===========================================================

Understanding how to calculate perpetual futures profit is one of the most important skills for traders and quantitative analysts alike. Whether you are a beginner testing leverage for the first time, or an experienced quant refining risk models, accurate profit calculation is the foundation of long-term success in perpetual futures markets.

This article offers a comprehensive 3000+ word guide covering formulas, strategies, real-world applications, and key considerations to ensure your profit calculations are both accurate and actionable.

What Are Perpetual Futures?

Perpetual futures contracts are derivative instruments that allow traders to speculate on the price of an asset (such as Bitcoin, Ethereum, or other cryptocurrencies) without expiry. Unlike traditional futures contracts, perpetual futures never settle on a fixed date, making them highly popular among both retail and institutional traders.

Their key features include:

- Leverage: Ability to control a larger position with relatively small margin.

- Funding Rate: A recurring payment between long and short traders to keep contract prices aligned with the spot market.

- 24⁄7 Trading: Particularly in crypto markets, perpetual futures provide uninterrupted opportunities.

Before we dive into profit calculations, let’s establish the core elements that influence profit outcomes: entry price, exit price, contract size, leverage, and funding payments.

Core Formula for Calculating Perpetual Futures Profit

The profit or loss (PnL) in perpetual futures is generally calculated as:

Profit (PnL) = (Exit Price – Entry Price) × Position Size × Contract Multiplier

For short positions, the formula is reversed:

Profit (PnL) = (Entry Price – Exit Price) × Position Size × Contract Multiplier

Example:

- Entry Price = $20,000

- Exit Price = $21,000

- Position Size = 0.5 BTC

- Contract Multiplier = 1 (if denominated in BTC)

Profit = (21,000 – 20,000) × 0.5 × 1 = $500

Adjusting for Leverage

Leverage magnifies both profits and losses. With leverage, traders commit only a fraction of the total position size as margin.

Effective Return = (Profit ÷ Margin Used) × 100%

Example:

- Position Size = $10,000

- Margin Used (with 10x leverage) = $1,000

- Profit = $500

Effective Return = (500 ÷ 1,000) × 100% = 50% ROI

This highlights why leverage can be powerful but also extremely risky.

Factoring in Funding Payments

One critical difference between perpetual futures and traditional contracts is the funding rate. Traders pay or receive funding periodically (every 8 hours on many exchanges) depending on their position and the market conditions.

Adjusted Profit = Trading Profit – Funding Payments Paid + Funding Payments Received

Ignoring funding fees can create misleading profit calculations, especially for longer holding periods.

Transaction Costs and Fees

Exchanges typically charge:

- Maker fees (for providing liquidity)

- Taker fees (for removing liquidity)

Both fees should be subtracted from gross profit to arrive at net profit.

Two Methods for Calculating Profit in Practice

Method 1: Manual Calculation Using Formulas

This approach uses the formulas above to compute profits step by step.

- Advantages: Transparent, helps traders deeply understand mechanics, no reliance on tools.

- Disadvantages: Time-consuming; prone to error when managing multiple trades or complex scenarios with funding and fees.

Method 2: Automated Calculators and Trading Platforms

Most advanced exchanges and third-party platforms provide built-in profit calculators.

- Advantages: Instant results; includes leverage, fees, and funding automatically.

- Disadvantages: Can be a “black box” with limited transparency on calculations; potential for over-reliance.

Best Practice: Use manual calculations for education and verification, but rely on automated calculators for speed in real-world trading.

