===================================================

Trading perpetual futures successfully requires more than just market direction prediction—it demands a deep understanding of order types and how to implement them strategically. With leverage, funding mechanisms, and continuous trading, perpetual futures are among the most complex derivatives in the crypto ecosystem. Developing an effective order type strategy for perpetual futures can be the difference between consistent profitability and devastating losses.

In this article, we will explore the fundamentals of perpetual futures order types, compare different strategies, share real-world insights, and provide actionable recommendations for retail and institutional traders alike.

What Are Order Types in Perpetual Futures?

Definition and Importance

Order types dictate how your trades are executed on exchanges. Unlike spot trading, where order simplicity might be sufficient, perpetual futures require precision. Effective order type strategies manage execution speed, slippage control, and risk exposure.

Common Order Types Used in Perpetual Futures

- Market Orders – Execute instantly at the best available price.

- Limit Orders – Execute at a specified price or better.

- Stop Orders – Trigger execution when a target price is reached.

- Post-Only Orders – Ensure maker fees rather than taker fees.

- Reduce-Only Orders – Prevent unintended position increases.

- Trailing Stop Orders – Adjust dynamically with market movement.

Each order type has unique advantages, and choosing correctly can directly impact trade outcomes. This is why how to choose the right order type for perpetual futures is a critical question for both beginners and seasoned traders.

Why Order Types Are Critical in Perpetual Futures

Unlike traditional futures with expiration dates, perpetual futures are rolling contracts with funding payments. Market volatility, high leverage, and liquidity gaps amplify risks. The correct order type not only optimizes entries and exits but also protects against forced liquidations.

For example:

- A market order might guarantee execution but cause heavy slippage in illiquid markets.

- A limit order offers precision but risks non-execution during rapid moves.

- A stop-limit helps secure profits but might fail in fast-moving crashes.

Thus, selecting the effective order type strategy for perpetual futures isn’t optional—it’s a survival mechanism.

Two Core Strategies for Effective Order Type Use

Strategy 1: Market Execution with Protective Stops

How It Works

- Enter positions quickly with market orders to avoid missing sudden moves.

- Use stop-loss and trailing stops to manage downside risk.

- Combine with position sizing rules to limit exposure.

Advantages

- Ensures immediate execution, crucial in volatile crypto markets.

- Trailing stops capture profits while protecting against reversals.

Disadvantages

- Higher fees due to taker orders.

- Slippage risks during thin liquidity conditions.

Strategy 2: Limit-Driven Liquidity Capture

How It Works

- Use limit and post-only orders to provide liquidity.

- Execute at desired entry levels while earning maker rebates.

- Pair with reduce-only exits to avoid accidental position scaling.

Advantages

- Lower trading costs thanks to rebates.

- More controlled entries and exits.

Disadvantages

- Risk of missed trades in fast markets.

- Requires patience and strong discipline.

Recommended Approach: Hybrid Strategy

From experience, the best results often come from a hybrid approach—entering core positions with limit orders to save costs, while using market orders for urgent execution. Protective stops (regular or trailing) should always complement this framework to reduce liquidation risks.

Advanced Techniques for Professional Traders

Algorithmic Execution

Institutions and algorithmic traders employ smart order routing and time-sliced execution strategies to optimize fill quality while minimizing market impact.

Layered Orders

Deploying multiple limit orders at different levels creates a grid effect, enhancing probability of execution while managing average entry cost.

Dynamic Stop Adjustments

Using AI-driven trailing stops or volatility-based stop placements adapts protection to changing market conditions.

