=========================================

Idiosyncratic risk, also known as unsystematic risk, refers to the unique risks tied to a specific company, asset, or industry that cannot be explained by overall market movements. While investors cannot eliminate market-wide risks, solutions for managing idiosyncratic risk are crucial to protect portfolios from sudden, unexpected shocks. In this article, we will explore the foundations of idiosyncratic risk, proven strategies for mitigation, personal insights from market practice, and cutting-edge tools reshaping modern portfolio management.

Understanding Idiosyncratic Risk

What Is Idiosyncratic Risk?

Idiosyncratic risk arises from internal factors that affect only a particular company or security. Examples include:

- A company’s management decisions.

- Product recalls or lawsuits.

- Earnings surprises.

- Industry-specific regulatory changes.

Unlike systematic risk, which stems from macroeconomic conditions, idiosyncratic risk can often be mitigated through diversification and risk management strategies.

Why Managing Idiosyncratic Risk Matters

Failing to control idiosyncratic risk can cause severe financial damage. For instance, investors in companies like Enron or Lehman Brothers learned how devastating firm-specific shocks could be. Today, with more complex instruments such as perpetual futures, understanding how idiosyncratic risk impacts perpetual futures has become essential for traders and portfolio managers.

Core Solutions for Managing Idiosyncratic Risk

1. Diversification Across Assets and Sectors

The most widely used method to manage idiosyncratic risk is diversification.

Advantages:

- Reduces exposure to single-company failures.

- Provides stability against unexpected firm-specific events.

Disadvantages:

- Diversification cannot eliminate systematic risk.

- Over-diversification may dilute returns.

2. Hedging with Derivatives

Hedging involves using financial instruments like options, futures, or swaps to protect against adverse price movements.

Advantages:

- Provides direct protection against downside risks.

- Tailored strategies can be customized to investor needs.

Disadvantages:

- Requires advanced knowledge of derivative pricing.

- May reduce potential upside.

3. Fundamental and Quantitative Analysis

By combining deep fundamental research with quantitative models, investors can identify red flags and adjust positions accordingly.

Advantages:

- Offers early-warning indicators of company-specific risk.

- Enhances decision-making with data-driven insights.

Disadvantages:

- Requires constant monitoring.

- May be resource-intensive for smaller investors.

Advanced Approaches to Idiosyncratic Risk

Factor-Based Risk Models

Factor models (like Fama-French or Barra) break down returns into systematic and idiosyncratic components, allowing managers to isolate and reduce unwanted risks.

Technology-Driven Solutions

AI and machine learning tools provide predictive insights into risk exposure. Automated trading systems now integrate automated solutions for idiosyncratic risk, enabling real-time detection of anomalies.

Stress Testing and Scenario Analysis

By simulating extreme events, investors can gauge potential portfolio losses. This technique is particularly effective in identifying vulnerabilities in assets sensitive to idiosyncratic risk considerations for portfolio managers.

Comparing Two Key Strategies: Diversification vs. Hedging

Diversification

- Pros: Cost-effective, simple to implement, accessible for retail investors.

- Cons: Cannot protect against systemic crises, may limit upside potential.

Hedging

- Pros: Provides direct protection, customizable for unique risk exposures.

- Cons: Complex, requires derivatives knowledge, can be costly.

Best Practice: Use a hybrid approach that combines diversification with selective hedging, tailored to portfolio size, investor goals, and risk tolerance.

Industry Trends in Idiosyncratic Risk Management

- AI-Powered Analytics: Advanced algorithms can detect correlations that traditional models miss, improving early identification of idiosyncratic risk.

- Blockchain Transparency: Distributed ledger technology improves auditability, reducing fraud-related risks.

- Integration with ESG Factors: Companies’ environmental, social, and governance (ESG) practices now play a role in assessing firm-specific risks.

Personal Insights: Practical Lessons

From my own experience working with risk managers, one lesson stands out: idiosyncratic shocks often come from unexpected areas, such as sudden management resignations or industry regulation shifts. A balanced framework that includes diversification, hedging, and predictive analytics has consistently proven more effective than relying on one method alone.

