===============================================

Perpetual futures have become one of the most popular instruments in the cryptocurrency derivatives market. Their appeal lies in continuous trading, high leverage, and the absence of expiry dates. However, these advantages come with significant risks. A robust perpetual futures trading risk management guide is essential for traders who want to protect their capital, stabilize performance, and avoid catastrophic losses. This article explores the essential risk management strategies, compares different approaches, and provides actionable insights for traders at every level.

Understanding Perpetual Futures Risk

Key Characteristics of Perpetual Futures

Perpetual futures differ from traditional futures contracts by not having an expiration date. Instead, they use a funding rate mechanism to anchor prices to the underlying spot market. While this structure offers flexibility, it also introduces risks such as unpredictable funding costs, high volatility, and liquidation exposure.

Why Perpetual Futures Have High Trading Risk

Leverage in perpetual futures can amplify returns but also magnifies losses. Price swings as small as 1–2% may liquidate over-leveraged positions. Moreover, trading risk in perpetual futures arises from:

- High volatility in cryptocurrency markets

- Funding rate fluctuations

- Counterparty risk on unregulated exchanges

- Systemic risks like exchange outages

For traders, the question is not whether risks exist, but how to manage trading risk in perpetual futures effectively.

Core Principles of Risk Management

Position Sizing

The most critical principle in trading risk management is never overexposing capital. A common guideline is to risk no more than 1–2% of account equity per trade.

Leverage Discipline

Excessive leverage is the downfall of many traders. Keeping leverage low (e.g., under 5x for most setups) greatly reduces the probability of liquidation.

Stop-Loss and Take-Profit Orders

Risk should always be defined before entering a trade. Placing a stop-loss ensures that losses are capped, while take-profit orders help lock in gains without emotional interference.

Two Different Risk Management Strategies

Strategy 1: Static Risk Control

Method: Use fixed rules such as always risking 1% per trade, applying stop-losses at predetermined levels, and maintaining consistent leverage.

Advantages:

- Simple and easy to execute

- Provides psychological stability

- Suitable for beginners

- Simple and easy to execute

Disadvantages:

- Lacks flexibility in volatile environments

- May miss opportunities during strong market trends

- Lacks flexibility in volatile environments

Strategy 2: Dynamic Risk Adjustment

Method: Adapt risk based on volatility, liquidity, and trading conditions. For example, reducing position size during high volatility or scaling into trades based on trend confirmation.

Advantages:

- Optimizes capital efficiency

- Allows more precise adjustments in fast-moving markets

- Favored by professional and institutional traders

- Optimizes capital efficiency

Disadvantages:

- Requires advanced analytics

- Higher cognitive load and execution complexity

- Requires advanced analytics

Recommendation: For most traders, a hybrid model works best—starting with static rules while gradually incorporating dynamic adjustments as experience grows.

Risk Mitigation Tools for Perpetual Futures

Hedging with Options

Using options contracts to hedge perpetual futures positions can limit downside risks. For instance, holding a long perpetual futures position and buying a put option reduces exposure to sharp downturns.

Diversification

Never concentrate all capital in one asset or strategy. Diversification across instruments, markets, and timeframes reduces the impact of a single losing position.

Risk Assessment Tools

Professional traders use monitoring tools for real-time evaluation. These tools provide insights on margin utilization, liquidation levels, and volatility forecasts—making them part of best practices for managing perpetual futures trading risk.

