=======================================================================

Basis is an important concept in trading, particularly in futures and perpetual futures markets. It represents the difference between the spot price (or cash price) and the futures price. The basis is a crucial element for traders and investors in understanding market dynamics, assessing arbitrage opportunities, and managing risk.

In this detailed guide, we will dive deep into basis influence reports, how they shape trading decisions, and why they are essential for professionals and retail investors alike. We will discuss how basis data can influence trading strategies, highlight its importance in risk management, and provide actionable insights on how to interpret basis trends. Additionally, we will compare different strategies for using basis data, explore common pitfalls, and share expert advice for integrating basis influence reports into your trading strategy.

What Are Basis Influence Reports?

Basis influence reports are analytical tools that provide insights into how changes in the basis (the difference between spot and futures prices) affect trading positions and strategies. These reports offer detailed analysis, projections, and predictions regarding how the basis behaves in various market conditions.

Components of Basis Influence Reports

- Basis Spread: The difference between the spot price and the futures price. It’s essential for understanding potential arbitrage opportunities.

- Basis Volatility: Measures the fluctuation of the basis over time. Volatile basis can indicate uncertainty in market conditions and impact risk management.

- Basis Forecast: Predicts how the basis will evolve based on historical data, market trends, and economic factors.

- Arbitrage Opportunities: Analyzing how the basis influences arbitrage strategies, particularly in markets like commodities, crypto, and perpetual futures.

Why Are Basis Influence Reports Important?

Basis influence reports are crucial for understanding the relationship between spot and futures prices, enabling traders to predict price movements, manage positions, and minimize risk. These reports are vital in the following ways:

- Arbitrage Identification: Basis can help traders spot arbitrage opportunities, where discrepancies between the spot and futures markets can be exploited for profit.

- Market Forecasting: By analyzing the basis, traders can forecast market trends and adjust their positions accordingly.

- Risk Management: Understanding basis volatility and its potential shifts helps traders mitigate risk, especially when using leverage.

How Does Basis Affect Perpetual Futures?

In perpetual futures, the basis plays an especially important role due to the continuous nature of these contracts. Unlike traditional futures contracts, which have an expiration date, perpetual futures allow traders to maintain positions indefinitely, making the basis influence more pronounced.

The Role of Basis in Perpetual Futures Trading

In perpetual futures, the basis can be positive (indicating that the futures price is higher than the spot price) or negative (indicating that the futures price is lower than the spot price). The basis in perpetual futures is particularly influenced by the funding rate, which helps keep the futures price aligned with the spot price over time.

Key Factors Influencing the Basis in Perpetual Futures:

- Funding Rates: The periodic payments made between long and short positions in perpetual futures. These rates often reflect the difference between the futures price and the spot price, which directly influences the basis.

- Liquidity: Low liquidity can lead to greater basis volatility, affecting traders’ ability to enter or exit positions at favorable prices.

- Market Sentiment: The basis can reflect traders’ expectations of future price movements. For example, if traders expect a significant upward price movement, the futures price might increase relative to the spot price, resulting in a positive basis.

How to Calculate Basis in Perpetual Futures

The formula for calculating the basis in perpetual futures is:

Basis=Futures Price−Spot Price\text{Basis} = \text{Futures Price} - \text{Spot Price}Basis=Futures Price−Spot Price

A positive basis indicates that the futures price is higher than the spot price, while a negative basis means that the futures price is lower. Understanding this difference is key to making informed decisions regarding arbitrage opportunities, hedging, and market positioning.

Basis Influence on Leverage and Risk Management

When leveraging positions in perpetual futures, the basis can have a significant impact on the potential for profit or loss. Leverage amplifies both the gains and risks associated with basis movements, making it crucial for traders to carefully monitor basis trends.

