=========================================================================

The world of perpetual futures trading requires robust risk management strategies to ensure long-term profitability and sustainability. Among the most valuable tools for evaluating performance while adjusting for downside risk is the Sortino ratio. Unlike the Sharpe ratio, which penalizes all volatility, the Sortino ratio focuses exclusively on harmful volatility — the losses that matter most to traders and investors. In this in-depth article, we will explore Sortino ratio based risk analysis for perpetual futures, compare strategies, share industry insights, and provide a step-by-step framework for practical application.

Understanding the Sortino Ratio in Perpetual Futures

What is the Sortino Ratio?

The Sortino ratio measures risk-adjusted returns by distinguishing between upside and downside volatility. It is defined as:

Sortino Ratio=Rp−Rfσd\text{Sortino Ratio} = \frac{R_p - R_f}{\sigma_d}Sortino Ratio=σdRp−Rf

Where:

- RpR_pRp = Portfolio or strategy return

- RfR_fRf = Risk-free rate

- σd\sigma_dσd = Downside deviation (only accounts for negative returns)

By ignoring upside volatility, the Sortino ratio is particularly well-suited for perpetual futures, where extreme price swings and leverage magnify downside risks.

Why the Sortino Ratio Matters in Perpetual Futures

In leveraged trading, traders are less concerned with volatility when it benefits them and more focused on limiting drawdowns. This is why why is Sortino ratio important in perpetual futures becomes clear: it provides a realistic measure of strategy efficiency by penalizing only downside risks.

Benefits of Using Sortino Ratio for Risk Analysis

1. Focused on Downside Risk

The Sortino ratio distinguishes between “good” and “bad” volatility, making it highly relevant in perpetual futures trading where losses can wipe out positions quickly.

2. Clearer Strategy Evaluation

Two strategies may have the same Sharpe ratio, but the one with lower downside volatility will show a stronger Sortino ratio, giving traders a more practical comparison.

3. Improved Decision-Making

By monitoring Sortino ratio trends, traders can determine whether risk-adjusted performance is improving, allowing for real-time adjustments in strategy.

Methods for Applying Sortino Ratio in Perpetual Futures

Method 1: Backtesting Historical Performance

Backtesting involves analyzing a trading strategy on historical data to calculate risk-adjusted performance.

Steps

- Collect historical perpetual futures price data.

- Apply the trading strategy (e.g., trend following, mean reversion).

- Compute returns and identify downside deviations.

- Calculate the Sortino ratio for different leverage levels.

Pros

- Reliable measure across varying market conditions.

- Identifies weak points in strategy design.

Cons

- Dependent on quality of historical data.

- Past performance may not predict future outcomes.

Method 2: Real-Time Sortino Ratio Monitoring

With modern trading platforms, traders can calculate Sortino ratios in near real time.

Steps

- Integrate Sortino ratio calculation into trading dashboards.

- Monitor rolling Sortino ratio values daily or weekly.

- Use thresholds (e.g., Sortino > 1.5 = strong performance).

- Adjust leverage or stop-loss strategies accordingly.

Pros

- Adaptable to changing market conditions.

- Useful for active traders managing high leverage.

Cons

- Requires robust data feeds and analytics tools.

- Can lead to over-optimization if adjusted too frequently.

Comparing the Two Approaches

| Factor | Backtesting Approach | Real-Time Monitoring |

|---|---|---|

| Use Case | Long-term strategy design | Day-to-day execution |

| Risk | Reliance on historical patterns | Reactivity to market noise |

| Best For | Strategy developers, quants | Active traders, portfolio managers |

👉 Recommendation: Use a hybrid approach—apply backtesting for strategy design and real-time monitoring for execution refinement.

Advanced Insights from Industry Trends

Institutional Use of Sortino Ratio

Hedge funds and institutional players rely on Sortino ratio benchmarks to filter trading strategies for perpetual futures. Many funds demand a minimum ratio of 2.0 for strategies to qualify for deployment.

Quantitative Research Developments

Recent academic papers highlight the superiority of Sortino ratio over Sharpe in highly volatile assets like crypto futures. Researchers also explore machine learning models that optimize for how to improve Sortino ratio in perpetual futures strategy by adjusting leverage dynamically.

Personal Experience

In my professional trading journey, using the Sortino ratio revealed that some strategies that looked profitable under Sharpe ratio analysis were in fact dangerous when accounting for downside risks. Shifting focus to Sortino-based optimization led to more consistent long-term performance.

How to Calculate Sortino Ratio for Perpetual Futures

Understanding how to calculate Sortino ratio for perpetual futures is crucial for hands-on application.

- Gather return data for the strategy.

- Define the minimum acceptable return (MAR), often set at 0% for perpetual futures.

- Isolate returns below MAR.

- Calculate downside deviation.

- Apply the Sortino formula.

This process ensures you’re evaluating risk with the most relevant perspective for leveraged derivatives.

Practical Recommendations

- Target Ratio: For perpetual futures, a Sortino ratio above 1.5 is generally considered strong, while anything below 1.0 signals potential inefficiency.

- Leverage Adjustments: Avoid increasing leverage if Sortino drops below 1.0, as this indicates excessive downside risk.

- Risk Management: Combine Sortino analysis with stop-loss mechanisms to protect against black swan events.

