========================================

Idiosyncratic risk—the type of risk unique to a specific asset, company, or investment—is often overlooked in favor of broader market risks. Yet for serious traders and institutional investors, ignoring it can lead to unexpected portfolio losses. Developing idiosyncratic risk mitigation strategies is therefore essential for anyone seeking to build resilient and profitable portfolios.

In this article, we’ll explore the fundamentals of idiosyncratic risk, compare different mitigation approaches, share practical insights, and integrate the latest industry practices. By the end, you’ll have a comprehensive understanding of how to protect your portfolio from asset-specific volatility while maintaining growth opportunities.

Understanding Idiosyncratic Risk

What Is Idiosyncratic Risk?

Idiosyncratic risk—also known as unsystematic risk—refers to the potential downside linked to an individual company, industry, or security. Unlike systematic risk (which impacts the entire market), idiosyncratic risk arises from company-specific events such as:

- Poor management decisions

- Regulatory changes

- Earnings surprises

- Supply chain disruptions

- Product recalls or failures

Why It Matters

While investors cannot eliminate systematic risk, they can manage and mitigate idiosyncratic risk. Doing so improves portfolio stability and protects against sharp declines tied to isolated events. This is particularly relevant when trading perpetual futures, where leverage magnifies exposure to asset-specific events.

Diversification is the first line of defense against idiosyncratic risk.

Key Principles of Idiosyncratic Risk Mitigation

1. Diversification Across Assets

Holding multiple uncorrelated securities spreads risk. If one company suffers a major setback, gains in other positions may offset the losses.

2. Hedging With Derivatives

Options, futures, and swaps allow investors to hedge against unexpected price swings tied to specific assets.

3. Dynamic Risk Assessment

Continuous monitoring of company news, sector developments, and geopolitical events ensures risk is proactively addressed rather than reactively managed.

4. Position Sizing

Adjusting exposure based on risk tolerance prevents single positions from jeopardizing the entire portfolio.

Two Core Mitigation Strategies for Experts

Strategy 1: Diversification Across Sectors and Geographies

The classic approach to mitigating idiosyncratic risk is diversification. By spreading capital across multiple industries and markets, traders reduce exposure to isolated shocks.

Advantages:

- Simple and widely accessible.

- Reduces exposure to single-company failures.

- Works well in long-term investment strategies.

- Simple and widely accessible.

Drawbacks:

- May dilute returns if over-diversified.

- Less effective in highly correlated markets.

- May dilute returns if over-diversified.

Strategy 2: Hedging With Perpetual Futures and Options

Active traders often hedge against idiosyncratic risk using derivatives. For example, if holding stock in a tech company, a trader may short its perpetual futures contract to hedge against unexpected declines.

Advantages:

- Provides direct, targeted protection.

- Can be customized to match risk exposure.

- Flexible across different asset classes.

- Provides direct, targeted protection.

Drawbacks:

- Costs associated with maintaining hedges.

- Requires deep expertise in derivative instruments.

- Costs associated with maintaining hedges.

Recommended Strategy

A hybrid approach—diversification combined with selective hedging—provides the most robust defense. Diversification reduces broad exposure, while derivatives act as precision tools for mitigating risks that cannot be diversified away.

Hedging with futures and options provides precision risk protection.

Modern Trends in Idiosyncratic Risk Mitigation

1. Technology-Driven Monitoring

AI-powered analytics platforms can track news, earnings, and regulatory events in real time, alerting investors to potential risks before they materialize.

2. Factor-Based Models

Institutional investors increasingly rely on factor models to separate systematic and idiosyncratic risk, enabling more precise mitigation strategies.

3. Smart Beta Portfolios

These strategies weight portfolios not just by market capitalization but by risk-adjusted measures, offering improved resilience to idiosyncratic shocks.

Where Is Idiosyncratic Risk Most Evident?

Idiosyncratic risk is most pronounced in:

- Small-cap stocks with less liquidity and transparency.

- Emerging markets where governance risks are higher.

- Highly leveraged companies vulnerable to earnings surprises.

This ties directly into how idiosyncratic risk impacts perpetual futures—since leveraged instruments magnify single-asset volatility, making mitigation strategies even more critical.

Case Study: Managing Idiosyncratic Risk in Tech Stocks

Consider an investor holding a large position in a semiconductor company. Supply chain disruptions during the pandemic significantly affected earnings, leading to sharp stock declines.

- Without mitigation: The investor suffered substantial portfolio drawdowns.

- With mitigation: Using futures contracts to hedge exposure, the investor offset losses and maintained overall portfolio balance.

This highlights the importance of proactive strategies rather than reactive panic selling.

Modern dashboards integrate AI-driven alerts for idiosyncratic risk monitoring.

Personal Experience: Lessons Learned

From my experience managing portfolios, idiosyncratic risk is often underestimated until it strikes. Early in my career, I concentrated too heavily on a single industry—financial services. When new regulations hit unexpectedly, my portfolio suffered outsized losses.

