======================================

Introduction

In today’s fast-paced financial markets, the concept of optimizing exposure is more critical than ever. Traders, institutional investors, and even retail participants must manage their market exposure carefully to balance potential returns with inherent risks. With the rise of perpetual futures, cryptocurrency derivatives, and complex trading strategies, exposure management has evolved into a multi-layered discipline that requires both expertise and adaptability.

This article provides expert insights on optimizing exposure, combining proven strategies, modern tools, and practical case studies. We will explore why exposure matters, different methods professionals use to manage it, and how traders can align exposure strategies with long-term financial goals. By the end, you will not only understand the theory but also gain practical steps to implement effective exposure optimization in real-world markets.

Why Exposure Optimization Matters

Balancing Risk and Return

Exposure determines how much capital is at risk relative to market movements. For example, a leveraged position in perpetual futures may amplify profits but also increases the likelihood of liquidation. Optimizing exposure ensures that traders are neither underexposed (missing opportunities) nor overexposed (taking unsustainable risks).

Protecting Against Market Volatility

Global markets—from equities to cryptocurrencies—are experiencing heightened volatility. Proper exposure management shields portfolios from extreme downside risks, while still enabling traders to benefit from positive trends.

Aligning With Investment Goals

Different traders have different objectives: hedge funds may prioritize steady risk-adjusted returns, while retail traders often pursue aggressive growth. Optimizing exposure allows each participant to tailor strategies to their unique goals.

Core Principles of Exposure Optimization

1. Position Sizing

Position sizing is one of the most fundamental exposure tools. It helps traders determine how much capital to allocate per trade based on account size, risk tolerance, and market volatility.

- Pros: Simple to implement, widely applicable, and effective for risk control.

- Cons: May limit upside potential if applied too conservatively.

2. Diversification

Diversification across assets, sectors, or markets reduces the impact of a single trade or asset class. Exposure optimization through diversification is especially valuable for crypto traders in perpetual futures, where individual asset volatility can be extreme.

- Pros: Minimizes concentration risk.

- Cons: May dilute strong performance in high-confidence trades.

3. Hedging Strategies

Hedging allows traders to protect positions by opening offsetting trades. For instance, going long in perpetual futures while holding short positions in correlated assets reduces downside exposure.

- Pros: Provides insurance against adverse price moves.

- Cons: Can reduce overall profitability due to costs of maintaining hedges.

