Introduction

Sovereign risk is one of the most important yet often underestimated factors that can influence financial markets. For new traders, building a sovereign risk framework is essential to better understand the macroeconomic and political forces that impact investment decisions, trading strategies, and portfolio management. The keyword sovereign risk framework for new traders reflects a growing demand for accessible yet professional guidance on this subject. This article will provide a detailed, SEO-optimized guide to help beginners build a practical understanding of sovereign risk, while also embedding industry insights, case studies, and actionable strategies.

What Is Sovereign Risk?

Sovereign risk refers to the likelihood that a government may default on its debt obligations or take actions that negatively impact foreign investors. It can manifest through direct debt defaults, currency devaluations, or capital controls that restrict the movement of funds. Sovereign risk is particularly relevant in global trading, especially in futures and derivatives markets where volatility is amplified.

Types of Sovereign Risk

- Default Risk: The chance that a government will fail to meet its debt repayment obligations.

- Transfer and Convertibility Risk: The risk that foreign investors cannot repatriate profits due to currency restrictions.

- Political Risk: Instability such as coups, sanctions, or corruption can undermine economic performance.

- Macroeconomic Risk: Poor fiscal management, inflation, or external shocks impacting a country’s solvency.

Why Sovereign Risk Matters for New Traders

New traders are often focused on price charts, technical patterns, or short-term sentiment indicators. However, ignoring sovereign risk can expose portfolios to sudden, systemic shocks. Understanding this framework is crucial because sovereign events often trigger large swings in asset classes such as bonds, currencies, equities, and perpetual futures.

For example, learning about why sovereign risk matters in perpetual futures can highlight how geopolitical events like sanctions or defaults ripple into derivative pricing, creating both risks and opportunities.

Methods to Assess Sovereign Risk

There are multiple approaches to evaluating sovereign risk. Below are two essential strategies:

1. Quantitative Models

Quantitative analysis involves structured models that use financial ratios, macroeconomic indicators, and credit spreads to estimate risk.

Pros:

- Data-driven, objective, and scalable.

- Easier to benchmark across countries.

- Useful for algorithmic trading strategies.

Cons:

- Often lags real-world developments.

- Over-reliance on historical data can miss new political dynamics.

2. Qualitative Analysis

Qualitative methods include analyzing political developments, government policy shifts, and social dynamics.

Pros:

- Captures real-time nuances.

- Better for anticipating black swan events.

- Complements hard data.

Cons:

- Subjective and dependent on analyst expertise.

- Harder to standardize across markets.

Recommended Approach: Hybrid Framework

For new traders, a hybrid framework that combines quantitative indicators (such as CDS spreads, inflation data, and sovereign credit ratings) with qualitative monitoring (political elections, international relations, or regulatory changes) is the most effective. This dual approach balances numerical reliability with real-world awareness.

Key Tools for Monitoring Sovereign Risk

- Credit Rating Agencies: Moody’s, S&P, Fitch provide sovereign credit ratings.

- Market Instruments: Sovereign bond spreads, credit default swaps.

- Economic Indicators: GDP growth, current account balances, foreign reserves.

- News and Geopolitical Sources: Reuters, Bloomberg, IMF country reports.

By combining these, traders can develop a more resilient sovereign risk framework.

Building a Sovereign Risk Framework for New Traders

Here is a step-by-step guide:

Step 1: Identify Key Countries in Your Portfolio

Focus on countries whose economic policies directly affect your investments. For example, U.S. Treasuries or emerging market bonds.

Step 2: Track Quantitative Indicators

Regularly monitor sovereign bond yields, credit spreads, and central bank reserves.

Step 3: Assess Political Risk

Follow local elections, geopolitical tensions, and policy announcements that may change market conditions.

Step 4: Incorporate Risk into Trading

Adjust leverage and hedging strategies based on sovereign risk levels.

Step 5: Review and Update

Sovereign risk evolves constantly; updating your framework ensures relevance and accuracy.

Case Studies of Sovereign Risk in Action

- Argentina’s 2001 Default: Triggered massive currency devaluation and investor losses.

- European Debt Crisis (2010-2012): Sovereign risk spread contagion across EU markets.

- Russia-Ukraine Conflict (2022): Sovereign risk escalated with sanctions, causing ripple effects in global futures trading.

These examples show how sovereign risk can shift market dynamics overnight.