Now, I implement sectoral diversification alongside hedging tools. This dual approach has consistently smoothed returns and reduced emotional stress during turbulent times.

FAQs

1. Can idiosyncratic risk be eliminated completely?

No, idiosyncratic risk cannot be fully eliminated. However, diversification and hedging can reduce its impact significantly, allowing investors to focus on long-term growth rather than short-term shocks.

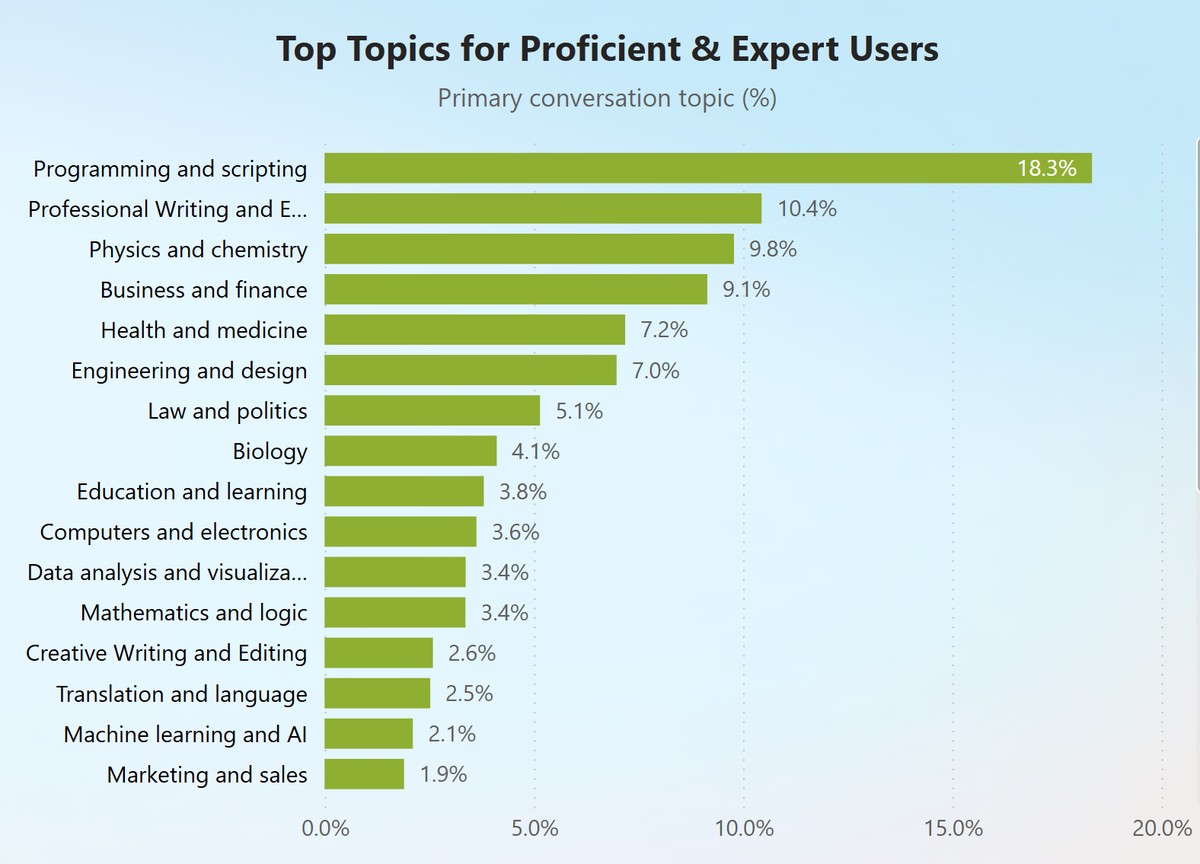

2. How do idiosyncratic risk mitigation strategies differ for beginners and experts?

- Beginners: Focus on diversification and position sizing.

- Experts: Use derivatives, factor models, and algorithmic monitoring for precise risk control. This aligns with guidelines for traders managing idiosyncratic risk.

3. How do perpetual futures amplify idiosyncratic risk?

Leverage in perpetual futures magnifies gains and losses. A company-specific event—like a product recall—can cause disproportionately large losses in leveraged positions. That’s why understanding how to manage idiosyncratic risk in perpetual futures is critical for traders.

Conclusion

Idiosyncratic risk is inevitable, but with effective mitigation strategies, its impact can be controlled. For professionals and serious traders, the best approach blends diversification across sectors with targeted hedging using derivatives. Adding technology-driven monitoring further enhances resilience.

Ultimately, protecting portfolios from idiosyncratic shocks is not about eliminating risk entirely—it’s about preparing for the unexpected and building systems that endure volatility.

What strategies have you used to mitigate idiosyncratic risk? Share your thoughts in the comments, and don’t forget to pass this article along to colleagues or students interested in smarter risk management.

Would you like me to also create a visual framework infographic that shows how diversification and hedging interact to mitigate idiosyncratic risk?