========================================================

Introduction

In today’s fast-moving cryptocurrency and futures markets, decoding sell wall formats for traders has become a crucial skill for both beginners and experienced professionals. Sell walls often represent large orders placed at specific price levels, influencing the way markets move. They can be either genuine signals of supply and resistance or deceptive strategies designed to manipulate retail traders. Understanding how to interpret these walls, differentiate between real and artificial patterns, and apply the right trading strategies is key to improving profitability and risk management.

This article provides an in-depth exploration of sell wall formats, practical analysis techniques, and strategies for traders. It also covers the psychology behind market walls, industry trends, and tools for monitoring them. Along the way, we will compare at least two distinct analytical approaches, highlight their pros and cons, and recommend the best-fit strategies for different trader profiles.

What is a Sell Wall?

A sell wall occurs when a trader or institution places a large sell order at a particular price level. This wall creates visible resistance on the order book, signaling to market participants that prices may struggle to move higher. While sometimes legitimate, sell walls can also be artificially engineered to manipulate market sentiment, particularly in highly speculative markets like crypto perpetual futures.

Key features of a sell wall:

- High concentration of sell orders at one price level.

- Creates psychological resistance for buyers.

- Can influence short-term momentum and liquidity.

- High concentration of sell orders at one price level.

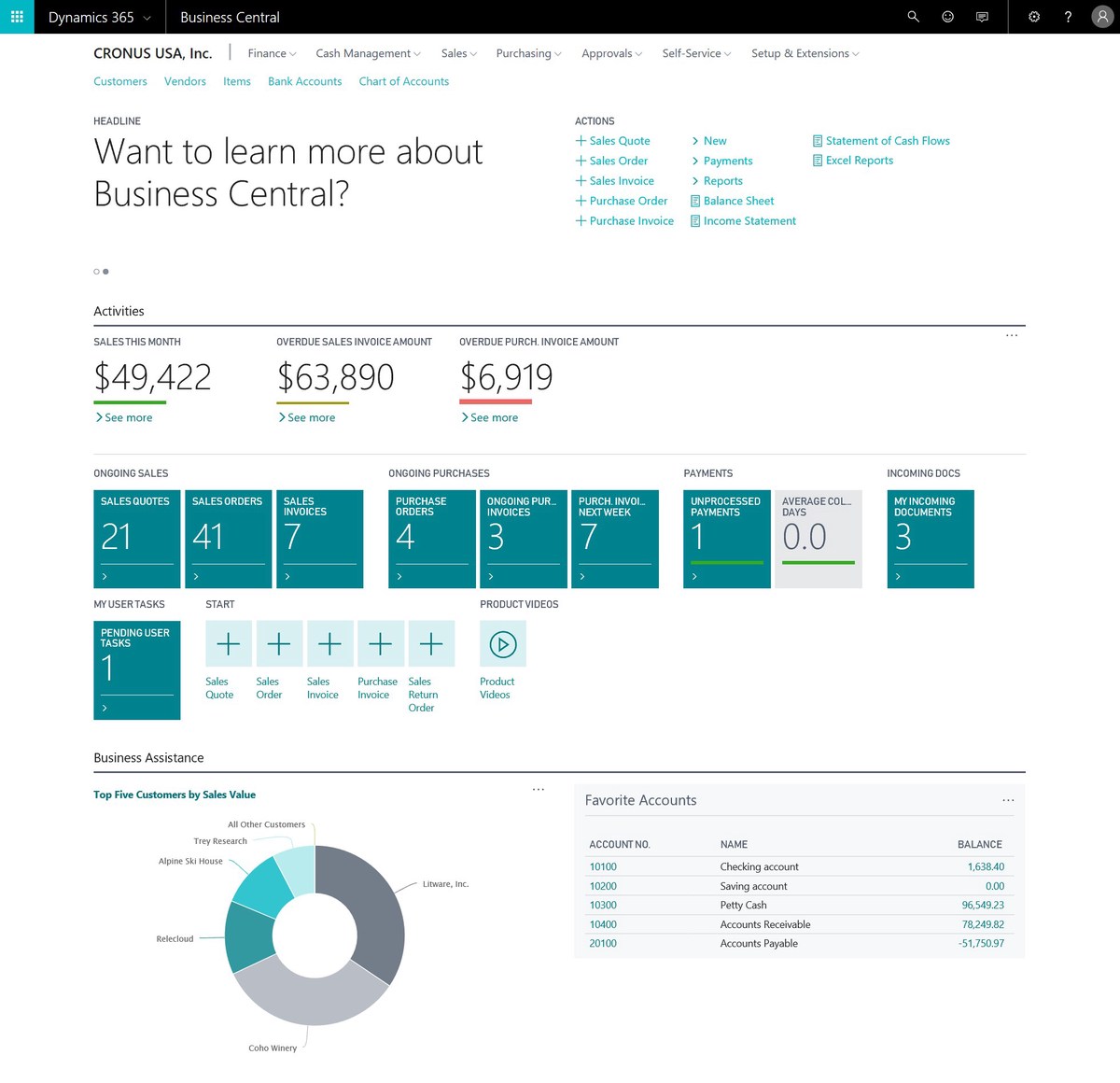

Sell wall displayed on an order book

Why Sell Walls Matter for Traders

Influence on Market Psychology

Sell walls often create the perception that upward price momentum will be blocked. Retail traders may hesitate to buy, while short-sellers gain confidence. This behavioral bias amplifies the wall’s impact even if the actual liquidity behind it is limited.

