====================================================================

Perpetual futures have emerged as one of the most widely traded instruments in crypto and traditional derivative markets. Their unique structure—without expiration dates—makes them highly liquid and attractive for both aggressive traders and risk-averse participants. For those who prefer conservative, low-risk strategies, arbitrage opportunities for risk-averse traders in perpetual futures offer consistent returns with managed exposure.

This comprehensive guide explores the mechanics of perpetual futures arbitrage, strategies for minimizing risks, and practical methods to capitalize on inefficiencies without overexposing to market volatility.

Understanding Arbitrage in Perpetual Futures

What is Perpetual Futures Arbitrage?

Arbitrage is the practice of exploiting price discrepancies between markets or instruments. In perpetual futures, this often means taking opposite positions in related markets—such as spot vs. futures—to earn risk-adjusted returns.

Why Risk-Averse Traders Favor Arbitrage

Unlike directional trading, arbitrage does not rely on predicting market movement. Instead, it profits from structural inefficiencies:

- Funding rate imbalances

- Exchange price variations

- Cross-market liquidity gaps

👉 For a structured overview, see What is arbitrage trading in perpetual futures, which explains the core mechanics for new traders.

Core Arbitrage Strategies for Risk-Averse Traders

1. Cash-and-Carry Arbitrage

This is the most common arbitrage strategy in perpetual futures. Traders buy the asset in the spot market while simultaneously shorting perpetual futures.

How it works:

- If perpetual futures trade at a premium to spot, the short position benefits from the funding payments while the long spot position hedges price risk.

- The difference between the two prices becomes the profit.

- If perpetual futures trade at a premium to spot, the short position benefits from the funding payments while the long spot position hedges price risk.

Pros:

- Low exposure to directional market risk.

- Works well in volatile markets with wide spreads.

- Low exposure to directional market risk.

Cons:

- Requires capital to hold spot positions.

- Returns can diminish when funding rates normalize.

- Requires capital to hold spot positions.

2. Funding Rate Arbitrage

Perpetual futures use funding rates to anchor their price close to spot. Traders can capture income by positioning on the favorable side of these payments.

How it works:

- When funding is positive, shorts get paid by longs.

- When funding is negative, longs get paid by shorts.

- When funding is positive, shorts get paid by longs.

Pros:

- Predictable yield opportunities during extreme market sentiment.

- Minimal execution complexity.

- Predictable yield opportunities during extreme market sentiment.

Cons:

- Funding rates can flip quickly, reducing profitability.

- Requires continuous monitoring.

- Funding rates can flip quickly, reducing profitability.

