==========================================================================

In the world of financial markets, spot trading plays a pivotal role in ensuring liquidity and efficiency. For brokers, mastering efficient spot market practices is crucial to maintaining a competitive edge, optimizing profit margins, and delivering the best service to clients. The spot market involves the immediate exchange of assets, typically currencies, commodities, or securities, where transactions are settled “on the spot” or within a short timeframe, usually two business days. This article explores key strategies, industry best practices, and the evolving tools that brokers can leverage to succeed in the spot market.

What Is the Spot Market and Why Is It Important?

Before diving into efficient practices, it’s essential to understand the spot market’s role. The spot market is where assets are bought and sold for immediate delivery. Unlike futures or options markets, where contracts are settled at a later date, spot markets deal with transactions that settle instantly, making them highly liquid and ideal for traders looking for quick execution.

Key Characteristics of the Spot Market:

- Instant Settlement: Transactions settle immediately or within a couple of business days.

- Price Transparency: Spot prices are readily available, reflecting the current supply and demand.

- Liquidity: The spot market often offers high liquidity, especially for popular assets like major currencies and gold.

- Volatility: Spot market prices can be volatile, as they respond to real-time market events.

For brokers, these characteristics present both opportunities and challenges. Efficiently managing these dynamics requires strategic planning, risk management, and a deep understanding of market behavior.

Best Practices for Brokers in the Spot Market

1. Liquidity Management

Liquidity is one of the defining features of the spot market. For brokers, ensuring access to sufficient liquidity is essential for smooth operations, particularly when executing high volumes of trades.

How Brokers Can Improve Liquidity Management:

- Partner with Multiple Liquidity Providers: Brokers can improve execution quality by connecting to multiple liquidity providers (LPs) to ensure consistent liquidity, especially during volatile market conditions.

- Use Aggregated Liquidity Solutions: Aggregators allow brokers to combine liquidity from different sources, providing deeper liquidity pools, lower spreads, and better fill rates.

- Monitor Market Depth: Brokers should continuously assess market depth to ensure that there is enough liquidity for both small and large orders. Trading platforms that offer real-time order book data help brokers spot potential liquidity gaps.

Pros:

- Better Execution: Enhanced liquidity ensures that brokers can execute client orders without significant slippage.

- Reduced Risk: Access to diverse liquidity sources mitigates the risk of price manipulation by single entities.

Cons:

- Increased Costs: Connecting to multiple liquidity providers or using aggregators may come with higher costs.

- Complexity: Managing liquidity from different providers requires advanced systems and analytics.

2. Price Transparency and Market Analysis

Price transparency is critical in the spot market, as it influences trader decision-making. Brokers need to provide real-time, accurate pricing to maintain trust and credibility with their clients.

How Brokers Can Ensure Accurate Pricing:

- Use Reliable Data Feeds: Brokers must use high-quality, real-time price feeds from reputable sources. These data feeds should include up-to-the-second price quotes for various assets.

- Leverage Quantitative Analysis: Incorporating quantitative analysis tools helps brokers understand price trends and predict future movements in the spot market. By utilizing machine learning models and statistical methods, brokers can gain insights into market behavior and adjust their pricing accordingly.

Pros:

- Client Trust: Accurate pricing fosters transparency, which builds long-term relationships with clients.

- Competitive Advantage: Brokers who provide superior pricing information can differentiate themselves in a crowded market.

Cons:

- Data Overload: Managing and interpreting vast amounts of data can be overwhelming without the proper tools.

- Technology Costs: High-quality data feeds and advanced analysis tools come with significant costs.

3. Risk Management Strategies

In the spot market, where prices can fluctuate rapidly, brokers must implement effective risk management strategies to protect both their interests and those of their clients.

Key Risk Management Techniques for Brokers:

- Hedging: Brokers can hedge their positions in the spot market to offset potential losses. For instance, if a broker anticipates a significant move in the currency pair they are trading, they might hedge by taking an opposite position in a related instrument.

