========================================================================

In the world of trading, managing risk is essential to long-term success. One of the most powerful tools for controlling risk is the stop order. A stop order, also known as a stop-loss order, is a trading order designed to limit potential losses or lock in profits once a trade has reached a specific price point. Understanding how to effectively use stop orders is crucial for both novice and experienced traders.

This comprehensive tutorial will explain the different types of stop orders, how they work, how to place and modify them, and why they are vital in risk management. We will also compare different strategies for using stop orders and provide actionable insights for optimizing their effectiveness in various trading scenarios.

Table of Contents

What is a Stop Order?

Types of Stop Orders

- 2.1 Standard Stop Order

- 2.2 Trailing Stop Order

- 2.3 Stop Limit Order

- 2.4 Market Stop Order

- 2.1 Standard Stop Order

Why Use Stop Orders in Trading?

How to Place a Stop Order

How to Modify and Cancel Stop Orders

Stop Orders for Different Trading Styles

- 6.1 Stop Orders for Day Traders

- 6.2 Stop Orders for Swing Traders

- 6.3 Stop Orders for Long-Term Investors

- 6.1 Stop Orders for Day Traders

Optimizing Stop Orders for Risk Management

Common Mistakes to Avoid When Using Stop Orders

Frequently Asked Questions (FAQ)

What is a Stop Order?

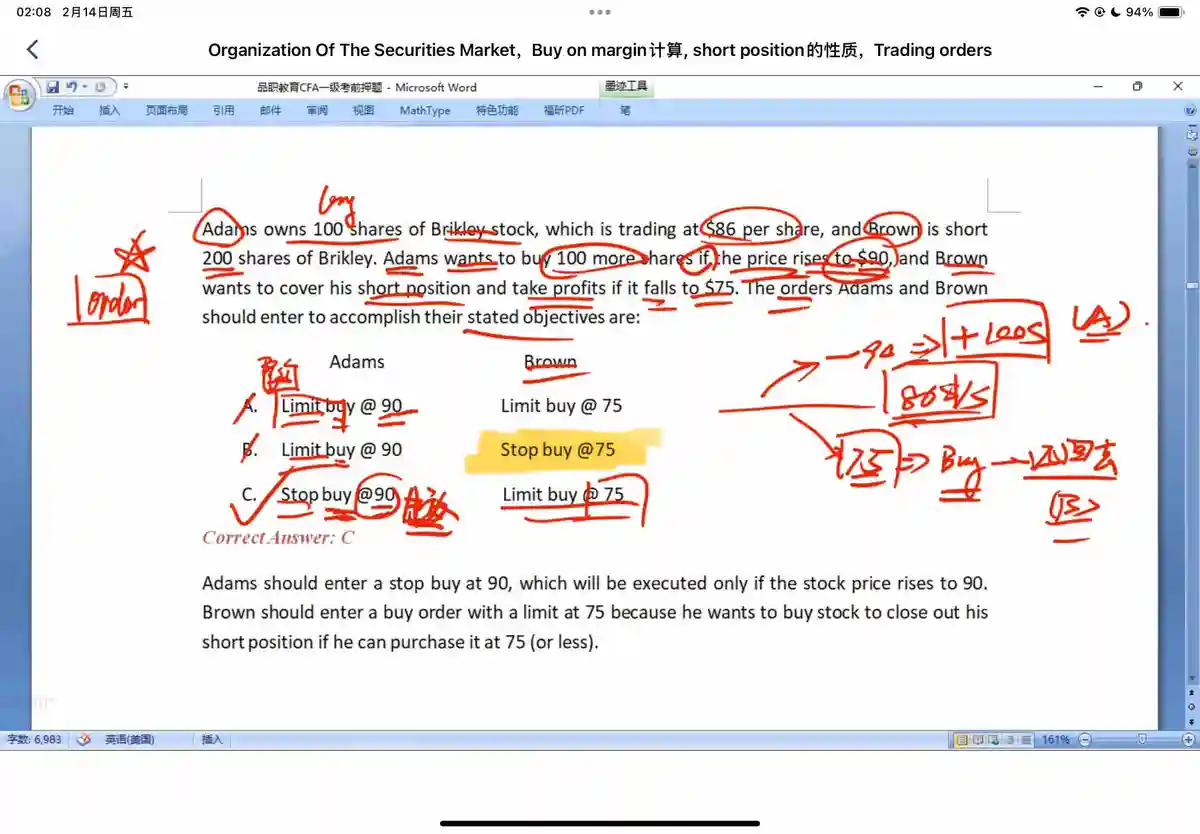

A stop order is a trading instruction that triggers a market order once a certain price level is reached. The primary purpose of stop orders is to limit potential losses or lock in profits in volatile markets. Once the price reaches the specified stop level, the stop order is converted into a market order, and the trade is executed at the next available price.

For example, if you buy a stock at \(100 and set a stop order at \)90, your stop order will trigger once the stock price falls to $90, automatically selling your position to limit your loss.

Types of Stop Orders

There are several types of stop orders that traders can use, each offering different features for various trading strategies.

2.1 Standard Stop Order

A standard stop order, often referred to as a stop-loss order, is the most basic type. It automatically triggers a market order once the price of an asset hits a predefined stop price.

