==========================================

For many new traders entering futures and derivatives markets, understanding the cross margin strategy for beginner traders can be a game changer. Cross margining is one of the most widely used margin systems in perpetual futures, cryptocurrency derivatives, and even traditional finance. By pooling funds across all open positions in a single account, cross margin helps maximize capital efficiency while managing liquidation risks. However, it also comes with unique challenges that every trader must understand before applying it in practice.

This guide will provide a comprehensive breakdown of cross margin strategies, compare them with isolated margin approaches, and share practical insights from industry trends. We will also cover risk management techniques, frequently asked questions, and best practices for beginners who want to integrate cross margin into their trading journey.

What is Cross Margin?

Cross margin is a margin allocation method where all available balance in a trading account is shared across multiple open positions. Instead of assigning margin individually for each trade, the account’s total equity is used to support positions collectively.

- Example: If a trader holds both long and short perpetual futures contracts, profits from one position can offset losses from the other. This reduces the risk of liquidation compared to isolated margin accounts.

Cross margin is especially useful for high-volatility markets like cryptocurrency futures, where sudden price swings can trigger margin calls.

Why Cross Margin Matters for Beginners

For new traders, margin management can feel overwhelming. Cross margin simplifies the process by pooling funds into a common balance, making it easier to sustain trades during volatile market conditions.

Key Benefits

- Capital efficiency: Optimizes available funds by sharing collateral across positions.

- Lower liquidation risk: Profits from one trade can support losses from another.

- Flexibility: Suitable for traders with diversified strategies.

Potential Risks

- Systemic exposure: If one trade suffers extreme losses, the entire account may be at risk.

- Complexity in risk assessment: Beginners may underestimate overall exposure since positions are interconnected.

This is why understanding how cross margin influences risk in perpetual futures is crucial before applying the strategy.

Cross Margin vs. Isolated Margin

Before diving deeper into strategies, it’s essential to compare cross margin with isolated margin—the two most common margining systems on trading platforms.

| Feature | Cross Margin | Isolated Margin |

|---|---|---|

| Margin Allocation | Shared across all positions | Separate for each individual trade |

| Liquidation Risk | Lower for diversified accounts | Higher (losses in one trade cannot be offset) |

| Capital Efficiency | High | Lower |

| Risk Exposure | Entire balance at risk if positions collapse | Limited to assigned margin per position |

| Best for | Experienced or diversified traders | Beginners who want clear risk separation |

Recommendation

Beginners should start small with cross margin in low-leverage scenarios while learning to balance risk exposure. Those who want strict control may first test isolated margin, then transition to cross margin as they gain experience.

How to Use Cross Margin as a Beginner

Step 1: Learn Platform Features

Different platforms (Binance, Bybit, OKX, CME) offer distinct cross margin tools. Understanding where to find cross margin features in trading platforms is the first step. Beginners should explore tutorials, demo sessions, and account setup guides before risking capital.

Step 2: Apply Low Leverage

Using high leverage with cross margin magnifies both risks and rewards. Beginners should limit leverage (2x–5x) to reduce exposure during early stages.

Step 3: Diversify Positions

Cross margin works best when you hold hedged or diversified positions. For example, a long Bitcoin futures position can be balanced with a short Ethereum contract.

Step 4: Monitor Account Equity

Since all positions share the same balance, constant monitoring is required. Set stop-loss orders and check margin ratio alerts regularly.

Strategies for Beginner Traders

1. Hedging Strategy with Cross Margin

Hedging is one of the safest ways to start using cross margin. Traders can open opposing positions to balance risks.

- Example: A trader goes long on Bitcoin while shorting Ethereum. If BTC rises and ETH falls, both positions complement each other.

- Advantages: Reduces overall volatility and liquidation risk.

- Disadvantages: Profits may be smaller since gains are offset by hedged positions.

2. Diversified Multi-Asset Strategy

This strategy involves trading multiple uncorrelated assets (e.g., BTC, ETH, and traditional futures like oil or indices).

- Advantages: Losses in one market may be balanced by profits in another.

- Disadvantages: Requires strong knowledge of multiple asset classes and correlation analysis.

Comparing the Two Strategies

| Strategy | Advantages | Disadvantages | Best For |

|---|---|---|---|

| Hedging | Safer, beginner-friendly | Limited profits | New traders managing risk |

| Diversified Multi-Asset | Balances exposure, higher efficiency | Complex to manage | Intermediate traders |

For absolute beginners, hedging with cross margin is the recommended starting point. Once familiar, they can expand into diversified strategies.

