====================================================

Introduction

Perpetual futures are among the most widely traded derivatives in crypto and traditional markets, allowing traders to take leveraged positions without expiration dates. To maximize efficiency and control risk, traders must understand the full spectrum of perpetual futures order types. Selecting the right order type is not only about execution—it directly impacts profitability, slippage, and exposure to liquidation risks.

This comprehensive guide on perpetual futures order types provides a deep dive into different order types, their mechanics, strategic use cases, and best practices. We will compare different strategies, highlight their pros and cons, and show how professional and retail traders alike can optimize their trading with the correct order type selection.

Why Order Types Matter in Perpetual Futures

Trading perpetual futures without a solid grasp of order types is like driving a car without understanding the brakes, gears, or accelerator. Order types define execution strategy, and choosing the wrong one can result in costly mistakes.

- Market efficiency: Ensures trades are executed at the right price and time.

- Risk management: Prevents unnecessary liquidation in volatile markets.

- Flexibility: Provides tools to manage long-term positions or short-term scalping.

- Strategic control: Aligns execution with a trader’s broader strategy.

This connects directly to the principle of how to choose the right order type for perpetual futures, where aligning trading goals with the right execution method becomes the foundation of sustainable profitability.

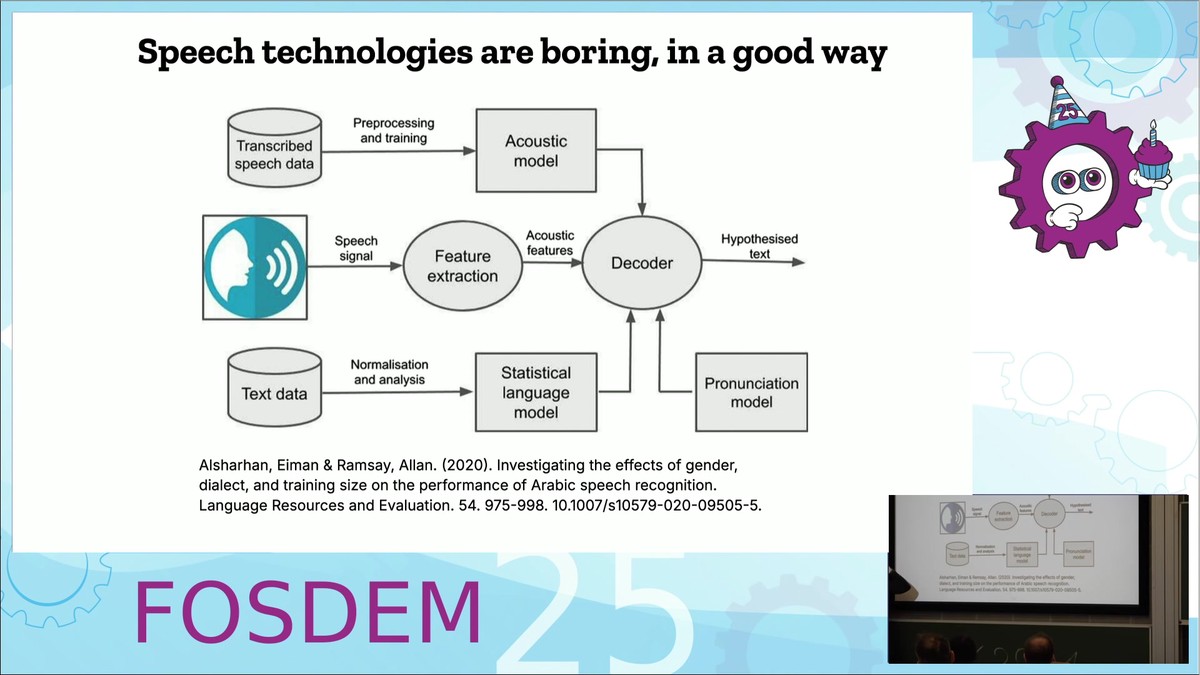

Flow of order execution in perpetual futures trading.

Core Order Types in Perpetual Futures

Market Orders

Definition: Executes immediately at the current best available price.

Use Cases:

- Urgent entries or exits.

- High liquidity environments.

Pros:

- Instant execution.

- Useful for volatility-driven strategies.

