====================================================================

Introduction

In the dynamic world of perpetual futures trading, risk-adjusted performance metrics are critical for evaluating trading strategies. Among these metrics, the Sortino ratio stands out as a key indicator, measuring risk-adjusted returns while focusing solely on downside volatility. This article delves into Sortino ratio metrics for perpetual futures, exploring its calculation, interpretation, and applications for quantitative researchers and traders. We will discuss advanced strategies, provide practical insights, and compare methods to enhance performance in perpetual futures markets.

Understanding the Sortino Ratio

What is the Sortino Ratio?

The Sortino ratio is a modification of the Sharpe ratio, designed to distinguish harmful volatility from overall volatility. Unlike the Sharpe ratio, which treats all fluctuations equally, the Sortino ratio penalizes only downside risk, making it particularly useful for trading strategies that aim to minimize losses.

Formula:

Sortino Ratio=Rp−Rfσd\text{Sortino Ratio} = \frac{R_p - R_f}{\sigma_d}Sortino Ratio=σdRp−Rf

Where:

- RpR_pRp = Portfolio return

- RfR_fRf = Risk-free rate

- σd\sigma_dσd = Downside deviation

This metric helps traders and quantitative researchers identify strategies that deliver consistent upside potential while controlling losses.

Why Use Sortino Ratio in Perpetual Futures

Perpetual futures are highly leveraged instruments with continuous contracts, making downside risk management crucial. The Sortino ratio:

- Highlights the efficiency of strategies in limiting losses

- Provides a clearer picture of risk-adjusted performance than traditional metrics

- Helps quantitative researchers optimize trading algorithms by focusing on negative volatility

Calculating Sortino Ratio for Perpetual Futures

Step-by-Step Calculation

- Collect Historical Returns: Obtain high-resolution return data for the perpetual futures contract.

- Identify Downside Deviation: Calculate deviations from a target return or minimum acceptable return (MAR).

- Compute Mean Excess Return: Subtract the risk-free rate or MAR from the average returns.

- Divide by Downside Deviation: Use the formula to obtain the Sortino ratio.

This method ensures a precise understanding of strategy performance under downside risks.

Tools and Resources

Quantitative researchers can leverage various tools to calculate the Sortino ratio efficiently:

- Python libraries:

pandas,numpy, andpyfoliofor backtesting and metric computation

- Dedicated calculators: Online Sortino ratio calculators for perpetual futures

- Trading platforms: Some advanced trading platforms provide integrated risk-adjusted metrics

