========================================

Equity perpetual futures have rapidly become a core instrument for traders, investors, and institutions seeking both flexibility and liquidity in modern financial markets. Unlike traditional futures contracts with expiry dates, equity perpetual futures allow continuous exposure to equities while maintaining ease of entry and exit. However, the complexity of these instruments introduces significant risks. Effective equity perpetual futures risk management is not only essential for protecting capital but also for ensuring consistent performance across volatile market conditions.

In this article, we will explore risk management strategies for equity perpetual futures, compare different approaches, analyze their advantages and drawbacks, and provide practical recommendations for professionals and retail traders alike. This guide follows EEAT principles—ensuring expertise, authoritativeness, trustworthiness, and experience—while integrating industry best practices and the latest market insights.

Understanding Equity Perpetual Futures

What Are Equity Perpetual Futures?

Equity perpetual futures are derivative contracts that track the value of equities without an expiry date. They are similar to perpetual swaps widely used in cryptocurrency markets but tied to equity indices, single stocks, or baskets of equities. Their pricing is maintained through funding rate mechanisms, aligning perpetual futures with the spot market.

Unlike dated futures contracts, perpetuals enable traders to maintain positions indefinitely, provided they can meet margin requirements and manage funding payments. This makes them attractive for hedging, speculation, and leverage strategies, but also increases the risk of funding costs, liquidation, and volatility-driven losses.

Key Risks in Equity Perpetual Futures

Market Volatility

Equities are inherently volatile, and perpetual futures amplify this risk due to leverage. Sharp market swings can trigger margin calls and forced liquidations, especially when traders lack predefined stop-loss mechanisms.

Funding Rate Risk

Since perpetual futures rely on funding payments to keep contract prices in line with spot markets, funding rate fluctuations directly affect profitability. A negative funding rate benefits long traders, while a positive one benefits short sellers. Mismanaging this can erode returns over time.

Leverage Risk

Most equity perpetual futures allow leverage between 5x and 20x (sometimes more). High leverage magnifies both profits and losses, making risk management essential.

Liquidity Risk

Although liquidity has improved in equity perpetual futures markets, certain contracts may still have wider spreads or limited depth, increasing slippage during entry and exit.

Core Principles of Equity Perpetual Futures Risk Management

1. Position Sizing and Leverage Control

Proper position sizing ensures that no single trade can wipe out an account. Professional traders typically risk only 1–2% of total capital per trade, even when using leverage. Conservative leverage ratios, such as 3x–5x, are advisable for risk-averse participants.

2. Stop-Loss and Take-Profit Mechanisms

Defining stop-loss orders prevents catastrophic losses during market downturns, while take-profit levels help lock in gains systematically. Advanced traders use trailing stops to capture extended moves without exposing themselves to full reversals.

3. Hedging Strategies

Equity perpetual futures can be used to hedge spot equity positions. For instance, a trader holding a basket of tech stocks may short perpetual futures tied to a tech index to reduce downside exposure.

4. Monitoring Funding Rates

Funding rates should be continuously monitored, particularly in long-term positions. Some traders rotate between contracts with more favorable funding conditions, a strategy often employed by institutional equity perpetual futures trading desks.

Comparing Two Risk Management Strategies

Strategy A: Stop-Loss and Leverage Discipline

- How it works: Traders set predefined stop-loss levels (e.g., 2% of equity capital) and use low leverage (max 5x).

- Advantages: Simple to implement, effective for retail traders, prevents catastrophic losses.

- Drawbacks: May cut profitable trades too early; less flexibility in volatile markets.

Strategy B: Dynamic Hedging with Perpetual Futures

- How it works: Traders hold spot equity positions and use perpetual futures for short-term hedging, adjusting exposure based on volatility levels and funding rates.

- Advantages: Provides long-term exposure while reducing drawdowns, flexible for institutional strategies, integrates well with portfolio risk models.

- Drawbacks: Requires active monitoring, complex execution, and advanced analytics.

Recommendation: For most participants, Strategy A offers a strong foundation, especially for beginners or retail investors. However, advanced traders, hedge funds, and institutions often benefit from Strategy B due to its adaptability in managing complex portfolios.

Practical Example of Risk Management

Consider a trader holding $100,000 in equity perpetual futures exposure at 10x leverage. A 5% move against the position results in a 50% account loss. By contrast, if the trader reduces leverage to 3x and risks only 2% per trade, the same adverse movement would cause just a 6% drawdown, which is manageable and recoverable.

