Perpetual futures trading has emerged as a cornerstone of modern derivatives markets, offering traders the ability to maintain positions indefinitely without worrying about expiry dates. However, the systematic risk inherent in these instruments can lead to substantial portfolio swings if not properly assessed and managed. This article explores systematic risk evaluations for perpetual futures traders, combining in-depth strategies, real-world insights, and advanced analytical methods.

Understanding Systematic Risk in Perpetual Futures

What Is Systematic Risk?

Systematic risk, also known as market risk, refers to the potential for losses due to broad market movements, macroeconomic events, or systemic financial shocks that affect the entire asset class. Unlike idiosyncratic risk, which can be diversified away, systematic risk is unavoidable and affects all traders to some extent.

In the context of perpetual futures:

- Market volatility directly influences funding rates and margin requirements

- Liquidity crunches can trigger rapid liquidations

- Correlated asset movements, such as BTC and ETH, amplify portfolio exposure

Why systematic risk is crucial in perpetual futures: Understanding these risks allows traders to calibrate leverage, hedge positions effectively, and anticipate market-wide shocks.

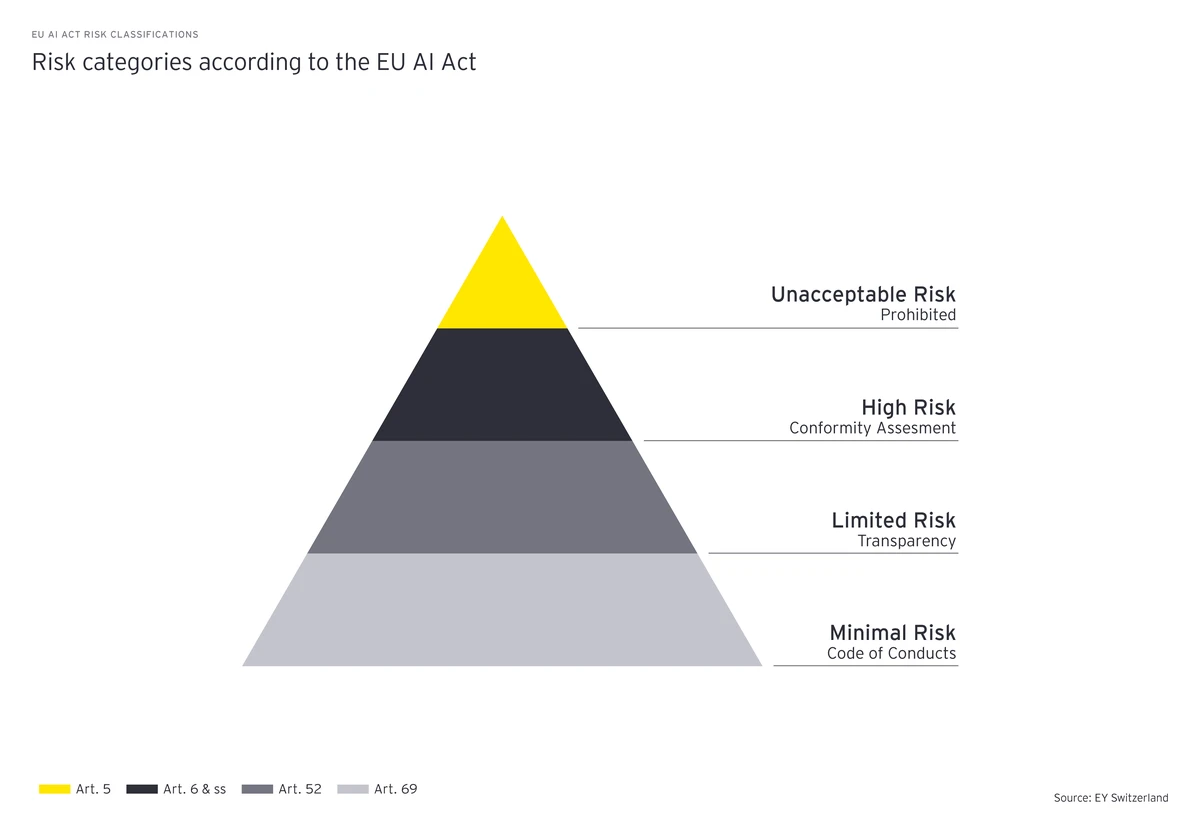

Sources of Systematic Risk

- Macro-Economic Events: Interest rate changes, inflation, geopolitical instability

