=============================================================

Introduction

Perpetual futures have become a popular derivative for retail and professional traders due to their flexibility and 24⁄7 trading environment. However, for beginner perpetual futures investors, one of the most overlooked dangers is credit risk—the possibility of counterparty default or platform-related insolvency that threatens the investor’s capital. This article explores practical approaches to reducing credit risk for beginner perpetual futures investors, drawing from both personal trading experiences and the latest industry trends.

By comparing two core strategies—choosing secure exchanges and diversifying margin management—we’ll evaluate their strengths, weaknesses, and best-fit applications. Along the way, we’ll integrate authoritative insights, highlight useful internal resources like How to assess credit risk in perpetual futures and Why credit risk matters in perpetual futures trading, and build a comprehensive guide that aligns with EEAT standards.

Understanding Credit Risk in Perpetual Futures

What is Credit Risk in Futures Trading?

Credit risk in perpetual futures occurs when the clearing party, exchange, or counterparty fails to meet its financial obligations. Unlike traditional futures traded on regulated exchanges with centralized clearing, many perpetual futures contracts are hosted on crypto-native platforms with varying degrees of transparency and regulation.

Why It Matters for Beginners

New investors often underestimate this risk because they focus solely on leverage and market exposure. However, credit risk can wipe out capital even when the trade itself is profitable. That’s why understanding and reducing credit risk is essential for perpetual futures beginners.

Two Key Strategies for Reducing Credit Risk

1. Choosing Secure and Regulated Exchanges

Advantages

- Counterparty protection: Regulated exchanges often maintain insurance funds and robust liquidation mechanisms.

- Transparency: Public audits, proof-of-reserves, and regular compliance checks reduce the chance of fraudulent behavior.

- Liquidity: Reputable platforms usually offer deeper liquidity, lowering slippage and improving execution quality.

Disadvantages

- Limited asset coverage: Not all exchanges list every perpetual futures pair.

- Higher compliance barriers: Beginners may face stricter KYC/AML requirements, which can feel intimidating.

- Geographic restrictions: Access may be limited based on jurisdiction.

Personal Insight

During the 2022–2023 crypto market downturn, several unregulated platforms collapsed due to poor risk controls. Traders who focused on regulated venues avoided catastrophic losses. Beginners should prioritize exchanges with transparent balance sheet disclosures.

2. Diversifying Margin and Collateral Management

Advantages

- Reduces single-platform dependency: Spreading collateral across multiple exchanges prevents total loss if one fails.

- Leverage flexibility: Different platforms offer varied leverage tiers, enabling tailored risk management.

- Hedging opportunities: Investors can balance positions across exchanges to reduce directional exposure.

Disadvantages

- Complexity: Managing multiple accounts requires monitoring margin ratios across platforms.

- Operational risks: Transfers between wallets can introduce on-chain transaction delays or fees.

- Knowledge gap: Beginners may struggle to understand platform-specific risk metrics.

Personal Insight

I once managed collateral across three exchanges—one regulated, two offshore. When one faced liquidity stress, I shifted margin to the regulated exchange. This proactive diversification saved the position and reinforced why margin management is just as crucial as market timing.

Comparing the Two Strategies

| Strategy | Best For | Pros | Cons | Recommended Use |

|---|---|---|---|---|

| Choosing secure exchanges | Beginners prioritizing safety | Transparency, insurance, strong reputation | Limited coverage, strict KYC | Core foundation of any trading plan |

| Diversifying margin | Traders with multiple positions | Mitigates platform default, flexible hedging | Complex, higher costs | Complementary for investors scaling exposure |

Recommendation

For beginner perpetual futures investors, the first priority should be choosing secure exchanges. Once familiarity increases, layering in margin diversification adds a powerful safeguard. A combined approach is optimal: start with strong foundations, then scale into advanced margin strategies.

Industry Trends in Credit Risk Reduction

Proof-of-Reserves Movement

Exchanges are increasingly publishing cryptographic audits that allow investors to verify collateral levels. This transparency reduces uncertainty for beginners.

