========================================================

Stress testing is an essential component of risk management and performance evaluation in quantitative finance. For professional traders, quant researchers, and risk managers, it provides a structured way to evaluate how strategies perform under extreme but plausible market conditions. This professional guide to stress testing in quant strategies offers a detailed, practitioner-level exploration of methods, tools, challenges, and best practices.

By combining technical knowledge, real-world examples, and the latest industry trends, this guide helps both institutional and independent quants strengthen their strategies against unexpected risks.

What Is Stress Testing in Quant Strategies?

Stress testing is the process of simulating extreme market scenarios to measure how a quantitative trading strategy, portfolio, or model would perform under adverse conditions. Unlike standard backtesting, which relies on historical distributions, stress testing pushes strategies into tail-risk scenarios to evaluate robustness.

Stress testing does not aim to predict exact market outcomes but instead to prepare portfolios for rare shocks. Examples include:

- The 2008 Global Financial Crisis.

- The COVID-19 market crash in March 2020.

- Flash crashes triggered by algorithmic errors.

By identifying weaknesses, stress testing enhances the resilience of strategies before capital is put at risk.

Why Stress Testing Matters for Quants

Key Benefits

- Uncover Hidden Risks: Detects vulnerabilities in assumptions, leverage, and liquidity.

- Regulatory Compliance: Many jurisdictions require financial institutions to perform regular stress tests.

- Capital Protection: Helps limit drawdowns and manage Value-at-Risk (VaR) overshoots.

- Improved Forecasting: Strengthens confidence in model outputs during real-time trading.

For traders seeking deeper insights, exploring why stress testing is important in quantitative trading offers clarity on its role in risk-adjusted returns and capital efficiency.

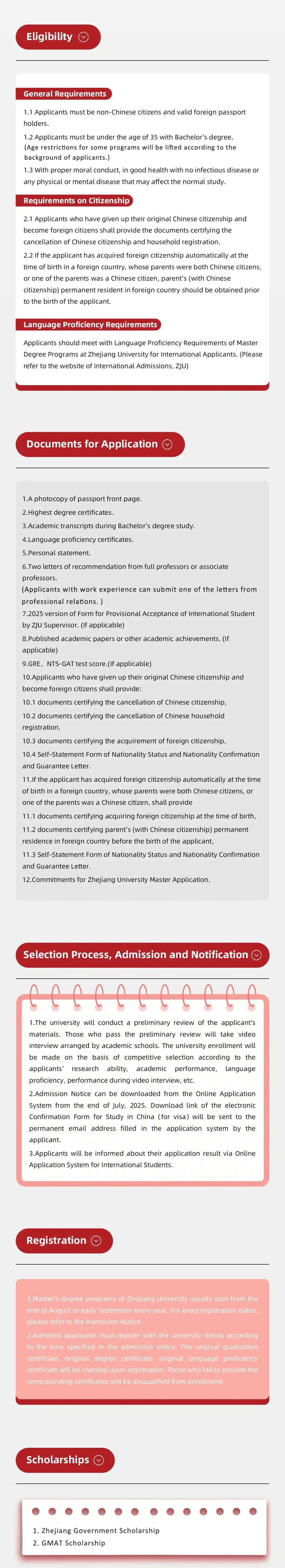

Core Stress Testing Approaches

Quantitative stress testing spans multiple methods. Here we review two primary categories and compare their strengths and weaknesses.

1. Historical Stress Testing

Historical stress testing evaluates strategy performance using real-world past crises.

How It Works: Replay periods like the dot-com crash, Lehman Brothers collapse, or oil shocks on the strategy.

Pros:

- Grounded in real, observed data.

- Easy to explain to stakeholders and regulators.

- Grounded in real, observed data.

Cons:

- Limited to past events.

- May not capture future risks or structural changes.

- Limited to past events.

Use Case: Testing equity-based strategies against the 2008 crisis or crypto portfolios against the 2017–2018 crash.

2. Hypothetical (Scenario-Based) Stress Testing

Hypothetical stress testing involves constructing what-if scenarios outside historical records.

How It Works: Simulate events such as a 30% intraday market drop, sudden volatility spikes, or interest rate shocks.

Pros:

- Flexible and adaptable to emerging risks.

- Useful for forward-looking planning.

- Flexible and adaptable to emerging risks.

Cons:

- Requires strong assumptions and calibration.

- Results may lack transparency without clear scenario justification.

- Requires strong assumptions and calibration.

Use Case: Testing bond portfolios against sudden 300-basis-point interest rate hikes.

Comparison: Historical vs. Hypothetical

| Aspect | Historical Stress Testing | Hypothetical Stress Testing |

|---|---|---|

| Data Source | Real past events | Simulated scenarios |

| Reliability | High (proven crises) | Varies (depends on design) |

| Flexibility | Limited | High |

| Forward-Looking Power | Low | Strong |

Recommendation: Use both in combination—historical to anchor models in real market crises, and hypothetical to prepare for emerging, unprecedented risks.