Liquidity and Resistance

Large sell orders absorb significant demand before prices can break through. This makes sell walls critical for identifying short-term resistance zones.

Manipulation Risks

Some walls are intentionally placed and then withdrawn to manipulate price movements, a tactic often referred to as spoofing. Traders must learn to distinguish between genuine and artificial sell walls to avoid traps.

Decoding Sell Wall Formats

Different formats of sell walls can indicate distinct market intentions. Traders who can decode these signals gain an edge in anticipating future price action.

Format 1: Genuine Institutional Sell Walls

- Description: Placed by large institutions liquidating positions.

- Characteristics: Stable, rarely canceled, linked to portfolio rebalancing.

- Implication: Signals real supply at that price level, often creating longer-lasting resistance.

Format 2: Spoofed or Manipulative Sell Walls

- Description: Fake orders intended to create fear or hesitation.

- Characteristics: Orders frequently appear/disappear, not executed when price approaches.

- Implication: Creates false market signals, but can be exploited by experienced traders.

Format 3: Layered Sell Walls

- Description: Multiple walls stacked at incremental price levels.

- Characteristics: Suggest systematic distribution strategy.

- Implication: Indicates strong supply zone and gradual liquidation.

Format 4: Temporary Scalping Sell Walls

- Description: Short-term walls placed by algorithmic scalpers.

- Characteristics: Small in size compared to institutional walls but frequent.

- Implication: Creates short bursts of resistance but rarely long-lasting.

Two Key Analysis Techniques for Sell Walls

1. Order Book Depth Analysis

This method involves analyzing real-time order book data to track the volume and distribution of sell orders.

Pros:

- Provides instant visibility of wall strength.

- Helps identify spoofing by tracking order cancellation.

- Works well with algorithmic trading software.

- Provides instant visibility of wall strength.

Cons:

- Requires high-quality, real-time data feeds.

- Retail traders may find it difficult to interpret raw order book fluctuations.

- Requires high-quality, real-time data feeds.

Best for: Professional traders and quantitative analysts who use tools like sell wall analysis software for quantitative trading.

2. Price Action Confirmation

Rather than focusing on the order book alone, this strategy analyzes how prices react when approaching a sell wall.

Pros:

- Does not require advanced data feeds.

- Captures real trader behavior and execution.

- More reliable for beginners who prefer chart-based analysis.

- Does not require advanced data feeds.

Cons:

- Less precise than order book depth analysis.

- Lagging compared to real-time wall detection.

- Less precise than order book depth analysis.

Best for: Retail traders and swing traders seeking practical confirmation methods.

Recommended Strategy: Hybrid Analysis

Based on both professional experience and market observations, the best approach is combining order book depth analysis with price action confirmation. While order book data shows potential resistance, actual price behavior validates whether the wall is genuine. This reduces the risk of falling into spoofing traps and increases the probability of executing profitable trades.

Integrating Sell Wall Insights with Broader Trading Strategies

Traders must integrate sell wall analysis with their overall trading system. For example, when learning how to react to a sell wall in perpetual futures, it’s essential to combine wall signals with indicators such as RSI, MACD, or volume trends. Similarly, advanced professionals often look into how sell wall affects price in perpetual futures to forecast short squeezes or liquidity hunts.

Industry Trends in Sell Wall Analysis

- AI-Powered Order Book Analytics: Machine learning is being applied to detect spoofing patterns and predict wall sustainability.

- Integration with Trading Bots: Sell wall detection is increasingly embedded in automated strategies.

- Regulatory Oversight: Exchanges are implementing stricter anti-spoofing mechanisms, making walls more “authentic.”

AI-assisted sell wall analysis

FAQs on Decoding Sell Walls

1. How can beginners identify a genuine sell wall?

Beginners should look for walls that remain stable over time and are not canceled when prices approach. Fake walls usually vanish as soon as buying pressure builds. Combining chart analysis with order book monitoring helps confirm authenticity.

2. Are sell walls always bearish signals?

Not necessarily. While they often create short-term resistance, breaking through a large sell wall can trigger strong bullish momentum as short sellers are forced to cover. Recognizing this dynamic is essential.

3. Can algorithms detect spoofed sell walls automatically?

Yes. Advanced trading platforms now offer sell wall detection software that flags suspicious order activity. These tools analyze patterns of cancellations and re-entries, providing alerts to traders about potential manipulation.

Conclusion

Decoding sell wall formats is a powerful skill that allows traders to navigate modern markets with confidence. Whether dealing with genuine institutional sell walls, layered supply, or spoofed manipulations, the key lies in combining real-time order book analysis with price action confirmation. By adopting this hybrid approach, traders reduce risks, enhance accuracy, and capitalize on hidden opportunities.

Sell walls are not just barriers—they are windows into market psychology, liquidity, and strategy. Mastering their interpretation can provide a long-term competitive edge.

If you found this article valuable, don’t forget to share it with fellow traders, leave a comment with your experiences, and join the conversation on how sell wall analysis can be further improved in the ever-changing world of trading.

Would you like me to also prepare a ready-to-publish SEO meta description and keyword set for this article so it can rank faster in Google?