==========================================================================

The Sharpe Ratio is one of the most widely used metrics in finance for evaluating risk-adjusted returns. Understanding and applying this metric effectively can significantly enhance trading strategies and portfolio management. This article serves as a complete guide to Sharpe Ratio tutorial videos, exploring methodologies, practical applications, and strategies for both beginners and seasoned investors.

Understanding the Sharpe Ratio

Definition and Significance

The Sharpe Ratio, developed by Nobel laureate William F. Sharpe, measures the performance of an investment relative to its risk. It is calculated as:

Sharpe Ratio=Rp−Rfσp\text{Sharpe Ratio} = \frac{R_p - R_f}{\sigma_p}Sharpe Ratio=σpRp−Rf

Where:

- RpR_pRp = Return of the portfolio

- RfR_fRf = Risk-free rate

- σp\sigma_pσp = Standard deviation of portfolio returns

A higher Sharpe Ratio indicates better risk-adjusted performance.

Why use Sharpe Ratio for evaluating risks: It allows traders and fund managers to compare portfolios objectively, balancing potential returns against volatility.

Practical Uses in Trading

- Portfolio Optimization: Sharpe Ratio helps allocate capital to assets with the best risk-return balance.

- Performance Benchmarking: Compare different strategies or funds effectively.

- Risk Management: Identify high-volatility investments that may not justify expected returns.

The Sharpe Ratio provides a clear measure of risk-adjusted returns for portfolio evaluation.

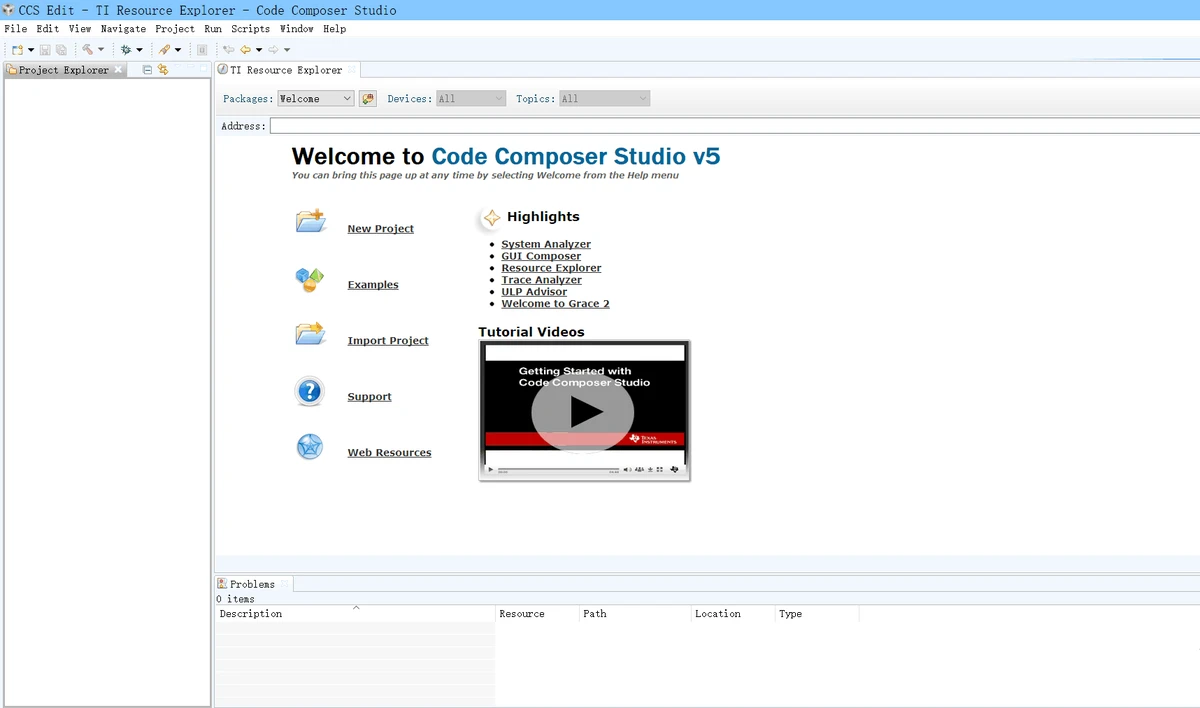

Sharpe Ratio Tutorial Videos: Learning Approaches

Method 1: Beginner-Friendly Video Tutorials

For newcomers, videos often focus on:

- Basic Formula Explanation: Step-by-step calculations using simple examples.

- Graphical Illustrations: Visual representation of risk-adjusted performance.

- Case Studies: Applying Sharpe Ratio to popular assets like stocks or ETFs.

