===========================================================================

Introduction

Understanding how to analyze position risk is essential for every trader, from retail beginners to institutional professionals. Position risk refers to the potential loss an investor may face due to the size, direction, and exposure of a trading position in relation to market volatility and broader portfolio composition. Analyzing position risk allows traders to optimize capital allocation, improve performance, and avoid devastating drawdowns.

In this article, we’ll break down the fundamentals of position risk, explore professional methods used by quant traders and portfolio managers, and compare strategies that balance precision with practicality. By the end, you’ll have a clear framework for evaluating your exposure and actionable best practices to protect your capital.

Why Position Risk Analysis Matters

Position risk analysis goes beyond simply calculating how much money could be lost on a single trade. It ensures traders remain in control of exposure across markets, leverage levels, and portfolio correlations.

Key reasons why risk analysis matters:

- Capital Preservation: Protects against catastrophic losses from oversized or correlated positions.

- Decision-Making: Offers data-driven insights to adjust entries, exits, and stop levels.

- Portfolio Balance: Prevents overexposure to a single asset class or strategy.

- Psychological Edge: Reduces fear and emotional decision-making by knowing worst-case scenarios.

For traders engaged in derivatives or perpetual futures, understanding risk becomes even more critical, as leverage amplifies both gains and losses.

Core Concepts in Position Risk

1. Position Size

The amount of capital allocated to a trade is the primary driver of position risk. Larger sizes amplify both potential profit and loss.

2. Volatility Exposure

Risk is influenced by how volatile the asset is. A 1% move in a stable stock differs vastly from a 1% move in Bitcoin.

3. Correlation and Diversification

Even if individual positions seem safe, high correlation among them can create hidden risks.

4. Leverage Impact

Leverage magnifies exposure. While it increases opportunity, it can also wipe out accounts if not managed properly.

Methods for Analyzing Position Risk

1. Value at Risk (VaR)

Value at Risk (VaR) estimates the maximum loss a portfolio or position could face over a set time horizon at a specific confidence level (e.g., 95%).

- Advantages: Simple, widely used by institutions, provides a clear numeric benchmark.

- Limitations: Assumes normal distributions, often underestimates extreme tail events.

2. Stress Testing and Scenario Analysis

Stress testing simulates performance under extreme but plausible market events, such as the 2008 financial crisis or the 2020 COVID crash.

- Advantages: Captures tail risks ignored by VaR, builds resilience.

- Limitations: Requires assumptions about extreme conditions, may not predict new black swan events.

Comparing the Two Approaches

- VaR works best for daily monitoring and setting risk limits in stable environments.

- Stress Testing provides long-term resilience by exposing vulnerabilities to extreme scenarios.

- Best Practice: Use both. Rely on VaR for day-to-day checks, and supplement with stress testing to ensure preparedness for rare shocks.

Step-by-Step Framework: How to Analyze Position Risk

Step 1: Define Position Parameters

- Entry price, size, leverage, stop-loss, and target levels.

Step 2: Assess Volatility

- Use indicators like ATR (Average True Range) or implied volatility to measure risk levels.

Step 3: Run VaR and Stress Simulations

- Calculate expected daily losses with VaR.

- Test extreme market shocks (e.g., sudden 20% drop).

Step 4: Adjust Position Size

- Reduce allocation if risks exceed tolerance.

- Refer to where to learn about position sizing for detailed frameworks on dynamic adjustments.

Step 5: Monitor Continuously

- Reassess as volatility changes.

- Track correlations with other positions to avoid hidden exposure.

Position Risk in Different Market Contexts

Position Risk in Perpetual Futures

In perpetual futures, leverage significantly impacts risk. Traders must understand liquidation thresholds and funding rate mechanics. Pairing risk models with how to open a position in perpetual futures can provide a complete roadmap for safe trading.

Position Risk in Equities

For equities, earnings announcements, sector correlations, and macroeconomic data often drive risk. Options strategies are frequently used to hedge exposure.

Position Risk in Cryptocurrencies

High volatility, social sentiment, and regulatory news create unique challenges. Position analysis must incorporate higher buffers and tighter controls.

Tools and Metrics to Support Position Risk Analysis

1. Risk-Adjusted Metrics

- Sharpe Ratio: Measures return relative to volatility.

- Sortino Ratio: Focuses on downside risk.

- Maximum Drawdown: Tracks largest portfolio decline.

2. Tracking and Visualization Tools

- Professional platforms like Bloomberg, RiskMetrics, or portfolio simulation software.

- Retail-friendly tools like TradingView and Excel-based risk calculators.

