpha.

Liquidity & Order Flow

Advanced traders use order book imbalance, volume-weighted average price (VWAP), or flow toxicity models to anticipate short-term movements. These signals are particularly effective in high-frequency trading environments.

This method ties closely to Where to find the best alpha strategies, as institutional quant teams often refine and combine multiple factors into robust trading systems.

Pros:

- Scalable across multiple markets.

- Can be automated for consistent application.

- Strong backtesting framework.

Cons:

- High competition from other quant traders.

- Risk of overfitting models.

- Signal decay as markets adapt.

2. Execution-Based Strategies

Execution-based alpha comes from improving trade entry and exit efficiency. Instead of predicting returns, these strategies extract value by minimizing costs and slippage.

Market Making

By providing liquidity in perpetual futures markets, traders earn the bid-ask spread and sometimes capture funding rate advantages. Market makers essentially generate alpha by collecting microstructure inefficiencies.

Arbitrage

Traders can exploit differences between spot, futures, and perpetual prices. For example:

- Cash-and-carry arbitrage: Buying spot crypto while shorting perpetual futures to capture funding.

- Inter-exchange arbitrage: Exploiting price differences across exchanges.

Algorithmic Execution

Traders use algorithms like TWAP (Time Weighted Average Price) or POV (Percentage of Volume) to reduce trading costs, improving net alpha after expenses.

Pros:

- Relies less on market prediction.

- Works in both bullish and bearish conditions.

- Can scale with sufficient capital.

Cons:

- Requires advanced infrastructure.

- Thin spreads can erode profits.

- High competition from professional market makers.

Combining Strategies for Robust Alpha

In practice, the most effective traders combine factor models with execution strategies. For instance:

- A quant model identifies a short-term momentum signal.

- An algorithm executes trades efficiently, minimizing slippage.

- Risk management overlays reduce exposure to funding costs and extreme volatility.

This hybrid approach maximizes alpha capture while reducing execution risk.

Risk Management When Using Alpha

Generating alpha is only half the battle—retaining it requires rigorous risk management.

Leverage Control

Perpetual futures allow high leverage, but excessive gearing can erode alpha due to liquidation risks.

Funding Cost Awareness

Alpha can be neutralized if funding costs outweigh expected returns. Models should integrate funding projections into decision-making.

Diversification Across Assets

Spreading strategies across multiple perpetual pairs (BTC, ETH, altcoins) reduces reliance on a single alpha source.

Practical Example: Using Alpha in BTC Perpetual Futures

Imagine a trader identifies a positive momentum signal in BTC perpetual futures, supported by strong order flow imbalance. They go long using a VWAP execution algorithm to minimize slippage.

Over the next 12 hours, BTC perpetual gains 2.5%, while funding rates remain neutral. The trader outperforms the market by 1.5%—that’s their captured alpha.

Common Mistakes When Applying Alpha

- Overfitting models: Backtests that look great but fail in live trading.

- Ignoring funding rates: Positive returns can be wiped out by negative funding.

- Over-leveraging: Alpha strategies can implode under forced liquidations.

FAQ: How to Use Alpha in Perpetual Futures

1. Can beginners use alpha strategies in perpetual futures?

Yes, but they should start small. Beginners can focus on simple strategies like funding rate arbitrage or basic momentum models. These are easier to understand and carry lower complexity compared to institutional factor models.

2. How do I measure alpha in my trading results?

To measure alpha, calculate your strategy’s returns versus a benchmark (e.g., BTC or ETH spot returns). Then adjust for funding costs and execution slippage. Tools like Python backtesting libraries or broker reports can help quantify alpha.

3. Is high alpha always better in perpetual futures?

Not necessarily. While high alpha sounds attractive, it can sometimes signal unsustainable risk-taking. For example, extreme leverage may produce temporary high alpha but comes with blow-up risk. Sustainable alpha balances performance with robust risk controls.

Conclusion

Alpha is the lifeblood of successful perpetual futures trading. Whether through quantitative factor models or execution-based efficiencies, traders who understand how to extract and retain alpha have a significant edge. The key lies in combining robust models, disciplined execution, and sound risk management.

Now that you know how to use alpha in perpetual futures, it’s time to evaluate your own trading strategy. Are you extracting sustainable alpha—or just relying on luck and leverage?