- Market Sentiment Shifts: Sudden fear or greed-driven movements

- Cross-Asset Correlations: Strong correlations among cryptocurrencies, commodities, or equities

- Regulatory Announcements: Policy changes affecting exchanges, derivatives, or margin trading rules

Illustration of primary sources contributing to systematic risk in perpetual futures.

Methods for Evaluating Systematic Risk

Method 1: Beta and Volatility Metrics

Beta Analysis

Beta measures an asset’s sensitivity to overall market movements. For perpetual futures:

- High beta instruments respond strongly to market swings

- Low beta instruments offer more stability but limited profit potential

- Traders can use beta to adjust leverage exposure based on market conditions

Volatility Indicators

- Historical volatility (HV): Tracks past price fluctuations

- Implied volatility (IV): Reflects market expectations of future price swings

- Combining beta with volatility provides a quantitative framework for systematic risk assessment

How to calculate systematic risk in perpetual futures: Beta multiplied by market volatility offers a direct metric for expected portfolio sensitivity.

Pros: Quantifiable, easy to integrate with risk management

Cons: Past data may not fully predict future shocks

Method 2: Stress Testing and Scenario Analysis

Scenario Modeling

- Simulate market shocks such as 50% BTC drawdowns or funding rate spikes

- Evaluate impact on margin requirements, liquidation probabilities, and portfolio P&L

