============================================================================

The financial industry thrives on information. Among the most powerful tools for understanding market dynamics are basis market outlook reports, which provide insights into the spread between spot and futures prices. For traders in commodities, equities, or cryptocurrency derivatives, these reports are indispensable for forecasting market trends, managing risk, and identifying arbitrage opportunities.

This article explores the purpose, methodologies, and benefits of basis market outlook reports, compares different approaches, and offers actionable strategies for professionals and beginners alike.

What Are Basis Market Outlook Reports?

A basis market outlook report is an analytical document that evaluates the difference (basis) between the spot price of an asset and its futures or derivatives price. For example, in perpetual futures trading, the basis is influenced by funding rates, interest rates, and supply-demand imbalances.

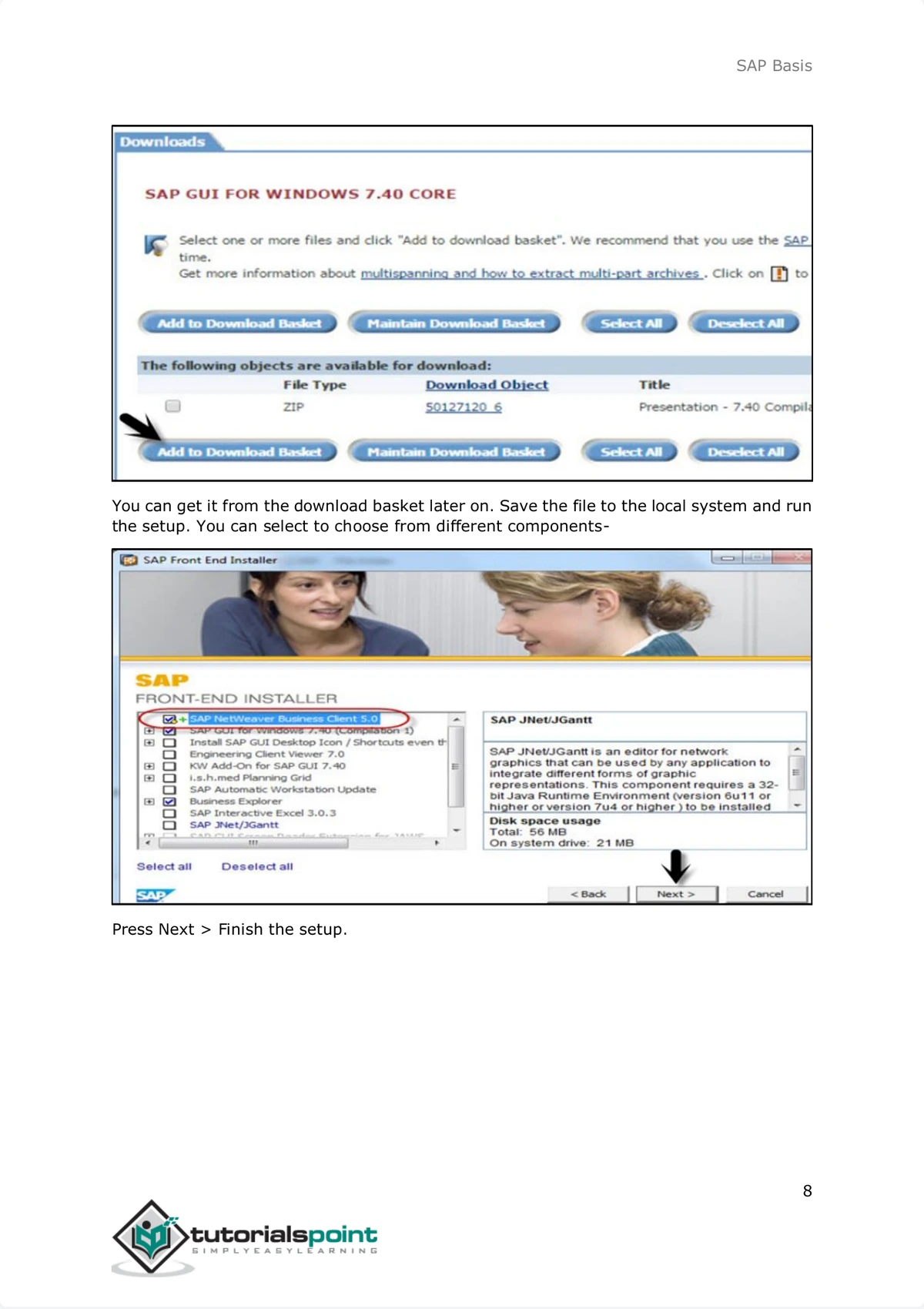

These reports typically include:

- Current basis levels across assets.

- Historical basis analysis.

- Forecasts of potential changes in basis.

- Implications for trading strategies and risk management.

Traders use these reports to:

- Anticipate shifts in market sentiment.

- Decide when to hedge or speculate.

- Identify arbitrage or carry trade opportunities.

Example of futures curve and basis insights

Why Basis Market Outlook Reports Matter

Price Discovery

They reveal whether futures prices are trading at a premium (contango) or discount (backwardation) relative to spot prices.

Risk Management

Basis fluctuations directly affect hedging strategies for institutions and retail traders.

Arbitrage Opportunities

Understanding the basis allows traders to exploit inefficiencies between spot and futures markets.

Forecasting Market Trends

Basis levels often reflect broader macroeconomic or sector-specific sentiment, serving as a predictive indicator.

| Category | Description | Key Topics | Application |

|---|---|---|---|

| What Are Basis Market Outlook Reports? | Analytical documents evaluating the difference between spot and futures prices. | Current basis levels, Historical analysis, Forecasts, Risk management | Used to forecast market trends, hedge, speculate, and identify arbitrage. |

| Importance of Basis Reports | Key for price discovery, risk management, arbitrage, and trend forecasting. | Price discovery, Risk management, Arbitrage, Market trends | Helps traders optimize hedging strategies, exploit inefficiencies, and predict trends. |

