==================================================

Perpetual futures are one of the most widely used derivatives in cryptocurrency and traditional markets, offering traders the ability to speculate on asset prices without an expiry date. However, to use perpetual futures effectively, traders need a detailed analysis of perpetual futures order types, since order execution strategies directly impact profitability, risk management, and trading efficiency.

This article explores the major perpetual futures order types, compares their advantages and disadvantages, and provides actionable insights for novice and professional traders alike.

Understanding Perpetual Futures Order Types

Before diving into specific order types, it’s important to understand why they matter. In perpetual futures trading, the way you enter and exit positions defines not only your profit potential but also your risk exposure.

- Order types control execution timing and price.

- They allow traders to automate decision-making.

- They serve as risk management tools to minimize losses.

For both retail and institutional traders, choosing the right order type is as critical as selecting the asset to trade. If you are wondering how to choose the right order type for perpetual futures, the key lies in aligning your strategy with your risk tolerance and market conditions.

Common Perpetual Futures Order Types

1. Market Orders

A market order executes immediately at the best available price.

Pros:

- Guaranteed execution.

- Ideal for fast-moving markets.

Cons:

- Slippage risk in volatile conditions.

- Less control over execution price.

Best Use Case: When speed matters more than precision, such as entering or exiting during high volatility.

2. Limit Orders

A limit order lets you set a specific price at which you want to buy or sell.

Pros:

- Price control with no unwanted slippage.

- Good for patient traders.

Cons:

- No guarantee of execution.

- Can miss market opportunities if price doesn’t hit your target.

Best Use Case: Swing traders or investors who want precision entry and exit points.

3. Stop Orders

Stop orders activate once a specified trigger price is reached. There are two main types:

- Stop-Loss Order: Closes a trade to prevent further losses.

- Stop-Entry Order: Opens a trade once the price crosses a set threshold.

Pros:

- Automates risk management.

- Ensures discipline in volatile conditions.

Cons:

- Vulnerable to “stop hunting” in choppy markets.

- Execution may be at worse-than-expected prices during spikes.

Best Use Case: Traders seeking structured risk control without constant monitoring.

4. Stop-Limit Orders

A stop-limit order combines stop and limit logic. Once the stop price is triggered, a limit order is placed.

Pros:

- More control than standard stop orders.

- Prevents execution at extreme prices.

Cons:

- Risk of non-execution in fast-moving markets.

Best Use Case: Advanced traders balancing risk and execution control.

5. Trailing Stop Orders

A trailing stop order adjusts automatically as the market moves in your favor, locking in profits.

Pros:

- Allows profit protection while letting winners run.

- Reduces need for constant manual adjustment.

Cons:

- Can be triggered prematurely in volatile conditions.

- Requires careful configuration of trailing distance.

Best Use Case: Trend-following strategies or long-term leveraged positions.

6. Post-Only and Reduce-Only Orders

- Post-Only: Ensures your order adds liquidity instead of taking it. Often used to reduce fees.

- Reduce-Only: Ensures the order only reduces or closes an existing position.

Pros:

- Cost efficiency with Post-Only.

- Risk management clarity with Reduce-Only.

Cons:

- Not ideal for beginners unfamiliar with liquidity mechanics.

Best Use Case: Professional traders optimizing fees and managing multiple positions.

