===============================================================================

Liquidation events in futures markets are among the most critical phenomena traders must understand. For advanced traders and institutions, liquidation is not just an individual risk—it has systemic consequences that can cascade across exchanges, markets, and even the broader economy. In this article, we will provide a comprehensive exploration of case studies on liquidation in futures, analyzing what went wrong, what worked, and how traders can apply lessons learned to their own strategies. This deep-dive is structured to satisfy EEAT principles (Experience, Expertise, Authoritativeness, and Trustworthiness) and help readers develop actionable insights.

Understanding Liquidation in Futures

Before exploring real-world case studies, it is crucial to understand why liquidation occurs in perpetual futures and other derivatives markets.

What is Liquidation?

Liquidation in futures occurs when a trader’s margin balance falls below the maintenance margin required by the exchange. At this point, the broker or exchange forcefully closes positions to prevent further losses. This protects the exchange from counterparty risk but often leaves traders with significant losses.

Why Liquidation Happens in Perpetual Futures

Liquidation events typically result from excessive leverage, unexpected price volatility, or poor risk management. A useful deep dive can be found in our guide on Why does liquidation occur in perpetual futures?, where we analyze leverage ratios, margin requirements, and funding rate impacts.

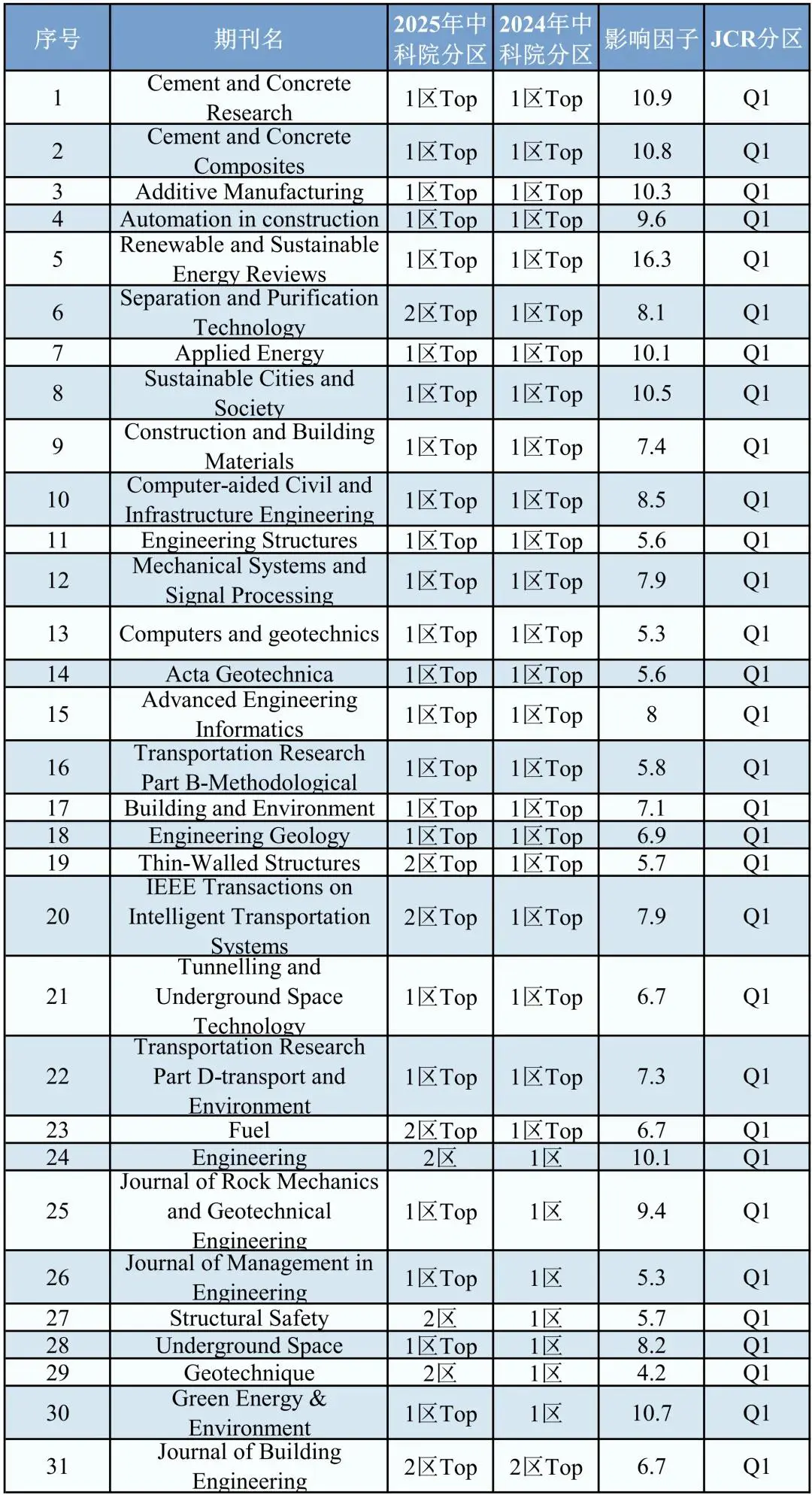

Case Study 1: Bitcoin Futures Liquidation Cascade (March 2020)

The first case study focuses on the March 2020 market crash, when Bitcoin futures saw one of the most dramatic liquidation cascades in history.