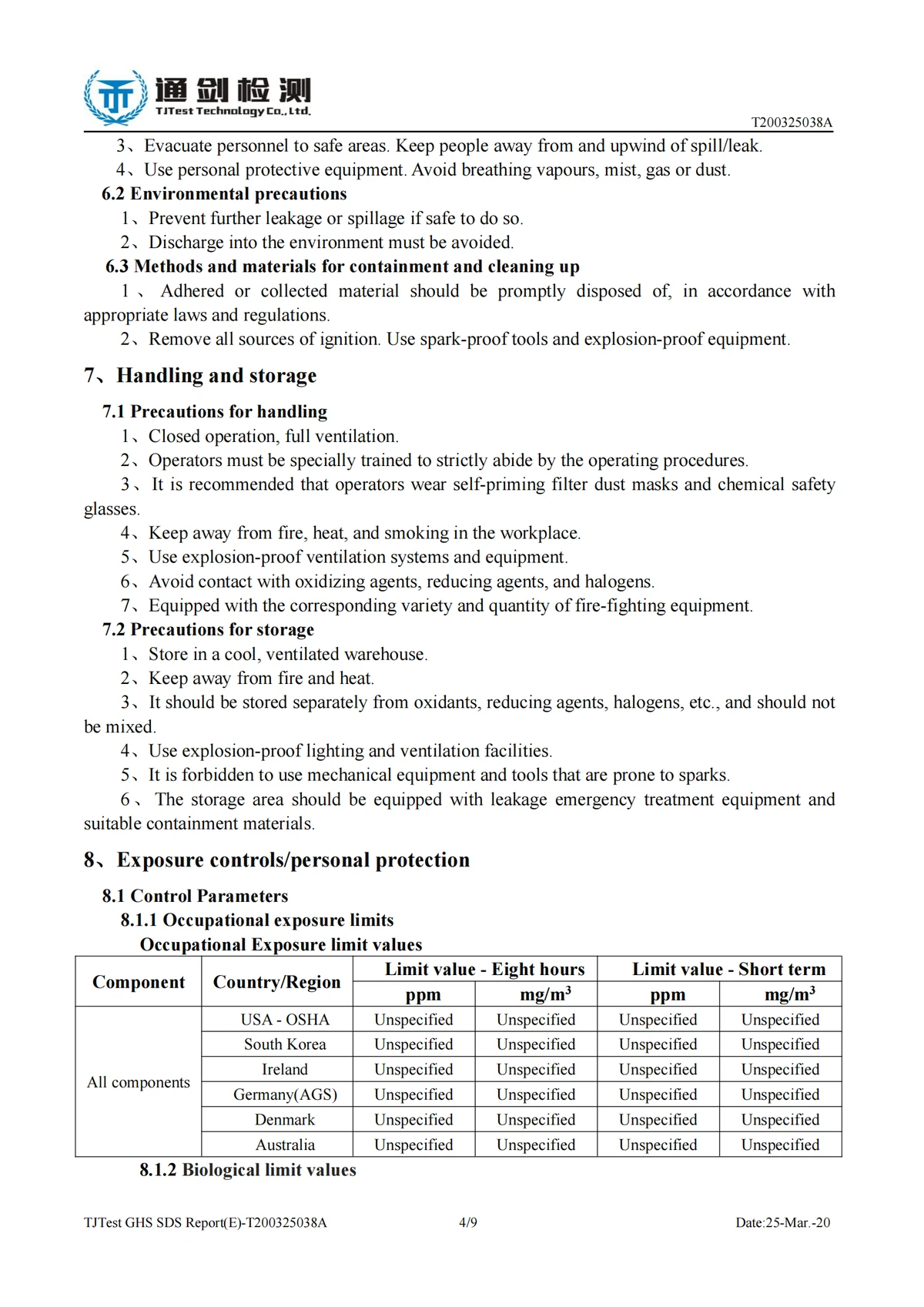

| Section | Key Points |

|---|---|

| Introduction | Basis is the difference between spot and futures prices, crucial for trading and risk. |

| Basis Influence Reports Definition | Analytical tools showing how basis changes impact trading positions and strategies. |

| Components of Reports | Basis spread, basis volatility, basis forecast, arbitrage opportunities |

| Importance of Reports | Helps identify arbitrage, forecast market trends, and manage risk |

| Role in Perpetual Futures | Basis can be positive or negative; influenced by funding rates, liquidity, and sentiment |