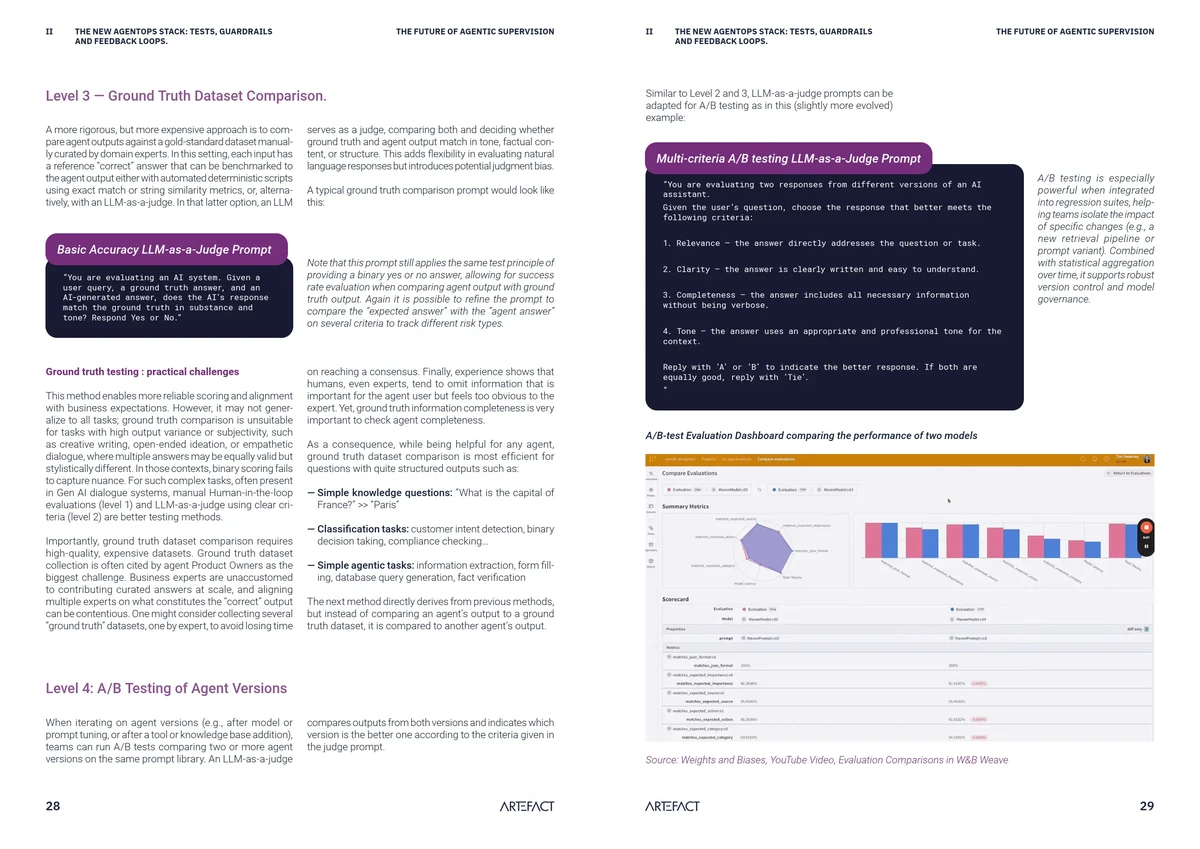

Order Types in Perpetual Futures Trading

Comparing Two Key Strategies Using Order Types

Strategy A: Precision Entry with Limit and Stop Orders

- Uses limit orders for favorable entry points.

- Adds stop-loss orders to cap risk.

Pros: Controlled execution, defined risk-reward ratio.

Cons: May miss trades if price never hits targets.

Strategy B: Momentum Trading with Market and Trailing Stops

- Uses market orders for instant entries in breakout conditions.

- Applies trailing stops to ride trends while minimizing downside.

Pros: Captures fast opportunities, automated profit protection.

Cons: High risk of slippage and premature exits.

Recommendation: For beginners, a mix of limit orders and stop-loss orders provides both structure and discipline. For advanced traders, combining market entries with trailing stops can maximize profit potential in volatile markets.

Why Order Type Selection Matters

Many novice traders underestimate the role of order types. However, why order type selection matters in perpetual futures comes down to three factors:

- Risk Mitigation: Proper order usage prevents catastrophic losses.

- Profit Optimization: Advanced strategies can squeeze more profit from the same trade.

- Execution Efficiency: Different order types fit specific strategies and time horizons.