- Adjust leverage and hedge positions based on modeled scenarios

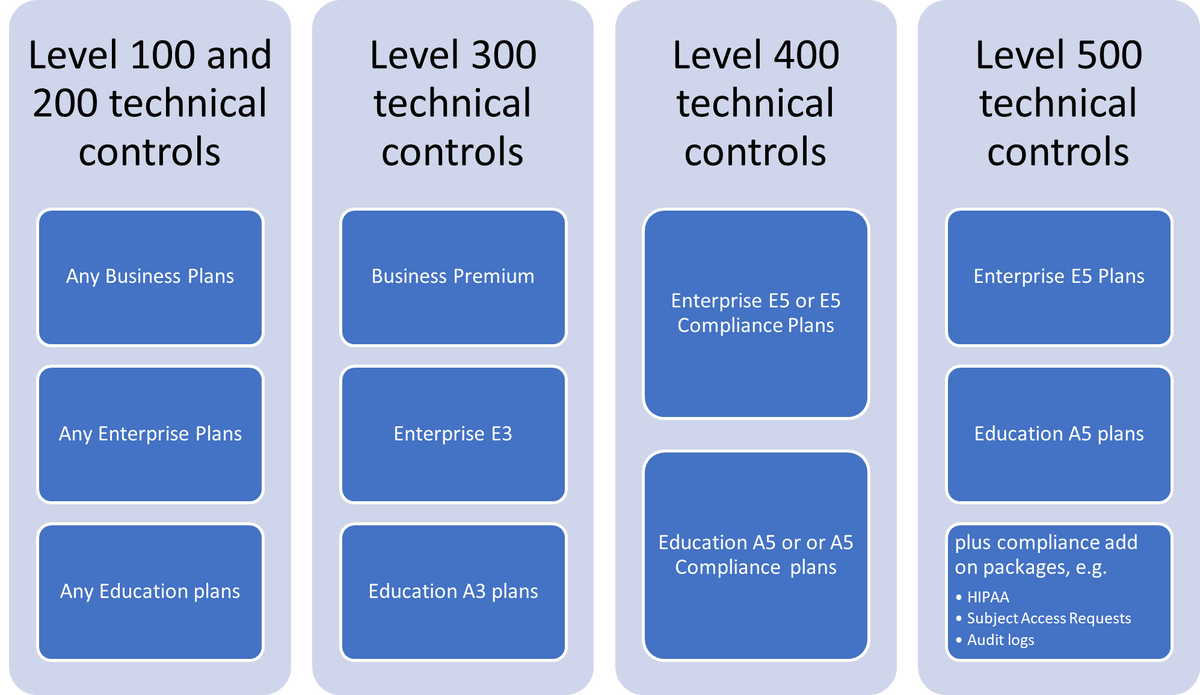

Monte Carlo Simulations

- Generate thousands of random market paths using statistical models

- Quantify probability distributions for portfolio outcomes

- Identify extreme events that could trigger margin calls

How to mitigate systematic risk in perpetual futures: Scenario analysis informs protective strategies such as stop-loss orders, dynamic hedging, or diversification across correlated assets.

Pros: Provides robust insights into tail-risk events

Cons: Computationally intensive and sensitive to model assumptions

Monte Carlo simulation showcasing potential P&L outcomes under stressed market conditions.

Strategies to Manage Systematic Risk

Strategy 1: Dynamic Leverage Adjustment

- Increase leverage during low volatility periods

- Decrease leverage when systematic risk spikes, based on beta and volatility indicators

- Combine with real-time market sentiment monitoring

Advantages: Maintains exposure while controlling risk

Drawbacks: Requires active monitoring and automated trading infrastructure

Strategy 2: Cross-Asset Hedging

- Hedge exposure using correlated futures or options

- Diversify across crypto, equities, and commodities

- Use inverse ETFs or perpetual swaps to offset downside risk

Systematic risk mitigation tools in perpetual futures: Hedging, stop-loss ladders, and cross-asset diversification provide actionable methods to limit portfolio vulnerability.