- Stop Loss and Take Profit Orders: Brokers should encourage clients to use stop loss and take profit orders, which automatically close trades at predetermined levels to protect profits and limit losses.

- Margin Management: Brokers must ensure that their clients maintain adequate margins to cover potential losses. Automated margin calls and margin limits can help prevent clients from accumulating excessive risk.

Pros:

- Capital Protection: Risk management strategies like hedging and stop losses help protect capital from significant market swings.

- Regulatory Compliance: By implementing risk management protocols, brokers can comply with regulations and prevent systemic risks.

Cons:

- Reduced Profit Potential: While hedging and stop losses limit losses, they can also cap potential profits during favorable market movements.

- Operational Complexity: Managing client positions and risk exposure can be operationally demanding, particularly for brokers with large volumes of trades.

4. Optimizing Trading Platforms and Technology

Brokers must provide their clients with the best possible trading environment to compete in the spot market. This includes offering reliable, fast, and secure trading platforms.

Key Platform Features for Spot Market Brokers:

- Fast Execution Speeds: Traders in the spot market require fast execution of trades to capitalize on short-term price movements. Latency can cause missed opportunities or slippage.

- User-Friendly Interface: A platform with an intuitive user interface can attract more clients and enhance their trading experience.

- Advanced Order Types: Brokers should offer a variety of order types such as limit orders, market orders, and trailing stops to allow traders greater control over their trades.

- Security: Since brokers deal with clients’ funds and sensitive data, ensuring robust security measures like two-factor authentication (2FA) and encryption is crucial.

Pros:

- Enhanced Client Experience: A high-performance platform enhances client satisfaction, leading to increased loyalty and retention.

- Competitive Edge: Brokers offering cutting-edge technology and features can stand out in the crowded financial services industry.

Cons:

- High Costs: Developing or licensing advanced trading platforms can be expensive for brokers, especially small and mid-sized firms.

- Technical Issues: Complex platforms may be prone to technical issues that could disrupt trading activities.

5. Compliance and Regulatory Practices

Maintaining compliance with global regulations is vital for brokers operating in the spot market. Regulatory standards ensure fair trading practices, protect clients, and help brokers avoid legal risks.

Key Regulatory Practices for Brokers:

- Know Your Customer (KYC): Brokers must conduct thorough KYC checks to verify their clients’ identities, ensuring compliance with anti-money laundering (AML) regulations.

- Transaction Reporting: Brokers are required to report certain transactions to regulatory bodies to maintain transparency and avoid illegal activity.

- Adherence to Leverage Limits: Many regulators impose limits on the amount of leverage brokers can offer their clients to prevent excessive risk-taking.

Pros:

- Client Trust: Compliance with regulations enhances the reputation and credibility of brokers, attracting more clients.

- Legal Protection: Adhering to regulatory requirements helps brokers avoid legal penalties and fines.

Cons:

- Cost of Compliance: Staying compliant with various regulations can be costly and time-consuming, especially for brokers operating in multiple jurisdictions.

- Operational Constraints: Regulatory requirements can limit the flexibility of brokers in offering certain products or services.