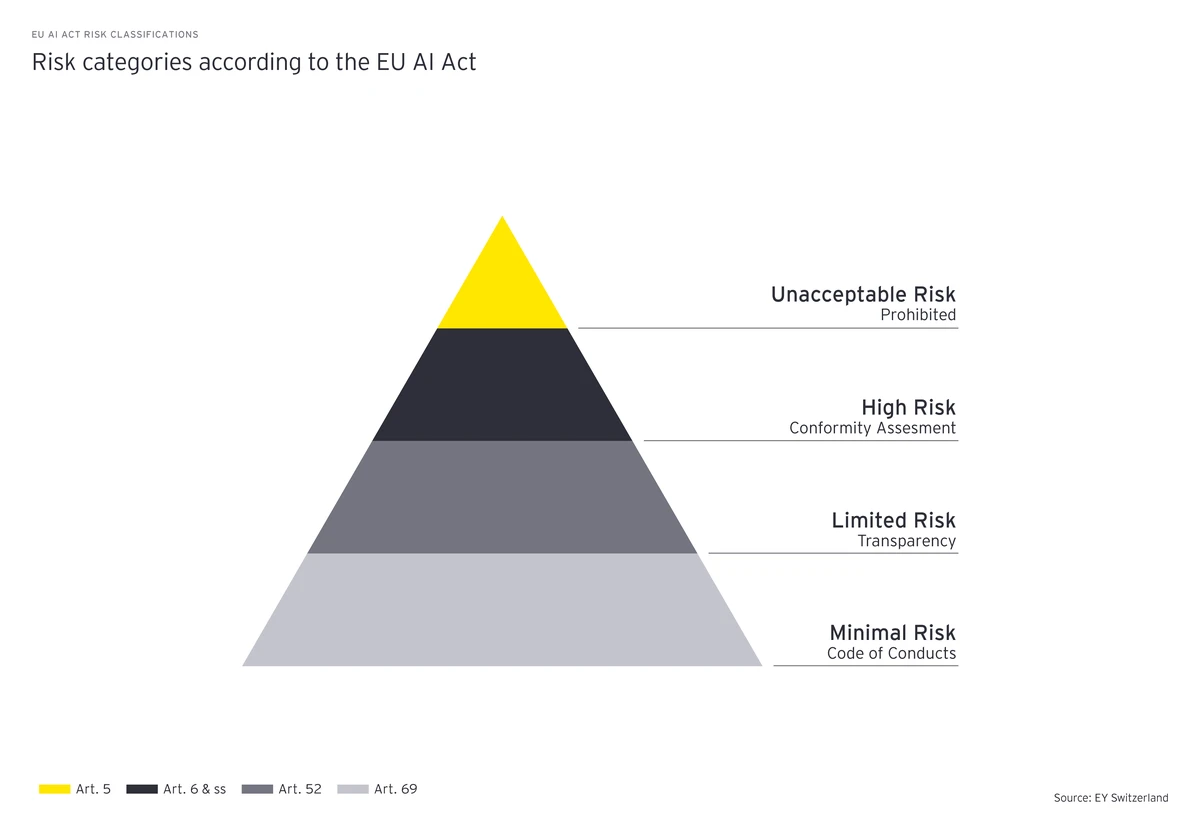

Comparison of two primary arbitrage strategies in perpetual futures.

3. Cross-Exchange Arbitrage

This involves taking advantage of price discrepancies for the same perpetual contract across different exchanges.

How it works:

- Buy perpetual futures on Exchange A while simultaneously selling on Exchange B when spreads diverge.

- Close both positions when prices converge.

- Buy perpetual futures on Exchange A while simultaneously selling on Exchange B when spreads diverge.

Pros:

- Frequent opportunities due to liquidity fragmentation.

- Profits independent of overall market direction.

- Frequent opportunities due to liquidity fragmentation.

Cons:

- Requires multiple accounts and high execution speed.

- Exposed to counterparty and transfer risks.

- Requires multiple accounts and high execution speed.

| Section | Key Points |

|---|---|

| Introduction | Perpetual futures are liquid; arbitrage offers low-risk returns |

| What is Arbitrage | Exploit price differences between markets or instruments |

| Why Favor Arbitrage | Profits from funding rate imbalances, price variations, liquidity gaps |

| Strategy 1: Cash-and-Carry | Buy spot, short perpetual; profit from price/funding difference |

| Cash-and-Carry Pros | Low directional risk, effective in volatile markets |

| Cash-and-Carry Cons | Requires capital, returns reduce when funding normalizes |

| Strategy 2: Funding Rate | Capture income from favorable funding payments |

| Funding Rate Pros | Predictable yield, minimal execution complexity |

| Funding Rate Cons | Rates can flip quickly, needs continuous monitoring |

| Strategy 3: Cross-Exchange | Exploit same contract price gaps across exchanges |

| Cross-Exchange Pros | Frequent opportunities, profits independent of market direction |

| Cross-Exchange Cons | Requires multiple accounts, counterparty and transfer risks |

| Risk Profile | Cash-and-carry: low, Funding rate: medium, Cross-exchange: high |

| Capital Efficiency | Cash-and-carry ties capital, others require less collateral |