| Quantitative, Data-Driven Reports | Uses historical data and statistical models to predict basis behavior. | Regression models, Volatility measures, Machine learning | Useful for precision in institutional trading. |

| Fundamental, Macro-Driven Reports | Focuses on economic factors and market sentiment indicators. | Economic fundamentals, Market events, Sentiment indicators | Suitable for beginners and adaptable to market shifts. |

| Recommended Approach | Combine quantitative and fundamental analysis for reliable results. | Data precision, Fundamental context | Enhances the reliability of basis outlook reports. |

| Industry Trends | Current trends affecting basis market outlook reports. | Crypto futures, AI integration, Retail access, Commodities | Highlights growing demand for crypto reports and machine learning models. |

| Practical Applications | Uses include arbitrage, portfolio diversification, and risk alerts. | Arbitrage strategies, Portfolio diversification, Risk alerts | Exploit spreads, adjust portfolio exposures, and signal liquidity stress. |

| How to Interpret Basis Reports | Steps to analyze basis levels, trends, historical data, and trading implications. | Basis levels, Trend forecasts, Historical data, Implications | Guides traders in hedging, speculating, or arbitraging based on basis trends. |

| Challenges and Risks | Issues that can affect basis analysis such as data quality and regulatory shifts. | Data quality, Regulatory shifts, Liquidity constraints, Model reliance | Risk of inaccurate signals and over-reliance on models. |

| Best Practices | Recommended methods for using basis outlook reports effectively. | Cross-verification, Scenario planning, Adaptation, Blending methods | Improve decision-making by combining multiple data sources and methods. |

| FAQs | Common questions related to basis reports. | Trader benefits, Data sources, Professional vs retail traders | Basis reports offer insights for both professionals and retail traders. |

1. Quantitative, Data-Driven Reports

These rely on historical time series data, statistical modeling, and computational tools. Analysts may use regression models, volatility measures, and machine learning techniques to forecast basis behavior.

Pros:

- Objective, data-driven, less prone to bias.

- Can handle large datasets for complex markets.

- Useful for institutional traders needing precision.