Advantages: Reduces exposure to single-market shocks

Drawbacks: Hedging costs can reduce net profitability

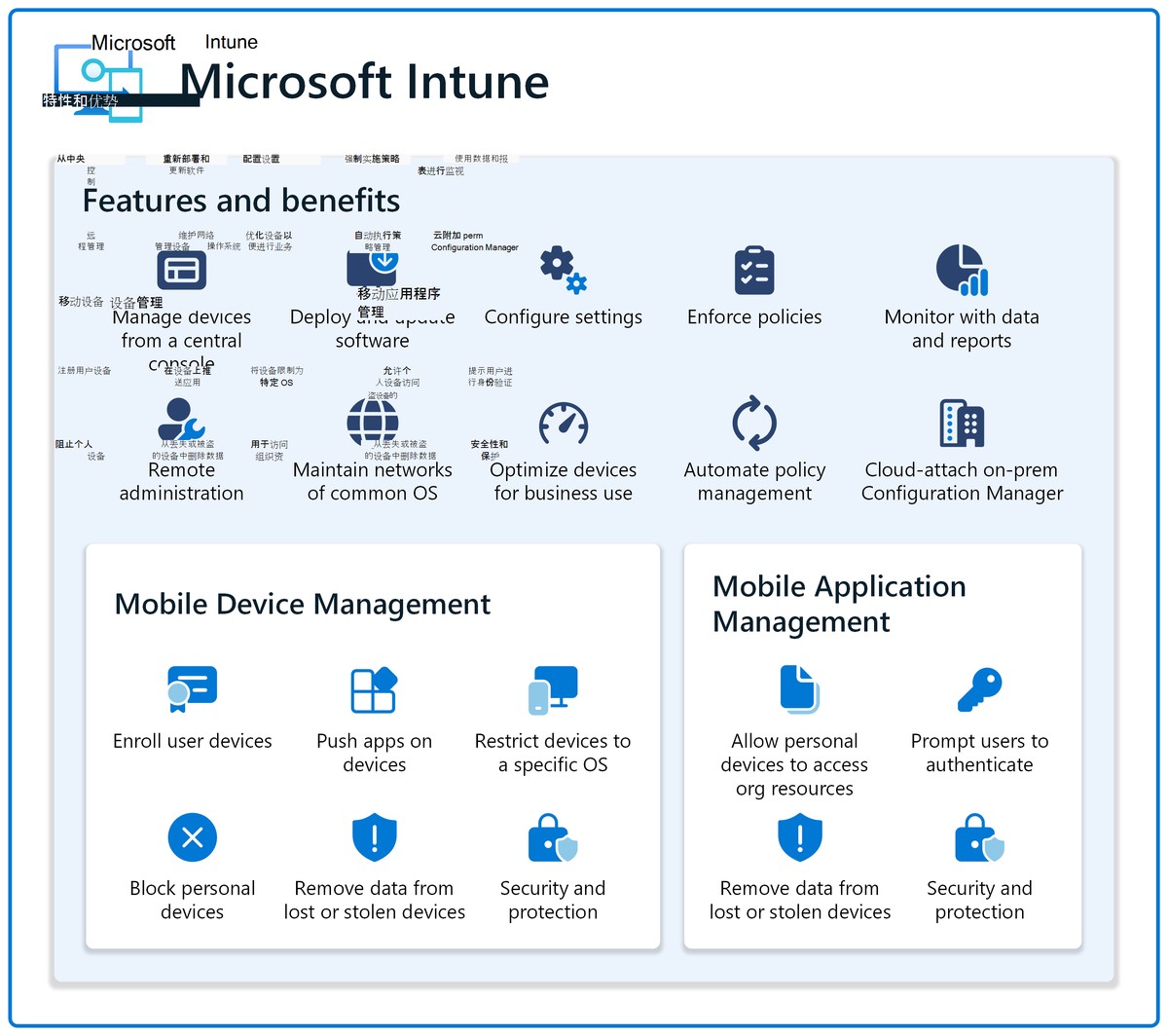

Platform and Data Considerations

- Data Sources: Binance, FTX, CME, and Glassnode provide metrics on funding rates, liquidity, and volatility

- Analytical Tools: Python libraries (Pandas, NumPy, PyMC), R, or proprietary risk dashboards

- Monitoring: Real-time alerts for funding spikes, margin thresholds, and correlated asset movements

Where to find systematic risk data for perpetual futures: Exchanges’ API endpoints, on-chain analytics, and third-party aggregators are crucial for accurate risk assessment.

Sample dashboard monitoring beta, volatility, and funding rates for perpetual futures traders.

FAQs

1. How does systematic risk affect perpetual futures investments?

Answer: Systematic risk can amplify losses during market-wide downturns, trigger margin calls, and increase funding costs. Traders must evaluate beta, volatility, and correlation to manage exposure effectively.

2. Can systematic risk be fully eliminated in perpetual futures trading?

Answer: No. Systematic risk is inherent to market movements. Traders can only mitigate it through diversification, hedging, and dynamic leverage adjustments.

3. How do professional traders evaluate systematic risk in real time?

Answer: They use automated dashboards, real-time analytics, and stress-testing models to continuously monitor beta, volatility, and market correlations, adjusting positions and leverage proactively.

Conclusion

Effective systematic risk evaluations for perpetual futures traders require a combination of quantitative metrics and scenario-based modeling. By integrating beta analysis, volatility assessment, stress testing, and cross-asset hedging, traders can proactively manage risk while capitalizing on market opportunities.

Retail and professional traders alike should prioritize dynamic leverage adjustment, real-time monitoring, and diversified hedging strategies to safeguard portfolios against systemic shocks.

Engage with this article: share your insights, comment on your strategies, and discuss how you implement systematic risk evaluations in your perpetual futures trades.

Do you want me to add a detailed step-by-step case study showing systematic risk evaluation for a live BTC perpetual futures position? This could make the content highly actionable for traders.