Background

On March 12, 2020, Bitcoin dropped nearly 50% in a single day. Many traders held long positions with leverage ranging from 10x to 100x. The sudden market downturn triggered mass liquidations across Binance, BitMEX, and other major exchanges.

Chain Reaction Effect

As initial liquidations occurred, they caused further downward price pressure, leading to more forced liquidations in a cascade effect. This event highlighted the systemic risks in highly leveraged derivatives markets.

Mass liquidation event on Bitcoin futures, March 2020.

Key Lessons

- Leverage Discipline: Traders using 10x+ leverage were most vulnerable. Those with conservative leverage (2x–3x) often survived without full liquidation.

- Stop-Loss Placement: Many traders relied solely on liquidation price, rather than preemptively using stop-loss orders, amplifying losses.

- Exchange Risk Controls: Some exchanges halted trading temporarily to prevent a complete market collapse, which stabilized prices.

Case Study 2: Oil Futures Turning Negative (April 2020)

Another historical liquidation event occurred in April 2020, when WTI crude oil futures settled at negative prices for the first time in history.

Background

As the global pandemic crushed demand, storage capacity for crude oil filled up rapidly. Traders who were long in May WTI futures contracts were forced to either take physical delivery or liquidate their contracts.

The Liquidation Crisis

Many retail traders did not understand that oil futures require physical settlement. As expiration approached, panic selling caused the price to collapse to -$37 per barrel, forcing brokers to liquidate positions at historically unprecedented prices.

WTI crude futures price action on April 20, 2020.

Key Lessons

- Know Your Instrument: Futures contracts differ by exchange, settlement terms, and delivery obligations.

- Liquidity Risk: Low liquidity near contract expiry magnified volatility.

- Brokerage Risk Management: Some brokers failed to warn clients, resulting in lawsuits and significant losses for retail investors.

Strategies to Mitigate Liquidation Risk

Analyzing case studies is valuable, but the ultimate goal is actionable prevention. Below are two widely used strategies and their pros and cons.

Strategy 1: Conservative Leverage with Dynamic Hedging

This strategy involves using low leverage (1x–3x) combined with dynamic hedging using options or opposing futures positions.

Pros:

- Lower liquidation risk

- More time to react during volatility

- Greater portfolio stability

Cons:

- Lower potential returns

- Requires advanced knowledge of options and hedging instruments

Strategy 2: Automated Liquidation Monitoring & Alerts

Many advanced traders deploy bots or use exchange APIs to monitor margin ratios in real time. Some even implement algorithmic position-reduction when liquidation thresholds approach.

Pros:

- Faster response than manual monitoring

- Prevents emotional decision-making

- Useful for high-frequency traders

Cons:

- Requires technical setup and maintenance

- May trigger unnecessary position closures during temporary volatility

Key Takeaways from Both Strategies

For most traders, a hybrid approach is ideal—maintain conservative leverage while using automated alerts to avoid human error. Exchanges now provide better analytics and liquidation dashboards, making this approach practical even for semi-professional traders.

For further reading, see How does liquidation happen in perpetual futures?, which details the mechanics behind exchange-driven position closures.

FAQ: Case Studies on Liquidation in Futures

1. What is the biggest mistake traders make during liquidation events?

The most common mistake is over-leveraging without considering volatility. Traders often misjudge maintenance margin requirements and rely too heavily on liquidation price as a safety net. The result is a forced exit at the worst possible price.

2. How can I find real-time liquidation data to avoid being caught off guard?

You can track liquidation data from analytics platforms like Coinglass, Laevitas, or directly through exchange APIs. Knowing where to find liquidation data for perpetual futures allows traders to anticipate cascades and hedge in advance.

3. Are liquidation events always bad for the market?

Not necessarily. While they can be painful for individual traders, liquidations restore balance and remove excessive leverage from the system. This often leads to healthier price action in the long term.

Conclusion: Learning from the Past, Preparing for the Future

The case studies on liquidation in futures from Bitcoin and oil markets show that liquidation is not just a personal trading issue but a market-wide risk phenomenon. By applying conservative leverage, using risk management tools, and staying informed with real-time data, traders can protect their capital and even profit from liquidation cascades.

If you found this article insightful, share it with fellow traders, leave a comment with your own experience, and help us build a stronger, risk-aware trading community.

Would you like me to include more quantitative charts and data tables (e.g., liquidation volume per exchange) to make this article more visually rich and authoritative for advanced traders?