In the rapidly evolving world of crypto and derivatives trading, perpetual futures have emerged as a cornerstone for both retail and institutional investors. However, trading these instruments comes with inherent risks, particularly systematic risk, which cannot be eliminated through diversification alone. This article provides a comprehensive guide on systematic risk forecasts for perpetual futures investors, blending practical strategies, expert insights, and actionable advice.

Understanding Systematic Risk in Perpetual Futures

What is Systematic Risk?

Systematic risk, also known as market risk, represents the exposure of an asset or portfolio to broad market movements. Unlike idiosyncratic risk, which is specific to individual securities, systematic risk is influenced by macroeconomic factors, market sentiment, geopolitical events, and global financial trends.

For perpetual futures investors, systematic risk is especially critical because leverage magnifies both gains and losses. Understanding how systematic risk affects perpetual futures investments enables traders to forecast potential market shifts and safeguard capital.

Why Systematic Risk Matters in Perpetual Futures Trading

Perpetual futures are derivatives without an expiry date, offering high liquidity and leverage. The continuous funding mechanism ties the contract closely to the spot market, making positions highly sensitive to:

- Market-wide volatility

- Regulatory announcements

- Liquidity fluctuations

- Macro-level economic indicators

Investors who ignore systematic risk may experience sudden liquidations, margin calls, or unexpected drawdowns.

Systematic risk is inherent in perpetual futures due to macroeconomic shifts and market-wide volatility.

Methods to Forecast Systematic Risk

Method 1: Statistical Models for Risk Forecasting

Concept Overview

Statistical approaches involve quantitative models that estimate potential market movements and correlations. Common techniques include:

- Value at Risk (VaR): Measures the potential loss in a portfolio over a specified timeframe and confidence level

- Beta Coefficient Analysis: Assesses sensitivity to market movements

- Historical Volatility Models: Analyzes past price fluctuations to project future risk

Advantages

- Provides quantifiable measures for risk exposure

- Integrates well with algorithmic trading strategies

- Supports scenario analysis for stress-testing

Limitations

- Dependent on historical data; may not predict sudden market shocks

- Requires advanced statistical knowledge and computational resources

Method 2: Macro-Factor and Event-Based Forecasting

Concept Overview

This approach evaluates systematic risk based on macroeconomic indicators and market events, such as:

