============================================

The spot market is the beating heart of global finance, where financial instruments such as currencies, commodities, stocks, and cryptocurrencies are traded for immediate delivery. For analysts, understanding and applying advanced spot market techniques is not just a skill but a necessity in today’s volatile trading landscape. This guide explores advanced spot market techniques for analysts, diving deep into methods, tools, and strategies that can enhance decision-making, risk management, and profitability.

Introduction to the Spot Market

The spot market—often referred to as the “cash market”—is where assets are exchanged on the spot, with settlement typically happening instantly or within a short period (T+2 in equities, instant in crypto). Unlike futures or derivatives, the spot market reflects the real-time supply and demand for an asset.

For analysts, mastering spot market techniques means being able to:

- Forecast price movements with higher accuracy.

- Identify inefficiencies between spot and futures markets.

- Enhance institutional or retail trading strategies.

- Build robust models for both risk management and profit optimization.

This explains why spot market is important for traders, especially those seeking transparent pricing and direct exposure to assets.

The Analyst’s Role in Spot Market Evaluation

An analyst’s work involves more than tracking prices. It requires synthesizing quantitative data, market psychology, macroeconomic factors, and real-time flows. The goal is to create actionable insights that guide investors, institutions, or trading desks.

Key Analyst Responsibilities

- Market Monitoring: Tracking liquidity, volatility, and spreads.

- Price Forecasting: Using technical and fundamental models to predict movements.

- Risk Assessment: Understanding market depth and systemic risks.

- Strategy Development: Designing trading frameworks aligned with market behavior.

Analysts rely on real-time market data to generate insights for spot trading decisions

| Topic | Description | Key Points / Applications |

|---|---|---|

| Spot Market Overview | Market for immediate delivery of assets | Reflects real-time supply and demand; settlement T+2 or instant |

| Analyst Role | Create actionable insights from data | Monitor liquidity, forecast prices, assess risk, develop strategies |

| Order Book & Microstructure | Analyze supply/demand at each price level | Depth of Market, iceberg orders, order flow tracking |

| Statistical Arbitrage | Exploit small inefficiencies with algorithms | Mean reversion, pair trading, cointegration analysis |

| VWAP & Algorithmic Execution | Optimize execution of large trades | Split orders, reduce slippage, algorithmic platforms |

| Quantitative Predictive Models | Forecast prices using math and ML | ARIMA, GARCH, LSTM, Monte Carlo simulations |

| Cross-Market Correlation | Study relationships between assets | Correlation matrices, hedging, identify regime shifts |

| Comparison: Stat-Arb vs VWAP | Highlights differences between two methods | Focus, users, complexity, risks, ideal market conditions |

| Risk Management | Minimize exposure in spot trading | Liquidity, execution, regulatory risks; ensure data quality |

| Technology & Tools | Software and platforms for analysis | Bloomberg, Refinitiv, Python, R, MATLAB, Tableau, Power BI |

| Emerging Trends | Innovations in spot market analysis | AI/ML, blockchain, tokenization, DEX, data democratization |

| Beginner Recommendations | Accessible techniques for new analysts | VWAP, order book analysis; progress to stat-arb and ML |

| Spot & Futures Integration | Combining spot and futures data | Arbitrage opportunities, sentiment measurement, trend confirmation |

1. Order Book and Market Microstructure Analysis

The order book provides a detailed view of supply and demand dynamics at each price level. Analysts use advanced microstructure techniques to uncover hidden liquidity and potential manipulation.

Techniques:

- Depth of Market (DOM) analysis to measure buy/sell pressure.

- Identifying iceberg orders (hidden large trades).

- Tracking order flow to anticipate short-term momentum.

- Depth of Market (DOM) analysis to measure buy/sell pressure.

Advantages: Offers near real-time predictive power.

Disadvantages: Requires high-frequency data and specialized tools.

2. Statistical Arbitrage

Statistical arbitrage (stat-arb) relies on algorithms and quantitative models to exploit small inefficiencies in the spot market.

