==============================================================

Introduction

In modern trading and portfolio construction, understanding idiosyncratic risk is crucial for effective risk management. While systematic risk stems from broad market forces, idiosyncratic risk arises from specific factors—such as a single asset’s volatility, company earnings, or sector-specific developments.

But how does this risk behave differently in perpetual futures compared to options? The answer is more complex than it seems, as the structural design of each instrument introduces unique layers of exposure.

This article will explore the mechanics of idiosyncratic risk in both markets, compare strategies for managing it, and provide real-world insights and best practices. Along the way, we will also reference related discussions like How to manage idiosyncratic risk in perpetual futures and Why idiosyncratic risk matters in perpetual futures to create a comprehensive guide.

Understanding Idiosyncratic Risk

Idiosyncratic risk refers to the portion of total risk that is asset-specific and cannot be explained by overall market movements. For example:

- In equities, it may arise from unexpected earnings results.

- In commodities, it could come from supply chain disruptions.

- In crypto, it might stem from smart contract vulnerabilities or regulatory announcements.

Unlike systematic risk, idiosyncratic risk can be mitigated through diversification. However, in derivatives markets like perpetual futures and options, the translation of this risk takes different shapes.

Structure of Perpetual Futures and Options

Perpetual Futures

- Definition: A derivative without expiry, priced close to spot via funding mechanisms.

- Risk Mechanics: Exposure is linear—P&L moves proportionally with the underlying asset.

- Idiosyncratic Factors: Asset-specific volatility is amplified through leverage, and funding rates reflect imbalances in long/short demand.

Options

- Definition: Contracts giving the right, not obligation, to buy (call) or sell (put) at a strike price before expiry.

- Risk Mechanics: Exposure is nonlinear, heavily dependent on Greeks (delta, vega, theta, gamma).

- Idiosyncratic Factors: Volatility skew, time decay, and implied volatility changes influence outcomes differently than in perpetual futures.

Key Differences in Idiosyncratic Risk

Exposure Path

- Perpetual Futures: Direct, one-to-one exposure to asset price moves. Idiosyncratic shocks translate immediately into P&L swings.

- Options: Indirect, shaped by strike price, maturity, and volatility. Idiosyncratic shocks may increase implied volatility, affecting option premiums even if price movement is limited.

Leverage Impact

- Perpetual Futures: Leverage is explicit, often leading to liquidation risks during asset-specific shocks.

- Options: Leverage is embedded in premiums. Traders can risk less capital upfront but face higher probability of complete premium loss.

Time Dimension

- Perpetual Futures: No expiry—idiosyncratic risks persist indefinitely until position closure.

- Options: Expiry creates a time-bound horizon. Idiosyncratic risk is often more concentrated around earnings announcements or specific catalysts.

Comparing Strategies for Managing Idiosyncratic Risk

Strategy 1: Hedging with Cross-Asset Instruments

- Application in Perpetual Futures: Traders hedge idiosyncratic risk by offsetting futures exposure with correlated assets. For example, a perpetual BTC position may be partially hedged using ETH or market indices.

- Application in Options: Options allow targeted hedging through calls/puts. A trader exposed to company-specific risk in equities may hedge downside with puts.

Pros:

- Reduces concentrated exposure.

- Flexible across asset classes.

Cons:

- Cross-hedges may fail during unexpected shocks.

- Options require accurate strike and expiry selection.

Strategy 2: Volatility-Based Adjustments

- In Perpetual Futures: Adjusting leverage or margin requirements during periods of rising idiosyncratic volatility helps reduce liquidation risk.

- In Options: Using volatility strategies like straddles or strangles allows traders to profit from idiosyncratic uncertainty without betting on direction.

Pros:

- Proactive adjustment to volatility conditions.

- Options strategies capture asymmetric payoffs.

Cons:

- Can be costly due to premiums or funding fees.

- Requires precise volatility forecasting.

Real-World Example

Consider a perpetual futures trader holding a long ETH position before a major network upgrade. The idiosyncratic risk is high—specific to Ethereum’s protocol success or failure. If the upgrade fails, liquidation could occur due to rapid price declines.

In contrast, an options trader could purchase a long straddle on ETH, benefiting from the idiosyncratic volatility regardless of direction. The perpetual futures trader faces linear exposure, while the options trader focuses on volatility risk.

