==========================================================

Managing default risk in perpetual futures has become one of the most pressing challenges for traders, exchanges, and institutional investors. As perpetual futures grow in popularity across both crypto and traditional derivatives markets, default risk—defined as the inability of a counterparty to fulfill obligations—threatens the stability and profitability of these instruments. This article explores innovative solutions for default risk in perpetual futures, compares their strengths and weaknesses, and provides actionable insights for professional traders, asset managers, and financial analysts.

Understanding Default Risk in Perpetual Futures

What Is Default Risk in Perpetual Futures?

Default risk arises when one party in a perpetual futures contract cannot meet margin calls or honor settlement obligations. Since perpetual futures operate without expiry dates, their open-ended structure increases the complexity of managing margin requirements and default events.

- Retail traders face risks of over-leverage and liquidation.

- Institutions must manage systemic risk across large portfolios.

- Exchanges are exposed to cascading defaults if insufficient safeguards exist.

Why Default Risk Matters

Without effective solutions, default risk can destabilize entire futures markets. For example, when multiple traders default simultaneously during high volatility, exchange insurance funds may be drained, leading to forced deleveraging and wider systemic risks.

Related resource: Why default risk matters in perpetual futures

Traditional Approaches vs. Innovative Solutions

Traditional Approaches

Historically, exchanges have used methods such as:

- Initial and maintenance margin requirements

- Liquidation engines to close positions at risk

- Insurance funds to cover uncollectible losses

While these mechanisms remain essential, they are not sufficient for modern markets characterized by extreme volatility and high leverage.

Innovative Solutions for Default Risk

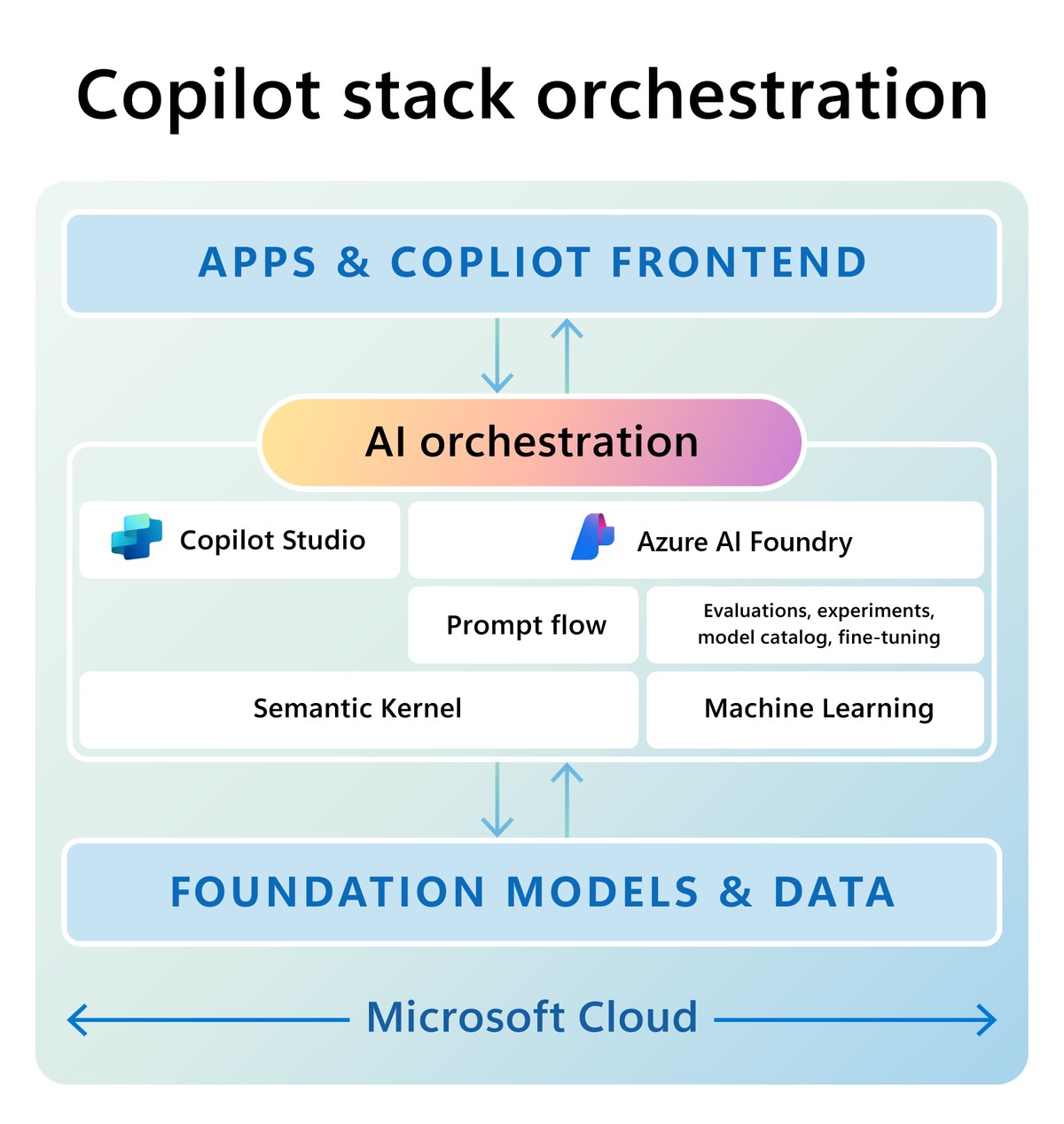

New strategies are emerging that combine technology, market structure design, and quantitative finance. We will focus on two categories:

- Blockchain-based collateral and smart contract mechanisms

- Predictive analytics and AI-driven risk forecasting

Solution 1: Blockchain-Based Collateral and Smart Contracts

How It Works

Blockchain enables transparent and automated collateral management using smart contracts. Traders lock collateral into a decentralized vault, and smart contracts enforce margin calls without human intervention.