- Example: You enter a long position at \(100, and place a stop order at \)90. If the price falls to $90, the stop order will be executed at the best available price.

2.2 Trailing Stop Order

A trailing stop order allows the stop price to automatically adjust as the market price moves in your favor. It helps lock in profits while still providing some room for the asset to move further in the favorable direction.

- Example: You enter a long position at \(100 and set a trailing stop of \)5. If the price rises to \(110, the stop price will adjust to \)105. If the price then falls to $105, the stop order will trigger and your position will be sold.

2.3 Stop Limit Order

A stop limit order is similar to a standard stop order, but with an added limit. When the stop price is triggered, a limit order is placed rather than a market order, meaning the trade will only be executed at the limit price or better.

- Example: You place a stop order at \(90 with a limit of \)89. If the price falls to \(90, the stop-limit order is activated, but the order will only execute if the price is \)89 or better. This prevents slippage, but may result in the order not being filled.

2.4 Market Stop Order

A market stop order is essentially the same as a standard stop order, but it ensures the order is executed immediately at the current market price once the stop price is reached. This can lead to slippage if the market moves quickly.

Why Use Stop Orders in Trading?

Stop orders are essential for a variety of reasons, particularly in risk management and optimizing profits.

- Risk Management: Stop orders help mitigate losses by automatically closing a position if the market moves against the trader.

- Emotion Control: Automated stop orders prevent traders from making emotional decisions, such as holding on to losing positions in hopes of a market reversal.

- Locking in Profits: Trailing stop orders allow traders to capture profits by letting the position ride higher while protecting downside risk.

- Protection in Volatile Markets: Stop orders act as a safeguard, especially in volatile or unpredictable markets, by preventing substantial losses.

How to Place a Stop Order

Placing a stop order is relatively simple, but it varies depending on the trading platform you’re using. Here’s a general guide:

- Log into Your Trading Platform: Choose a reliable broker with a user-friendly interface.

- Select the Asset: Choose the asset you want to trade (stock, forex, crypto, futures, etc.).

- Choose the Stop Order Type: Depending on the platform, select the type of stop order you wish to place (standard, trailing, stop-limit, etc.).

- Set the Stop Price: Decide the price at which the stop order should trigger.

- Review and Confirm: Double-check the details of your stop order, including the stop price and order type, and then confirm the order.

How to Modify and Cancel Stop Orders

Once a stop order is placed, you might want to adjust it based on market conditions or strategy changes.

Modifying Stop Orders

- Access Your Open Positions: Go to the “Orders” or “Positions” section on your trading platform.

- Select the Order: Click on the stop order you want to modify.

- Adjust the Stop Price: Enter the new stop price or modify the stop order type.

- Confirm Changes: Review and confirm the modifications.

Cancelling Stop Orders

- Navigate to Active Orders: Go to your active or open orders.

- Select the Order: Click on the stop order you wish to cancel.

- Cancel the Order: Choose the option to cancel or delete the stop order.

Stop Orders for Different Trading Styles

Different trading styles require different stop order strategies. Here’s how stop orders can be used effectively for various types of traders:

6.1 Stop Orders for Day Traders

Day traders rely on stop orders to protect themselves from sudden price swings during the trading day. A tight stop is often used to limit losses quickly, and trailing stops can be employed to lock in profits as the trade moves in the desired direction.

6.2 Stop Orders for Swing Traders

Swing traders typically use wider stop orders to give the price more room to move. This allows them to capture larger price moves while still managing risk effectively.

6.3 Stop Orders for Long-Term Investors

For long-term investors, stop orders can be used as a safety net to protect against large declines in market value. A stop-limit order might be a better option for investors looking to avoid execution at unfavorable prices during volatile conditions.

Optimizing Stop Orders for Risk Management

The key to successful stop order usage is optimizing them for risk management. Here are some tips:

- Position Sizing: Adjust the size of your trades to ensure you are not risking too much on any single stop order.

- Use Technical Indicators: Incorporate technical analysis tools, such as moving averages or support/resistance levels, to place stops at optimal points.

- Avoid Placing Stops Too Close: Setting a stop too close to the entry price may trigger it unnecessarily during normal market fluctuations.

- Monitor Market Conditions: Regularly adjust stop orders to account for changing market conditions, volatility, and trends.

Common Mistakes to Avoid When Using Stop Orders

While stop orders are essential tools, traders often make mistakes that can lead to losses:

- Placing Stops Too Tight: Setting stop orders too close to the entry price can result in being stopped out prematurely.

- Ignoring Market Gaps: Stop orders may not execute at the expected price during market gaps or high volatility.

- Failing to Modify Stops: Not adjusting stops in response to changing market conditions can expose you to unnecessary risks.

Frequently Asked Questions (FAQ)

1. What is the best type of stop order for beginners?

For beginners, a standard stop-loss order is the easiest and safest to implement. It provides straightforward protection and limits losses without much complexity.

2. Can I use stop orders for day trading?

Yes, trailing stop orders are especially useful for day traders. They allow you to lock in profits while minimizing risk, making them ideal for volatile intraday movements.