=======================================================================================

In the dynamic world of cryptocurrency perpetual futures trading, political developments can have a profound impact on market stability and trader profitability. This guide provides a detailed exploration of political risk alerts, offering strategies, practical insights, and best practices to help traders manage exposure and optimize their trading decisions.

Understanding Political Risk in Perpetual Futures

What is Political Risk?

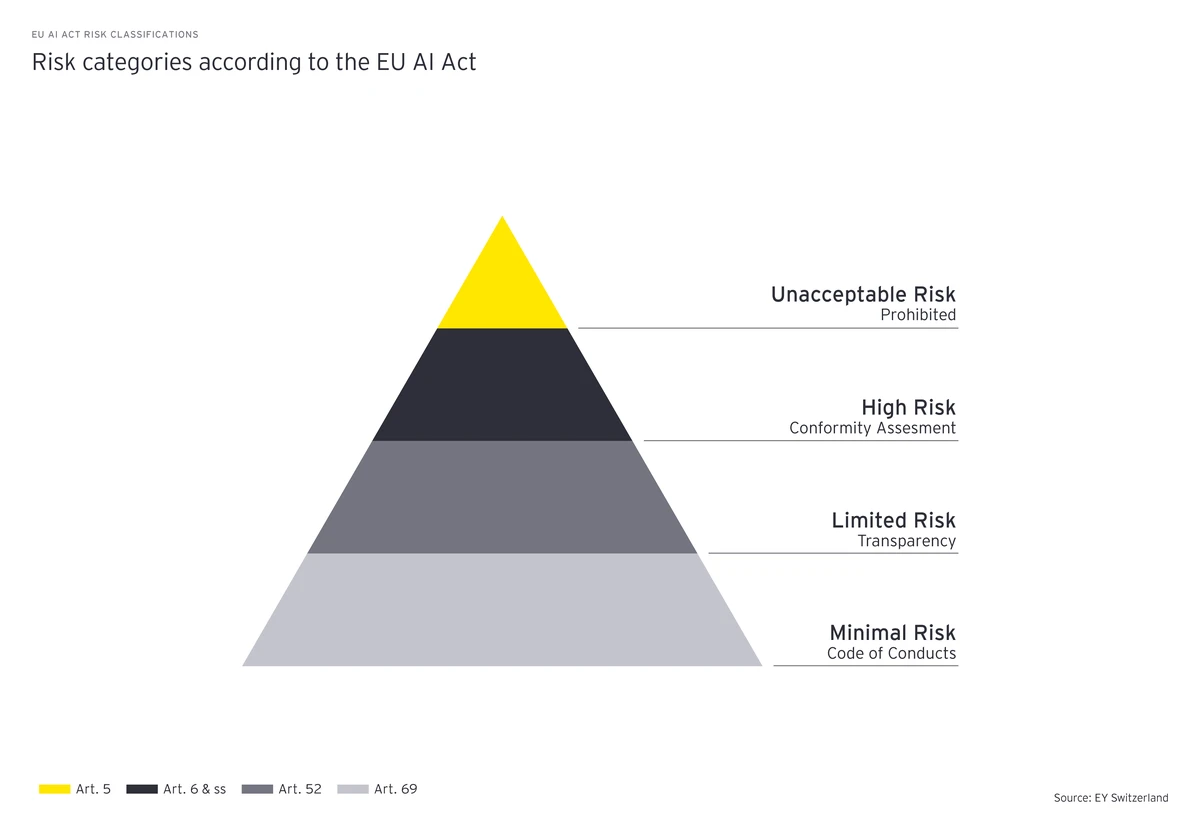

Political risk refers to the uncertainty and potential financial losses arising from political events, government decisions, or regulatory changes that can influence the cryptocurrency market. Examples include sudden changes in legislation, sanctions, taxation policies, and central bank interventions.

Political Risk Factors Affecting Perpetual Futures

- Regulatory Changes: New laws regarding cryptocurrency trading can lead to abrupt price fluctuations.

- Geopolitical Tensions: International conflicts may trigger market volatility, affecting liquidity and derivatives pricing.

- Government Interventions: Sudden bans or restrictions on exchanges or derivatives can disrupt market access.