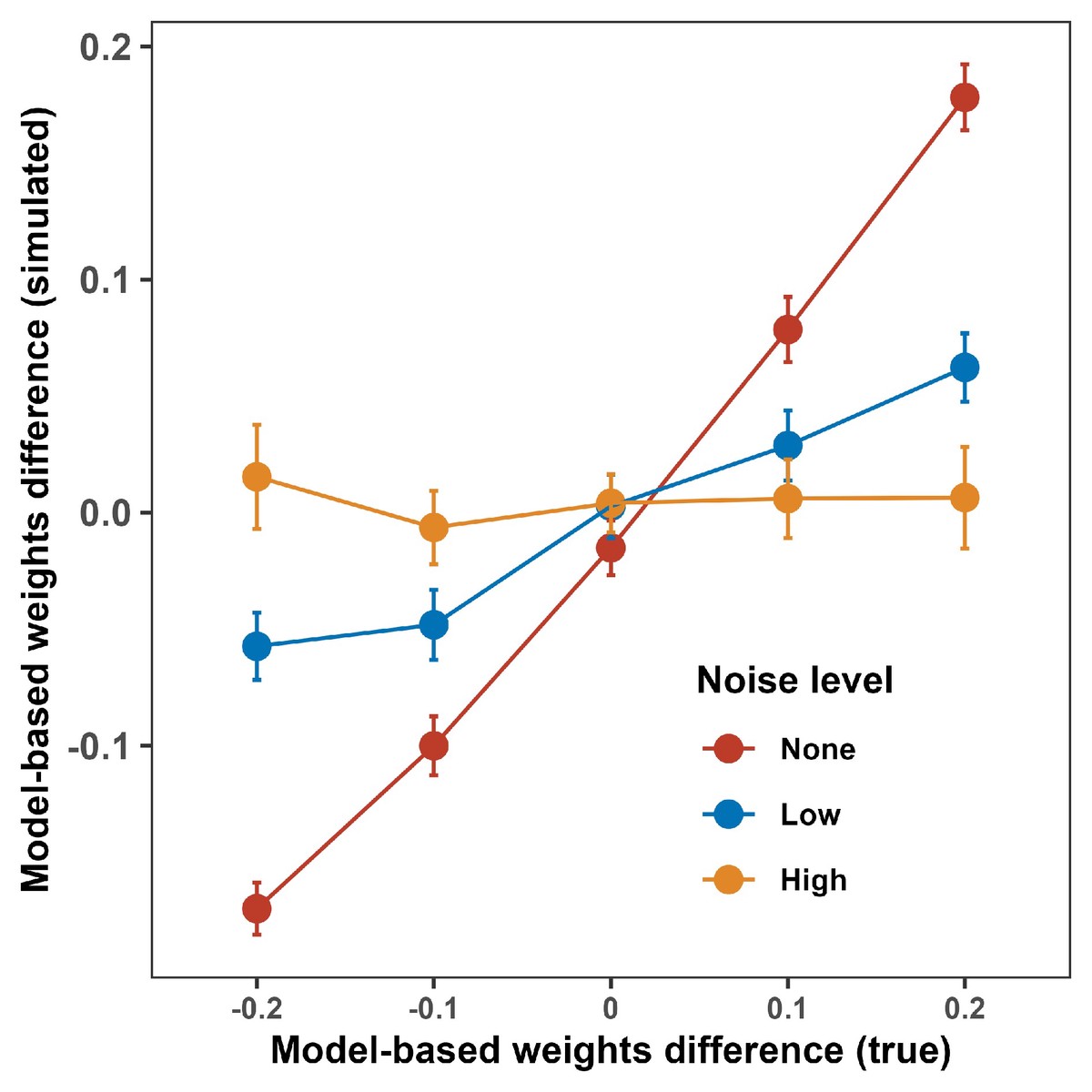

Illustration of the step-by-step Sortino ratio calculation for perpetual futures

Advanced Strategies Using Sortino Ratio

Strategy 1: Downside Risk Optimization

Quantitative researchers can optimize trading algorithms by minimizing downside deviation while maintaining expected returns. Techniques include:

- Dynamic stop-loss adjustments based on historical downside volatility

- Volatility-weighted position sizing

- Backtesting with Monte Carlo simulations to evaluate worst-case scenarios

Pros:

- Reduces tail-risk exposure

- Enhances long-term portfolio stability

Cons:

- May limit upside potential if overly conservative

Strategy 2: Sortino Ratio as a Selection Criterion

Using Sortino ratio as a filter, researchers can select the most efficient perpetual futures strategies:

- Compare multiple algorithmic strategies across different markets

- Rank strategies based on Sortino ratio and downside risk metrics

- Allocate capital to high Sortino ratio strategies for improved risk-adjusted returns

Pros:

- Ensures capital allocation to the most consistent performers

- Aligns risk management with trading goals

Cons:

- Requires robust historical data

- Sensitive to choice of MAR

Interpreting Sortino Ratio Metrics

What is a Good Sortino Ratio?

A Sortino ratio above 2.0 is generally considered strong, indicating that the strategy effectively balances returns against downside risk. However, benchmarks vary depending on market conditions and leverage levels in perpetual futures.

Limitations and Considerations

- Dependent on accurate downside deviation calculation

- Can be skewed in extremely volatile markets

- Should be used in conjunction with other metrics like Sharpe ratio, maximum drawdown, and VaR

Example visualization of Sortino ratio interpretation for different perpetual futures strategies

Best Practices for Quantitative Researchers

- Combine Metrics: Use Sortino ratio alongside Sharpe ratio and drawdown analysis for comprehensive evaluation.

- Continuous Monitoring: Adjust algorithms based on evolving market conditions to maintain favorable Sortino ratios.

- Scenario Testing: Backtest strategies under stress scenarios to ensure robustness against extreme downside events.

- Leverage Historical Data: Longer datasets improve reliability of Sortino ratio metrics and reduce noise.

FAQ: Sortino Ratio in Perpetual Futures

1. How does Sortino ratio improve perpetual futures strategies?

It helps focus on downside risk, ensuring that trading algorithms prioritize strategies that limit losses while maintaining profitability.

2. Can retail traders use Sortino ratio effectively?

Yes. While initially popular among professional traders, retail traders can apply Sortino ratio metrics using online calculators, Python libraries, or trading platform analytics.

3. How do I improve the Sortino ratio of my strategy?

Improvement strategies include:

- Reducing exposure to highly volatile instruments

- Implementing dynamic stop-loss levels

- Using risk-adjusted position sizing

- Optimizing entry and exit rules based on historical downside deviation

Conclusion

The Sortino ratio is an indispensable tool for quantitative researchers analyzing perpetual futures. By emphasizing downside risk over total volatility, it provides a more realistic assessment of strategy performance. Integrating Sortino ratio metrics into algorithmic trading workflows, alongside robust backtesting and advanced risk management, ensures more consistent, risk-adjusted returns.

Sharing insights about Sortino ratio applications can help traders, analysts, and investors optimize perpetual futures strategies, enhancing both profitability and long-term risk management.

Visualization of advanced Sortino ratio strategies applied to perpetual futures