==================================================

Perpetual futures trading offers traders access to high leverage and continuous exposure without an expiry date. While this flexibility can lead to significant profit opportunities, it also exposes traders to substantial risks. One of the most widely used tools to measure and manage this risk is Value at Risk (VaR). In this guide, we will explore how to use VaR to manage risk in perpetual futures, covering both theoretical foundations and practical applications. We will also compare different strategies, provide case studies, and share insights to help both beginners and experienced traders.

Understanding the Basics of VaR in Perpetual Futures

What is VaR?

Value at Risk (VaR) is a statistical measure used to estimate the potential loss of a portfolio within a given time frame, under normal market conditions, at a certain confidence level (e.g., 95% or 99%). In perpetual futures, VaR helps traders answer a critical question:

“What is the maximum expected loss I could face over the next day (or week) with 95% confidence?”

This allows traders to set position sizes, leverage limits, and stop-loss levels based on quantifiable risk rather than intuition.

Why VaR Matters in Perpetual Futures

Perpetual futures markets operate 24⁄7, and volatility can spike due to liquidations, funding rate changes, or sudden macroeconomic events. Using VaR ensures that traders do not overexpose their capital. This is why many professionals emphasize why VaR is important in perpetual futures trading—it creates discipline in risk-taking and prevents catastrophic drawdowns.

Methods to Calculate VaR for Perpetual Futures

There are multiple approaches to calculating VaR. Here we will examine the two most relevant ones for perpetual futures traders:

1. Historical Simulation Method

The historical simulation method uses past market data to model future risks. For perpetual futures, this means analyzing past returns of the contract and simulating the distribution of outcomes.

Steps:

- Collect historical price data for the perpetual futures contract.

- Calculate daily returns.

- Rank returns from worst to best.

- Identify the percentile cutoff (e.g., 5th percentile for 95% confidence).

- Collect historical price data for the perpetual futures contract.

Advantages:

- Simple to implement.

- Reflects real market behaviors, including fat tails and volatility clustering.

- Simple to implement.

Disadvantages:

- Dependent on historical data, which may not predict future volatility shifts.

- May understate risk during calm periods.

- Dependent on historical data, which may not predict future volatility shifts.

Historical simulation method applied to futures returns distribution.

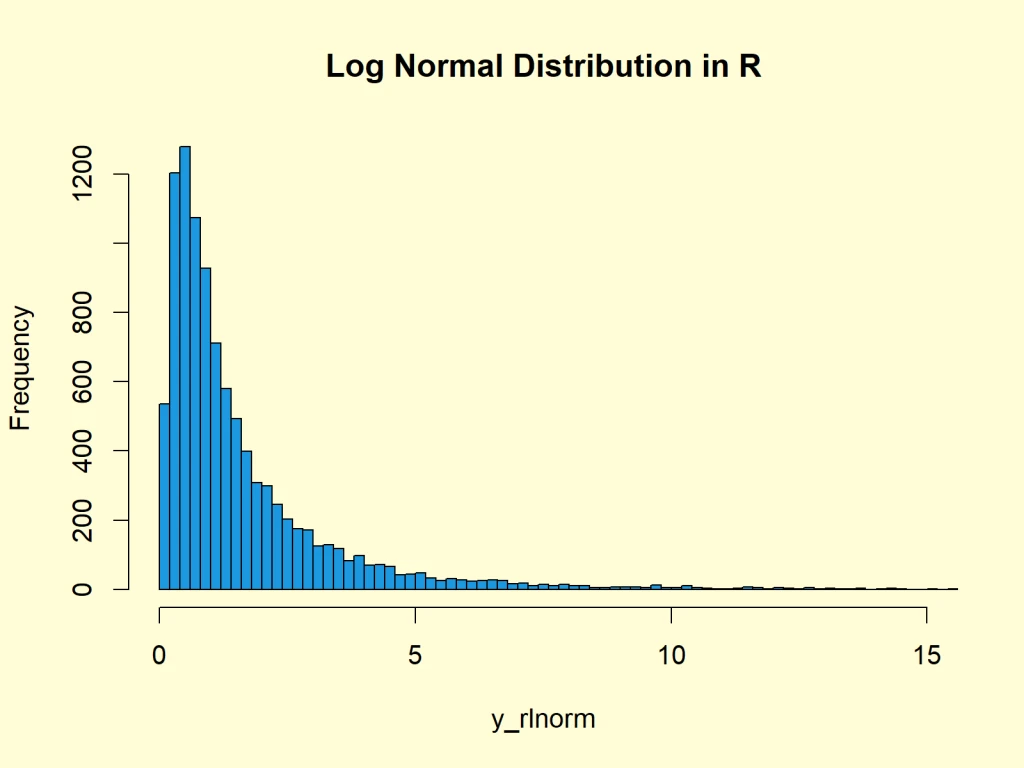

2. Variance-Covariance (Parametric) Method

This method assumes returns follow a normal distribution and calculates VaR using mean and standard deviation.

