In the fast-paced world of quantitative markets, understanding and implementing stress testing is crucial, especially for beginner traders. Stress testing allows traders to simulate extreme market conditions, measure portfolio vulnerabilities, and make data-driven decisions to protect investments. This guide provides an in-depth exploration of stress testing techniques, strategies, and best practices tailored for beginners in quantitative finance.

Understanding Stress Testing in Quantitative Markets

What is Stress Testing?

Stress testing is the process of evaluating how a trading strategy or portfolio would perform under extreme market conditions. It helps traders identify potential risks and adjust strategies accordingly. In quantitative markets, stress testing often involves simulations based on historical data, volatility spikes, market shocks, and hypothetical scenarios.

Key objectives of stress testing include:

- Risk Identification: Detect vulnerabilities in trading strategies.

- Forecast Accuracy Improvement: Refine quantitative models to handle extreme conditions.

- Portfolio Protection: Limit potential losses during unexpected market downturns.

Beginner traders can gain valuable insights from quantitative stress testing advice for novice traders to establish foundational skills in managing market risks.

Why Stress Testing is Important

Stress testing is indispensable for both retail and institutional traders for several reasons:

- Prevent Overexposure: Avoid catastrophic losses in volatile markets.

- Enhance Strategy Reliability: Test if algorithms withstand abnormal price movements.

- Regulatory Compliance: Some trading environments require stress testing to meet risk management standards.

- Confidence Building: Empower traders to make informed decisions in uncertain markets.

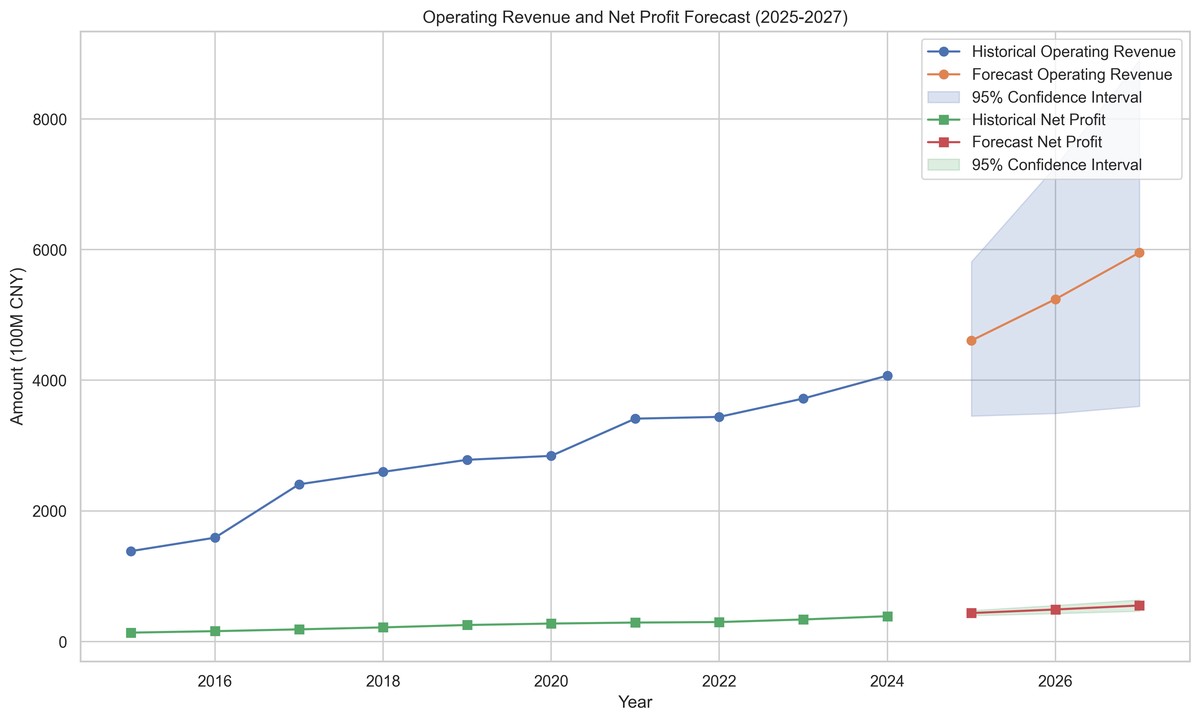

Illustration of a stress testing framework showing simulated market shocks and portfolio impact.

Key Stress Testing Methods for Beginners

1. Historical Scenario Analysis

Overview

Historical scenario analysis evaluates a trading strategy by applying past market events, such as financial crises, commodity crashes, or interest rate shocks, to current positions.