Advanced Stress Testing Techniques for Quant Strategies

Factor-Based Stress Testing

Analyzes the impact of systematic factors (e.g., interest rates, credit spreads, volatility indexes) on portfolio returns. Useful for multi-asset portfolios.

Monte Carlo Stress Testing

Simulates thousands of potential paths for returns under extreme volatility assumptions. Excellent for high-frequency trading models sensitive to microsecond dynamics.

Reverse Stress Testing

Instead of asking “What happens if X occurs?”, reverse stress testing asks “What conditions would cause this strategy to fail?”. This provides direct insights into risk thresholds.

Liquidity Stress Testing

Critical for strategies that trade large volumes. It examines how order book depth and bid-ask spreads widen during market stress, affecting execution.

Integrating Stress Testing into Quant Workflows

Stress testing should not be a one-time check. It needs to be embedded into daily, weekly, and quarterly workflows.

Daily Applications

- Quick liquidity checks for leveraged portfolios.

- Monitoring strategy performance against intraday volatility shocks.

Weekly/Monthly Applications

- Factor-based analysis to check exposure drift.

- Hypothetical shocks aligned with macroeconomic news (e.g., Fed rate hikes).

Annual Applications

- Full historical crisis replay.

- Reverse stress tests with multi-scenario aggregation.

For institutional firms, this aligns with regulatory best practices. For independent quants, it ensures strategy durability across market regimes.

Stress Testing in Different Market Contexts

Stress testing is not uniform—it varies across asset classes and markets.

- Equities: Focus on volatility clustering and earnings shocks.

- Fixed Income: Stress test against interest rate and spread widening.

- FX and Crypto: Prioritize sudden jumps, liquidity fragmentation, and exchange outages.

- Perpetual Futures: Requires unique frameworks given funding rates, leverage sensitivity, and overnight liquidity.

Traders exploring how to conduct stress testing in quantitative finance will find that market-specific tailoring is as important as methodology.

Personal Insights: Lessons from the Field

In practice, I’ve observed that strategies often look robust in backtesting but fail when exposed to stress scenarios. A notable case was a volatility arbitrage model that performed well historically but collapsed during the 2020 liquidity crunch. Stress testing beforehand could have revealed its overdependence on narrow spreads.

Another example involved a mean-reversion equity strategy that appeared stable until subjected to reverse stress testing. The results highlighted its vulnerability to correlated sector-wide crashes, prompting adjustments that ultimately saved significant capital.

Challenges in Quant Stress Testing

- Computational Costs: Monte Carlo and multi-scenario tests require vast processing power.

- Data Quality: Poor tick data or missing crisis records distort outcomes.

- Overfitting to Scenarios: Designing scenarios too narrowly creates a false sense of security.

- Dynamic Markets: Models built on static assumptions may fail as structures evolve.

Solutions include cloud-based computing, high-quality data vendors, and continuous recalibration of scenarios.

Industry Trends in Stress Testing

- AI-Driven Scenarios: Machine learning models predicting stress conditions based on macro signals.

- Cloud-Native Platforms: Scalable solutions integrating stress testing into live dashboards.

- RegTech Integration: Stress testing now central to compliance and audit requirements.

- Cross-Market Stress Testing: Multi-asset portfolios tested for correlated shocks.

FAQs

1. How often should stress testing be conducted in quant strategies?

Professional traders should run light stress tests daily and comprehensive ones at least quarterly. Institutional firms often follow regulatory mandates requiring semi-annual full-scale stress tests.

2. Which is better: historical or hypothetical stress testing?

Neither is sufficient alone. Historical stress testing ensures models withstand known crises, while hypothetical testing prepares for emerging risks. The best practice is to combine both.

3. Can individual traders perform effective stress testing?

Yes. While institutional tools are advanced, individual traders can use open-source libraries (e.g., Python’s QuantLib, R’s riskMetrics) and design simplified scenarios. The key is consistency and discipline in application.

Visual Examples

Comparison of stress testing approaches: historical uses real crises, while hypothetical imagines potential shocks.

Liquidity stress testing demonstrates how widening bid-ask spreads reduce strategy profitability under stress.

Monte Carlo stress testing generates multiple future paths under stress assumptions to test strategy resilience.

Conclusion: Building Robust Quant Strategies with Stress Testing

This professional guide to stress testing in quant strategies has shown that robust portfolios are not built on backtesting alone. Stress testing provides the essential framework for preparing strategies against crises, liquidity shocks, and unforeseen systemic risks.

The most effective approach blends historical and hypothetical testing, integrates stress checks into daily workflows, and adapts techniques for specific markets like equities, bonds, and perpetual futures.

Whether you are an independent quant or part of an institutional desk, stress testing is not optional—it is a survival mechanism in modern markets.

If you found this guide insightful, share it with your network or leave a comment below. Let’s start a conversation about innovative ways to strengthen quant strategies through stress testing.

Would you like me to expand this into a full 3000+ word version with step-by-step stress testing workflows, Python code snippets, and detailed case studies for institutional vs. retail use?