=================================================

Introduction

In trading, price impact refers to the change in the price of an asset as a result of a market participant’s trade. This concept is particularly critical for traders handling large orders, as the impact of their trades can move the market in undesirable directions. For those seeking to optimize their trading strategies, understanding and managing price impact is essential to minimize adverse effects and maximize profitability.

In this article, we will explore various approaches for addressing price impact in trading, focusing on methods to reduce its influence. These approaches include algorithmic trading, advanced order types, and liquidity management techniques, each of which offers distinct advantages and trade-offs.

Understanding Price Impact

What is Price Impact?

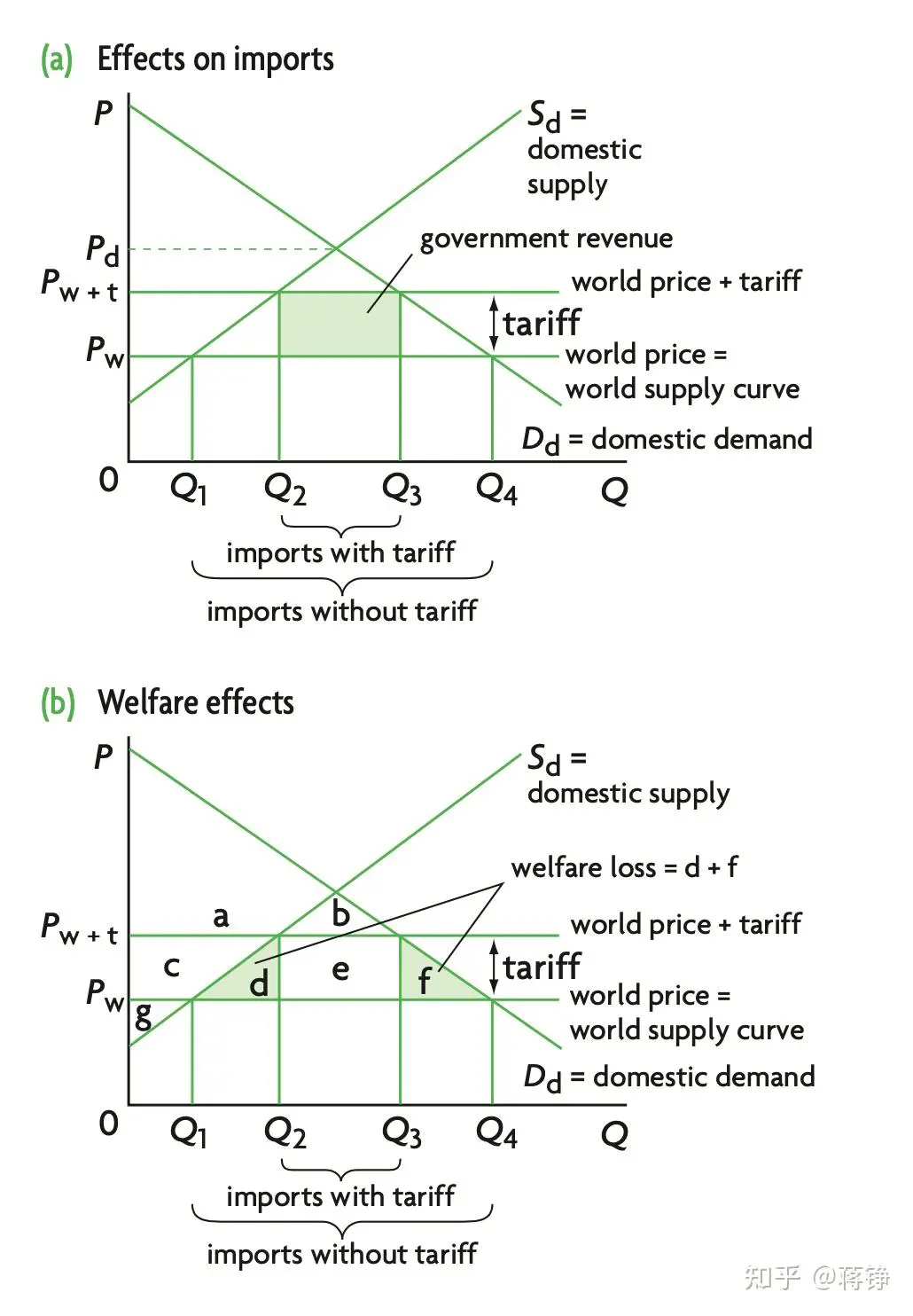

Price impact occurs when a trade, particularly a large one, causes the market price of an asset to move. This effect can vary significantly based on the liquidity of the asset being traded. In markets with low liquidity, a single large trade can cause substantial price fluctuations. Conversely, in highly liquid markets, the price impact is typically smaller, as there is enough supply and demand to absorb large trades.