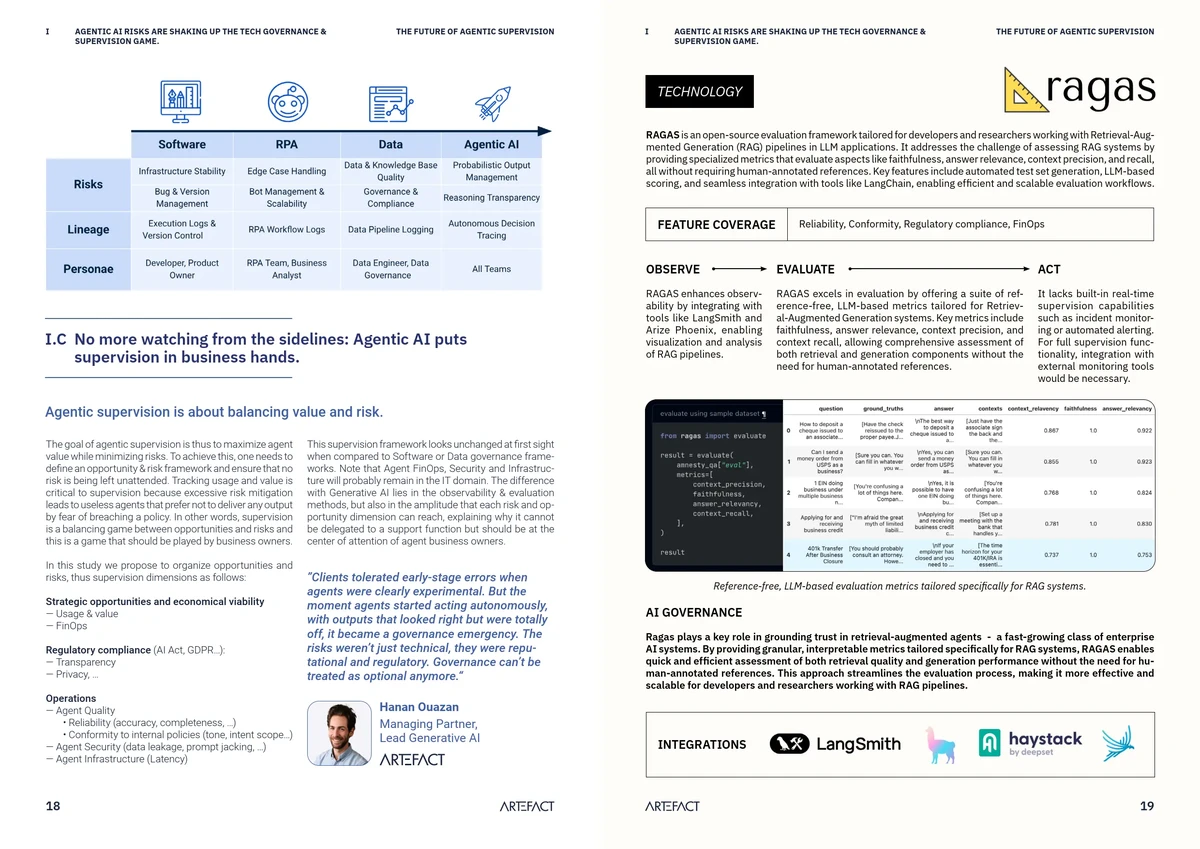

Trading Chart Showing Market, Limit, and Stop Orders

Expert Insights and Personal Experience

In my own trading journey, I started with simple market and limit orders. While market orders gave me instant access, I quickly realized that slippage was eating into my profits. Transitioning to limit orders with stop-loss protections gave me much more control.

Later, as I gained confidence, I began using trailing stops to secure profits in trending markets. This shift significantly improved my risk-reward profile and reduced the stress of constant monitoring.

The lesson? Order type mastery evolves with trading experience.

FAQs: Perpetual Futures Order Types

1. Which order type is best for beginners?

Beginners should focus on limit orders with stop-loss protection. This combination ensures better entry prices while keeping risk controlled.

2. How do I minimize risk using order types?

To minimize risk with order types in perpetual futures, always pair entries with stop-losses or trailing stops. Avoid relying solely on manual monitoring.

3. Why are there so many order types?

Different strategies require different execution methods. Scalpers may prefer market orders, while swing traders lean on limit and stop-limit orders. The diversity ensures flexibility for every trading style.

Final Thoughts

Understanding and applying a detailed analysis of perpetual futures order types is crucial for both new and seasoned traders. Market, limit, stop, stop-limit, trailing stop, and advanced orders each serve a distinct role in shaping a trader’s success.

The best approach is to start simple with limit and stop-loss orders, then gradually integrate advanced types like trailing stops and reduce-only orders as you refine your strategy.

If this article helped you gain clarity, share it with fellow traders, comment on your favorite order type below, and let’s build a community of smarter perpetual futures traders.

Perpetual Futures Trading in Action