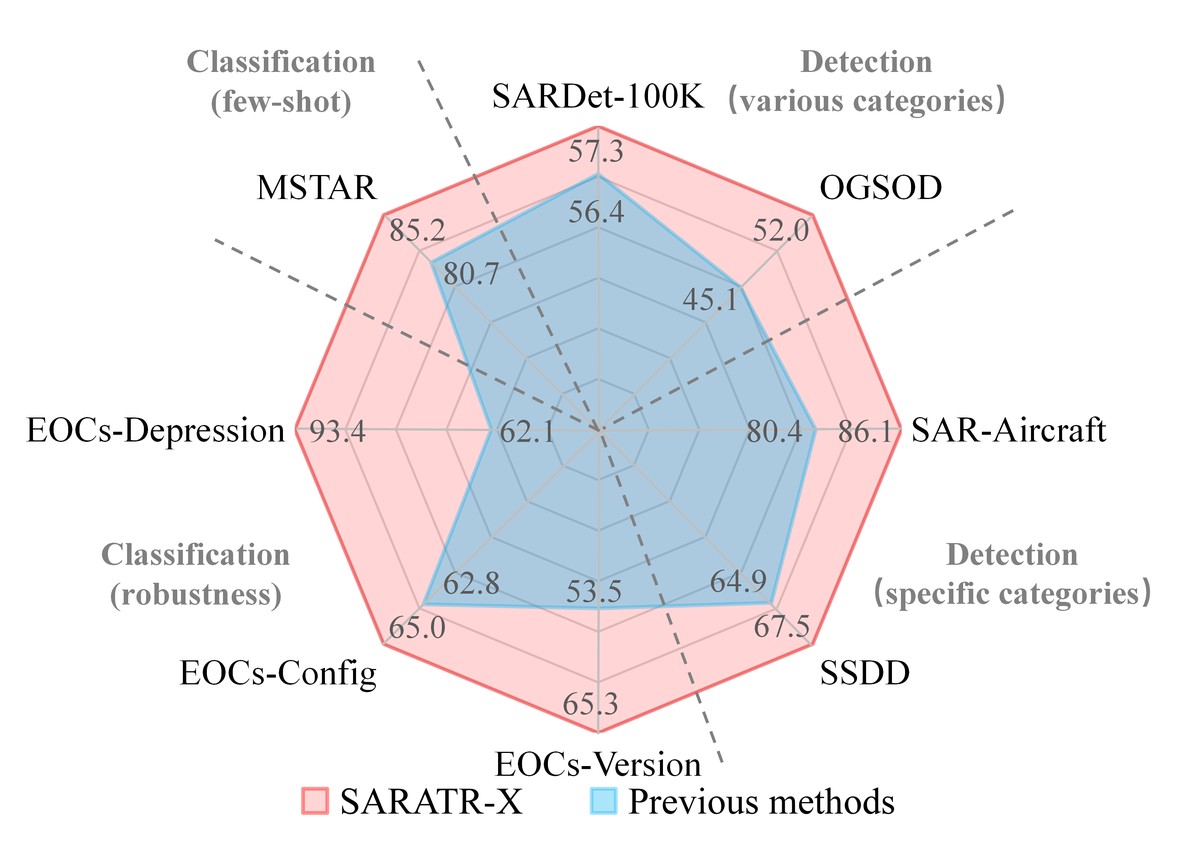

Visual Example

Comparison of systematic and idiosyncratic risk contributions in portfolio exposure.

FAQ: Solutions for Managing Idiosyncratic Risk

1. Can diversification alone eliminate idiosyncratic risk?

No. Diversification reduces idiosyncratic risk significantly but cannot eliminate it completely. Black swan events, fraud, or regulatory changes can still impact even well-diversified portfolios.

2. What role do perpetual futures play in idiosyncratic risk management?

Perpetual futures allow traders to hedge specific exposures dynamically. Understanding how to manage idiosyncratic risk in perpetual futures is crucial since futures can magnify both gains and losses if not managed carefully.

3. Are automated solutions reliable for managing idiosyncratic risk?

Yes, to an extent. AI-driven models and automated systems can provide real-time detection of firm-specific anomalies. However, they should complement—not replace—human judgment and oversight.

Conclusion: Building a Resilient Risk Management Framework

Effective solutions for managing idiosyncratic risk require a multi-layered approach. Diversification provides a baseline defense, hedging adds tailored protection, and advanced analytics enhance foresight. As markets grow more complex, the integration of technology-driven tools with traditional strategies becomes indispensable.

The future of idiosyncratic risk management lies in blending experience, data, and innovation. Whether you are a retail investor, portfolio manager, or institutional analyst, adopting a comprehensive framework will help safeguard your investments from unexpected shocks.

If you found this article useful, share it with colleagues or leave a comment below. Let’s continue the conversation on building smarter, more resilient risk management strategies.

Would you like me to also prepare a case study-based infographic on real-world idiosyncratic risk events to enrich this article?