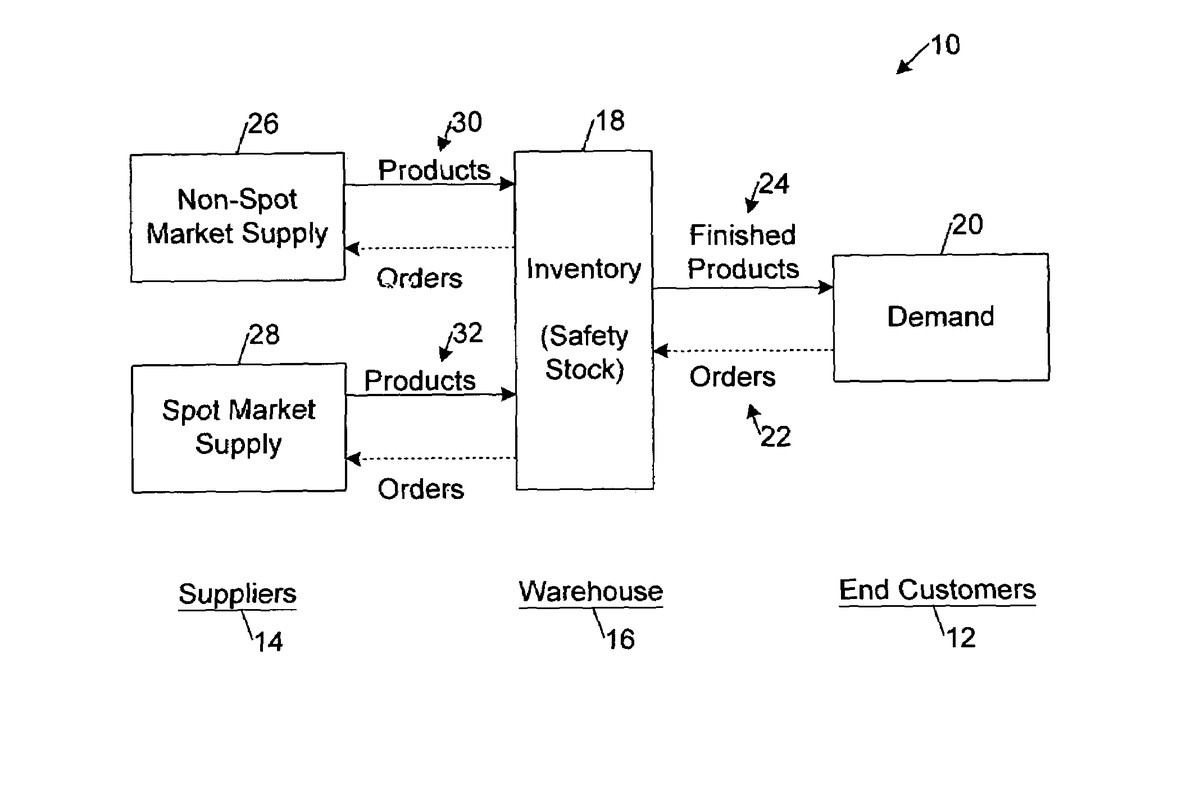

Comparing Spot Market Practices with Derivative Trading

While spot market trading involves the direct exchange of assets, derivative trading focuses on contracts that derive their value from an underlying asset. Understanding the differences between these two types of trading can help brokers and traders decide which market to engage with.

Spot Market vs. Derivatives Market:

- Immediate Settlement: The spot market involves the immediate transfer of assets, whereas derivatives settle at a future date.

- Market Volatility: Spot markets are often more volatile than derivatives markets, where prices are influenced by factors like time decay and volatility in the underlying asset.

- Leverage: Derivatives markets typically offer higher leverage compared to spot markets, increasing both potential profits and risks.

For brokers, deciding whether to offer spot market or derivative products depends on their target audience, risk appetite, and technological capabilities.

FAQ (Frequently Asked Questions)

1. How can brokers reduce risks in the spot market?

Brokers can reduce risks by implementing robust risk management tools like stop-loss orders, margin management, and hedging strategies. Using multiple liquidity providers also ensures smoother execution during volatile market conditions.

2. Why is liquidity management crucial in the spot market?

Liquidity management ensures that brokers can execute large orders quickly and efficiently without causing significant price slippage. It also allows brokers to offer better spreads and avoid the risk of price manipulation.

3. What role does technology play in spot market trading?

Technology is essential for brokers in the spot market as it allows for faster execution speeds, more accurate pricing, and a better overall trading experience. Advanced trading platforms and automated systems help brokers manage trades and reduce operational risks.

Conclusion

Efficient spot market practices are essential for brokers looking to stay competitive in the fast-paced world of financial trading. By focusing on liquidity management, price transparency, risk management, and advanced technology, brokers can create a strong foundation for success. The strategies outlined in this article provide a roadmap for brokers to enhance their operations, attract more clients, and ensure long-term profitability.

If you found this guide helpful, feel free to share it with your network and leave a comment below!