| Recommended Approach | Combine cash-and-carry with funding rate analysis |

| Risk Management | Monitor liquidity, funding fluctuations, exchange/counterparty risks |

| Practical Example | Buy BTC spot \(30,000, short perpetual \)30,600, lock $600 profit |

| Industry Trend 1 | Institutional participation tightens spreads, increases liquidity |

| Industry Trend 2 | Growth in altcoins/DeFi expands arbitrage opportunities |

| Industry Trend 3 | Automation and bots accelerate execution, increase competition |

| FAQ 1 | Typical annual returns 5–15%; extreme events can yield 20–30% |

| FAQ 2 | Essential tools: portfolio software, APIs, risk dashboards |

| FAQ 3 | Beginners can start small, prioritize cash-and-carry, use automation gradually |

| Conclusion | Arbitrage offers steady low-risk returns; discipline and risk management are key |

Risk Profile

- Cash-and-carry: Best for risk-averse traders due to hedging.

- Funding rate: Medium risk, reliant on market conditions.

- Cross-exchange: Higher execution and counterparty risk.

Capital Efficiency

- Cash-and-carry requires holding spot, tying up capital.

- Funding rate and cross-exchange can be done with lower collateral requirements.

Recommended Approach

For risk-averse traders, cash-and-carry arbitrage remains the most reliable, especially when combined with funding rate analysis. Together, these create a balanced strategy that captures inefficiencies while minimizing exposure.

