=================================================

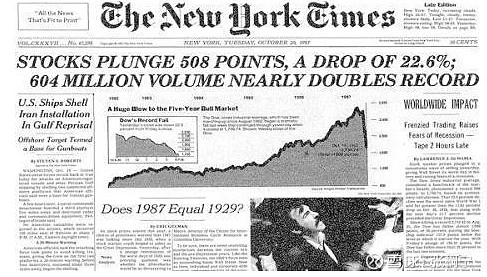

Value at Risk (VaR) is a critical risk management tool that is widely used in financial markets to estimate potential losses in portfolios over a defined period, given normal market conditions. For traders in perpetual futures, VaR plays an even more pivotal role as it helps to measure the risk associated with maintaining open positions in these contracts. In this article, we’ll dive deep into how VaR impacts perpetual futures strategies, how it is used in practice, and how traders can optimize their risk management using VaR.

What is VaR and Why is it Important for Perpetual Futures?

Value at Risk (VaR) is a statistical measure that quantifies the potential loss in value of an asset or portfolio within a specific timeframe and under normal market conditions. It provides a confidence level, such as “there is a 95% chance that the portfolio will not lose more than $X in a day.” This calculation is vital in understanding the amount of risk embedded in perpetual futures contracts, which, by nature, have no expiry date and can expose traders to ongoing price fluctuations.

1. Key Elements of VaR:

- Time Horizon: The time period over which the risk is assessed.

- Confidence Level: Common levels are 95% or 99%, which represent the probability of not exceeding the loss.

- Portfolio Value: The total value of the assets or contracts being measured for risk.

For perpetual futures, calculating VaR is essential to ensure that the exposure to price movements is understood, especially when leverage is involved. A trader might be exposed to significant price swings that can magnify their losses, and VaR helps quantify these risks.

2. Why is VaR Critical in Perpetual Futures Trading?

- Managing Leverage Risk: Leverage allows traders to open positions larger than their initial capital. While it can amplify profits, it also increases the potential for substantial losses. VaR helps traders understand the risk exposure at various levels of leverage.

- Risk Control: It enables traders to set risk thresholds and determine how much they are willing to lose in a worst-case scenario.

- Regulatory Requirements: In many financial markets, including derivatives like perpetual futures, VaR is used by institutions to ensure compliance with risk management regulations.

How to Calculate VaR for Perpetual Futures?

The calculation of VaR for perpetual futures involves a few different approaches. Traders can use historical data, parametric models, or Monte Carlo simulations to estimate potential losses under various market conditions.

1. Historical Simulation Method

This method uses past price data of a perpetual futures contract to simulate potential losses. It involves looking at historical price changes and calculating the worst-case loss for a given confidence level.

Steps:

- Gather historical data of the underlying asset.

- Calculate the price changes (returns) over a defined time period.

- Sort the returns from worst to best.

- Identify the loss at the 95th percentile (for a 95% confidence level).

This method is simple and intuitive but relies on the assumption that past price behavior will repeat, which may not always be true.

2. Parametric VaR (Variance-Covariance Method)

The parametric method assumes that the returns of a perpetual futures contract are normally distributed. It uses the mean and standard deviation of past price changes to estimate the potential loss.

Steps:

- Calculate the mean (average) and standard deviation of historical returns.

- Multiply the standard deviation by a z-score (typically 1.645 for 95% confidence).

- Calculate the VaR as:

VaR=Portfolio Value×(μ−z×σ)VaR = \text{Portfolio Value} \times (\mu - z \times \sigma)VaR=Portfolio Value×(μ−z×σ)

where μ\muμ is the mean return, σ\sigmaσ is the standard deviation, and zzz is the z-score.

While this method is faster and easier to compute, it assumes a normal distribution of returns, which may not be accurate during periods of market stress.

3. Monte Carlo Simulation

This technique uses random sampling to simulate numerous potential price paths for the asset underlying the perpetual futures contract. It generates a large number of possible outcomes based on assumed volatility and correlation.