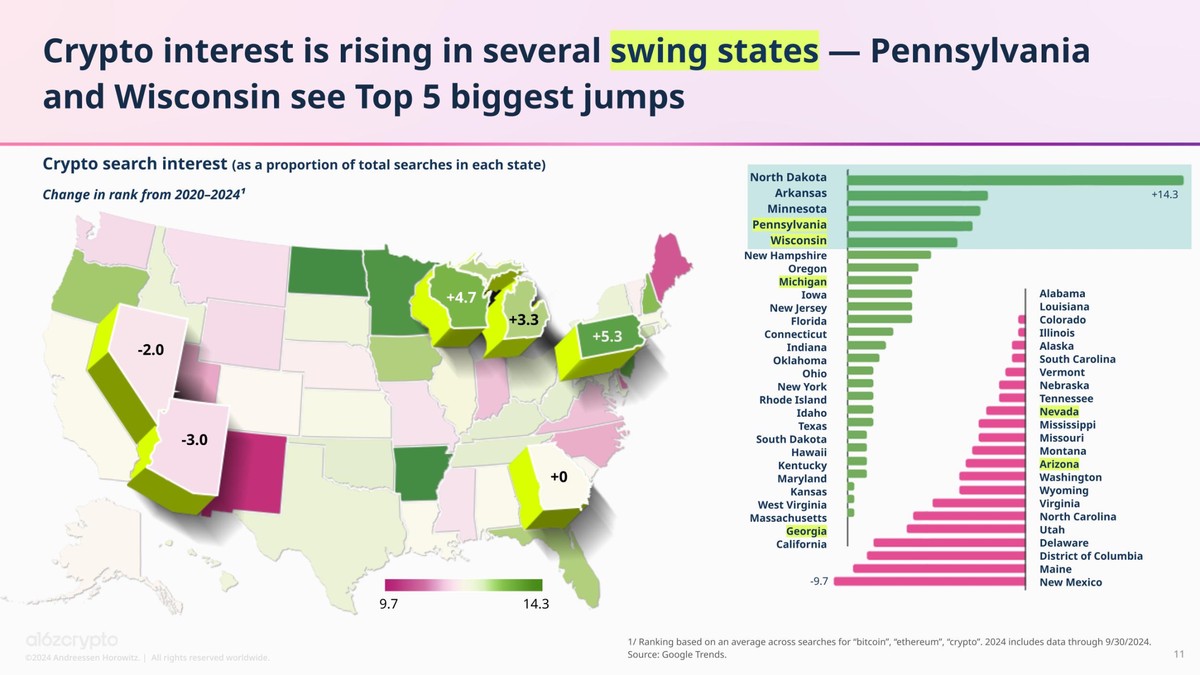

- Election Cycles: Shifts in government leadership can alter fiscal and monetary policies impacting crypto markets.

Global cryptocurrency political risks affecting perpetual futures markets

Importance of Political Risk Alerts

Why Political Risk Matters for Perpetual Futures Traders

Political events often trigger significant price swings in crypto markets, affecting leveraged positions. Traders who ignore these risks can face sudden liquidation or unexpected losses. Political risk alerts provide early warnings, enabling traders to adjust their strategies proactively.

How Political Risk Impacts the Market

Political instability can lead to higher volatility, reduced liquidity, and price gaps. Understanding these dynamics allows traders to:

- Protect capital through stop-loss orders and position sizing.

- Adjust leverage to manage risk exposure.

- Identify safer trading instruments or geographies.

Strategies to Monitor Political Risk

Strategy 1: News-Based Monitoring

Using political news feeds, social media monitoring, and government announcements, traders can identify upcoming events that may influence market volatility. Real-time alert systems can notify traders of critical developments.

Pros: Timely information, allows proactive adjustments.

Cons: High information noise, requires careful filtering.

Strategy 2: Quantitative Political Risk Models

By analyzing historical market reactions to political events, traders can develop predictive models. Metrics may include volatility indices, derivatives volume, and sentiment analysis.

Pros: Data-driven, reduces emotional trading.

Cons: Requires technical expertise, cannot capture unforeseen black swan events.

Workflow for monitoring political risk in cryptocurrency perpetual futures

How to Manage Political Risk in Perpetual Futures

Position Sizing and Leverage Adjustment

Reducing leverage and trading smaller positions in politically sensitive periods can minimize potential losses. This strategy ensures that traders survive high-volatility events without catastrophic account depletion.

Diversification Across Exchanges and Assets

Spreading positions across multiple exchanges and assets reduces the impact of a single jurisdiction’s political event.

Hedging Strategies

Advanced traders may use derivatives to hedge political risk. This includes:

- Options and futures to offset losses from sudden price moves.

- Cross-asset hedges, such as stablecoins or gold-pegged tokens, to reduce exposure.

Internal Link Embedded: [How to manage political risk in perpetual futures]

Internal Link Embedded: [Where to find perpetual futures with low political risk]

Tools and Resources for Political Risk Alerts

News Aggregators and Alert Systems

Platforms that consolidate political news and crypto market updates provide traders with actionable insights. Examples include:

- Crypto-specific political news dashboards

- API-based alerts for exchange regulations and geopolitical events

Risk Assessment Frameworks

Structured frameworks help traders quantify political risk exposure:

- Assign risk scores to countries and exchanges

- Monitor regulatory compliance and updates

- Evaluate geopolitical trends influencing derivatives markets

Case Study: Political Events Impacting Crypto Perpetual Futures

During the announcement of sudden cryptocurrency regulations in a major market, leveraged traders faced a rapid 20% correction within hours. Traders who had positioned with alerts and hedging mechanisms minimized losses and adjusted trading strategies promptly.

Market reaction of crypto perpetual futures to sudden political regulation

FAQ (Frequently Asked Questions)

Q1: How can I assess political risk in perpetual futures trading?

A1: Begin by identifying high-risk jurisdictions, tracking regulatory changes, and using real-time news alert platforms. Quantitative models can provide historical insight on market reactions to similar political events.

Q2: Can political risk alerts prevent all losses?

A2: No. Alerts provide early warnings and guidance but cannot predict every event. Combining alerts with risk management strategies, diversification, and hedging improves resilience against unforeseen events.

Q3: What strategies are best for retail traders?

A3: Retail traders should focus on moderate leverage, conservative position sizing, and using exchanges with low political risk. Avoid overexposure to volatile regions and maintain stop-loss protocols.

Advanced Strategies for Professional Traders

Algorithmic Integration

Integrating political risk indicators into trading algorithms allows automated adjustment of positions and leverage in response to political news. This reduces reaction time and human error.

Scenario Analysis and Stress Testing

Professional traders perform scenario analyses simulating potential political events. Stress testing portfolios against hypothetical government actions or geopolitical crises enhances preparedness.

Conclusion

Political risk is an unavoidable aspect of cryptocurrency perpetual futures trading. By leveraging alerts, monitoring tools, and comprehensive strategies, traders can mitigate potential losses, optimize leverage usage, and maintain portfolio stability. Combining real-time news monitoring, quantitative models, and risk management frameworks provides a holistic approach to navigating politically sensitive markets.

Engage with this guide—share your experiences, comment on strategies that work for you, and contribute to the community of informed perpetual futures traders.

Comprehensive approach to mitigating political risk in perpetual futures trading