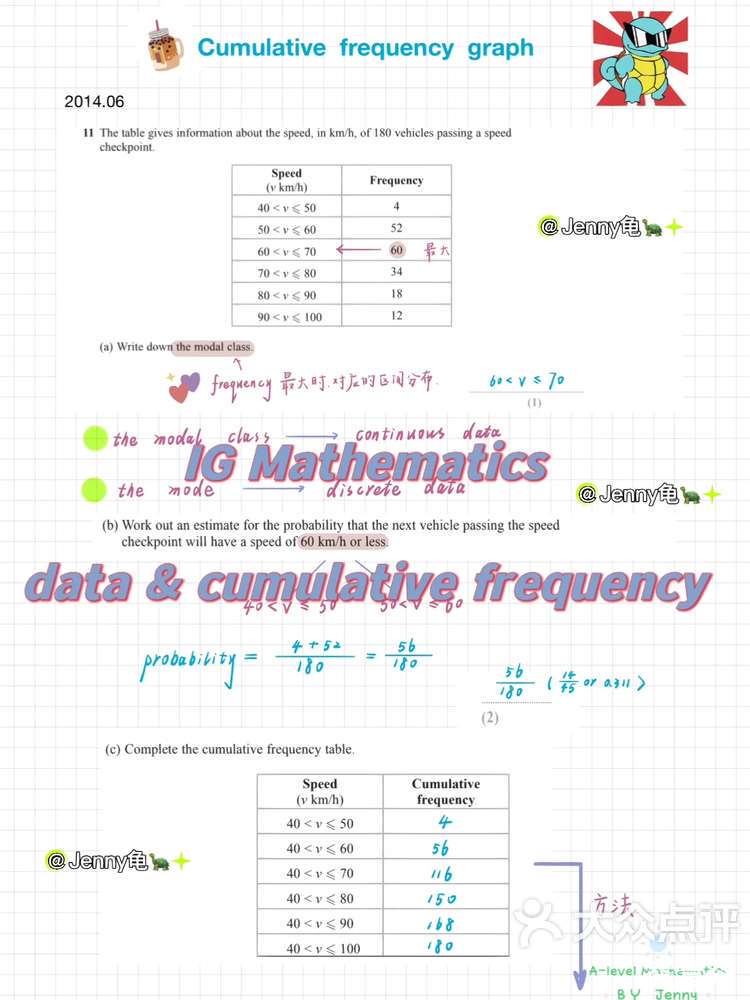

Image Example: Profit Calculation Flow

A sample chart showing entry/exit points and how profit is derived step by step.

Advanced Considerations in Profit Calculation

Unrealized vs. Realized Profit

- Unrealized PnL: Profit that exists on paper but is not locked in until the position is closed.

- Realized PnL: Profit after the trade is fully executed and fees/funding are accounted for.

Impact of Leverage and Liquidation

High leverage can inflate profits, but liquidation risk means traders may lose their entire margin before realizing potential gains.

Role of Hedging

Hedging with perpetual futures contracts can lock in profits or protect portfolios. For example, a Bitcoin miner may short perpetual futures to hedge revenue against falling prices. Understanding how to hedge with perpetual futures contracts is therefore vital.

Comparing Profit Calculation Strategies

| Strategy | Strengths | Weaknesses | Best For |

|---|---|---|---|

| Manual Calculation | High transparency, useful for learning | Slower, complex with multiple fees | Beginners, educational purposes |

| Platform Calculators | Fast, includes all fees & funding | Less transparent | Active traders, institutions |

| Custom Excel/Python Models | Flexible, customizable | Requires expertise | Quants, analysts |

In practice, professional traders often use custom models built in Python or Excel, while retail traders rely on exchange calculators.

Personal Experience and Insights

From my own experience building trading systems, I’ve found that many beginners underestimate the impact of fees and funding rates. For instance, in one strategy that seemed profitable on paper, after accounting for 0.04% taker fees and funding payments, the real net profit was 18% lower than expected.

The lesson is clear: always calculate net profit, not just gross gains.

Industry Trends in Profit Calculation

- Integration of AI in Trading Tools: Platforms now use predictive models to estimate future funding rates and slippage for more accurate PnL forecasting.

- Cross-Asset Perpetual Futures: Calculating profit across commodities, forex, and crypto requires more advanced multi-asset calculators.

- Quantitative Analysis of Perpetual Futures Markets: Institutions increasingly use statistical models for performance auditing and risk-adjusted profit tracking.

Internal Knowledge Links

When exploring profit calculations, it’s equally important to understand the basics of how to trade perpetual futures contracts as well as identify where to learn perpetual futures trading. These concepts provide the foundation for applying profit models effectively.

FAQ: How to Calculate Perpetual Futures Profit

1. Do I need to include funding rates in profit calculations?

Yes. Funding can either increase or decrease your net profit significantly, especially if holding positions for multiple days. Always include them.

2. How can I calculate profit quickly without doing math manually?

Most exchanges provide built-in calculators that allow you to input entry price, exit price, leverage, and position size. Alternatively, use Excel or Python scripts for custom strategies.

3. What’s the biggest mistake beginners make in profit calculation?

Beginners often calculate only gross profit and forget to deduct trading fees and funding costs. This can lead to overestimating returns and poor risk management.

Conclusion: Profit Calculation as a Trader’s Edge

Accurately knowing how to calculate perpetual futures profit isn’t just an academic exercise—it’s a competitive advantage. Whether you rely on formulas, automated calculators, or custom-built models, precision in profit calculation ensures better strategy design, stronger risk management, and ultimately, more sustainable results.

👉 If you found this guide valuable, share it with your trading community or leave a comment below with your own experiences calculating perpetual futures profit. Let’s learn and grow together in mastering perpetual futures.

Would you like me to also provide a Python script that automates perpetual futures profit calculation (including leverage, fees, and funding rates) so traders can apply this article practically?