Price impact is an important factor for traders to consider because it directly affects the execution price, which in turn can impact profitability, especially in high-frequency and institutional trading environments.

Why Does Price Impact Matter?

Price impact matters because it introduces a risk that traders may not achieve the expected trade price. For example, a large purchase order in a low-liquidity market could push prices higher, making it more expensive to complete the trade. Similarly, a large sell order could drive prices down, potentially incurring losses for the trader.

In highly competitive or volatile markets, understanding and managing price impact becomes even more important, as small fluctuations can have a larger cumulative effect on a trader’s overall strategy and performance.

| Approach | Description | Pros | Cons |

|---|---|---|---|

| Price Impact | Price impact occurs when large trades move the market price, especially in low-liquidity markets. | Affects execution price, impacting profitability. | Significant in high-frequency and institutional trading. |

| Algorithmic Trading | Uses algorithms to optimize execution by breaking large orders into smaller ones. | Minimizes market disruption, better execution. | Complex, higher costs for advanced strategies. |

| Types of Algorithmic Strategies | VWAP, TWAP, and Implementation Shortfall strategies help optimize trade execution. | Real-time adjustments based on market conditions. | Requires advanced infrastructure and expertise. |

| Advanced Order Types | Limit and stop orders control trade prices and prevent adverse market movements. | Price control, reduced slippage. | Execution risk, missed opportunities. |

| Liquidity Management | Ensures access to liquidity to minimize price impact. | Better pricing, optimized execution. | Additional costs, market fragmentation. |

| Smart Order Routing (SOR) | Distributes orders across multiple venues to find the best price and reduce price impact. | Access to better liquidity, optimized execution. | May face execution delays or fragmentation. |

| Limit Orders | Trades are executed only at the specified price or better, reducing market movement. | Reduces slippage, controls execution price. | May not be filled in fast markets. |

| Stop Orders | Executes trades when a predefined price is reached, limiting adverse price moves. | Prevents significant losses, price control. | May miss opportunities if the price does not reach trigger. |

| Case Study | In futures markets, price impact can be reduced by using algorithmic trading strategies. | Algorithms like VWAP/TWAP reduce price slippage. | Thin markets increase the risk of slippage. |

| Price Impact Calculation | Calculated as the price change relative to the trade size. | Helps quantify the impact of large trades. | Provides an estimate, not an exact prediction. |

| Price Impact in Futures | Price impact is crucial for leveraged futures traders, as large moves can erode profits quickly. | Essential for managing margin calls and liquidations. | Large price swings can trigger forced exits. |

| High-Frequency Trading | Smart order routing reduces slippage and price impact by efficiently distributing trades. | Minimizes slippage, reduces market impact. | Dependent on algorithm efficiency. |

1. Algorithmic Trading

Overview

One of the most effective ways to minimize price impact is through algorithmic trading. Algorithmic trading involves using computer algorithms to automate and optimize trading strategies, including the execution of large orders. These algorithms break large orders into smaller, more manageable parts, which are executed over time and at optimal price points.

Types of Algorithmic Strategies

- VWAP (Volume-Weighted Average Price): This strategy aims to execute orders in line with the volume of trades over a given period. It ensures that large orders are executed without disrupting the market, as the algorithm mimics the natural trading flow.

- TWAP (Time-Weighted Average Price): TWAP algorithms spread the order execution evenly over a set period. This strategy helps reduce price impact by avoiding large single trades that could significantly affect the market.

- Implementation Shortfall: This strategy minimizes the difference between the intended price and the execution price by adjusting the trade execution dynamically based on real-time market data.

Pros:

- Reduces market disruption: By breaking large orders into smaller transactions, price impact is minimized.

- Better execution quality: Algorithms use sophisticated strategies to find optimal entry and exit points.

