===========================================

Introduction

Equity perpetual futures have emerged as one of the most innovative instruments in modern financial markets. Unlike traditional futures contracts that have an expiry date, equity perpetual futures are designed to allow traders to hold positions indefinitely. This feature has attracted day traders, hedge funds, and retail investors looking for flexibility and efficiency in trading equity-related assets.

In this article, we will provide a comprehensive guide to equity perpetual futures trading strategies, highlight their role in portfolio management, and explore why they are gaining popularity among professional and retail traders alike. We will also cover practical strategies, compare their strengths and weaknesses, and integrate key insights such as How to trade equity perpetual futures and Equity perpetual futures risk management.

What Are Equity Perpetual Futures?

Equity perpetual futures are derivatives contracts linked to equities or equity indices that do not expire. Instead of a fixed maturity, these contracts are maintained through a mechanism called the funding rate, which ensures that the contract price stays close to the underlying equity or index.

Key Features

- No expiry date: Traders can hold positions as long as they maintain margin requirements.

- Funding payments: Long and short traders exchange periodic payments to keep prices aligned with the spot market.

- Leverage: Perpetual futures typically offer high leverage, making them attractive but risky.

- Liquidity: Many exchanges offering equity perpetual futures have deep liquidity, enabling efficient execution.

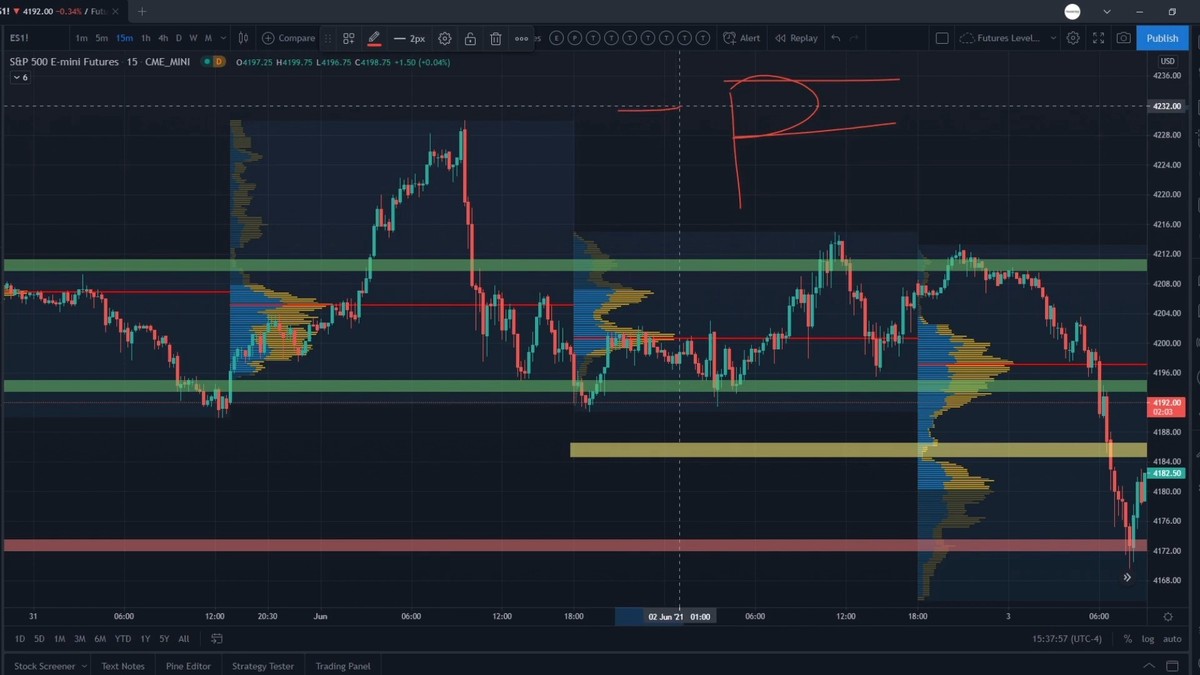

Equity perpetual futures structure explained

Why Traders Use Equity Perpetual Futures

1. Hedging Equity Portfolios

Institutional investors and hedge funds use perpetual futures to hedge equity exposures without worrying about contract rollovers.

2. Speculation and Leverage

Retail investors and day traders can speculate on short-term price movements of equities and indices with higher leverage than in cash markets.