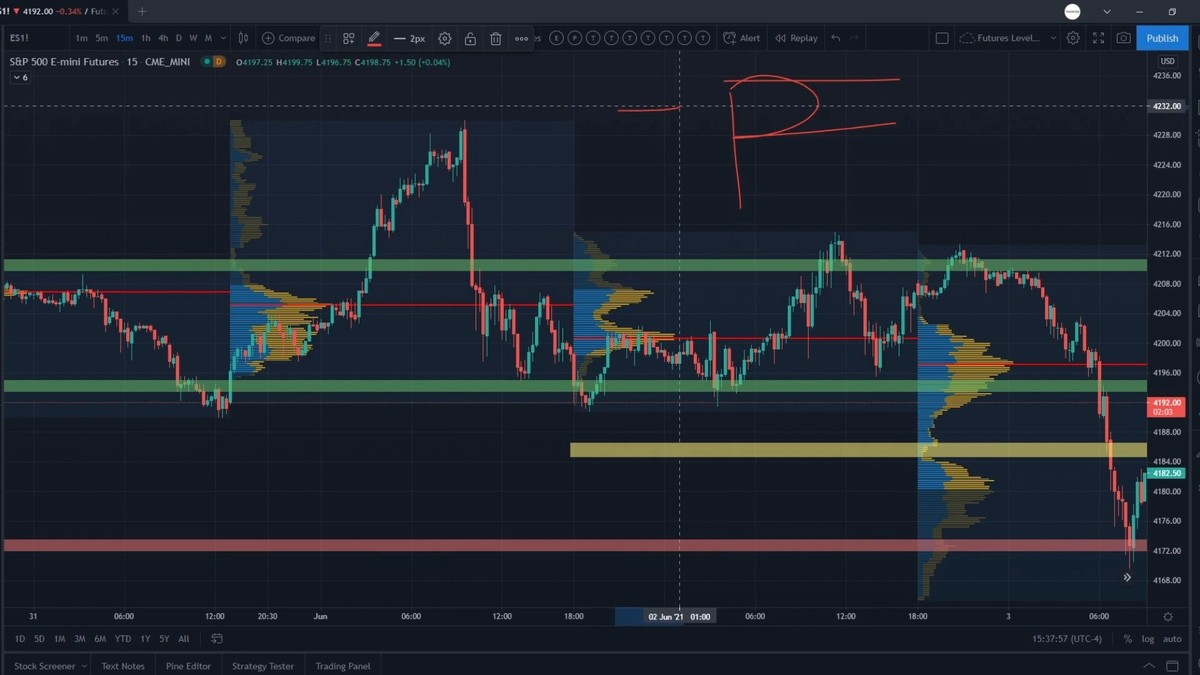

Perpetual futures trading risk matrix showing leverage impact vs. liquidation probability

Advanced Industry Practices

Institutional Approach

Hedge funds and professional desks deploy algorithmic strategies that integrate volatility targeting, real-time stop adjustments, and correlation hedging. They also emphasize how to reduce trading risk in perpetual futures by combining risk metrics like Value-at-Risk (VaR) with liquidity buffers.

Retail Trader Perspective

Retail traders often struggle with discipline. Common mistakes include excessive leverage and revenge trading. Adopting a retail trader guide to perpetual futures trading risk—with simple stop-loss rules, low leverage, and emotional control—is vital for survival.

Integrating Risk with Performance Goals

Risk-to-Reward Ratio

Every trade should target at least a 2:1 reward-to-risk ratio. This ensures profitability even with less than a 50% win rate.

Tracking Risk Metrics

Professional traders continuously track metrics like maximum drawdown, Sharpe ratio, and win/loss consistency. Knowing how to evaluate trading risk in perpetual futures provides measurable benchmarks for long-term sustainability.

Risk management framework in perpetual futures trading

Frequently Asked Questions (FAQ)

1. How can beginners start managing risk in perpetual futures?

Start small. Use low leverage (1–3x), set clear stop-losses, and risk no more than 1% of account capital per trade. Focus on learning execution discipline rather than maximizing profits.

2. What’s the best tool for evaluating trading risk in perpetual futures?

Professional traders often use risk dashboards that include margin utilization, liquidation thresholds, and volatility metrics. Beginners can rely on built-in exchange tools but should gradually adopt advanced platforms for better insights.

3. How do perpetual futures trading risks affect profits?

Poor risk management leads to inconsistent performance and high drawdowns. Conversely, disciplined risk strategies stabilize equity curves and allow profits to compound over time. Understanding how perpetual futures trading risk affects profits is crucial to becoming consistently profitable.

Conclusion: Building a Sustainable Risk Management Mindset

Managing risk in perpetual futures trading is not optional—it is the foundation of long-term survival and profitability. From static controls to dynamic strategies, each approach has merits and drawbacks. A trader’s goal should be to combine structured discipline with adaptive flexibility. By applying effective tools, maintaining leverage discipline, and continuously assessing risks, traders can thrive in this volatile market.

If this perpetual futures trading risk management guide has given you valuable insights, share it with your trading community. Let’s build a culture of risk-aware traders who prioritize longevity over short-term gains.

👉 What’s your go-to strategy for managing perpetual futures risk? Comment below and join the discussion!