==================================================================================

In the world of financial trading, the spot market and futures market are two of the most prominent venues where assets are bought and sold. While both markets provide opportunities for trading, they differ significantly in terms of trading mechanics, risk profiles, and strategies employed. Understanding these differences is crucial for traders seeking to optimize their investment strategies. This article explores the key differences between the spot and futures markets, compares their advantages and disadvantages, and offers guidance on how to navigate each market effectively.

Table of Contents

What is the Spot Market?

What is the Futures Market?

Spot Market vs Futures Market: Key Differences

Spot Market Trading Strategies

- 4.1 How to Trade on Spot Market for Perpetual Futures

- 4.2 Spot Market Strategies for Beginners

- 4.1 How to Trade on Spot Market for Perpetual Futures

Futures Market Trading Strategies

- 5.1 How Futures Contracts Work

- 5.2 Best Futures Market Strategies for Institutional Traders

- 5.1 How Futures Contracts Work

Risk Management in Spot and Futures Markets

Spot Market vs Futures Market: Which is Better for You?

What is the Spot Market?

The spot market, also known as the “cash market,” is where financial instruments such as commodities, currencies, and stocks are bought and sold for immediate delivery. Transactions in the spot market are settled “on the spot”—usually within two business days for most currencies, or even instantly in the case of some commodities.

Characteristics of the Spot Market:

- Immediate Settlement: The transaction is completed instantly, and the assets are transferred immediately.

- Current Market Price: Transactions are made at the current market price, known as the spot price.

- Physical Delivery: For some assets like commodities, physical delivery of the asset takes place after the transaction.

- Highly Liquid: Because of the quick execution, the spot market is highly liquid, with assets readily available for trading.

The spot market is essential for retail investors, brokers, and businesses that require immediate access to an asset or wish to make short-term investments. It’s often the go-to market for day traders and those looking for instant transactions.

What is the Futures Market?

The futures market, on the other hand, involves trading contracts that obligate the buyer to purchase (or the seller to sell) an asset at a predetermined future date and price. Unlike the spot market, futures contracts are not settled immediately but instead at a future date, allowing for speculation on price movements.

Characteristics of the Futures Market:

- Delayed Settlement: Futures contracts are settled at a later date (e.g., in a month, a quarter, or a year).

- Leverage: Traders can use leverage to control a larger position with a smaller initial margin.

- Speculation and Hedging: Futures are primarily used for hedging against price changes or speculating on price movements.

- Standardized Contracts: Futures contracts are standardized, meaning that their terms (e.g., quantity, quality) are predefined by exchanges.

The futures market is typically used by institutional traders, hedge funds, and those who want to speculate on the future price of assets or hedge risk in their portfolios.

Spot Market vs Futures Market: Key Differences

| Feature | Spot Market | Futures Market |

|---|---|---|

| Settlement | Immediate (T+2) | Deferred (set date in the future) |

| Price Type | Spot price (current market price) | Futures price (agreed upon in advance) |

| Leverage | No leverage or minimal | High leverage available |

| Purpose | Immediate buying/selling of assets | Hedging or speculation on price changes |

| Market Participants | Retail investors, brokers, businesses | Hedge funds, institutional traders |

| Liquidity | Generally high in major assets | Can be lower depending on the contract |

Spot Market Trading Strategies

Trading in the spot market requires a solid understanding of market trends and a focus on immediate, short-term price movements. Below are key strategies that can help spot market traders make informed decisions.

4.1 How to Trade on Spot Market for Perpetual Futures

Perpetual futures are a combination of spot and futures trading, allowing traders to speculate on price movements without expiration dates. When trading in the spot market, perpetual futures can be used as a hedge against potential downturns.

- Using Perpetual Futures as a Hedge: Traders can buy spot assets and simultaneously take short positions in perpetual futures contracts, which will offset potential losses if the market turns against them.

- Leverage Spot Market Trends: By observing long-term trends in the spot market, traders can use perpetual futures to benefit from short-term fluctuations.

4.2 Spot Market Strategies for Beginners

For beginners, the spot market can be a safer starting point as it involves direct ownership of assets. Here are some strategies to consider:

- Dollar-Cost Averaging (DCA): Invest a fixed amount at regular intervals, regardless of the asset’s price, to smooth out market fluctuations.

