The Sortino ratio is one of the most crucial metrics for evaluating the risk-adjusted returns of investment strategies. Unlike the Sharpe ratio, which considers both upside and downside volatility, the Sortino ratio only penalizes downside volatility, making it a more relevant indicator for traders and investors focused on minimizing risk. For perpetual futures traders, understanding how to improve the Sortino ratio can significantly enhance your trading strategy and lead to more consistent and profitable outcomes. In this article, we’ll explore the Sortino ratio, why it matters in the context of perpetual futures, and actionable tips to improve it.

1. What is the Sortino Ratio?

1.1 Definition and Importance

The Sortino ratio measures the risk-adjusted return of an investment, but it differs from traditional risk-adjusted metrics by focusing solely on negative volatility. This is particularly relevant for traders who are more concerned with minimizing potential losses than maximizing overall volatility.

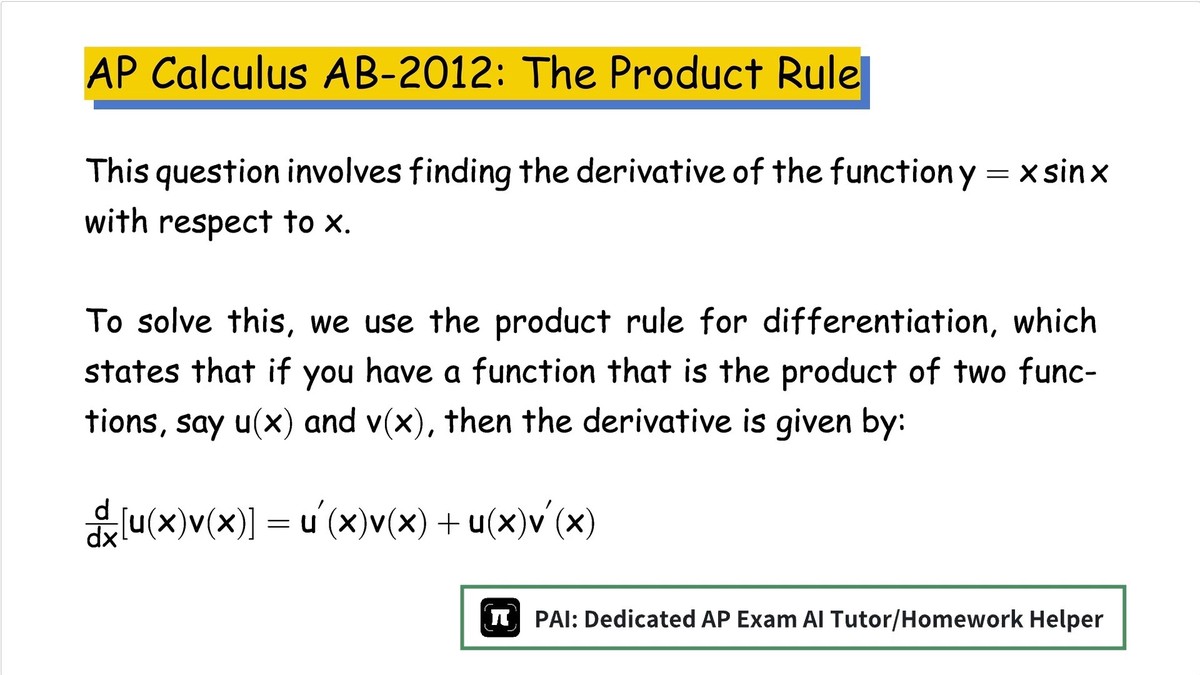

The formula for the Sortino ratio is:

\[ \text{Sortino Ratio} = \frac{\text{Actual Return} - \text{Target Return}}{\text{Downside Deviation}} \]

- Actual Return: The return of the asset or strategy over a period.

- Target Return: The minimum acceptable return, often set as 0% or the risk-free rate.

- Downside Deviation: The standard deviation of negative asset returns, which reflects downside risk.

For perpetual futures traders, the Sortino ratio helps assess whether the rewards are worth the potential downside risk, offering valuable insights into strategy performance.

2. Why is the Sortino Ratio Important for Perpetual Futures Traders?

2.1 Understanding the Role of Downside Risk in Perpetual Futures

In perpetual futures, traders deal with high volatility, frequent liquidations, and the risk of significant market moves. This type of trading can lead to substantial drawdowns, especially if the trader is over-leveraged. By using the Sortino ratio, traders can evaluate the effectiveness of their strategies in terms of minimizing large losses while still achieving competitive returns.

While traditional measures like the Sharpe ratio penalize both positive and negative volatility, the Sortino ratio focuses exclusively on negative volatility, making it a more precise measure for risk-sensitive traders.

Why traders in perpetual futures should care about the Sortino ratio:

- Emphasis on downside risk: Perpetual futures often involve leveraged positions, which can exacerbate the impact of downside volatility.

- Focus on risk-adjusted returns: Ensures that the returns are not just high but are achieved with an acceptable level of risk.