- Interest rate changes

- Cryptocurrency regulation updates

- Global liquidity trends

- Market sentiment from news or social media

Advantages

- Accounts for exogenous factors that statistical models may miss

- Useful for scenario planning in highly leveraged perpetual futures positions

- Enhances decision-making for both short-term and long-term positions

Limitations

- Qualitative in nature, making it harder to quantify

- Requires real-time monitoring and expert interpretation

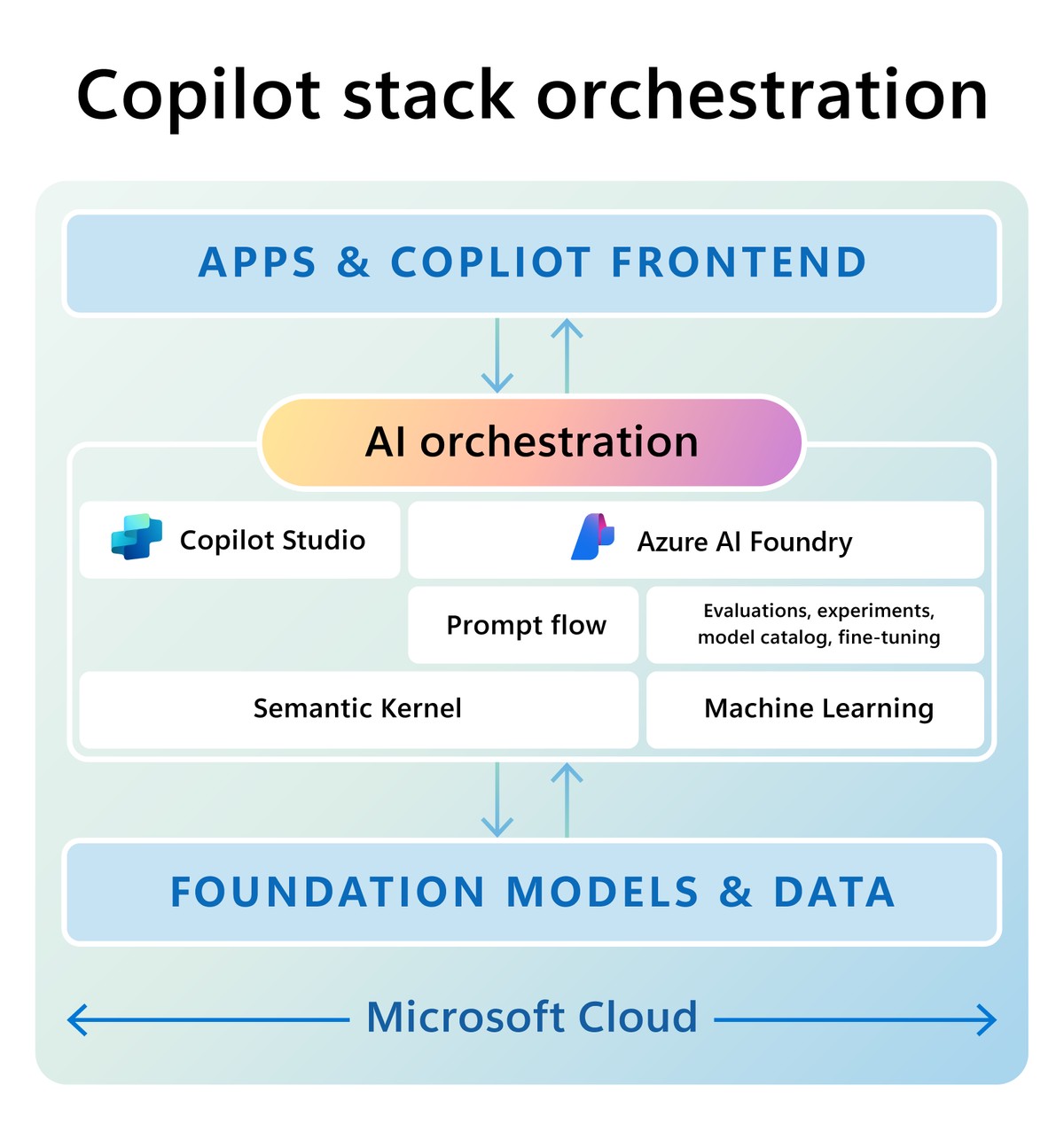

Advanced dashboards allow investors to combine macro indicators and statistical models for systematic risk forecasts.

Practical Strategies for Investors

Strategy 1: Integrated Risk Models

Combining statistical and macro-factor forecasting provides a holistic view of systematic risk. Investors can implement:

- Real-time VaR and beta tracking with macroeconomic overlays

- Scenario simulations for extreme market conditions

- Dynamic leverage adjustments based on predicted risk levels

Strategy 2: Hedging Systematic Risk

Hedging is essential for mitigating exposure in perpetual futures markets. Common methods include:

- Inverse perpetual contracts: Profits increase when the underlying market falls

- Cross-asset hedges: Using correlated assets to offset portfolio exposure

- Options-based strategies: Protecting against tail risk through puts and calls

Step-by-Step Risk Assessment Framework

- Data Collection: Gather historical price data, funding rates, and liquidity metrics

- Risk Metric Computation: Calculate beta, VaR, and historical volatility

- Macro-Factor Integration: Overlay interest rates, regulatory changes, and market sentiment

- Scenario Analysis: Model stress scenarios for sudden market shifts

- Continuous Monitoring: Adjust positions dynamically using automated alerts

Systematic risk evaluation frameworks help investors forecast potential losses and optimize perpetual futures strategies.

Advanced Insights for Expert Investors

Using Machine Learning for Risk Forecasting

- Predictive models: Train algorithms to detect patterns leading to market-wide stress

- Sentiment analysis: Integrate social media and news sentiment into risk projections

- Adaptive algorithms: Automatically adjust leverage and position sizing based on forecasted risk

Systematic Risk Mitigation Techniques

- Diversify across multiple perpetual futures contracts

- Implement automated stop-loss orders to minimize drawdowns

- Monitor correlation changes across crypto and traditional markets

Investors can refer to how to assess systematic risk in perpetual futures for detailed modeling techniques and expert tips.

Common Challenges

- Data Quality and Latency: Poor data can lead to inaccurate forecasts

- Model Overfitting: Algorithms may fail under unprecedented market conditions

- Leverage Amplification: Even minor risk miscalculations can result in outsized losses

- Rapid Market Shifts: Systematic risk can spike quickly in response to macro events

FAQ: Systematic Risk in Perpetual Futures

1. How do I calculate systematic risk in perpetual futures?

Systematic risk can be calculated using beta coefficients, Value at Risk (VaR), and factor models that account for market correlations and volatility. Combining these with macro indicators enhances accuracy.

2. Where can I find systematic risk data for perpetual futures?

Investors can access data from crypto exchanges, financial analytics platforms, and institutional risk reports, which provide metrics on volatility, correlations, and funding rate trends.

3. How can I mitigate systematic risk in perpetual futures?

Mitigation strategies include hedging with inverse contracts, options, cross-asset diversification, and automated risk-adjusted position sizing. Continuous monitoring is crucial for timely adjustments.

Recommended Best Practices

- Regularly update risk models with real-time market data

- Integrate both quantitative metrics and macro indicators

- Use automation for position management and risk alerts

- Maintain a dynamic hedging strategy aligned with market conditions

- Leverage expert resources for continuous improvement, such as systematic risk guides for institutional investors in perpetual futures

Conclusion

For perpetual futures investors, systematic risk forecasting is indispensable. By combining statistical models, macro-factor analysis, and advanced automation, investors can:

- Anticipate market-wide movements

- Optimize position sizing and leverage

- Protect portfolios against unexpected losses

A structured, forward-looking approach ensures that investors not only survive but thrive in the highly volatile perpetual futures markets. Sharing insights and strategies within the community enhances collective risk awareness and fosters more informed trading decisions.

Do you want me to create an interactive chart showing systematic risk exposure across multiple perpetual futures contracts to visualize risk levels for investors?