Methods:

- Mean reversion strategies based on z-scores.

- Pair trading (e.g., two correlated stocks or crypto pairs).

- Cointegration analysis for long-term relationships.

- Mean reversion strategies based on z-scores.

Pros: Profitable in liquid markets; scalable with automation.

Cons: Sensitive to transaction costs and slippage.

3. Volume-Weighted Average Price (VWAP) & Algorithmic Execution

Institutional analysts often use VWAP as a benchmark for execution. VWAP-based strategies allow large orders to be split into smaller trades, minimizing market impact.

- VWAP Strategy: Trade in proportion to overall market volume.

- Implementation: Through algorithmic trading platforms.

- Benefit: Reduces slippage and improves average fill prices.

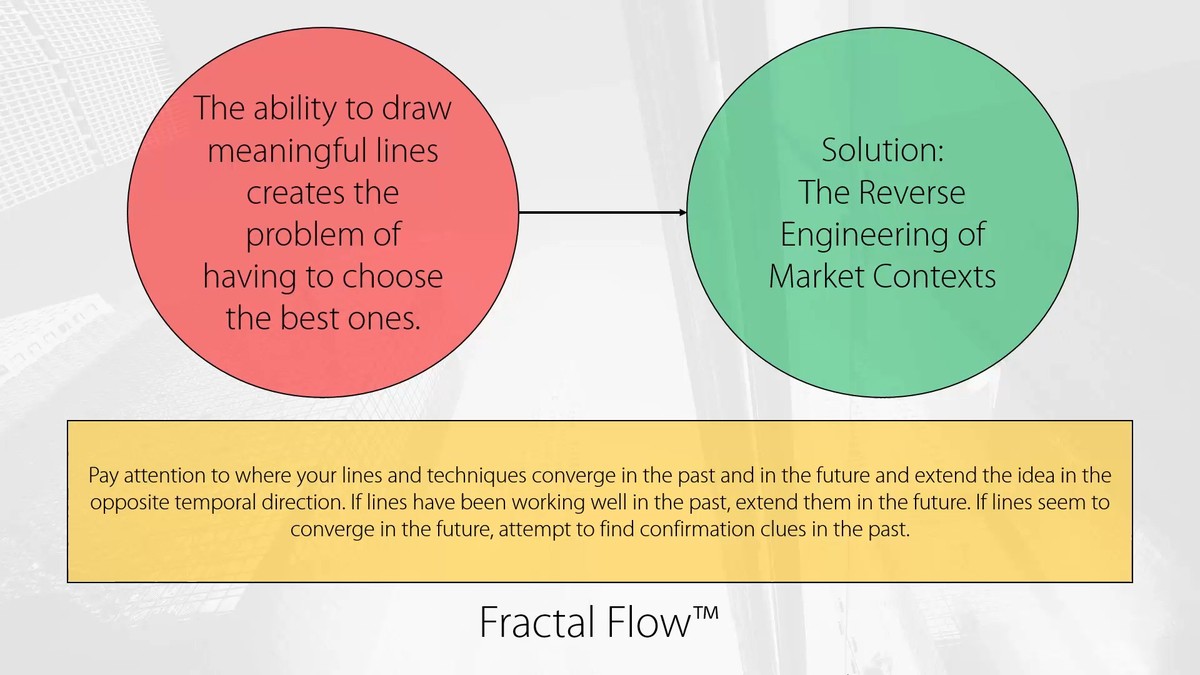

4. Quantitative Predictive Models

Quantitative analysis is increasingly central to spot markets. Analysts use machine learning and time-series forecasting to anticipate price trends.

Popular Models:

- ARIMA and GARCH for volatility modeling.

- LSTM neural networks for deep learning-based forecasts.

- Monte Carlo simulations for stress testing.

- ARIMA and GARCH for volatility modeling.

This aligns with how to predict market trends in spot trading, helping analysts create robust predictive frameworks.