3. Tips to Improve Your Sortino Ratio in Perpetual Futures Trading

Improving your Sortino ratio in perpetual futures requires a careful balance of optimizing returns while reducing downside risk. Below are several strategies to help enhance your Sortino ratio:

3.1 Optimize Position Sizing

One of the most effective ways to reduce downside risk in perpetual futures trading is through proper position sizing. A well-calibrated position size ensures that you can ride out market volatility without risking too much of your capital in a single trade.

How to optimize position sizing:

- Risk-based position sizing: Define the amount of risk per trade as a percentage of your total capital. For example, risking no more than 1-2% of your account balance on each trade can protect you from catastrophic losses.

- Leverage management: In perpetual futures, leveraging can amplify both gains and losses. By using appropriate leverage, you ensure that your position size remains manageable, reducing the likelihood of a large loss.

Pros:

- Limits exposure to large losses.

- Protects capital during periods of high volatility.

Cons:

- Requires constant monitoring and adjustment based on market conditions.

- Overly cautious position sizing can lead to missed profit opportunities.

3.2 Use Stop-Loss and Take-Profit Orders Effectively

Implementing stop-loss orders is a key component of risk management. By setting stop-loss levels, you automatically limit potential losses on any given trade, improving the risk-to-reward ratio and, consequently, the Sortino ratio.

How to use stop-loss and take-profit:

- Trailing stop-loss: A trailing stop moves in tandem with the market price, locking in profits while protecting against downside moves.

- Dynamic take-profit levels: Set take-profit levels based on technical analysis (e.g., resistance levels) or price action, ensuring you capture profits before a reversal.

Pros:

- Helps to protect gains and minimize drawdowns.

- Provides emotional discipline by automatically executing trades.

Cons:

- A market spike could trigger the stop-loss, closing a position prematurely.

- Setting stops too tight could lead to early exits, especially in volatile markets.

4. Advanced Techniques for Sortino Ratio Optimization

4.1 Incorporate Trend Following Strategies

Trend-following strategies help traders take advantage of market momentum, which is especially useful in volatile perpetual futures markets. By identifying and trading in the direction of the dominant market trend, traders can reduce the likelihood of being caught in significant drawdowns.

How to implement a trend-following strategy:

- Use moving averages: Employ short-term and long-term moving averages (e.g., 50-day and 200-day MAs) to identify the prevailing trend.

- Momentum indicators: Use indicators like MACD or RSI to confirm the strength of a trend before entering a position.

Pros:

- Increases the likelihood of trading in favorable market conditions.

- Reduces exposure to choppy or sideways markets that often lead to losses.

Cons:

- Trend-following strategies may lag behind the market, causing delayed entries.

- Can lead to whipsaw losses in volatile or sideways markets.

4.2 Diversify Across Multiple Perpetual Futures Contracts

Another advanced method to improve the Sortino ratio is through diversification. By trading multiple perpetual futures contracts across different assets (e.g., BTC, ETH, and altcoins), traders can reduce the impact of market-specific risks.

How to diversify effectively:

- Asset diversification: Spread positions across different cryptocurrencies to avoid correlation risks.

- Time-frame diversification: Trade across different timeframes, such as short-term, medium-term, and long-term positions, to smooth out volatility.

Pros:

- Reduces overall portfolio volatility.

- Increases the likelihood of maintaining a steady risk-adjusted return.

Cons:

- Requires more time and resources to track multiple positions.

- Can lead to smaller, more frequent losses if not properly managed.

5. FAQ: Frequently Asked Questions About Improving Sortino Ratio in Perpetual Futures

5.1 What is the ideal Sortino ratio for perpetual futures trading?

Answer: A Sortino ratio above 2 is generally considered excellent, indicating that the strategy generates more returns for each unit of downside risk. However, for perpetual futures, a ratio above 1.5 can still indicate a strong performance, given the high volatility of the market.

5.2 How can I calculate the Sortino ratio for perpetual futures?

Answer: The Sortino ratio is calculated by subtracting the target return (often 0% or the risk-free rate) from the actual return of your futures strategy and then dividing it by the downside deviation (the standard deviation of negative returns). You can find many online calculators or use software like Excel to calculate it.

5.3 Why is the Sortino ratio important in perpetual futures?

Answer: The Sortino ratio is crucial for perpetual futures traders because it helps assess whether the strategy is providing a good risk-to-reward ratio by focusing on downside risk. Given the high leverage and volatility in perpetual futures, minimizing large losses while capturing upside potential is essential for long-term success.

6. Conclusion

Improving the Sortino ratio in perpetual futures trading is essential for managing downside risk while maximizing returns. By optimizing position sizing, using stop-loss orders, and employing advanced strategies like trend following and diversification, traders can significantly enhance their Sortino ratio and reduce risk. However, it’s important to balance these strategies with a solid understanding of market conditions and personal risk tolerance. With the right tools and strategies, you can build a robust trading approach that offers superior risk-adjusted returns in the unpredictable world of perpetual futures.