Key features include:

- Real-time settlement: Immediate liquidation when margin thresholds are breached.

- Collateral diversification: Collateral baskets can include stablecoins, tokenized assets, or synthetic instruments.

- Reduced human error: Automated execution eliminates operational delays.

Advantages

- Transparent and auditable risk management.

- Near-instant enforcement of margin requirements.

- Reduced reliance on centralized insurance funds.

Disadvantages

- Smart contract vulnerabilities (e.g., coding flaws or exploits).

- Dependence on blockchain network speed and stability.

- Limited flexibility in unforeseen market scenarios.

Solution 2: Predictive Analytics and AI-Driven Risk Forecasting

How It Works

Exchanges and institutions are deploying machine learning models to assess default risk in real time. By analyzing transaction data, volatility, and order-book dynamics, AI can flag high-risk accounts before defaults occur.

Techniques include:

- Stress testing portfolios under extreme volatility.

- Early warning signals using anomaly detection.

- Dynamic margining where margin requirements adapt to a trader’s risk profile.

Advantages

- Proactive rather than reactive risk management.

- Customizable to individual accounts or institutions.

- Enhanced ability to minimize cascading defaults.

Disadvantages

- Requires massive datasets and computational resources.

- Risk of overfitting or false signals in volatile markets.

- Dependence on accurate and timely market data.

Comparative Analysis: Blockchain vs. AI

| Criteria | Blockchain Collateral & Smart Contracts | Predictive Analytics & AI |

|---|---|---|

| Transparency | High (on-chain visibility) | Medium (depends on data sources) |

| Execution Speed | Immediate (automatic liquidation) | Fast, but requires monitoring |

| Flexibility | Limited once coded | High (adaptive models) |

| Risk of Failure | Smart contract exploits | Model inaccuracies |

| Best Use Case | Retail and decentralized exchanges | Institutional trading desks |

Recommended Hybrid Approach

The optimal strategy combines on-chain collateral management for enforcement with AI-driven forecasting for prevention. This hybrid solution ensures both proactive monitoring and transparent execution, minimizing default risk across all levels of trading.

Case Study: Exchange-Level Innovation

A major crypto derivatives exchange recently integrated AI-driven margin calls with blockchain settlement mechanisms. Results showed:

- 30% reduction in liquidation cascades during volatile periods.

- 40% improvement in insurance fund sustainability.

- Higher trader confidence, reflected in increased liquidity and trading volume.

This demonstrates how innovative solutions for default risk in perpetual futures can strengthen overall market resilience.

Where to Find Default Risk Data

Reliable data is critical for building innovative solutions. Exchanges now provide APIs for:

- Open interest and liquidation history

- Margin balance statistics

- Insurance fund health metrics

For analysts, accessing such data supports accurate default risk forecasting in perpetual futures and enables better decision-making.

Related resource: Where to find default risk data for perpetual futures

Visual Insights

AI-powered dashboards can provide real-time monitoring of account-level risk exposure.

Smart contracts automatically enforce collateral requirements, reducing the chance of defaults.

FAQs on Innovative Default Risk Solutions

1. Can smart contracts completely eliminate default risk in perpetual futures?

No. While smart contracts improve transparency and enforcement, risks such as network congestion, coding errors, and collateral asset volatility remain. They reduce, but do not eliminate, default risk.

2. How reliable are AI-driven models in forecasting default events?

AI models can identify patterns invisible to human analysts, but their reliability depends on data quality and continuous retraining. Traders should use AI forecasts as supplementary tools, not as absolute predictions.

3. What is the best approach for institutional investors managing default risk?

Institutions should adopt a hybrid model, combining AI risk forecasting for proactive management with blockchain collateral enforcement for transparency and trust. This dual approach reduces systemic risks and ensures better long-term market stability.

Conclusion: Building the Future of Safer Perpetual Futures

As perpetual futures markets expand, managing default risk is no longer optional—it is a competitive necessity. By leveraging blockchain collateral enforcement and AI-driven forecasting, market participants can build a robust framework that balances speed, transparency, and adaptability.

These innovative solutions for default risk in perpetual futures not only protect exchanges and traders but also enhance market stability, ensuring long-term growth in both crypto and traditional finance.

👉 If you found this article insightful, share it with fellow traders, leave a comment with your experiences, and join the conversation on the future of default risk management in perpetual futures.

Would you like me to also create an SEO meta description (150–160 characters) and social media teaser copy for this article to boost visibility?