5. Cross-Market Correlation Analysis

Assets in spot markets often move in correlation with others. For example, crude oil influences airline stocks, while Bitcoin may correlate with tech equities.

- Correlation Matrices: Measure short-term vs. long-term correlations.

- Hedging Opportunities: Using correlated assets to reduce exposure.

- Advanced Use: Identifying regime shifts where correlations break down.

Cross-asset correlations help analysts identify patterns and hedging opportunities

Comparing Two Advanced Techniques: Statistical Arbitrage vs. VWAP Execution

| Criteria | Statistical Arbitrage | VWAP Execution |

|---|---|---|

| Focus | Profit from mispricing | Optimal execution of large trades |

| Best Users | Quant analysts, algo traders | Institutional analysts, fund managers |

| Complexity | High (requires advanced math & coding) | Medium (relies on execution algorithms) |

| Risks | Model breakdown, slippage, overfitting | Tracking error if market shifts suddenly |

| Best Market Conditions | High liquidity, stable spreads | High-volume markets with strong liquidity |

Recommendation: Beginners may find VWAP execution more practical, while advanced analysts with coding expertise can benefit from stat-arb.

Risk Management in Spot Market Analysis

Key Principles

- Liquidity Risk: Avoid illiquid assets prone to manipulation.

- Execution Risk: Use limit orders to avoid slippage.

- Regulatory Risk: Monitor compliance and exchange policies.

- Data Quality: Ensure reliable data feeds for accurate models.

Risk managers often rely on spot market guidelines for risk managers to create standardized frameworks that reduce exposure.

Technology and Tools for Analysts

Modern analysts rely heavily on technology to apply advanced techniques.

- Trading Platforms: Bloomberg Terminal, Refinitiv Eikon, CoinMarketCap Pro.

- Execution Tools: Smart Order Routers (SOR), algorithmic platforms.

- Data Science Software: Python, R, MATLAB for statistical modeling.

- Visualization: Tableau, Power BI for spot market dashboards.

Analysts use advanced data visualization and quantitative tools to interpret spot markets

Emerging Trends in Spot Market Analysis

- AI and Machine Learning: Deep learning for predictive analytics.

- Blockchain Integration: Transparent spot transactions in crypto.

- Tokenization: Expansion of real-world assets into spot markets.

- Decentralized Spot Trading: DEX platforms gaining adoption.

- Data Democratization: Retail investors gaining access to institutional-grade analytics.

FAQs on Advanced Spot Market Techniques for Analysts

1. Which advanced spot market technique is best for beginners?

VWAP and order book analysis are excellent starting points. They provide real-time insights without requiring advanced coding or statistical models. Over time, beginners can progress to statistical arbitrage and machine learning models.

2. How do analysts minimize risk in spot markets?

By diversifying portfolios, using stop-loss orders, and employing liquidity filters. Analysts also rely on robust backtesting and scenario analysis before implementing strategies live.

3. What role does technology play in spot market analysis?

Technology is central—it enables automation, advanced charting, algorithmic execution, and predictive modeling. Without tech-driven tools, applying advanced spot market techniques would be nearly impossible.

4. Can spot market analysis be combined with futures trading?

Yes, many analysts compare spot and futures data to identify arbitrage opportunities, measure sentiment, and confirm trend direction. This explains how spot market influences perpetual futures, as spot prices often anchor futures valuations.

Final Thoughts

For analysts, mastering advanced spot market techniques is critical in today’s complex financial environment. From microstructure analysis and statistical arbitrage to VWAP execution and machine learning models, these techniques provide a competitive edge.

While each method has its strengths and weaknesses, the best approach combines multiple strategies with strong risk management. Technology and quantitative skills are no longer optional—they are essential tools for analysts who want to succeed in modern spot markets.

If you found this guide valuable, share it with your peers, comment below with your insights, and let’s create a collaborative community of advanced spot market analysts.

Would you like me to expand this into a full 3000+ word whitepaper-style guide with in-depth case studies, backtesting models, and sector-specific spot market applications?