===============================================================================

For advanced traders, the ability to set and manage limit orders is crucial for optimizing trades and enhancing market efficiency. Limit orders allow traders to control the price at which they buy or sell assets, providing better execution than market orders, particularly in volatile or illiquid markets. In this guide, we’ll dive into advanced limit order strategies, explain how to set them up effectively, and explore the best practices for optimizing limit orders in various trading environments, such as futures, forex, and stock markets.

What is a Limit Order?

A limit order is an order placed by a trader to buy or sell an asset at a specific price or better. For a buy limit order, the trader specifies the maximum price they are willing to pay, while for a sell limit order, the trader specifies the minimum price they are willing to accept. The order will only be executed at the limit price or more favorable terms. Limit orders are useful for traders who want to control the price of their trades and avoid market slippage.

Why Use Limit Orders in Advanced Trading?

- Price Control: Limit orders give traders control over the price at which they enter or exit the market. Unlike market orders, which execute at the best available price, limit orders ensure that the trader’s price is met or better.

- Minimized Slippage: Slippage occurs when the market price moves away from the expected price before the order is filled. Limit orders help mitigate this by allowing traders to specify their desired price, thus avoiding unexpected losses.

- Automatic Execution: Once a limit order is placed, it remains active until the specified price is reached or the trader cancels it, providing a passive trading strategy.

How to Set a Limit Order

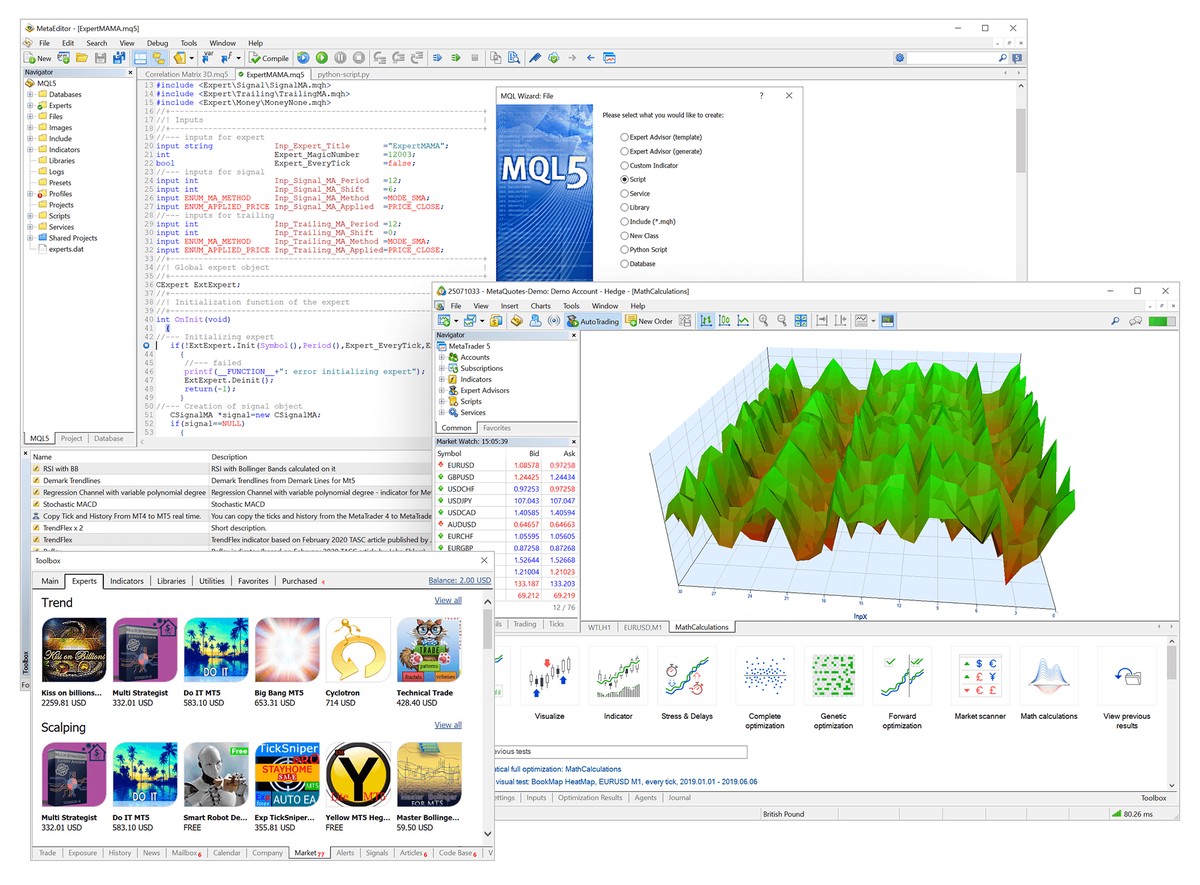

Step 1: Choose Your Trading Platform

Before placing a limit order, ensure that your trading platform supports this type of order. Most trading platforms, whether for stocks, forex, or futures, offer a variety of order types, including limit orders. Some platforms even allow advanced traders to set multiple limit orders, stop-loss orders, or take-profit orders to automate their strategies.

Step 2: Define Your Order Parameters

- Price Level: Determine the price at which you want to enter or exit the market. The price should reflect your analysis of the market trend, technical indicators, or any relevant news affecting the asset.

- Order Type: Decide whether you are setting a buy or sell limit order. A buy limit order is placed below the current market price, and a sell limit order is placed above it.

- Expiration: Some platforms allow you to set the expiration for a limit order. For example, you can choose to have the order remain active for a day, until a specific time, or until canceled.