Cons:

- Higher slippage risk.

- Poor for thinly traded markets.

Limit Orders

Definition: Executes only at a specified price or better.

Use Cases:

- Entering trades with predefined entry levels.

- Protecting against unfavorable fills.

Pros:

- Price control.

- Can improve cost efficiency.

Cons:

- No guarantee of execution.

- Potentially missed opportunities.

Stop Orders (Stop-Market and Stop-Limit)

Stop-Market: Triggers a market order once the stop price is reached.

Stop-Limit: Triggers a limit order once the stop price is reached.

Use Cases:

- Protecting against downside risk.

- Automating breakout strategies.

Pros:

- Risk management tool.

- Useful for both long and short positions.

Cons:

- Stop-limit may not execute in fast-moving markets.

- Stop-market can trigger on price wicks.

Take-Profit Orders

Definition: Closes positions automatically at a predetermined profit target.

Use Cases:

- Locking in gains without active monitoring.

- Systematic trading strategies.

Pros:

- Disciplined profit-taking.

- Reduces emotional trading.

Cons:

- Can close positions too early in trending markets.

Trailing Stop Orders

Definition: A stop order that adjusts dynamically with favorable price movement.

Use Cases:

- Capturing extended trends.

- Automated swing and position trading.

Pros:

- Locks in profits while allowing upside potential.

- Adaptive risk management.

Cons:

- Can be triggered prematurely by volatility spikes.

Advanced Order Types for Institutional and Professional Traders

Iceberg Orders

Large institutional traders use iceberg orders to hide true order size, reducing market impact.

- Pros: Conceals strategy, minimizes slippage.

- Cons: Limited availability on exchanges, complex setup.

Conditional Orders

Execute only when certain criteria are met, such as price levels or volume triggers.

- Pros: Strategic automation, reduces monitoring.

- Cons: Requires accurate triggers, can miss opportunities.

Post-Only and Reduce-Only Orders

- Post-Only: Ensures order adds liquidity (limit maker).

- Reduce-Only: Ensures order only decreases position size, never increases it.

These orders are essential for professional traders using specific order types for perpetual futures, ensuring strict position management.