Steps:

- Generate a large number of random price paths for the asset using historical volatility.

- Calculate the profit or loss for each path.

- Determine the VaR by looking at the percentile of worst losses.

Monte Carlo simulations provide more flexibility and accuracy, especially for non-normal price distributions, but they can be computationally expensive.

How Does VaR Impact Perpetual Futures Strategies?

VaR is not just a tool for risk management but also a guide for developing and refining trading strategies. Here’s how VaR can influence perpetual futures strategies:

1. Position Sizing and Leverage

- Risk-based Position Sizing: VaR helps traders to determine the size of their positions based on the risk they are willing to take. For example, if the VaR for a particular futures position is $1,000, the trader may choose to reduce position size or use lower leverage to lower this potential loss.

- Leverage Management: In perpetual futures, where leverage is often used, VaR calculations ensure that traders stay within their risk tolerance. Traders can adjust leverage based on VaR assessments, ensuring that they don’t overexpose themselves.

2. Risk Mitigation

- Stop-loss and Risk Limits: Traders use VaR to determine stop-loss levels and position limits. For instance, if a trader’s VaR exceeds a predefined threshold, they may decide to exit the position early or adjust their risk limits.

- Diversification: VaR can highlight concentrated risks within a portfolio. By analyzing the risk of different positions, traders may adjust their portfolio to achieve better diversification, reducing the likelihood of a large drawdown.

3. Hedging Strategies

- Traders use VaR to guide their hedging strategies. For example, if the VaR of a perpetual futures position suggests a high potential for loss, traders may enter into offsetting positions (e.g., buying options) to hedge against these potential losses.

- Dynamic Hedging: With VaR estimates, traders can adjust their hedging strategies dynamically based on changes in volatility or price trends.

Strategies to Optimize VaR in Perpetual Futures Trading

1. Tail Risk Hedging

Tail risks are extreme events that lie outside the normal distribution of returns, and they can cause severe losses. Traders can use options or other derivatives to hedge against these risks. By incorporating VaR calculations, traders can optimize the cost of hedging while ensuring that potential extreme losses are covered.

Pros:

- Helps in protecting against large, unexpected losses.

- Provides a safety net during periods of market stress.

Cons:

- Tail risk hedging can be expensive, especially when volatility is high.

- It might lead to over-hedging, reducing potential profits.

2. VaR-Based Algorithmic Trading

Algorithmic traders can integrate VaR into their trading algorithms. By continuously calculating the VaR of positions in real-time, algorithms can adjust trading strategies, such as scaling positions up or down based on risk tolerance.

Pros:

- Allows real-time risk management.

- Automates trading decisions based on risk parameters.

Cons:

- Complex to implement, especially for smaller traders.

- Requires significant computational resources.

FAQ (Frequently Asked Questions)

1. How is VaR used to manage risk in perpetual futures?

VaR helps traders assess the risk of holding perpetual futures contracts by estimating the potential loss over a given period. Traders use VaR to set stop-loss levels, manage position sizes, and adjust leverage, ensuring that their risk remains within acceptable bounds.

2. Can VaR be used to predict future losses in perpetual futures?

VaR is a measure of potential loss under normal market conditions, but it does not account for extreme events or “black swan” risks. While VaR provides valuable insights into the risk profile of a position, it should be complemented with other risk measures such as stress testing.

3. How do I calculate VaR for perpetual futures positions?

There are several methods to calculate VaR, including the historical simulation, parametric, and Monte Carlo methods. The best approach depends on the trader’s resources, the complexity of the strategy, and the data available. For perpetual futures, where markets can be volatile, a more robust method like Monte Carlo simulation may be preferred.

Conclusion

VaR is an indispensable tool for managing risk in perpetual futures trading. By incorporating VaR into their strategies, traders can optimize position sizes, set effective stop-loss limits, and minimize the risk of large losses. Whether using historical simulation, parametric methods, or Monte Carlo simulations, understanding how to calculate and apply VaR can help traders navigate the complexities of perpetual futures markets and enhance their risk management practices.