- Swing Trading: Buy at the dip and sell at the peak within short-term market swings, capitalizing on momentum.

Futures Market Trading Strategies

The futures market offers more sophisticated strategies that can yield higher returns due to leverage. However, it also carries greater risk. Below are some advanced strategies for futures trading.

5.1 How Futures Contracts Work

Futures contracts allow traders to lock in a price for an asset to be purchased or sold at a later date. The ability to use leverage amplifies both potential returns and risks. A basic understanding of futures contract mechanics is essential:

- Long Position: If you believe the asset will rise in price, you buy the contract (going long).

- Short Position: If you believe the asset will fall, you sell the contract (going short).

5.2 Best Futures Market Strategies for Institutional Traders

Institutional traders often employ complex strategies to maximize their returns in the futures market:

- Hedging: Institutions use futures to hedge against risk in their portfolios. For instance, a company that holds large amounts of commodities may use futures to lock in prices and avoid losses if commodity prices drop.

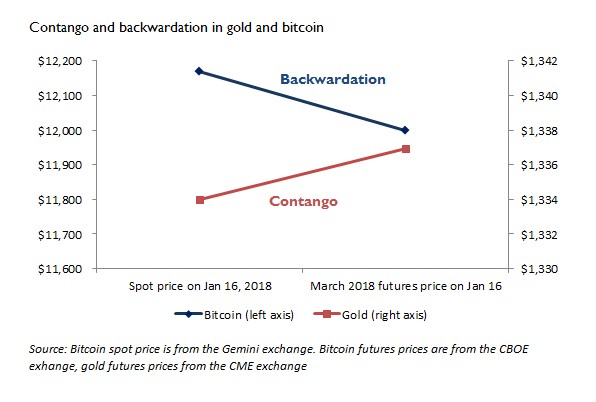

- Arbitrage: This strategy exploits price differences between the spot and futures market. Traders will buy the asset in one market and sell it in another, profiting from price discrepancies.

Risk Management in Spot and Futures Markets

Risk management is crucial in both the spot and futures markets, though the approaches differ due to the nature of the assets and contracts.

Spot Market Risk Management:

- Diversification: Spread your investments across various assets to reduce risk exposure.

- Setting Stop-Loss Orders: Limit potential losses by setting a stop-loss order to sell assets if they fall below a certain price.

Futures Market Risk Management:

- Using Margin Carefully: While leverage can amplify profits, it also increases the potential for significant losses. Use margin wisely and be prepared for margin calls.

- Hedging: Use futures contracts to offset potential losses in other areas of your portfolio.

Spot Market vs Futures Market: Which is Better for You?

Choosing between the spot market and the futures market depends on your trading goals, risk tolerance, and expertise. Here’s a comparison:

- Spot Market: Ideal for beginners and retail investors looking for simplicity and immediate ownership of assets. Suitable for short-term trading and lower-risk strategies.

- Futures Market: Best for advanced traders or institutions looking to hedge risks, leverage positions, or speculate on future price movements. It requires a higher level of expertise and risk management.

FAQs

1. What are the main differences between spot market and futures market?

The key differences lie in the settlement time, leverage, and market participants. Spot market trades are settled immediately at the current price, while futures involve contracts to be settled at a future date with the potential for leverage.

2. Is futures trading riskier than spot trading?

Yes, futures trading is generally riskier due to the use of leverage, which can amplify both gains and losses. Spot trading, on the other hand, involves direct ownership of assets and is typically less volatile.

3. Can I use the same strategies in both markets?

While some strategies, like trend following, can work in both markets, the mechanics of each market require different approaches. Spot trading is simpler and focused on short-term price movements, while futures trading involves speculation on future prices and the use of leverage.

Conclusion

Both the spot market and the futures market offer distinct advantages and opportunities for traders. While the spot market is ideal for beginners and those seeking to trade physical assets with immediate settlement, the futures market caters to more experienced traders seeking higher returns through speculation and leverage. Understanding the differences and choosing the right strategy for your trading style can help you maximize your returns and minimize risks. Whether you choose spot trading for its simplicity or futures trading for its leverage, mastering each market’s strategies is key to