- Formula:

VaR=Z×σ×tVaR = Z \times \sigma \times \sqrt{t}VaR=Z×σ×t

where:

ZZZ = Z-score for chosen confidence level (1.65 for 95%, 2.33 for 99%).

σ\sigmaσ = standard deviation of returns.

ttt = time horizon.

Advantages:

- Easy to compute and scalable across multiple assets.

- Useful for institutional traders running large portfolios.

- Easy to compute and scalable across multiple assets.

Disadvantages:

- Assumes normality, which underestimates tail risk in crypto markets.

- Sensitive to volatility spikes.

- Assumes normality, which underestimates tail risk in crypto markets.

Normal distribution assumption in variance-covariance VaR.

Comparing VaR Methods for Perpetual Futures

Both methods serve valuable purposes, but their suitability depends on the trader’s profile:

- Retail traders often prefer historical simulation since it captures crypto’s volatility and fat-tail risks more realistically.

- Institutional traders may lean toward parametric VaR due to its simplicity, speed, and integration with portfolio-level risk systems.

For many, a hybrid approach—using both methods for cross-validation—is the best practice. This aligns with VaR strategies for advanced perpetual futures traders, who balance practicality with statistical robustness.

Practical Applications of VaR in Perpetual Futures Risk Management

Position Sizing and Leverage Control

By setting a daily VaR limit, traders can determine the maximum allowable leverage. For example, if a portfolio’s 95% 1-day VaR is $5,000, a trader may choose not to exceed this loss threshold by adjusting contract size.

Setting Stop-Loss Levels

VaR helps define stop-loss triggers that align with statistical probabilities instead of arbitrary numbers. For instance, if 1-day 99% VaR = -8%, then a stop-loss at -10% provides a buffer beyond expected worst-case losses.

Portfolio Diversification

Traders managing multiple perpetual contracts (BTC, ETH, SOL) can aggregate VaR to estimate total exposure. This ensures that diversification reduces overall portfolio risk rather than compounding it.

Stress Testing

Traders often combine VaR with stress testing—examining how portfolios react to extreme market shocks, such as BTC dropping 20% in one day. This helps validate whether VaR captures risk adequately.

Real-World Case Study: Using VaR in BTC Perpetual Futures

Imagine a trader with $100,000 equity trading BTC perpetual futures with 5x leverage.

- Portfolio Value = $500,000.

- Historical daily volatility of BTC futures ≈ 4%.

- At 99% confidence (Z = 2.33):

VaR=2.33×0.04×500,000=\(46,600VaR = 2.33 \times 0.04 \times 500,000 = \\)46,600VaR=2.33×0.04×500,000=$46,600

This means the trader can expect a daily maximum loss of \(46,600 at 99% confidence. If this exceeds their risk tolerance (e.g., 10% of capital = \)10,000), they must reduce leverage or position size.

This example illustrates the importance of knowing how to calculate VaR for perpetual futures and applying it before entering trades.

Best Practices for Implementing VaR in Perpetual Futures

- Use rolling windows for historical simulation to capture current volatility trends.

- Backtest regularly to verify the accuracy of VaR predictions against actual outcomes.

- Combine with other risk measures like Expected Shortfall (ES) to account for tail risk.

- Integrate VaR into trading dashboards so it influences real-time decisions.

- Avoid over-reliance on VaR—treat it as a guiding tool, not an absolute predictor.

FAQ: Using VaR in Perpetual Futures

1. Is VaR enough to manage all risks in perpetual futures?

Not entirely. VaR is useful for quantifying typical losses but fails to capture extreme market events. Traders should supplement it with stress testing, scenario analysis, and liquidity risk management.

2. How often should I update my VaR calculations?

For crypto perpetual futures, daily updates are recommended due to high volatility. Professional traders often update intraday, especially during volatile markets.

3. Can beginners use VaR without coding skills?

Yes. Many trading platforms and tools offer built-in VaR calculators. Beginners can also find simplified tutorials and ready-to-use spreadsheets, making it accessible without advanced math or coding skills.

Conclusion: The Role of VaR in Perpetual Futures Risk Management

Learning how to use VaR to manage risk in perpetual futures is a crucial step toward professional-level trading. Whether you use historical simulation or parametric models, VaR provides a quantifiable framework for controlling leverage, setting stop-losses, and avoiding catastrophic losses.

Traders who integrate VaR into their daily workflow enjoy a disciplined, statistically grounded approach to risk-taking. If you are a beginner, start simple with platform calculators; if you are advanced, build multi-layered VaR models. In both cases, the goal remains the same—protect capital and trade sustainably.

💬 What about you? Do you rely on VaR or alternative risk measures in your trading? Share your experience in the comments and don’t forget to share this guide with fellow traders!