==========================================

In the world of leveraged trading, cross margin is a critical concept for traders who want to optimize their margin usage across multiple positions. By understanding how cross margin works and how to calculate its requirements, traders can manage their risk more effectively and maximize their trading potential. In this article, we will guide you through the process of calculating cross margin requirements, explore the benefits of cross margin in trading, and offer insights into strategies for minimizing risk.

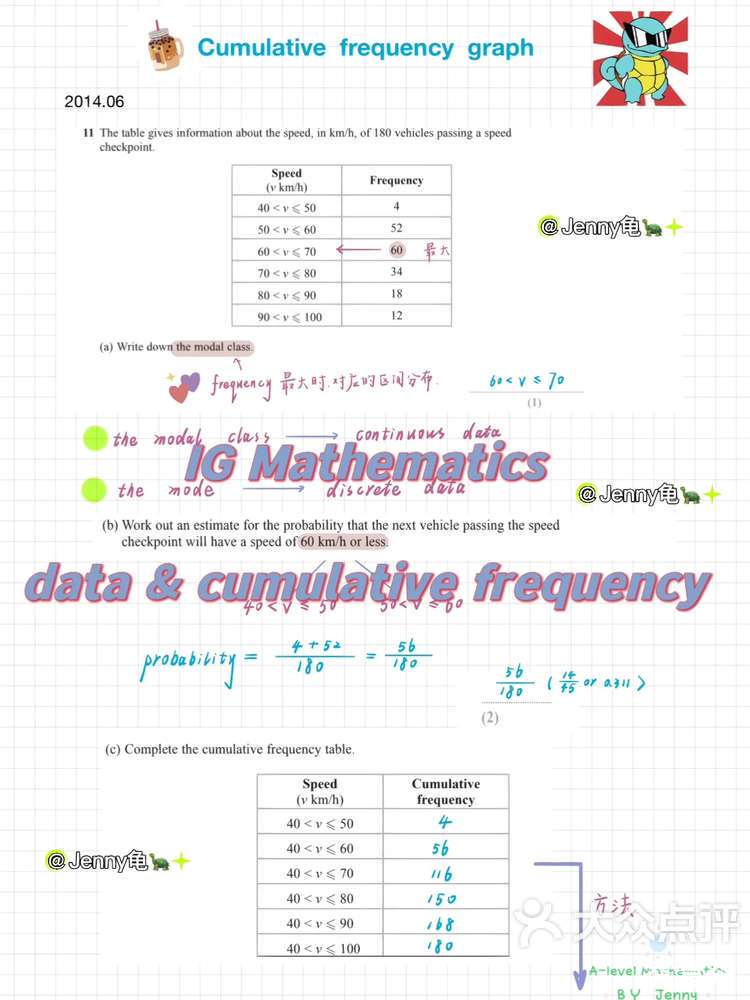

What is Cross Margin?

Before diving into how to calculate cross margin requirements, it’s essential to understand the basic concept. Cross margin is a risk management strategy that allows traders to use the same pool of funds to margin multiple positions, rather than having a separate margin for each individual position. This means that the margin balance can be shared across all positions, reducing the chances of a margin call.

Cross margining is often used in perpetual futures, cryptocurrency trading, and forex trading, where traders can maximize their leverage by combining funds across positions. This can significantly enhance the flexibility of the trader but also increase the risk.

- The Basics of Cross Margin Calculation

—————————————–

1.1 Key Components of Cross Margin

To calculate cross margin requirements, it’s important to understand the key factors that influence it:

- Total Margin: The amount of capital allocated to support your positions.

- Equity: The total value of your margin account, including profits, losses, and any available balance.

- Leverage: The ratio between your total position size and the margin you need to put up.

- Unrealized P/L (Profit/Loss): The ongoing profit or loss from your open positions.

1.2 Formula for Cross Margin Calculation

The basic formula for calculating cross margin can be simplified as:

Cross Margin Requirement=Total Position ValueLeverage\text{Cross Margin Requirement} = \frac{\text{Total Position Value}}{\text{Leverage}}Cross Margin Requirement=LeverageTotal Position Value

Where:

- Total Position Value is the sum of the value of all open positions.

- Leverage is the amount of leverage you’re using in the market.

For example, if you have a $100,000 position and use 10x leverage, your margin requirement would be:

\(100,00010=\)10,000\frac{$100,000}{10} = $10,00010\(100,000=\)10,000

This is the amount you need to have in your margin account to maintain the position.

1.3 Cross Margin vs. Isolated Margin

In isolated margin, each position has its own margin, meaning that if one position suffers a loss, only that position will be affected, and you may lose the entire isolated margin. In contrast, cross margin allows you to use the funds from other positions to cover the loss, which reduces the likelihood of a liquidation event.

While isolated margin is a safer choice for risk-averse traders, cross margin is more beneficial for traders looking to optimize their capital usage across multiple positions.