3. Arbitrage Opportunities

Traders can exploit differences between perpetual futures and spot prices, creating low-risk arbitrage strategies.

4. Market Access

Equity perpetual futures allow access to global equity indices and baskets of stocks, often with lower capital requirements compared to traditional equity trading.

Core Equity Perpetual Futures Trading Strategies

Strategy 1: Directional Trend Following

This is the most straightforward strategy where traders follow market momentum.

How It Works

- Use technical indicators such as moving averages, RSI, and MACD to identify trends.

- Enter long positions in uptrends or short positions in downtrends.

- Manage risk using stop-loss levels aligned with support or resistance.

Pros

- Easy to understand and implement.

- Works well in strong trending markets.

Cons

- Poor performance in choppy or sideways markets.

- Requires disciplined stop-loss management.

Strategy 2: Equity Hedging with Perpetual Futures

One of the most powerful applications of equity perpetual futures is hedging existing stock positions.

How It Works

- A trader holding a long equity portfolio can short perpetual futures on the same index.

- This reduces exposure to downside risk while maintaining ownership of the stocks.

- Funding rate dynamics must be considered to avoid long-term cost burdens.

Pros

- Effective risk reduction tool.

- Flexible since positions can be held indefinitely.

Cons

- Costs from funding payments can erode returns.

- Not effective if correlation between portfolio and hedging contract is weak.

Strategy 3: Basis and Funding Rate Arbitrage

This strategy exploits differences between the spot equity market and perpetual futures pricing.

How It Works

- Buy spot equities while shorting perpetual futures when the contract trades at a premium.

- Collect funding payments if the market favors your position.

- Reverse the trade when the contract trades at a discount.

Pros

- Relatively low-risk if executed properly.

- Can generate consistent returns from funding payments.

Cons

- Requires large capital for arbitrage.

- Sensitive to liquidity and execution timing.

Strategy 4: Mean Reversion

Markets often revert after extreme moves, and equity perpetual futures provide an efficient way to capture this.

How It Works

- Use volatility indicators such as Bollinger Bands.

- Enter positions when prices deviate significantly from average levels.

- Exit trades once the market reverts.

Pros

- Works well in sideways or range-bound markets.

- Provides frequent trading opportunities.

Cons

- Risk of extended trends breaking the mean reversion assumption.

- Requires quick reaction and execution.

Comparing Trading Strategies

| Strategy | Best For | Strengths | Weaknesses |

|---|---|---|---|

| Trend Following | Day traders, swing traders | Easy to apply, high profit in strong moves | Poor in sideways markets |

| Hedging | Long-term investors, hedge funds | Effective risk management, indefinite holding | Funding costs reduce efficiency |

| Arbitrage | Institutional traders | Lower risk, consistent returns | Requires capital and speed |

| Mean Reversion | Range traders | Works in sideways markets | Fails in strong breakouts |

Recommendation: Beginners should start with trend following due to its simplicity, while advanced traders and institutions may benefit from hedging and arbitrage strategies.

Comparison of equity perpetual futures trading strategies

Risk Management in Equity Perpetual Futures

Since leverage and volatility are key characteristics, robust risk management is essential. As explained in Equity perpetual futures risk management, the following practices are vital:

- Position sizing: Limit exposure to a percentage of capital.

- Stop-loss orders: Predefine risk per trade.

- Monitoring funding rates: Long-term traders must factor in cumulative funding costs.

- Diversification: Avoid concentration in one index or sector.

Practical Applications and Market Trends

Institutional Use

Large institutions are using equity perpetual futures to efficiently hedge equity exposure across global indices without managing multiple contracts.