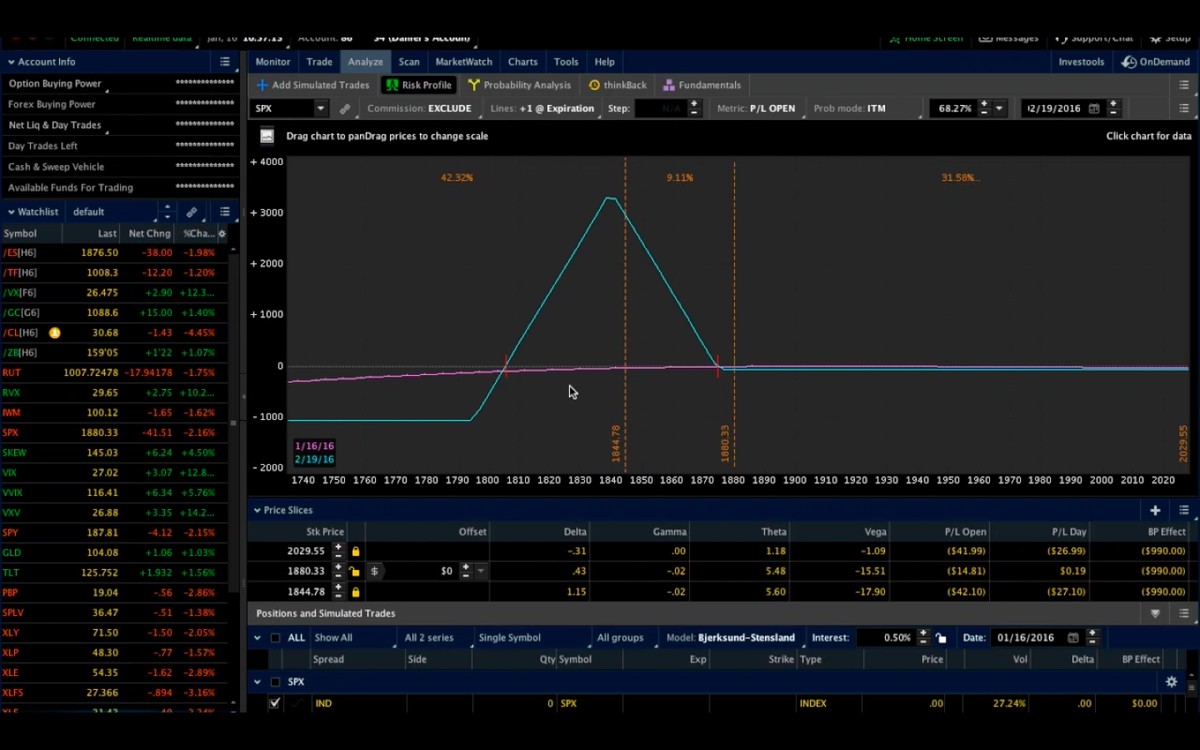

Visualizing position risk and portfolio exposure

Best Practices for Position Risk Analysis

- Never Risk More Than 1–2% per Trade: Helps survive losing streaks.

- Regular Position Rebalancing: Adjust as volatility and correlations shift.

- Hedge When Necessary: Use options or inverse ETFs.

- Combine Quantitative and Qualitative Inputs: Numbers matter, but macro events and sentiment shifts also drive risk.

- Document and Review: Keep a trading journal of position outcomes and risk management results.

Common Mistakes in Position Risk Analysis

- Ignoring Correlations: Thinking each position is independent when they move together.

- Overconfidence in Leverage: Focusing on profits while underestimating liquidation risks.

- Static Models: Relying on outdated risk assumptions instead of updating models regularly.

- Neglecting Stop-Losses: Believing a position will always recover.

FAQ: Position Risk Analysis

1. What is the simplest way to start analyzing position risk?

Begin with basic risk-per-trade limits (e.g., 1–2% of account). Then add volatility checks (ATR) and stop-loss placements. Over time, integrate more advanced methods like VaR and scenario testing.

2. How often should I analyze my position risk?

At a minimum, review risk exposure before entering a trade and at the close of each trading day. In volatile markets, intra-day reviews may be necessary.

3. Can technology automate position risk analysis?

Yes. Many trading platforms integrate risk dashboards that calculate exposure in real-time. Advanced traders can code custom Python scripts or use APIs to run automated VaR, correlation checks, and alerts.

Conclusion

Analyzing position risk is the cornerstone of long-term trading success. From simple methods like percentage risk allocation to advanced tools like VaR and stress testing, every trader must adapt their analysis to market conditions, asset class, and personal tolerance.

The best results come from a blended approach — use quantitative tools for precision, qualitative insights for adaptability, and disciplined frameworks for consistency.

Workflow for analyzing and managing position risk

Final Thoughts

Position risk analysis isn’t just for professional hedge funds — it’s a universal skill for anyone serious about trading. By applying the methods outlined here, you’ll strengthen your portfolio resilience and sharpen your decision-making.

If this article gave you actionable insights, share it with your trading community. And tell us in the comments: What’s your go-to method for analyzing position risk — percentage-based, VaR, or stress testing?