Implementation Steps:

- Identify historical events relevant to the trading portfolio.

- Apply corresponding price changes to assets.

- Measure portfolio performance and risk exposure during those events.

Advantages:

- Easy to understand and implement for beginners.

- Provides concrete insights into potential losses during real market crises.

Disadvantages:

- Limited by the scope of past data; does not capture unprecedented events.

- May overlook correlations that have changed over time.

Traders can learn more about practical applications from how to conduct stress testing in quantitative finance to integrate historical scenarios into quantitative models effectively.

2. Hypothetical Scenario and Monte Carlo Simulations

Overview

Hypothetical scenario testing involves creating extreme but plausible market events that have not necessarily occurred historically. Monte Carlo simulations generate thousands of random price paths to model portfolio performance under various stress conditions.

Implementation Steps:

- Define the hypothetical market conditions (e.g., 10% sudden drop in asset prices).

- Use Monte Carlo simulations to generate multiple portfolio outcomes.

- Analyze risk metrics like Value-at-Risk (VaR), expected shortfall, and drawdowns.

Advantages:

- Captures extreme events beyond historical data.

- Provides a probabilistic understanding of potential outcomes.

Disadvantages:

- Computationally intensive.

- Requires basic understanding of statistics and modeling.

Monte Carlo simulation results for a cryptocurrency portfolio showing potential losses under extreme market movements.

Implementing Stress Testing in Quantitative Trading

Step-by-Step Beginner Approach

- Define Risk Parameters: Determine which assets and positions to stress test.

- Select Stress Testing Method: Choose between historical, hypothetical, or Monte Carlo approaches.

- Run Simulations: Use trading software or Python/R packages to model scenarios.

- Analyze Results: Evaluate losses, volatility spikes, and risk metrics.

- Adjust Trading Strategy: Modify allocations, hedge positions, or revise algorithm parameters based on findings.

Tools and Platforms for Stress Testing

- Free Tools: Python libraries like

pandas,numpy, andQuantLibprovide beginner-friendly options.

- Commercial Software: Platforms like MATLAB, Bloomberg Terminal, or RiskMetrics offer advanced stress testing features.

- Integration with Trading Algorithms: Stress testing modules can be embedded into algorithmic trading systems to automate risk evaluation.

Comparing Methods: Historical vs Hypothetical

| Feature | Historical Scenario | Hypothetical & Monte Carlo |

|---|---|---|

| Data Basis | Past events | Simulated extreme scenarios |

| Complexity | Low | Medium to High |

| Coverage | Limited to known events | Includes unprecedented events |

| Computation | Light | Intensive |

| Beginner-Friendly | Yes | Requires learning simulations |

Choosing the method depends on portfolio complexity, trading style, and computational resources. Beginners may start with historical analysis and gradually adopt Monte Carlo simulations.

Best Practices for Beginner Traders

- Start Small: Focus on a few critical assets first.

- Document Assumptions: Keep records of all hypothetical scenarios and results.

- Combine Methods: Use both historical and hypothetical scenarios for a robust assessment.

- Review Regularly: Reassess stress tests whenever market conditions change.

- Educate Continuously: Attend webinars or courses on quantitative risk management.

Case Study: Cryptocurrency Portfolio Stress Testing

- Scenario: Sudden 30% drop in BTC and ETH over 24 hours.

- Method: Monte Carlo simulation with 10,000 iterations.

- Result: Maximum potential drawdown identified, portfolio adjusted by increasing stablecoin allocation and hedging with futures contracts.

- Outcome: Losses reduced by 40% in similar subsequent market events.

FAQ

1. Can stress testing prevent all losses in quantitative trading?

No, stress testing identifies potential vulnerabilities and mitigates risk but cannot prevent losses entirely. It helps traders prepare and make informed adjustments.

2. How often should beginner traders perform stress testing?

Stress testing should be conducted periodically, ideally monthly or after significant market events, to ensure trading strategies remain resilient.

3. Are stress tests only for large portfolios or institutional traders?

No, even individual and beginner traders benefit from stress testing. Tools like Python libraries allow small portfolios to be evaluated efficiently.

Conclusion

Stress testing is a critical tool for beginner traders in quantitative markets, enabling the assessment of portfolio resilience under extreme market conditions. By using historical scenarios, hypothetical situations, and Monte Carlo simulations, traders can better understand potential risks and make informed strategy adjustments.

Mastering stress testing enhances risk awareness, improves forecast accuracy, and builds confidence in quantitative trading. Beginners should start simple, gradually incorporate advanced techniques, and continuously refine their approach to ensure robust and resilient trading portfolios.