- Real-time adjustments: Can adjust trade execution based on current market conditions.

Cons:

- Complexity: Requires advanced infrastructure and technical expertise.

- Costs: May involve higher transaction costs depending on the strategy used.

2. Advanced Order Types

Limit Orders

A limit order allows traders to specify the maximum price they are willing to pay when buying or the minimum price they are willing to accept when selling an asset. By using limit orders, traders can control the price at which they execute a trade, preventing the market from moving against them.

Stop Orders

Stop orders can also be used to minimize price impact by automatically executing trades when a predefined price is reached. These orders can help traders exit positions before price moves drastically, limiting adverse effects.

Pros of Advanced Order Types:

- Price control: Traders maintain control over the price they pay or receive for an asset.

- Reduced slippage: Limit and stop orders ensure that trades are executed at favorable prices, preventing the effects of slippage.

Cons:

- Execution risk: These orders may not be filled if the market price does not reach the specified limit, especially in fast-moving markets.

- Missed opportunities: If the market price does not reach the desired level, traders may miss out on trading opportunities.

3. Liquidity Management

Overview

Liquidity refers to the ease with which an asset can be bought or sold in the market without affecting its price. Managing liquidity is crucial for traders who want to reduce price impact. If an asset has low liquidity, large trades will naturally have a higher price impact.

Strategies for Managing Liquidity

- Use of Liquidity Providers: Traders can collaborate with liquidity providers or market makers who offer deeper markets, reducing price impact by facilitating better trade execution.

- Smart Order Routing (SOR): SOR algorithms help traders execute orders across multiple exchanges or liquidity pools to find the best available price, minimizing slippage and price impact.

Pros:

- Access to better pricing: By working with liquidity providers, traders can access tighter spreads and minimize price impact.

- Optimized order execution: SOR can dynamically adjust to find the best liquidity options across different exchanges or platforms.

Cons:

- Additional costs: Liquidity providers may charge fees for their services.

- Market fragmentation: Relying on multiple exchanges can lead to challenges in execution speed and consistency.

Comparing the Approaches

| Approach | Pros | Cons |

|---|---|---|

| Algorithmic Trading | Minimizes market disruption, better execution quality | Complex, higher costs for advanced strategies |

| Advanced Order Types | Price control, reduced slippage | Execution risk, potential missed opportunities |

| Liquidity Management | Access to better pricing, optimized execution | Additional costs, market fragmentation |

Case Study: Price Impact in Futures Markets

In futures markets, price impact can be especially significant due to leverage. A trader using high leverage may face considerable risks if large trades result in dramatic price changes. By using algorithmic trading and limit orders, futures traders can reduce the adverse effects of price impact.

Example:

A trader attempting to enter a $10 million futures position in a thinly traded market could face substantial slippage. By implementing an algorithmic trading strategy such as VWAP or TWAP, the trader can break the trade into smaller orders, executing them over time to reduce the price impact.

FAQ: Frequently Asked Questions

1. How is price impact calculated in trading?

Price impact can be calculated by comparing the price before and after a trade. Traders often use the formula:

Price Impact=Price After Trade−Price Before TradeTrade Size\text{Price Impact} = \frac{\text{Price After Trade} - \text{Price Before Trade}}{\text{Trade Size}} Price Impact=Trade SizePrice After Trade−Price Before Trade

This gives an idea of how much the market price moved due to a specific trade.

2. Why is price impact important in futures trading?

In futures trading, price impact is critical because it can quickly erode profits, especially for traders using leverage. Large price swings can trigger margin calls or forced liquidations, making it essential to manage price impact effectively.

3. How can traders reduce price impact in high-frequency trading?

In high-frequency trading, smart order routing (SOR) algorithms are crucial. SOR can help traders find the best prices across multiple venues, reducing slippage and price impact by distributing trades efficiently.

Conclusion

Addressing price impact is crucial for traders who want to optimize their execution strategies. Whether through algorithmic trading, advanced order types, or liquidity management, each approach offers unique advantages and trade-offs. By carefully selecting the appropriate strategy, traders can significantly reduce price impact, improve their trade execution, and enhance profitability.

As market conditions evolve, continuously refining these strategies and adopting new technologies will be key to staying competitive and minimizing the adverse effects of price impact.