- How to Calculate Cross Margin in Perpetual Futures

—————————————————–

2.1 Understanding Perpetual Futures and Cross Margin

In perpetual futures, there is no expiration date. Traders can hold positions indefinitely, provided they meet the margin requirements. Cross margin allows traders to spread their margin across multiple positions, which is crucial for maximizing leverage and managing risk efficiently.

2.2 Example Calculation in Perpetual Futures

Let’s say you want to open a long position of 2 BTC in a Bitcoin perpetual futures contract. The price of Bitcoin is $30,000, and you want to use cross margin with 10x leverage.

- Total Position Value = 2 BTC * \(30,000 = \)60,000

- Leverage = 10x

Using the cross margin formula:

Cross Margin Requirement=\(60,00010=\)6,000\text{Cross Margin Requirement} = \frac{$60,000}{10} = $6,000Cross Margin Requirement=10\(60,000=\)6,000

Thus, you need to have at least $6,000 in your margin account to open this position with 10x leverage.

2.3 Importance of Cross Margin in Perpetual Futures Trading

Cross margin in perpetual futures allows for better risk management. For example, if your position starts losing value, the loss can be covered by the remaining balance in your margin pool, reducing the likelihood of liquidation. However, this also means that if multiple positions are in the red, the entire margin pool can be at risk, so it’s essential to monitor your positions carefully.

- Calculating Cross Margin for Multiple Positions

————————————————–

3.1 Cross Margin Across Multiple Positions

When calculating cross margin for multiple positions, the total margin required is the sum of the margin for all positions divided by the leverage. The idea is to optimize the use of capital across different assets or contracts to maintain sufficient margin without overexposing yourself to risk.

Example: Cross Margin Across Multiple Positions

Let’s assume you have three positions in different assets with the following parameters:

- Position 1 (Bitcoin): 2 BTC at $30,000 with 10x leverage

- Position 2 (Ethereum): 10 ETH at $2,000 with 5x leverage

- Position 3 (Litecoin): 50 LTC at $200 with 20x leverage

First, calculate the margin requirement for each position:

- Bitcoin Margin = 2×30,00010=6,000\frac{2 \times 30,000}{10} = 6,000102×30,000=6,000

- Ethereum Margin = 10×2,0005=4,000\frac{10 \times 2,000}{5} = 4,000510×2,000=4,000

- Litecoin Margin = 50×20020=500\frac{50 \times 200}{20} = 5002050×200=500

Now, total margin required = \(6,000 + \)4,000 + \(500 = **\)10,500**.

3.2 Optimizing Margin Usage

By using cross margin, your $10,500 is shared across all three positions. This allows for better capital efficiency compared to isolated margin, where each position would require separate funds.

- Risk Management: Why Cross Margin is Crucial

———————————————–

4.1 Cross Margin and Leverage

Cross margin gives traders more flexibility with leverage. By pooling margin across positions, traders can use more capital for other trades, potentially increasing returns. However, the risk is that large losses across multiple positions can deplete the margin balance quickly.

Example: If your BTC position starts to lose value, the margin from your Ethereum and Litecoin positions can be used to cover the losses. However, if all positions begin to lose value simultaneously, it can lead to liquidation of the entire margin pool.

4.2 Risk Management Tips

- Diversification: Spread your positions across different assets to minimize the impact of a downturn in any one market.

- Monitor Margin Levels: Always keep an eye on your margin levels to ensure that your positions are not at risk of liquidation.

- Set Stop-Loss Orders: Protect your positions with stop-loss orders to limit losses in case the market moves against you.

- FAQs: Cross Margin Calculation and Risk Management

—————————————————–

5.1 How do I use cross margin in perpetual futures?

To use cross margin in perpetual futures, select the cross margin option when setting up your trade on your platform. This allows the platform to use the total margin across your open positions, giving you flexibility in how your margin is allocated.

5.2 Why should I choose cross margin over isolated margin?

Cross margin allows you to use your margin more efficiently across multiple positions, offering flexibility and better risk management. Isolated margin, on the other hand, is safer as each position has its own margin, but it requires more capital to cover each position individually.

5.3 How does cross margin impact my leverage?

Using cross margin allows you to effectively maximize your leverage by sharing the margin across positions. This increases your potential for higher returns but also exposes you to greater risk, as losses in one position can affect all others in your margin pool.

Conclusion

Understanding how to calculate cross margin requirements is essential for traders looking to optimize their capital usage across multiple positions. By using cross margin in perpetual futures, cryptocurrency trading, or forex markets, traders can better manage their margin and leverage, while improving risk management practices. However, it’s essential to balance the benefits of cross margin with its inherent risks, ensuring that you have a solid strategy in place to manage and monitor your positions.

Join the discussion! How do you use cross margin in your trading strategy? Share your insights below and don’t forget to share this article with your fellow traders!