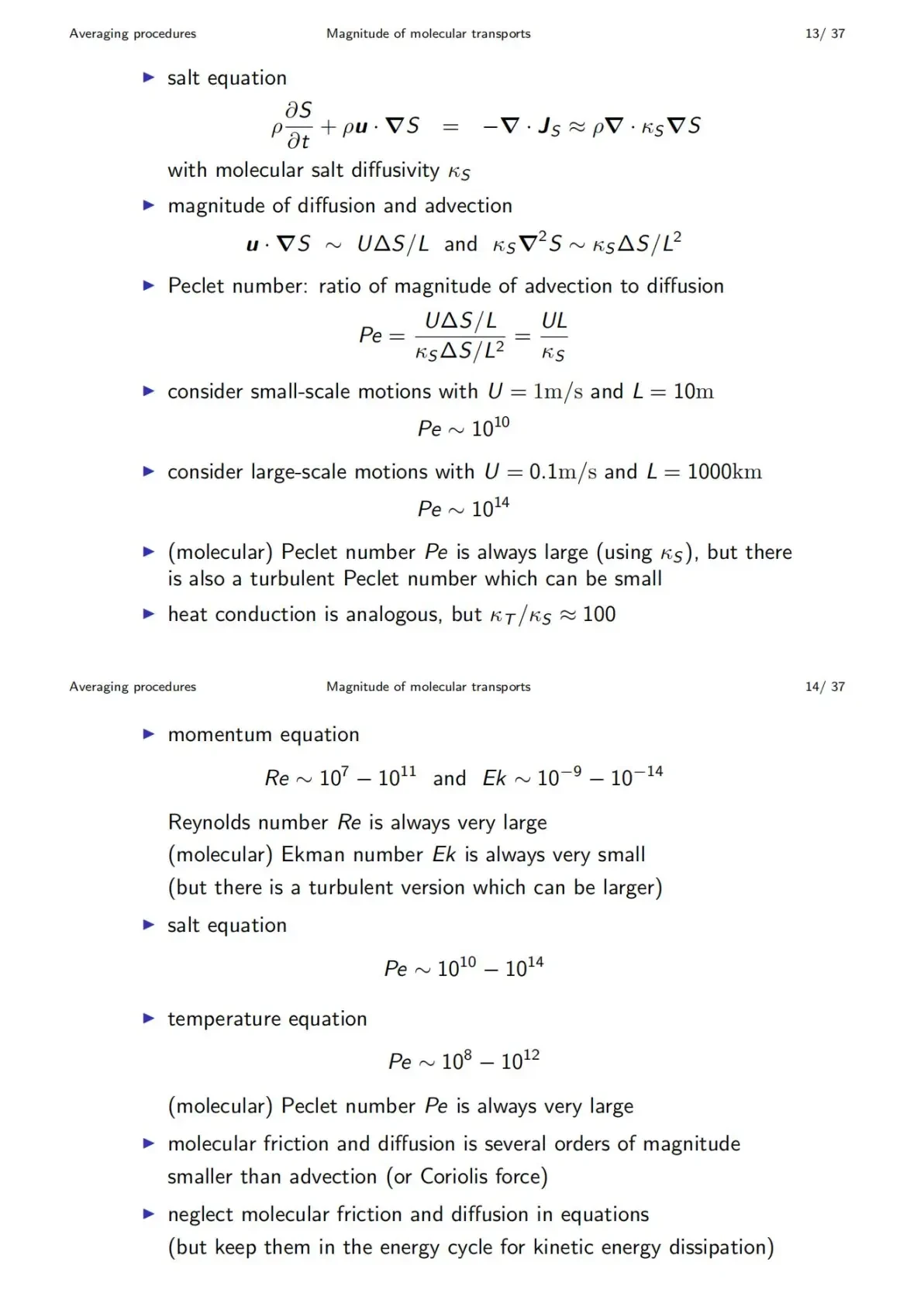

Relative risk-return profiles of perpetual futures arbitrage strategies.

Risk Management in Arbitrage

Market Liquidity Risks

- Thin order books can create slippage.

- Large positions may move markets.

Funding Rate Fluctuations

- Sudden funding changes can erode expected profits.

- Use dynamic monitoring to adjust quickly.

Exchange and Counterparty Risks

- Diversify across exchanges to mitigate systemic risks.

- Prefer regulated platforms with proven track records.

👉 For deeper insights, explore How to minimize risk in perpetual futures arbitrage to learn techniques for protecting capital.

Practical Example of Arbitrage

Imagine Bitcoin trades at \(30,000 on spot markets while perpetual futures are priced at \)30,600.

- Buy 1 BTC in spot market ($30,000).

- Short 1 BTC in perpetual futures ($30,600).

- Lock in $600 profit when positions converge, plus funding rate benefits.

This setup is independent of whether Bitcoin rises or falls, as long as the spread closes.

Industry Trends Impacting Arbitrage

1. Institutional Participation

Large funds are now deploying arbitrage strategies, tightening spreads but also increasing liquidity.

2. Growth in Digital Assets

Arbitrage opportunities are expanding in altcoins and DeFi perpetual contracts, which often have higher inefficiencies.

3. Advanced Execution Tools

Automation and arbitrage bots make strategy implementation faster, though competition is fierce.