Advanced Strategies for Optimizing Exposure

Strategy 1: Dynamic Risk Allocation

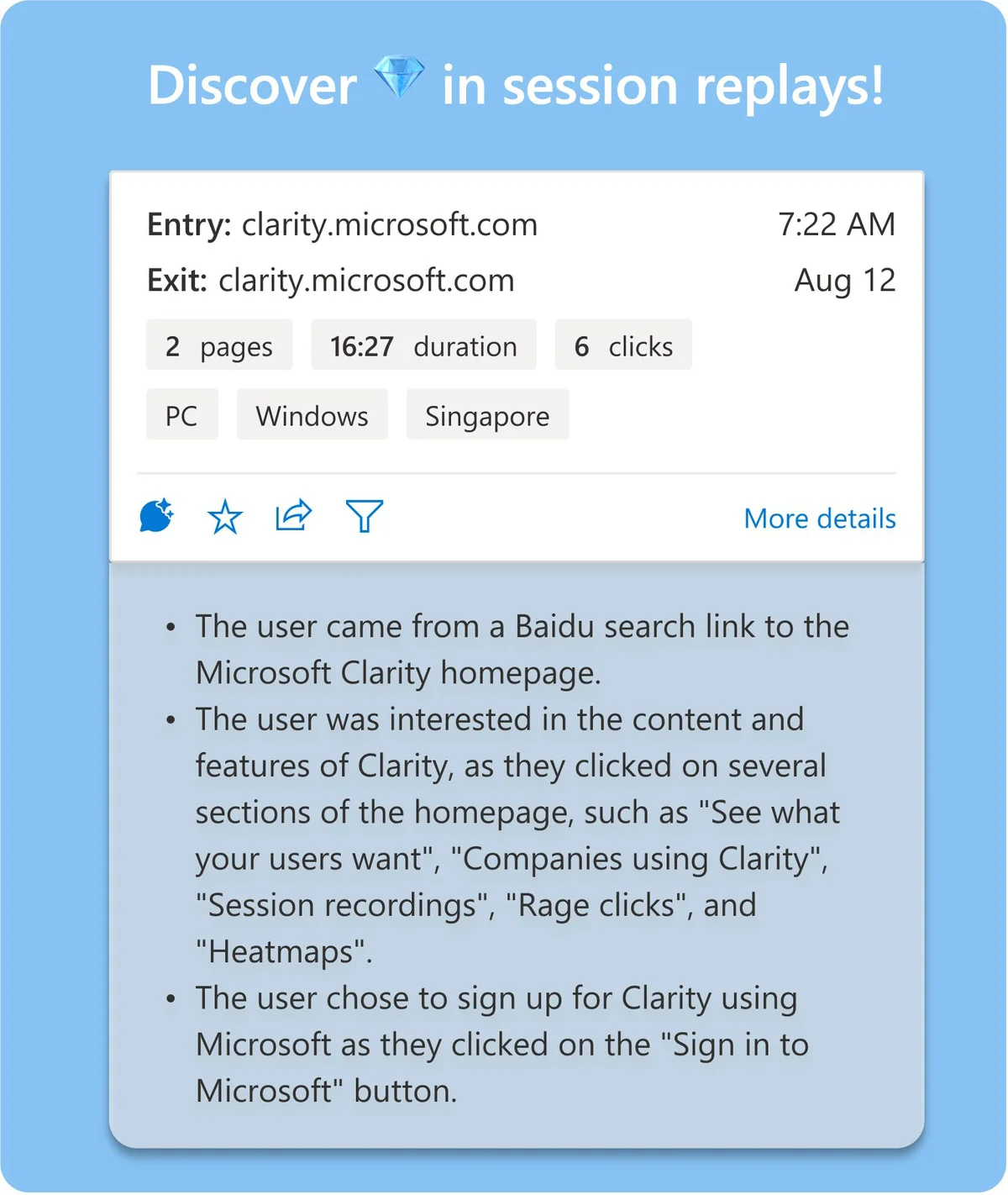

Dynamic risk allocation adjusts exposure based on changing market conditions. For example, exposure is increased during low-volatility environments and reduced when volatility spikes.

- Advantages: Responsive to market conditions, maximizes efficiency.

- Disadvantages: Requires advanced analytics and constant monitoring.

Strategy 2: Volatility-Weighted Positioning

This approach uses volatility-adjusted sizing, where exposure is scaled according to asset volatility. Assets with higher volatility receive smaller allocations, balancing portfolio risk.

- Advantages: Scientifically grounded, improves risk-adjusted returns.

- Disadvantages: Relies heavily on accurate volatility measurement.