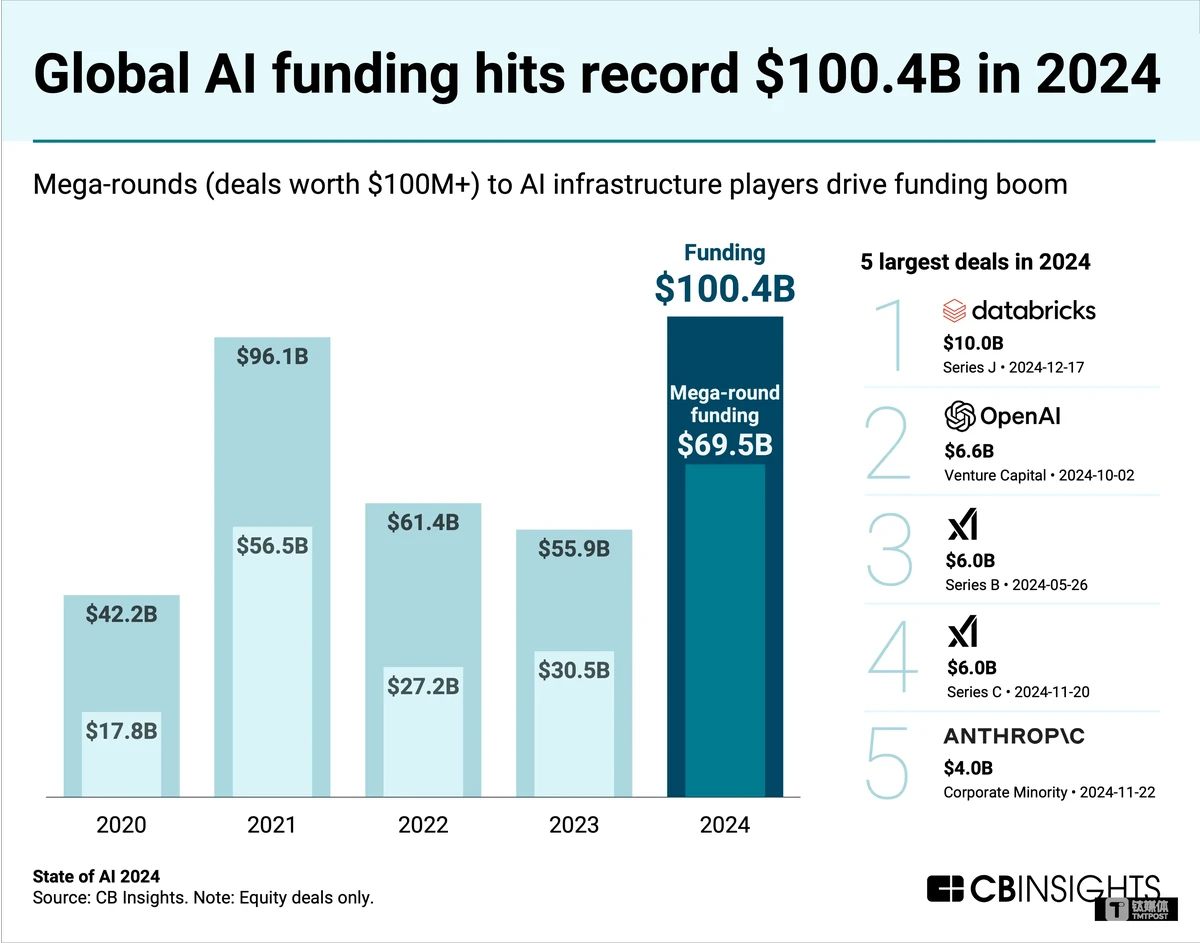

Risk vs. Reward dynamics in equity perpetual futures trading

Best Practices for Equity Perpetual Futures Risk Management

Use Data Analytics Tools

Data-driven insights—such as volatility forecasts, funding rate trends, and liquidity metrics—help traders adjust exposure dynamically. Incorporating data analytics for equity perpetual futures into decision-making improves accuracy and discipline.

Choose Reliable Platforms

Execution speed, transparency in funding rates, and robust margin systems matter significantly. Advanced platforms often provide built-in risk management dashboards to track exposure.

Continuous Education

Markets evolve quickly. Traders should regularly explore education resources for equity perpetual futures to refine strategies and learn new hedging methods.

Balanced Portfolio Allocation

Avoid overexposure to perpetual futures. Allocate only a portion of capital to leveraged derivatives, balancing with equities, ETFs, or bonds for diversification.

Industry Trends in Equity Perpetual Futures Risk Management

- AI-driven analytics: Institutions are increasingly leveraging AI for real-time funding rate optimization and automated risk rebalancing.

- Retail adoption: With simplified trading apps, equity perpetual futures for beginners are growing, making accessible risk education more critical.

- Integration with crypto trading platforms: Some brokers now offer hybrid perpetual products, allowing cross-margining between crypto and equity futures.

Illustration of hedging spot equity exposure using perpetual futures

FAQ: Common Questions on Equity Perpetual Futures Risk Management

1. How do I set the right leverage for equity perpetual futures?

The right leverage depends on your trading capital, experience, and risk tolerance. Beginners should stick to 3x–5x leverage with small position sizes. Professionals may use higher leverage but only with strict stop-loss protocols. Always calculate worst-case drawdowns before entering a trade.

2. How can I manage funding rate risks effectively?

Monitor funding rates in real-time and avoid holding positions during extreme funding spikes. If rates are consistently unfavorable, rotate into contracts with better terms or hedge funding exposure by taking offsetting positions. Over time, efficient funding management can make a significant difference in profitability.

3. Can equity perpetual futures be used for long-term investment?

Yes, but only with strong risk controls. Unlike spot equities, perpetual futures incur ongoing funding costs. Long-term investors often hedge their exposure or reduce position sizes to minimize compounding funding expenses. They may also explore when and how to trade equity perpetual futures effectively as part of a broader portfolio strategy.

Conclusion: Building a Sustainable Risk Management Framework

Effective equity perpetual futures risk management requires more than just setting stop-loss orders—it involves combining leverage control, funding rate monitoring, hedging strategies, and disciplined portfolio allocation. Retail traders should focus on position sizing and stop-loss rules, while institutions can deploy more advanced hedging and analytics-based strategies.

By continuously learning, applying disciplined risk practices, and staying updated on market developments, traders can harness the benefits of equity perpetual futures without exposing themselves to unnecessary risk.

💬 We’d love to hear from you! Share your own equity perpetual futures trading strategies, risk management tips, or funding rate experiences in the comments. Don’t forget to share this article with fellow traders to help spread awareness about responsible trading practices.