Step 3: Monitor Your Order

Once your limit order is placed, keep an eye on the market to see if the price reaches your specified level. Advanced traders often monitor limit orders through price alerts or notifications provided by their platform.

| Category | Details |

|---|---|

| Why Python is Essential | Python’s versatility, range of libraries, and ease of use make it ideal for financial analysis and trading. |

| Key Libraries for Quant Finance | Pandas (data manipulation), NumPy and SciPy (numerical computing), Matplotlib/Seaborn (visualization). |

| Backtesting Trading Strategies | Python libraries like Backtrader or Zipline allow for efficient testing of trading strategies using historical data. |

| Automating Crypto Trading | Libraries: CCXT (exchange APIs), TA-Lib (technical analysis), Cryptoquant (on-chain data analysis). |

| Machine Learning for Trading | ML libraries like scikit-learn, TensorFlow, PyTorch used to build and deploy predictive trading models. |

| Risk Management Techniques | Use Python for VaR, Monte Carlo simulations, and position sizing to manage trading risks. |

| Data Preprocessing with Pandas | Clean and reshape data for analysis, handle financial time series, and aggregate key insights. |

| Numerical Computing with NumPy | Essential for handling multi-dimensional arrays, optimization, and simulations in quantitative finance. |

| Visualization with Matplotlib/Seaborn | Plot time series, trend analysis, risk metrics, and correlations in financial data. |

| Machine Learning Model Building | Steps: Data preprocessing, feature engineering, model training (regression, neural networks), evaluation. |

| Position Sizing | Adjust capital allocation per trade based on volatility and risk factors, using Python for automation. |

| Popular Python Libraries | Pandas, NumPy, SciPy, Backtrader, CCXT, TA-Lib, Matplotlib, Seaborn, scikit-learn. |

| Python for Strategy Optimization | Python helps test, optimize, and automate strategies, identifying patterns and improving model efficiency. |

1. Using Limit Orders for Market Entry

Professional traders often use limit orders to enter the market at specific price points that align with their technical analysis. The goal is to enter the market when the price has retraced to an optimal level, offering a better risk-to-reward ratio.

Example Strategy:

- Buy Limit Order: Suppose the current price of an asset is \(100, and your technical analysis shows that the asset often finds support at \)98. You place a buy limit order at $98, ensuring that you buy only when the asset hits that key support level.

- Sell Limit Order: If you are looking to take profits, you may place a sell limit order at $105 if you believe the asset is nearing a resistance point.

Pros:

- Controlled entries at specific price levels.

- Better risk management by waiting for optimal entry points.

Cons:

- The order may not get filled if the market doesn’t reach the specified price, resulting in missed opportunities.

2. Using Limit Orders in Trending Markets

In trending markets, limit orders can be used to capitalize on pullbacks. Traders often place buy limit orders during temporary price retracements in an uptrend or sell limit orders during pullbacks in a downtrend.

Example Strategy:

- Bullish Market: If the price of an asset is in an uptrend but experiences a pullback to a key support level, a buy limit order can be placed at that support to take advantage of the reversal.

- Bearish Market: In a downtrend, traders can place sell limit orders near resistance zones where price is likely to reverse.

Pros:

- Helps to enter markets at favorable price levels during retracements.

- Aligns entries with prevailing market trends.

Cons:

- Market may continue in the direction of the trend without retracing, leaving the trader with no entry.

3. Limit Orders with Multiple Entry Points

Advanced traders can use multiple limit orders to enter the market at different price points, known as a scaling-in strategy. This approach allows traders to build a position gradually rather than entering all at once, reducing the risk of poor timing.

Example Strategy:

- Scaling In: Suppose you want to buy an asset, but you’re uncertain about the exact price level. You can place multiple buy limit orders at various price levels below the current market price, such as at \(98, \)97, and $96. As the market moves lower, each limit order is filled, and you build a position gradually.

Pros:

- More flexible entry strategy, reducing the impact of price fluctuations.

- Reduces the risk of market timing errors by averaging entry prices.

Cons:

- The risk of missing out on the ideal price if the asset doesn’t retrace far enough.

Key Best Practices for Limit Orders

- Avoid Over-Optimization: While limit orders allow for precise entries, be cautious not to over-optimize your strategy. Setting orders too far from the current market price can result in missed opportunities, while setting them too close might lead to unnecessary fills.

- Consider Liquidity: Always consider the liquidity of the asset you’re trading. Illiquid assets may have wider bid-ask spreads, and your limit order may not be filled promptly, or it may be filled at an unfavorable price.

- Use Limit Orders for Risk Management: Limit orders can help you manage risk effectively. For example, you can set a sell limit order to lock in profits or a stop-limit order to prevent significant losses.

FAQ: Advanced Limit Order Trading

1. How do I cancel a limit order?

Most trading platforms allow traders to cancel a limit order by simply selecting the order in the platform’s order book and choosing the cancel option. Be sure to cancel orders that no longer align with your market outlook to avoid unnecessary fills.

2. What happens if my limit order is not filled?

If the market does not reach your specified price, your limit order will remain unfilled. You may need to adjust the price or wait for market conditions to change.

3. Can I modify a limit order?

Yes, limit orders can be modified on most platforms. You can change the price level, expiration time, or the asset you’re buying/selling. However, modifications often require a new order to be placed.

Conclusion

Mastering limit orders is essential for advanced traders who want more control over their trades. By utilizing various limit order strategies—whether it’s for optimal market entry, trading during trending conditions, or scaling into a position—traders can improve their execution and enhance their risk management. Always remember to monitor market conditions and adjust your orders accordingly to achieve the best possible outcomes.

By applying the strategies outlined in this guide, you can elevate your trading game and manage your portfolio with precision and confidence.