Practical Applications for Futures Traders

New traders entering futures markets must understand that sovereign risk does not just impact bond yields but also influences futures price discovery. For instance, how sovereign risk affects perpetual futures trading is crucial for those trading crypto derivatives tied to macroeconomic events. Sovereign crises can create volatility spikes that demand disciplined risk management.

Images to Visualize Sovereign Risk

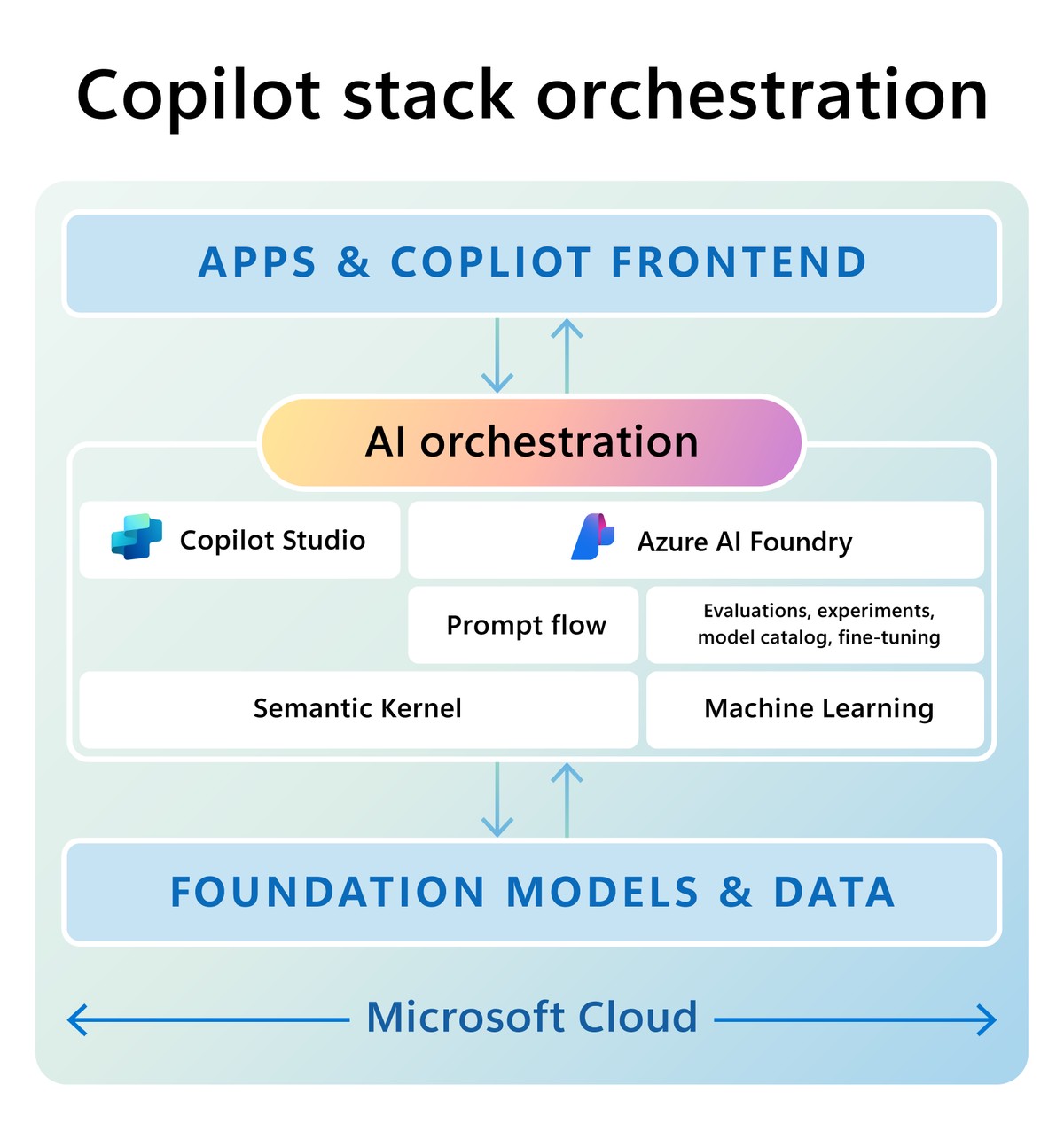

Sovereign risk framework combining quantitative and qualitative methods

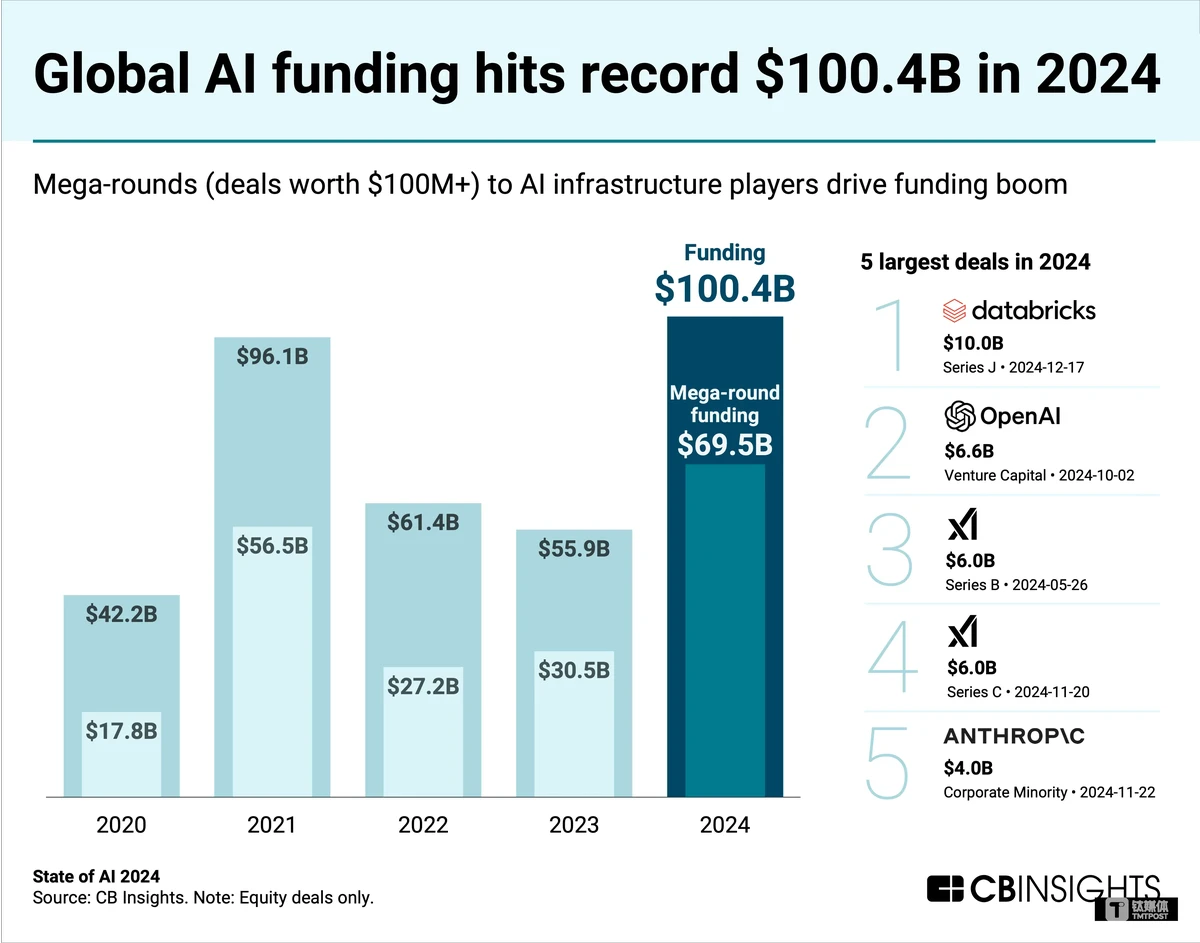

Example of sovereign risk impact on bond yields

FAQ: Sovereign Risk Framework for New Traders

1. What is the best starting point for new traders learning about sovereign risk?

Begin with sovereign bond spreads and credit ratings, then integrate political risk monitoring. Free reports from the IMF and World Bank are good entry points.

2. How does sovereign risk impact futures trading?

Sovereign crises affect investor confidence, increase volatility, and shift pricing in futures markets. For example, a downgrade in a major economy’s credit rating can spark broad market sell-offs.

3. Can sovereign risk be mitigated completely?

No, it cannot be eliminated, but diversification, hedging with derivatives, and staying informed can significantly reduce exposure.

Conclusion

Sovereign risk is a fundamental concept for traders of all levels, but especially for beginners aiming to build strong foundations. Developing a sovereign risk framework for new traders requires blending quantitative tools with qualitative awareness. By integrating this framework into trading, new traders can better anticipate risks, protect portfolios, and identify profitable opportunities.

If you found this guide useful, feel free to share it with your trading community, leave a comment, or ask questions below—your input can help others refine their sovereign risk approach.