Sharpe Ratio tips for beginner traders: These videos make complex concepts accessible and provide actionable insights for risk-aware decision-making.

Advantages:

- Simplified learning process

- Interactive examples

- Foundation for advanced analysis

Disadvantages:

- Limited coverage of complex scenarios

- May not address nuances in futures or derivatives

Method 2: Advanced Tutorials for Professionals

Professional-grade tutorials target:

- Perpetual Futures: Evaluating Sharpe Ratio in highly leveraged instruments.

- Algorithmic Trading Strategies: Integrating Sharpe Ratio into automated decision-making.

- Comparative Analysis: Measuring Sharpe Ratio across portfolios, time frames, or market conditions.

Sharpe Ratio tutorial for perpetual futures: Advanced tutorials focus on adjusting calculations for unique characteristics of futures markets, providing deeper insights for quantitative analysts.

Advantages:

- In-depth exploration of complex instruments

- Real-world applications in algorithmic trading

- Comparative performance evaluation

Disadvantages:

- Requires prior knowledge of trading concepts

- Heavier cognitive load for beginners

Advanced Sharpe Ratio tutorials help professional traders integrate risk-adjusted performance metrics into strategy development.

Comparing Learning Formats

Video vs Text-Based Tutorials

| Feature | Video Tutorials | Text-Based Guides |

|---|---|---|

| Engagement | High, visual | Medium |

| Learning Speed | Faster for beginners | Slower but detailed |

| Demonstration | Step-by-step examples | Theoretical explanations |

| Interactivity | Interactive quizzes or visual cues | Passive reading |

Video tutorials are particularly effective for demonstrating calculations, live chart analysis, and software usage.

Recommended Platforms for Sharpe Ratio Videos

- YouTube Channels: Channels focusing on finance education provide free tutorials.

- Financial Education Websites: Offer structured courses, often including quizzes and assignments.

- Professional Platforms: Bloomberg, Coursera, and Udemy provide in-depth Sharpe Ratio courses.

Where to find Sharpe Ratio analysis tools online: Many of these platforms integrate Sharpe Ratio calculators, enabling learners to apply knowledge in real-time scenarios.

Common Mistakes to Avoid

- Ignoring Risk-Free Rate: Omitting RfR_fRf can distort performance comparisons.

- Using Sharpe Ratio in Isolation: Always consider alongside other metrics like Sortino Ratio or maximum drawdown.

- Applying to Illiquid Assets: Low-volume markets may produce misleading volatility estimates.

Integrating Sharpe Ratio into Trading Strategies

Portfolio Optimization

- Allocate capital based on highest Sharpe Ratios.

- Rebalance periodically as Sharpe Ratios change.

Algorithmic Trading

- Incorporate Sharpe Ratio as a constraint in trading algorithms.

- Adjust strategy parameters dynamically to optimize risk-adjusted returns.

Where to apply Sharpe Ratio in trading strategies: Both manual and automated approaches benefit from incorporating Sharpe Ratio into decision-making frameworks.

Case Studies

Case Study 1: Stock Portfolio Evaluation

A diversified portfolio with a Sharpe Ratio of 1.5 outperformed a concentrated stock portfolio with a ratio of 1.0, despite lower absolute returns.

Case Study 2: Futures Trading Strategy

Using Sharpe Ratio-adjusted leverage in perpetual futures allowed a fund manager to maintain risk-adjusted returns during volatile market conditions.

Case studies highlight the practical benefits of Sharpe Ratio in portfolio evaluation and futures trading.

FAQ

1. Can beginners rely solely on video tutorials to learn Sharpe Ratio?

Yes, beginners can grasp the basics from video tutorials, but practical application and software exercises are crucial for mastery.

2. How do I apply Sharpe Ratio in futures trading?

Adjust calculations to account for leverage and daily settlement; professional tutorials for perpetual futures provide detailed methodologies.

3. What other metrics should complement Sharpe Ratio?

Use Sortino Ratio, maximum drawdown, and volatility measures to get a holistic view of portfolio performance.

Conclusion

Sharpe Ratio tutorial videos offer a comprehensive and accessible approach to understanding risk-adjusted performance. From beginner-friendly introductions to advanced perpetual futures applications, these videos equip traders and analysts with actionable insights for optimizing portfolios and strategies.

Engage with these resources, practice calculations, and integrate Sharpe Ratio into both manual and algorithmic trading to achieve consistent risk-adjusted returns.

Sharpe Ratio tutorials, when combined with practical application, provide a solid foundation for evaluating and improving trading strategies.

Sharing your experiences with Sharpe Ratio videos, discussing methods with peers, and experimenting with real portfolios can deepen understanding and improve financial decision-making.