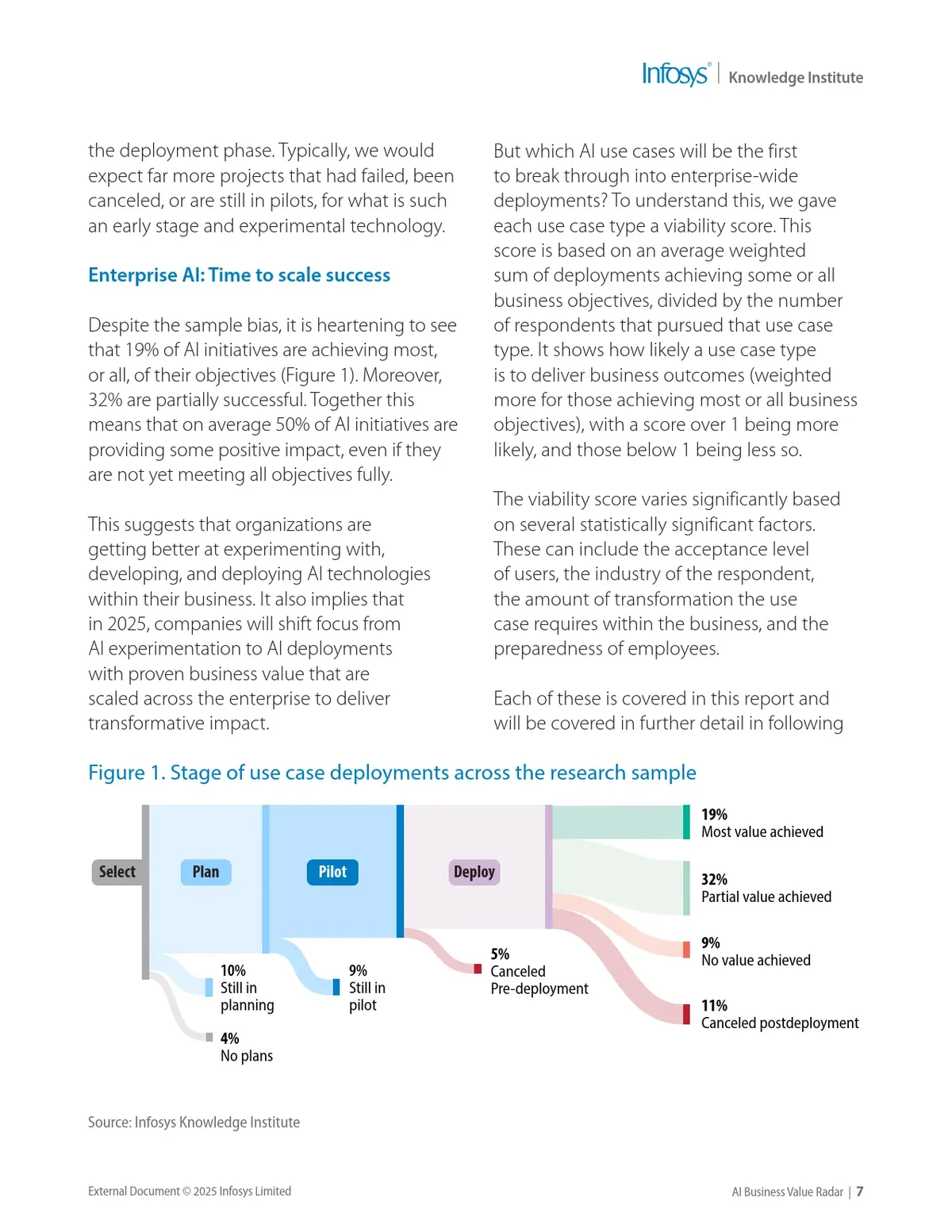

Latest trends shaping arbitrage in perpetual futures markets.

FAQ: Arbitrage Opportunities for Risk-Averse Traders in Perpetual Futures

1. How profitable is arbitrage in perpetual futures?

Returns vary, but risk-averse traders typically earn 5–15% annually through consistent strategies like cash-and-carry. During extreme funding events, yields can exceed 20–30% annually.

2. What tools are essential for perpetual futures arbitrage?

- Portfolio management software for tracking spot and futures exposure.

- API connections for real-time monitoring and execution.

- Risk dashboards for funding rate alerts and margin requirements.

3. Can beginners perform perpetual futures arbitrage?

Yes, but it requires discipline. Beginners should start with small allocations, prioritize cash-and-carry setups, and gradually adopt automation once experienced.

Conclusion

For traders seeking low-risk strategies, arbitrage opportunities for risk-averse traders in perpetual futures present a compelling option. By leveraging techniques like cash-and-carry and funding rate arbitrage, investors can achieve steady returns without betting on market direction.

As the market evolves, risk management remains the cornerstone of sustainable arbitrage. Success lies not in chasing every opportunity, but in executing a disciplined, consistent strategy with well-managed capital.

If this guide helped you understand arbitrage in perpetual futures, share it with your trading community, leave a comment with your experiences, and join the discussion on building smarter risk-averse strategies.