Expert Insights on Institutional vs. Retail Exposure

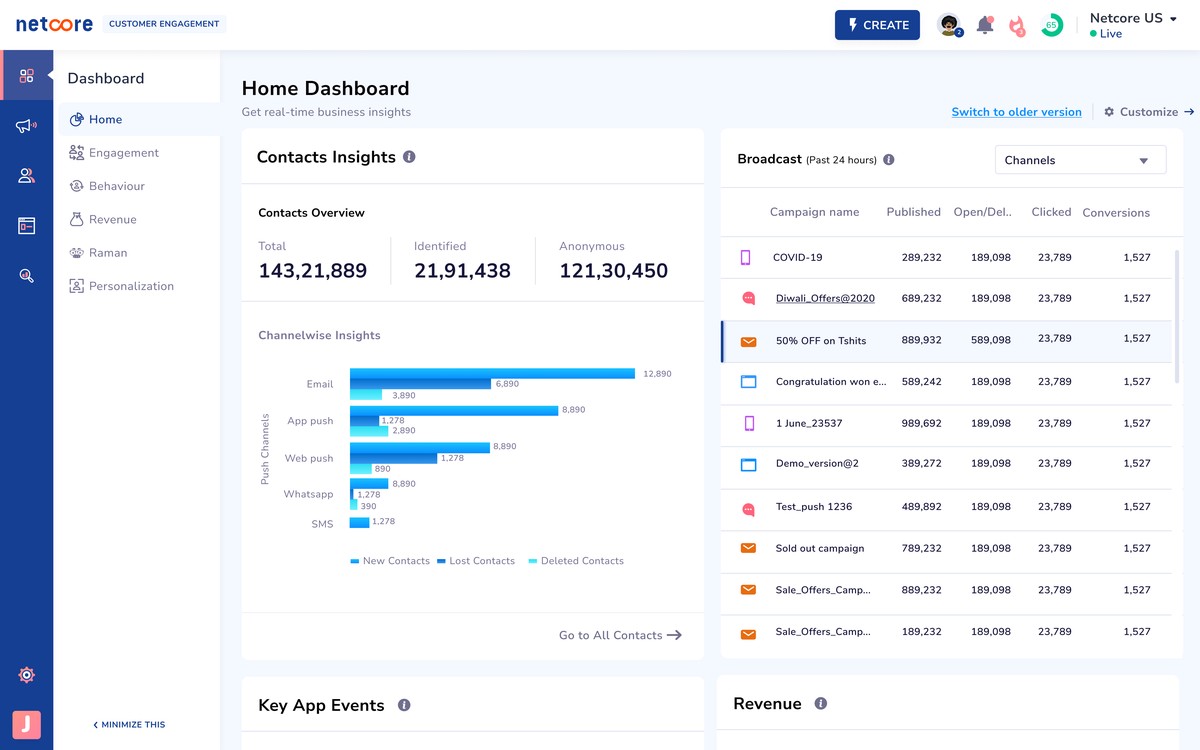

Institutional Investors

Institutional players such as hedge funds rely on advanced analytical tools for exposure in perpetual futures. These tools allow real-time exposure tracking, scenario modeling, and stress testing. Institutions optimize exposure through algorithmic trading models and strict portfolio risk limits.

Retail Traders

Retail traders often lack access to sophisticated systems, but they can still optimize exposure through structured strategies. Learning how to manage exposure in perpetual futures effectively is crucial for individuals navigating volatile markets without institutional resources.

Case Study: Exposure Management in Futures Trading

A mid-sized hedge fund implemented volatility-weighted positioning across crypto perpetual futures. Over a 12-month period:

- Drawdowns decreased by 30% compared to unadjusted exposure.

- Annualized returns increased by 15% due to improved risk-adjusted trades.

- Liquidity stress during volatile events was reduced significantly.

This case highlights how exposure optimization is not just theory but a measurable performance enhancer.

Visual Insights

Risk vs. Exposure Curve – demonstrating how incremental exposure increases both potential returns and risks.

Diversification helps balance exposure across assets, reducing portfolio concentration risks.

Volatility-adjusted sizing ensures consistent exposure management across different market conditions.

Recommended Best Practices

- Set Clear Exposure Limits – define maximum allowable drawdowns and risk percentages.

- Use Scenario Testing – evaluate how exposure behaves under different volatility regimes.

- Combine Multiple Methods – integrate diversification, dynamic risk allocation, and hedging.

- Stay Updated With Market Trends – exposure strategies must evolve alongside liquidity shifts and regulatory changes.

FAQ: Expert Guidance on Exposure Optimization

1. What is the best way to optimize exposure for retail traders?

Retail traders should start with position sizing and diversification, ensuring no single trade risks more than 1–2% of account equity. Over time, they can incorporate more advanced exposure tools like volatility-based adjustments.

2. How does exposure optimization differ between crypto futures and traditional markets?

Crypto futures have higher volatility and often lack the deep liquidity of traditional markets. This means exposure strategies must be more conservative, with tighter risk controls and adaptive hedging.

3. Can exposure optimization improve long-term profitability?

Yes. While exposure optimization may sometimes reduce short-term gains, it significantly improves risk-adjusted returns and reduces portfolio drawdowns, which is essential for sustainable long-term growth.

Conclusion

Optimizing exposure is not a one-time decision but a continuous process shaped by market dynamics, trading objectives, and risk tolerance. From position sizing to volatility-weighted models, traders must combine strategies to find the balance that works best for them.

For institutional investors, optimization requires advanced systems and analytics, while retail traders can achieve significant improvements by adopting structured approaches. Regardless of scale, exposure optimization is the cornerstone of sustainable success in perpetual futures and beyond.

If you found these expert insights valuable, share this article with your peers, and leave a comment with your own strategies for managing exposure. Let’s build a community of smarter, more resilient traders together.