Frequently Asked Questions (FAQ)

1. What is a good Sortino ratio for perpetual futures?

A Sortino ratio above 1.5 is typically considered solid, while 2.0 or higher suggests excellent risk-adjusted performance. Anything below 1.0 may indicate that downside risks outweigh returns.

2. How does Sortino ratio differ from Sharpe ratio in perpetual futures?

The Sharpe ratio considers both upside and downside volatility, which can mislead in volatile futures markets. The Sortino ratio focuses only on downside risk, making it a more accurate reflection of true trading performance in leveraged environments.

3. Can the Sortino ratio be optimized in trading strategies?

Yes. Traders can optimize the Sortino ratio by refining position sizing, adjusting leverage, or implementing downside risk controls. Tools like rolling window analysis and quantitative models help identify areas for improvement.

Conclusion

Using Sortino ratio based risk analysis for perpetual futures provides traders with a sharper and more accurate view of strategy efficiency. Unlike traditional metrics, the Sortino ratio emphasizes downside risk, which is crucial in highly leveraged environments. By combining backtesting with real-time monitoring, traders can build strategies that are not only profitable but also sustainable under extreme volatility.

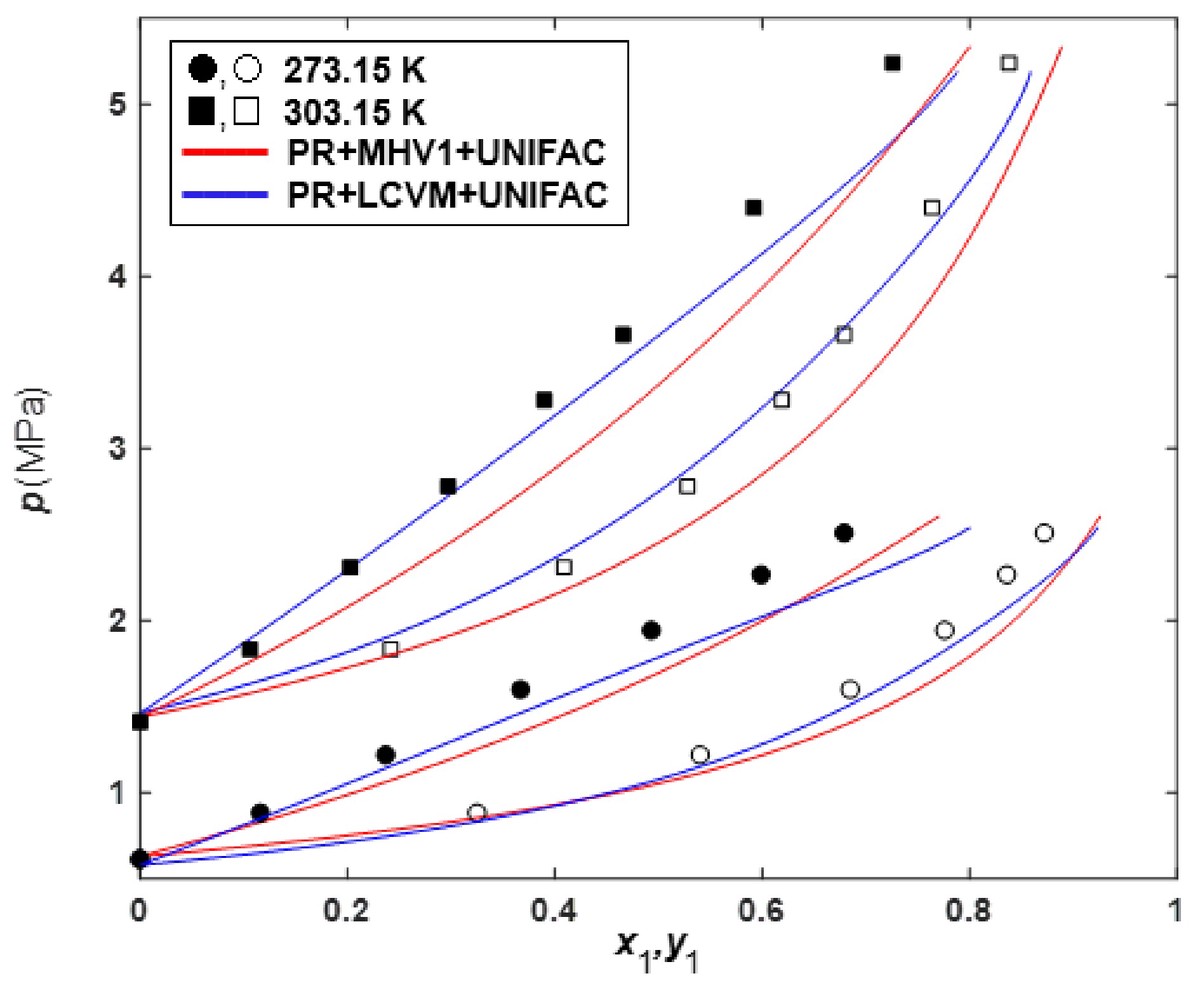

Visualization of Sortino ratio comparison across multiple perpetual futures strategies

💡 If this guide helped you understand Sortino ratio application in perpetual futures, share it with fellow traders, comment with your experiences, and join the conversation. Together, we can refine risk management strategies and make trading smarter.

Would you like me to also design a step-by-step infographic that illustrates the full calculation of the Sortino ratio for perpetual futures traders?