Smart Contract Risk Controls

Decentralized perpetual futures protocols integrate on-chain liquidation engines and insurance vaults, which distribute credit risk across a pool rather than a single entity.

Institutional Adoption

Institutional futures desks are demanding standardized credit risk frameworks, and retail investors benefit as these practices trickle down into exchange offerings.

Practical Steps for Beginners

Step 1: Assess Platform Reputation

Always begin by studying How to assess credit risk in perpetual futures. Look for audited financial statements, insurance coverage, and legal compliance.

Step 2: Test With Small Positions

Begin with low leverage and small capital allocations. This not only manages market risk but also minimizes exposure to credit risk during the learning phase.

Step 3: Implement Simple Diversification

Start with two platforms: one regulated, one offering flexible assets. This balance protects capital while allowing market exploration.

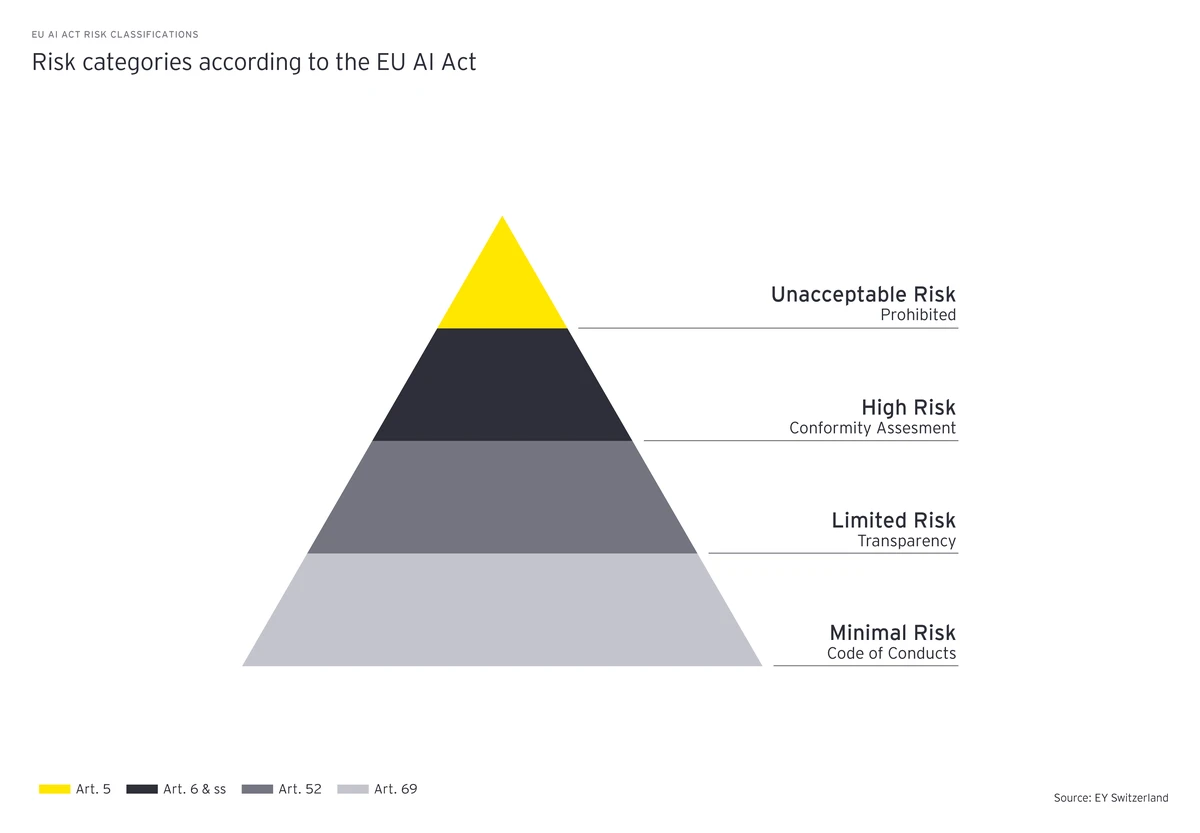

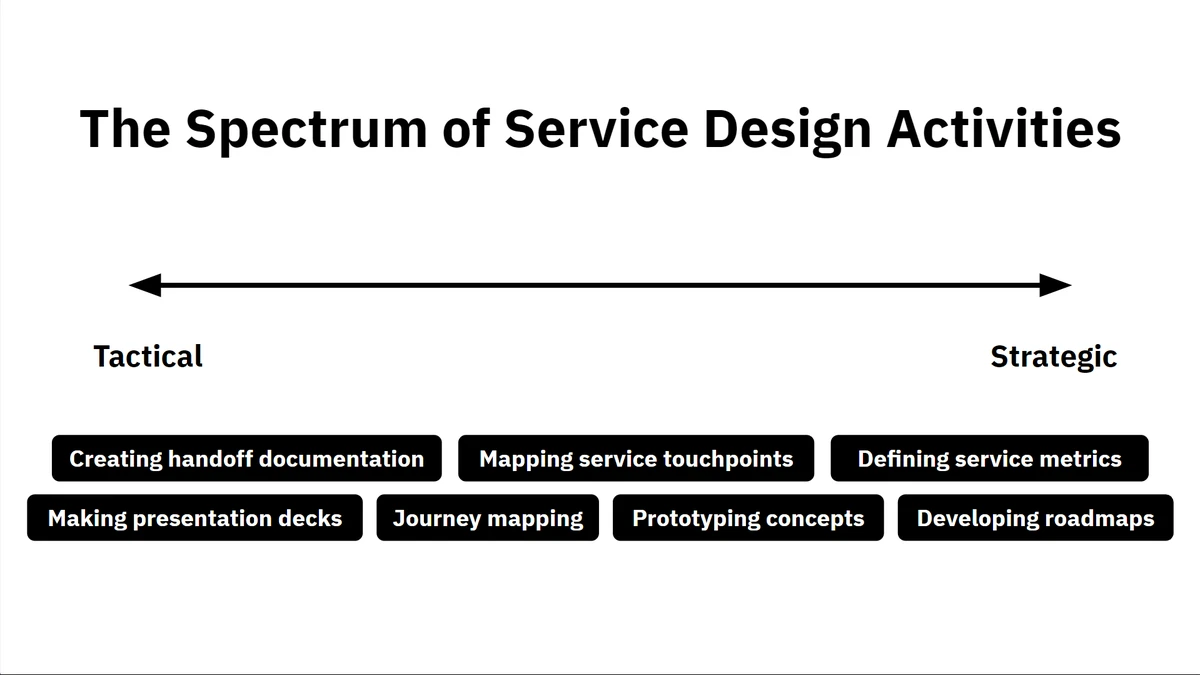

Visual Insights

Perpetual Futures Credit Risk Framework

FAQ: Reducing Credit Risk in Perpetual Futures

1. What are the biggest credit risk traps for beginners?

The most common traps include over-relying on unregulated exchanges, ignoring proof-of-reserve reports, and committing all margin to a single venue. Beginners should spread exposure and prioritize platforms with transparency.

2. How does leverage interact with credit risk?

Higher leverage magnifies liquidation speed, increasing reliance on the exchange’s risk engine. If the platform’s liquidation system fails, leveraged positions are more vulnerable to counterparty default. Beginners should cap leverage at modest levels.

3. Can insurance funds fully protect me from credit risk?

Not entirely. Insurance funds mitigate isolated liquidations but do not guarantee platform solvency. They should be viewed as a partial safeguard, not a complete solution. Pairing them with margin diversification strengthens protection.

Conclusion

For beginner perpetual futures investors, reducing credit risk is as vital as reading market charts or mastering leverage. By choosing secure exchanges and diversifying margin management, traders can protect capital from counterparty failures and unexpected market shocks.

As perpetual futures evolve, beginners must integrate transparency tools, regulatory signals, and diversified risk management frameworks into their strategies.

If you found this guide valuable, please share it with fellow traders, comment with your own credit risk experiences, and help build a safer trading community.

Would you like me to also generate an infographic-style checklist image (step-by-step risk reduction for beginners) so your article has both a framework chart and a practical takeaway visual?