| Basis Calculation | Basis = Futures Price − Spot Price; positive indicates futures higher than spot |

| Basis Impact on Leverage | Leverage amplifies gains and risks from basis movements |

| Key Strategies: Basis Arbitrage | Exploit spot/futures discrepancies; use hedging to lock in risk-free profits |

| Key Strategies: Basis Trend Analysis | Analyze historical data and statistical models to predict future basis movements |

| Advantages & Disadvantages of Trends | Provides forecasting insights; historical trends may not always predict future movements |

| Using Reports in Trading Strategy | Risk monitoring, arbitrage execution, and market sentiment tracking |

| FAQ: Checking Frequency | Day traders: hourly; longer-term traders: daily or weekly |

| FAQ: Tools for Tracking | Platforms like TradingView, CryptoCompare, Binance for real-time and historical data |

| FAQ: Risk Management | Reports help adjust positions, hedge effectively, and avoid excessive exposure |

| Conclusion | Basis analysis is key for perpetual futures, arbitrage, risk management, and informed trading |

1. Basis Arbitrage

Basis arbitrage involves exploiting discrepancies between the spot price and the futures price to make a profit. Traders who engage in basis arbitrage seek to profit from differences in the basis, usually by buying in one market and selling in another.

How Basis Arbitrage Works:

- Spot/Futures Discrepancy: If the futures price is higher than the spot price, traders may buy the asset in the spot market and sell it in the futures market.

- Risk Mitigation: Basis arbitrage typically involves hedging strategies that protect traders from adverse price movements while locking in risk-free profits based on the basis difference.

2. Basis Trend Analysis

Basis trends can provide valuable insights into future price movements. By studying how the basis has shifted historically, traders can predict how the market will behave in the short to medium term.

How to Analyze Basis Trends:

- Historical Data: Analyze historical basis data to identify patterns, such as consistent widening or narrowing of the basis.

- Statistical Analysis: Use statistical models, such as moving averages or regression analysis, to project future basis behavior.

Advantages and Disadvantages of Basis Trend Analysis:

Advantages:

- Provides a structured approach to forecasting price movements.

- Allows for the identification of key turning points in the market.

- Provides a structured approach to forecasting price movements.

Disadvantages:

- Historical trends may not always predict future movements.

- Requires deep knowledge of market conditions and data analysis tools.

- Historical trends may not always predict future movements.

How to Use Basis Influence Reports in Your Trading Strategy

Integrating basis influence reports into your trading strategy can enhance your decision-making process and improve your overall trading performance. Here’s how you can use these reports:

- Risk Monitoring: Use basis reports to keep an eye on potential market risks and volatility. When basis changes significantly, it could signal that the market is heading into a period of high volatility.

- Arbitrage Execution: Basis reports can help you spot arbitrage opportunities across different markets. With timely reports, you can execute trades before the basis correction occurs.

- Market Sentiment Tracking: Monitor basis trends to gauge overall market sentiment. A narrowing basis may indicate market confidence, while a widening basis could signal uncertainty or market correction.

FAQ: Basis Influence Reports

1. How often should I check basis influence reports?

It depends on your trading strategy. If you’re a day trader, you should check basis reports frequently—at least once every hour or two. For longer-term traders, checking them daily or weekly should suffice.

2. What tools can I use to track the basis in perpetual futures?

You can use platforms like TradingView, CryptoCompare, or Binance to track basis and access detailed analysis tools. Many of these platforms offer real-time data, charts, and historical data to help you monitor the basis effectively.

3. How can basis influence reports help with risk management?

Basis influence reports help by giving you real-time insights into market conditions and potential price discrepancies. By understanding the basis, you can adjust your positions, hedge effectively, and avoid excessive exposure to price fluctuations.

Conclusion

Basis influence reports are an indispensable tool for traders, especially those involved in perpetual futures, arbitrage trading, and risk management. By understanding how the basis affects market dynamics and leveraging the insights from these reports, you can enhance your trading strategy, make informed decisions, and minimize risk. Whether you’re a retail investor or an institutional trader, integrating basis analysis into your trading process can lead to more consistent profits and a better grasp of market behavior.