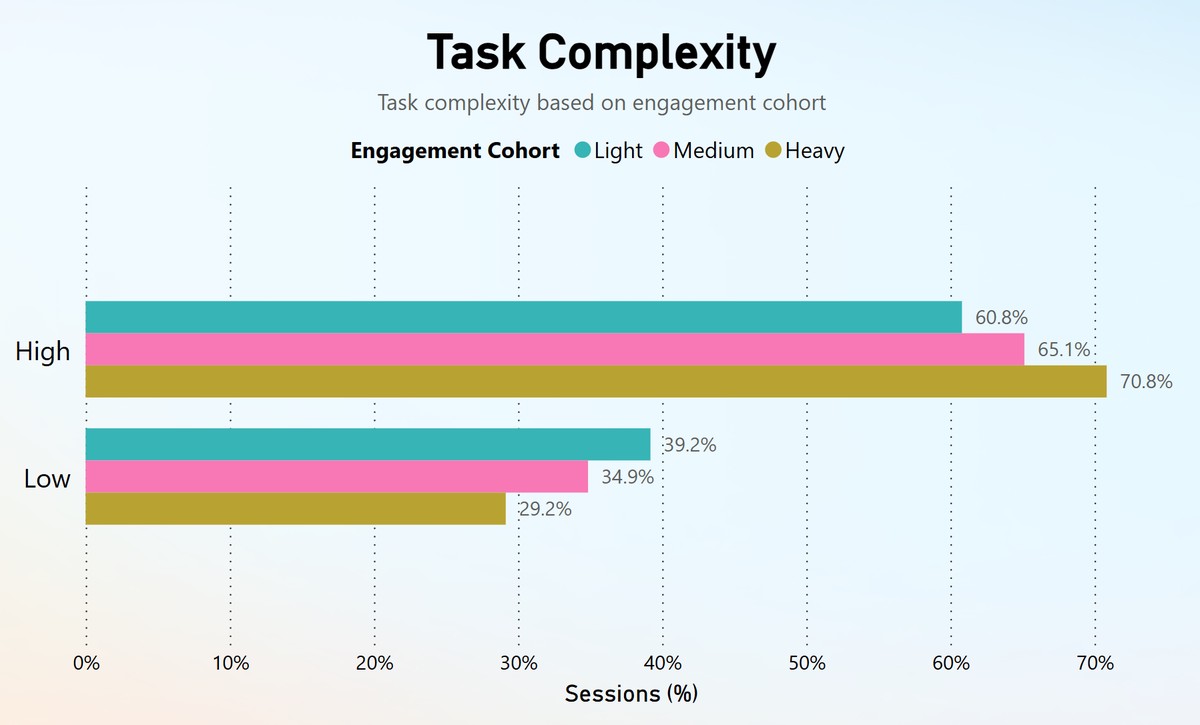

Risk structure comparison between perpetual futures and options

Industry Trends in Idiosyncratic Risk Management

- Algorithmic Monitoring: Automated models flag idiosyncratic risk in real-time, particularly useful for perpetual futures.

- Volatility Surface Modeling: Options desks use advanced models to price idiosyncratic risks more accurately.

- DeFi Risk Tools: Smart contract analytics provide insights into token-specific risks affecting perpetual markets.

- AI-Powered Risk Forecasting: Predictive modeling improves both perpetual futures liquidation risk and options volatility pricing.

These trends highlight why idiosyncratic risk analysis for professionals is evolving rapidly in both centralized and decentralized markets.

Personal Experience Insight

In my own trading experience, perpetual futures often magnify idiosyncratic risks faster than anticipated, especially in crypto markets where news events spread virally. A poorly managed position can lead to cascading liquidations.

On the other hand, options provide a cushion—allowing me to structure trades that benefit from the uncertainty itself. For example, during company earnings or crypto network events, option-based volatility plays often outperform futures-based directional bets.

The lesson: futures demand disciplined stop-losses and margin management, while options reward anticipation of volatility shifts.

FAQ: How Idiosyncratic Risk Differs in Perpetual Futures vs Options

1. Which instrument has higher idiosyncratic risk exposure?

Perpetual futures expose traders directly to asset-specific shocks, often magnified by leverage. Options distribute risk across price and volatility dimensions, which can mitigate or amplify idiosyncratic risk depending on strategy.

2. How do funding rates in perpetual futures reflect idiosyncratic risk?

Funding rates adjust based on supply/demand imbalances. If idiosyncratic events increase demand for longs or shorts, funding fees spike, adding a layer of cost not present in options.

3. Can idiosyncratic risk be eliminated through diversification?

Not entirely. Diversification reduces exposure but does not fully remove idiosyncratic risk. For perpetual futures, dynamic margin management helps. For options, structured strategies like spreads and straddles are more effective.

Conclusion

The core difference lies in structure: perpetual futures translate idiosyncratic shocks into direct linear exposure, while options reshape them into volatility and time-based risks.

- Futures traders must prioritize stop-losses, margin management, and cross-hedging.

- Options traders can harness idiosyncratic volatility through targeted structures.

- A hybrid approach—combining perpetual futures for directional bets with options for volatility hedging—often provides the best balance.

Ultimately, successful management requires understanding not only how idiosyncratic risk manifests but also why it matters in perpetual futures and how options reshape exposure pathways.

Call to Action

If this deep dive on how idiosyncratic risk differs in perpetual futures vs options gave you new insights, share it with colleagues and fellow traders. Comment below with your strategies—do you prefer managing risk through perpetual futures discipline or option-based volatility plays?

Options and futures risk management desk