Cons:

- Requires advanced tools and technical skills.

- May fail during black swan events when models break down.

2. Fundamental, Macro-Driven Reports

These focus on economic fundamentals, market events, and sentiment indicators. For instance, in commodities, weather and supply chain disruptions are crucial. In crypto, funding rates and liquidity flows matter.

Pros:

- Intuitive and easier for beginner investors.

- Captures qualitative market drivers that numbers alone may miss.

- Flexible and adaptable to sudden market shifts.

Cons:

- More subjective, prone to analyst bias.

- Limited in scalability compared to algorithmic models.

Recommendation: Combining quantitative precision with fundamental context produces the most reliable basis outlook reports. Data can highlight patterns, while fundamentals explain the “why” behind them.

Industry Trends Shaping Basis Market Outlook Reports

- Crypto Perpetual Futures: Increasing demand for reports on funding rates and long/short imbalances.

- AI Integration: Machine learning models enhancing predictive accuracy.

- Retail Access: Simplified outlook reports designed for non-institutional traders.

- Global Commodities: Supply disruptions and geopolitical tensions influencing basis volatility.

Factors influencing futures basis and settlement values

Practical Applications of Basis Outlook Reports

Arbitrage and Hedging Strategies

Traders can use reports to exploit spreads by buying spot and selling futures (or vice versa). For instance, knowing how to use basis for arbitrage in perpetual futures helps capture risk-free or low-risk profits.

Portfolio Diversification

Institutional investors track basis to adjust portfolio exposures across markets.

Risk Alerts

Sudden changes in basis levels may signal liquidity stress or upcoming volatility spikes.

How to Interpret Basis Market Outlook Reports

- Check Basis Levels: Identify whether the market is in contango or backwardation.

- Review Forecast Trends: Look for short- and medium-term predictions.

- Compare with Historical Data: Spot anomalies or repeating cycles.

- Analyze Implications: Decide whether to hedge, speculate, or arbitrage.

By applying these steps, traders can turn raw outlook reports into actionable insights.

Challenges and Risks

- Data Quality Issues: Inaccurate spot or futures pricing skews basis analysis.

- Regulatory Shifts: New laws can suddenly alter futures markets.

- Liquidity Constraints: Thinly traded assets produce unreliable basis signals.

- Over-Reliance on Models: Blind trust in quantitative outputs can be dangerous.

Risk management remains essential when relying on outlook reports.

Basis volatility often spikes during market uncertainty

Best Practices for Using Basis Market Outlook Reports

- Cross-Verify Sources – Always compare multiple reports for consistency.

- Incorporate Scenario Planning – Prepare for best-case, base-case, and worst-case basis outcomes.

- Adapt Regularly – Update strategies in line with market developments.

- Blend Quantitative and Fundamental Approaches – Don’t rely solely on one method.

- Stay Educated – Explore advanced resources such as basis forecasting methods and case studies.

FAQs

1. How do basis market outlook reports help traders?

They provide actionable insights into price spreads, enabling traders to hedge, speculate, or arbitrage with greater accuracy. They also highlight risks and market sentiment shifts.

2. Where can I access reliable basis outlook data?

Traders can find data from exchanges, broker platforms, and specialized research firms. For crypto, platforms offering where to access basis analytics for perpetual futures are particularly useful.

3. Are basis outlook reports only for professional traders?

No. While institutions rely heavily on them, simplified versions are increasingly available for retail traders, offering guidance without requiring advanced expertise.

Conclusion

Basis market outlook reports are a cornerstone of modern trading and investment analysis. By providing a structured view of the relationship between spot and futures markets, they help traders identify opportunities, manage risks, and anticipate market shifts.

For the best results, combine quantitative models with fundamental insights and apply disciplined risk management. As markets evolve—especially in crypto and commodities—the role of reliable basis reports will only grow stronger.

Share Your Perspective

Do you rely on basis market outlook reports in your trading? Which approach—quantitative or fundamental—works best for you? Share your insights in the comments below and help fellow traders refine their strategies.

Related reads: