======================================

Introduction

In the competitive world of futures trading, performance metrics define the edge between success and failure. Among these metrics, the Sharpe Ratio is one of the most widely used indicators for measuring risk-adjusted returns. For futures traders, learning how to improve Sharpe Ratio in futures is essential for building sustainable strategies, attracting institutional capital, and maintaining a disciplined approach to risk management.

This article explores practical methods, expert strategies, and industry insights to enhance Sharpe Ratio outcomes in futures trading. We’ll break down key concepts, compare methods, highlight best practices, and share actionable recommendations that align with both retail and professional trading environments.

Understanding the Sharpe Ratio in Futures

What Is the Sharpe Ratio?

The Sharpe Ratio measures how much excess return an investment generates for each unit of risk taken. The formula is:

Sharpe Ratio=Rp−Rfσp\text{Sharpe Ratio} = \frac{R_p - R_f}{\sigma_p}Sharpe Ratio=σpRp−Rf

Where:

- RpR_pRp = Portfolio or strategy return

- RfR_fRf = Risk-free rate (often U.S. Treasury yields)

- σp\sigma_pσp = Standard deviation of returns

A higher Sharpe Ratio indicates better risk-adjusted performance, meaning the strategy generates more reward per unit of volatility.

Why Sharpe Ratio Matters in Futures

Futures markets are inherently leveraged, making risk management critical. Understanding what is the importance of Sharpe Ratio in futures trading allows traders to:

- Compare strategies across different asset classes

- Measure consistency and sustainability of performance

- Communicate results to investors in a standardized way

Sharpe Ratio measures excess return per unit of volatility

Methods to Improve Sharpe Ratio in Futures

1. Reduce Volatility Through Position Sizing

Volatility management directly impacts the denominator of the Sharpe Ratio formula. One effective way to reduce volatility is by applying dynamic position sizing models.

Approach:

- Use volatility-adjusted position sizing to scale down exposure when risk spikes.

- Apply stop-losses consistently to cut outliers from the distribution of returns.

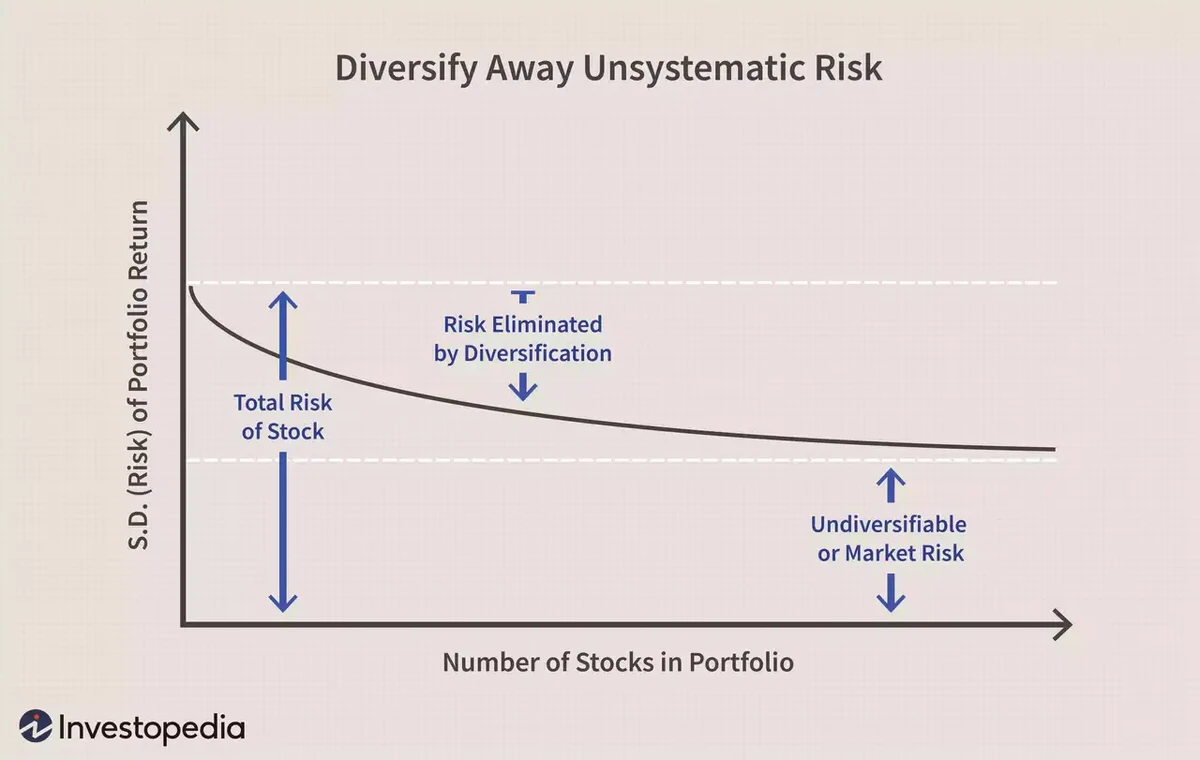

- Balance exposure across multiple futures contracts to diversify systemic risk.

Advantages:

- Smoothens equity curve.

- Prevents catastrophic drawdowns.

- Increases predictability of returns.

Disadvantages:

- May cap upside potential during strong trending phases.

- Requires frequent recalibration of risk models.

2. Enhance Return Through Strategy Diversification

Another way to improve the Sharpe Ratio is by increasing excess returns through diversification across uncorrelated futures strategies.

Methods:

- Combine trend-following models with mean-reversion strategies.

- Add commodity futures to equity index futures for cross-sector exposure.

- Implement intraday scalping alongside swing trading positions.

Advantages:

- Reduces portfolio correlation and smoothens performance.

- Captures opportunities across different timeframes.

- Expands the opportunity set beyond a single market.

Disadvantages:

- More complex to manage.

- Requires higher infrastructure and monitoring costs.

Comparative Analysis

| Method | Strength | Weakness | Best Use Case |

|---|---|---|---|

| Position Sizing | Controls volatility effectively | Limits returns in trending markets | Traders seeking stability and lower drawdowns |

| Diversification | Boosts returns across uncorrelated assets | Operational complexity | Institutional or professional traders with multiple strategies |

Recommendation:

For retail traders, start with position sizing discipline to build consistency. For advanced traders, combining diversification across futures markets can significantly improve long-term Sharpe Ratios.

Advanced Approaches for Sharpe Ratio Optimization

Use of Sharpe Ratio Forecasting

Quantitative models can forecast expected Sharpe Ratios by simulating future volatility and returns. This is especially useful for Sharpe Ratio evaluation for algorithmic traders.

Risk Hedging with Options

Adding options overlays to futures positions helps limit downside while preserving upside potential, thereby increasing the ratio.

Adaptive Leverage

Instead of fixed leverage, applying risk parity models allows traders to scale leverage proportionally to volatility, boosting efficiency.

Real-World Example

In 2022, a commodity hedge fund adjusted its futures portfolio after recognizing underperformance in its Sharpe Ratio. By shifting from concentrated crude oil positions to a diversified basket including agricultural and currency futures, the fund increased its annual Sharpe Ratio from 0.85 to 1.45 within 12 months.

This highlights the impact of where to apply Sharpe Ratio in trading strategies—using it as a dynamic performance benchmark rather than a static afterthought.

Sharpe Ratio improvement from diversification and volatility control

Frequently Asked Questions (FAQ)

1. What Sharpe Ratio is considered good for futures trading?

A Sharpe Ratio above 1.0 is generally considered acceptable. Ratios above 2.0 indicate excellent risk-adjusted returns. However, interpretation depends on market conditions—futures strategies may naturally exhibit higher volatility than traditional equity portfolios.

2. Can Sharpe Ratio be manipulated?

Yes, Sharpe Ratio can be manipulated by smoothing volatility artificially (e.g., through illiquid instruments or infrequent pricing). Traders should evaluate the transparency of Sharpe Ratio calculation in futures before relying on reported numbers.

3. How does Sharpe Ratio compare with other metrics?

While Sharpe Ratio is widely used, it should not be viewed in isolation. Other ratios, such as Sortino Ratio (which penalizes downside volatility) and Calmar Ratio (which compares returns to maximum drawdown), complement Sharpe Ratio for a fuller picture of risk-adjusted performance.

Conclusion

Improving Sharpe Ratio in futures is not about chasing higher returns blindly—it’s about balancing reward with disciplined risk management. Through volatility control, diversification, adaptive leverage, and hedging, traders can achieve higher efficiency in their strategies.

Whether you’re a retail trader or managing institutional capital, mastering how to improve Sharpe Ratio in futures is a cornerstone for sustainable success.

If you found this guide insightful, share it with your trading community, leave a comment with your Sharpe Ratio experiences, and help foster smarter conversations in the world of futures trading.

Would you like me to also create a Sharpe Ratio optimization checklist infographic (summarizing improvement steps visually) so the article has a strong, shareable takeaway?