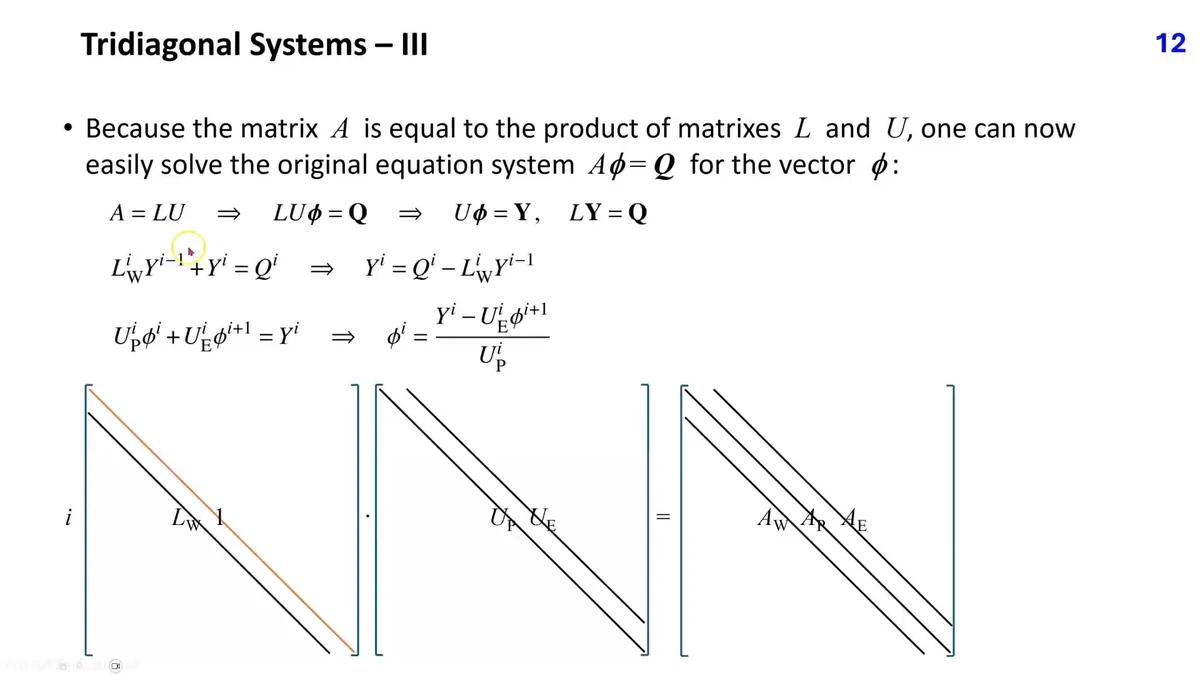

Example Visualization

Cross margin allows multiple positions to share account equity, balancing risk across trades.

Risk Management in Cross Margin

Proper risk management ensures beginners avoid unnecessary losses.

Best Practices

- Use stop-loss orders: Prevents account wipeout from sudden volatility.

- Avoid over-leveraging: High leverage reduces margin buffer.

- Regularly rebalance: Adjust portfolio to maintain risk balance.

- Keep emergency reserves: Always retain unused funds as margin safety.

Beginners must study why choose cross margin over isolated margin carefully, since both systems have different risk implications.

FAQ: Cross Margin Strategy for Beginner Traders

1. Is cross margin better than isolated margin for beginners?

Not always. Isolated margin gives clearer risk control per trade, which can be easier for new traders. However, cross margin is more efficient if you are trading multiple positions. Beginners should start small with cross margin and learn its mechanics before scaling up.

2. How does cross margin affect leverage?

Cross margin allows higher leverage since all positions share the account balance. But this can be risky—if one trade loses heavily, it may liquidate the entire account. Beginners should always use conservative leverage.

3. Can I use cross margin in cryptocurrency futures?

Yes. Most major platforms (Binance, Bybit, OKX) offer cross margin features. Beginners should start in testnet environments or with minimal funds. Learning how cross margin is calculated in perpetual futures is essential before applying it to live markets.

Conclusion

The cross margin strategy for beginner traders offers significant benefits in terms of capital efficiency and risk management. By pooling funds across multiple trades, it reduces liquidation risk and supports diversified strategies. However, it requires discipline, careful monitoring, and a solid understanding of platform mechanics.

For new traders, starting with hedging strategies and low leverage is the safest way to explore cross margin. Over time, expanding into diversified multi-asset strategies can unlock higher efficiency.

If you found this guide useful, share it with other traders or leave a comment with your experience using cross margin—let’s build a community where beginners grow into confident, disciplined traders.