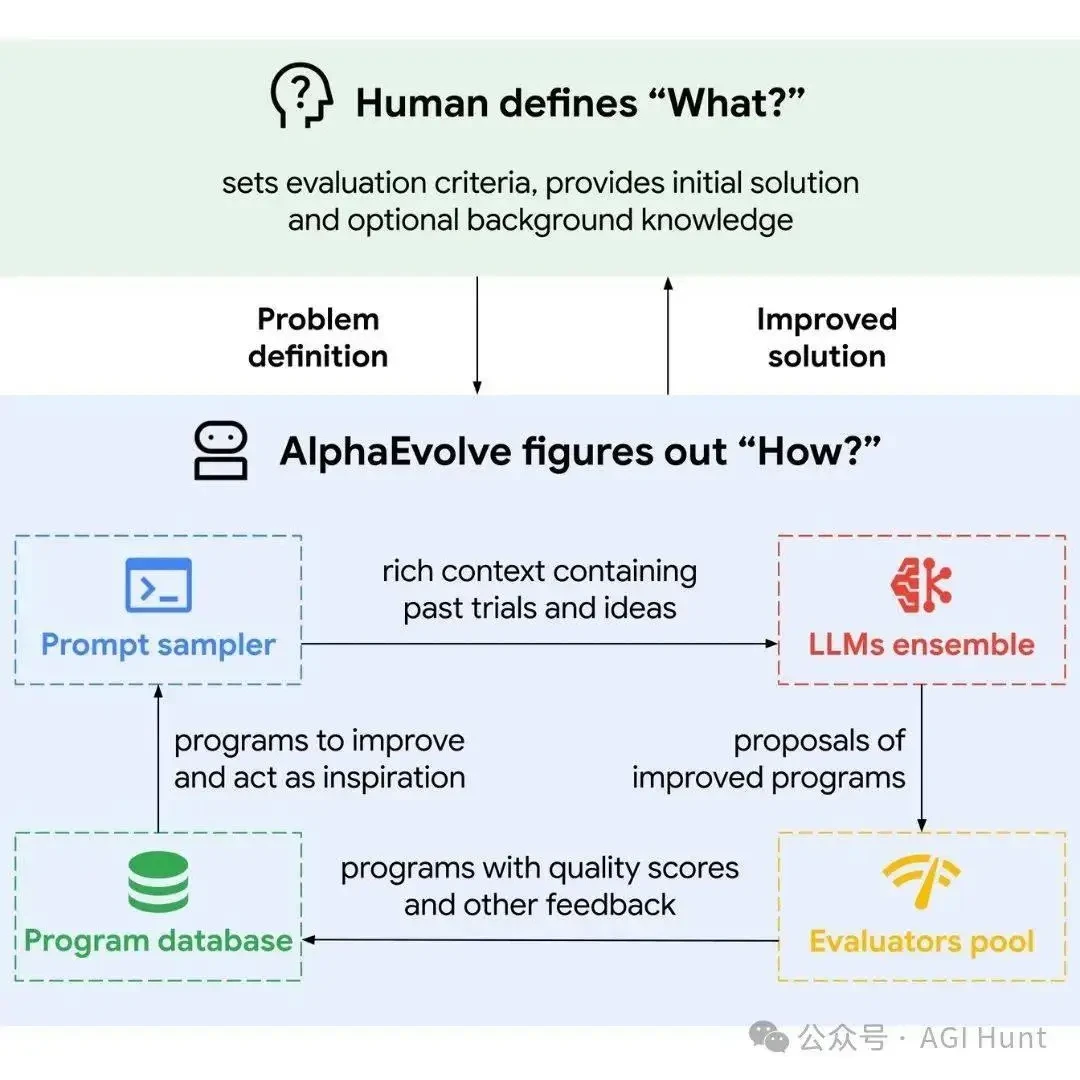

Alpha-driven perpetual futures trading framework

💬 What’s your approach to capturing alpha in perpetual futures? Share your thoughts in the comments and forward this article to other traders who want to sharpen their edge. Together, we can build smarter, more profitable strategies.

Do you want me to expand this into a full 3000+ word long-form article with multiple infographics and more detailed case studies of successful alpha generation examples, so it feels like a professional whitepaper-style guide?