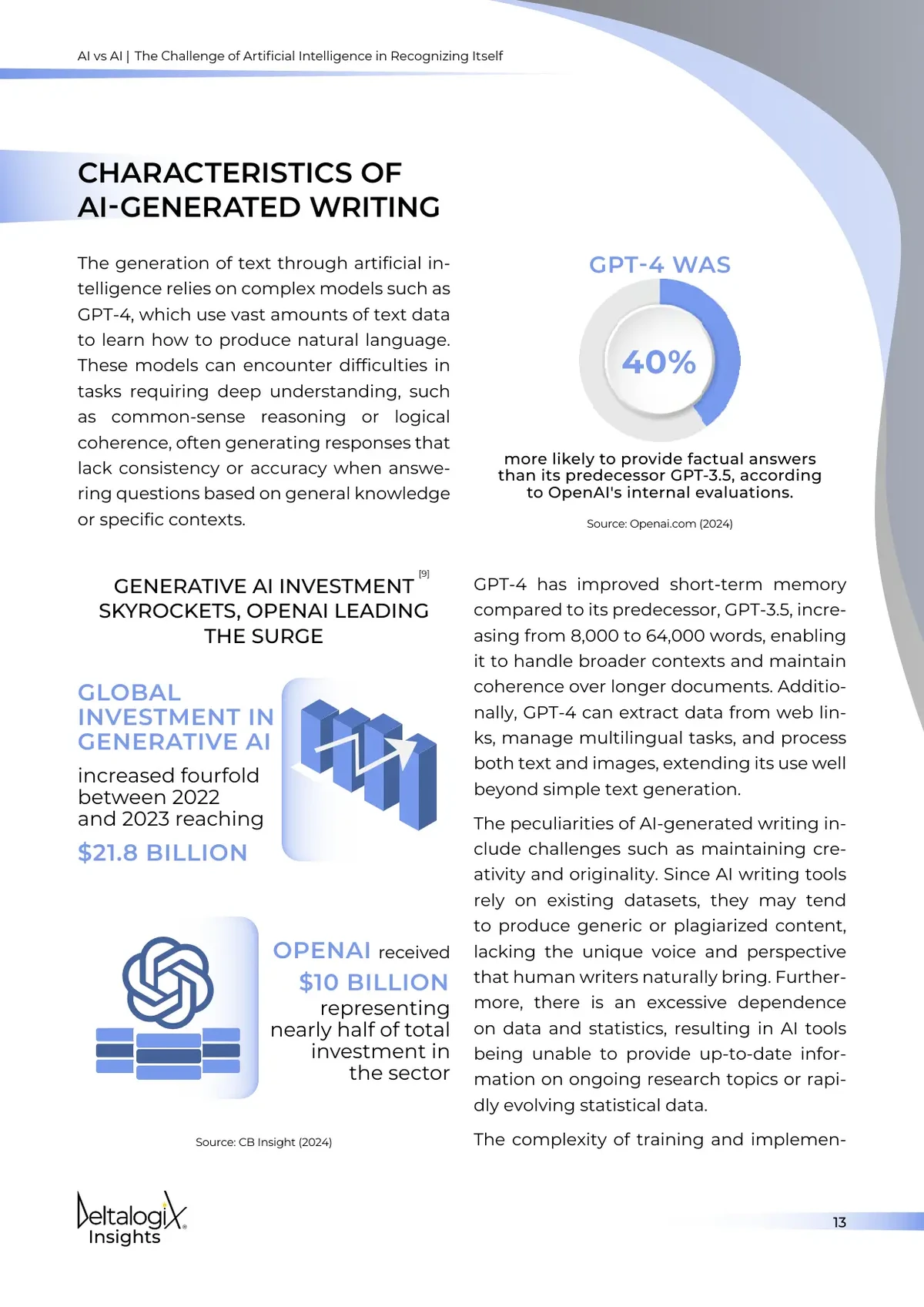

Advanced order types allow institutional-level execution precision.

Comparing Order Strategies

Strategy 1: Active Scalping with Market and Stop Orders

Scalpers thrive on speed. Market and stop-market orders allow quick entries and exits.

- Pros: High reactivity, fast profit capture.

- Cons: Higher slippage, less control.

Strategy 2: Swing Trading with Limit and Trailing Stops

Swing traders prefer control and patience. Using limit entries and trailing stops locks in favorable risk/reward.

- Pros: Controlled entries, systematic profit-taking.

- Cons: Execution uncertainty, requires discipline.

Recommended Approach

For most traders, a hybrid strategy—using limit orders for entry and trailing stops for exit—provides the best balance of control and flexibility.

Best Practices for Using Order Types

- Always combine stop-loss and take-profit orders to manage risk.

- Use limit orders for entries in low-liquidity environments.

- Apply trailing stops to capture trends without constant monitoring.

- Institutions should leverage iceberg orders to reduce visibility.

- Monitor execution efficiency regularly with post-trade analysis.

These align with where to find information on perpetual futures order types, as professional traders constantly refine execution by studying exchange documentation, broker guides, and case studies.

FAQs

1. How do order types affect perpetual futures trading?

Order types define how and when trades are executed. They influence slippage, risk exposure, and the probability of execution. Using the wrong order type can lead to liquidations, missed opportunities, or excessive costs.

2. Why choose specific order types for perpetual futures?

Different market conditions require different tools. For instance, market orders are useful during high liquidity, while limit orders are safer in volatile, thin markets. Matching strategy with order type improves efficiency.

3. What is the best order type for beginners?

Beginners should start with limit orders and stop-market orders, as they offer price control and risk protection. As they gain experience, they can explore advanced orders like trailing stops.

Conclusion

Understanding and applying the right perpetual futures order types is crucial for successful trading. From market and limit orders to advanced institutional tools like iceberg and conditional orders, each has unique strengths and weaknesses.

The best approach is not a one-size-fits-all solution but a strategy-driven selection tailored to market conditions, trading style, and risk tolerance. By mastering order types, traders—whether retail or institutional—gain a decisive edge in perpetual futures markets.

If this guide helped you gain clarity, share it with fellow traders and leave a comment below: Which order type has been most effective in your perpetual futures trading strategy?

Would you like me to expand this into a step-by-step illustrated trading handbook with live market examples and order execution screenshots for practical training?