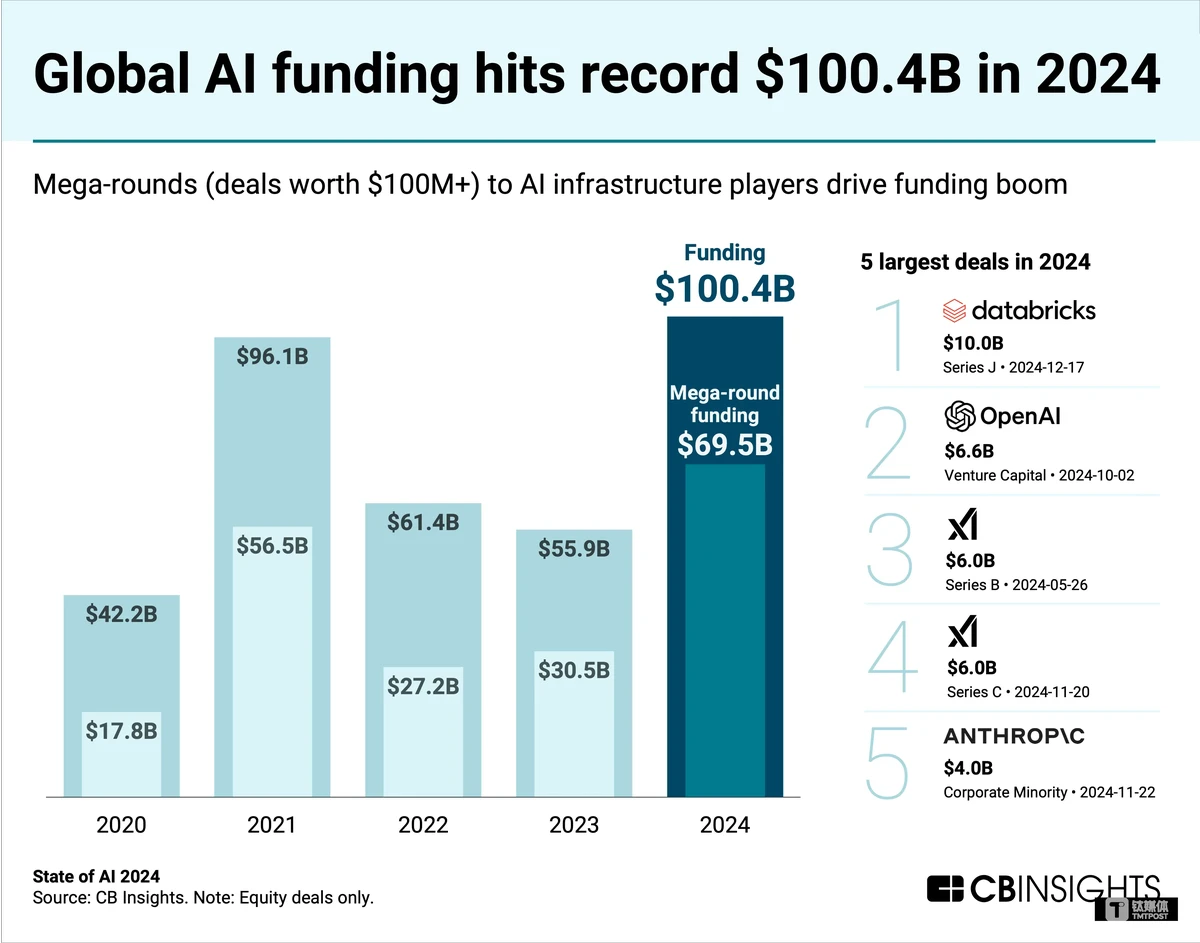

Retail Growth

Retail adoption is accelerating thanks to user-friendly exchanges and lower entry barriers. According to recent surveys, over 40% of active retail derivatives traders now use perpetual contracts.

Future Developments

- Integration with AI-driven risk models.

- Expansion of equity perpetual futures into emerging markets.

- Growth of cross-asset perpetual futures combining equities, bonds, and crypto.

FAQ

1. How do equity perpetual futures work compared to traditional futures?

Traditional futures expire and require rollover, while perpetual futures remain open indefinitely with funding payments aligning them to spot prices. This makes them more flexible but introduces funding cost risks.

2. Are equity perpetual futures suitable for beginners?

Yes, but with caution. Beginners can start with Equity perpetual futures for beginners guides, focusing on simple trend-following strategies and small position sizes. Risk management is critical due to leverage.

3. What risks should traders be aware of?

The main risks include high leverage exposure, volatile funding rates, and liquidity issues. Without strict discipline, losses can escalate quickly.

Conclusion

Equity perpetual futures are reshaping how traders and investors engage with equity markets. Their flexibility, leverage, and hedging benefits make them attractive to both retail and institutional participants.

By applying structured strategies such as trend following, hedging, arbitrage, and mean reversion, traders can harness the full potential of this instrument. However, without robust risk management, perpetual futures can be dangerous.

If you found this article helpful, share it with your network and comment below about your experiences with equity perpetual futures trading strategies. Engaging in discussions helps all traders refine their approaches and grow together in this evolving market.

Future of equity perpetual futures market