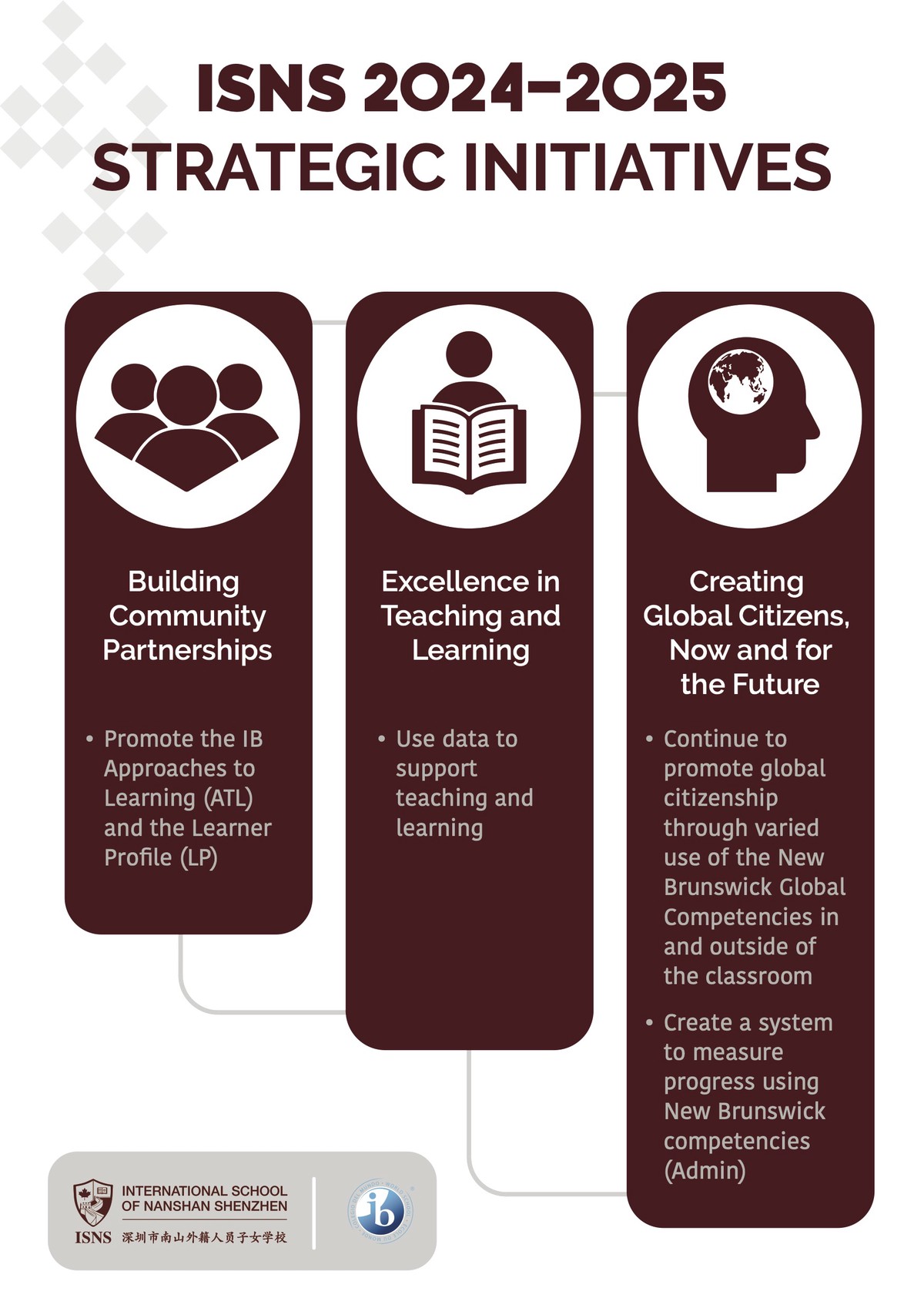

Visual Example

Visualizing how different order types impact perpetual futures execution efficiency.

Institutional vs. Retail Use Cases

Retail Traders

Retail traders often overuse market orders due to impatience. While simple, this leads to higher fees and slippage costs. For retail participants, learning where to find information on perpetual futures order types can drastically improve results.

Institutional Traders

Institutions prefer sophisticated limit-based strategies, often combined with proprietary algorithms. Their focus is cost minimization and execution precision. This highlights why order types affect perpetual futures trading at a strategic level.

Risk Management with Order Types

- Stop-Loss Orders: Essential for leveraged positions.

- Reduce-Only Orders: Prevents accidental liquidation risks.

- Position Scaling: Use smaller order blocks instead of all-in entries.

- Hedging via Opposite Orders: Entering opposing trades on correlated pairs for downside protection.

Case Study: Effective Use of Limit Orders in Volatility

During a Bitcoin flash crash in May 2021, market orders caused severe slippage as liquidity evaporated. Traders relying solely on them faced liquidation. In contrast, those who layered limit orders at strategic price zones not only avoided liquidation but secured profitable entries when the market recovered.

FAQ: Effective Order Type Strategy for Perpetual Futures

1. What’s the safest order type for beginners in perpetual futures?

Limit orders are the safest for beginners since they control entry price and reduce slippage. Combining them with reduce-only exits adds extra protection.

2. How can I minimize risk while trading with high leverage?

Always use stop-loss and trailing stop orders. High leverage amplifies every tick, so protective orders are essential to avoid liquidation. Additionally, never risk more than a small percentage of your margin on a single trade.

3. Are advanced order types necessary for retail traders?

Yes. Even simple tools like reduce-only and post-only can dramatically improve results. Advanced traders may use layered strategies, but retail traders should at least master the basics before scaling complexity.

Conclusion: Building a Robust Perpetual Futures Order Strategy

An effective order type strategy for perpetual futures isn’t about using every tool—it’s about knowing when and why to use each one. Market orders provide speed, limit orders provide control, and protective stops provide safety. By combining them intelligently, traders can balance execution quality with risk management.

Perpetual futures reward precision. Whether you’re a retail trader just starting or an institutional desk deploying algorithms, mastering order type strategies will give you a significant edge in competitive markets.

If you found this guide valuable, share it with your trading community and comment below with your own experiences using different order types in perpetual futures. Your insights could help the next trader avoid costly mistakes.

Would you like me to create a comparison table infographic that shows how each order type performs across criteria like speed, cost, slippage, and risk control?