=================================================

Perpetual futures have become a cornerstone of modern crypto and derivatives trading. Unlike traditional futures, these contracts have no expiry date, enabling traders to maintain positions indefinitely—provided they manage funding rates and margin requirements. However, one critical factor that determines profitability and risk is exposure. Understanding how exposure affects perpetual futures investment is vital for both novice and professional traders aiming to balance opportunity with risk.

This comprehensive guide explores the concept of exposure in perpetual futures, its impact on trading outcomes, strategies to manage it effectively, and expert tips to optimize risk-adjusted returns.

Understanding Exposure in Perpetual Futures

Exposure represents the total market value that a trader is effectively controlling with their capital. In perpetual futures, exposure is influenced by factors such as leverage, position size, and market volatility.

What Is Exposure in Perpetual Futures?

Exposure refers to the notional value of an open position. For example, if you open a \(10,000 long position on BTC with 10x leverage using \)1,000 in margin, your exposure is \(10,000, not the \)1,000 you deposited. High exposure magnifies potential profits and losses, making risk management crucial.

Key Elements Influencing Exposure

- Leverage: Higher leverage multiplies exposure but also increases liquidation risk.

- Funding Rates: Perpetual futures require periodic payments between long and short traders. Poorly managed exposure can lead to funding costs eating into profits.

- Market Volatility: Sudden price swings can cause significant mark-to-market losses if exposure is excessive.

How Exposure Shapes Investment Outcomes

Exposure is directly tied to profit potential and risk in perpetual futures. It determines how much price movement translates into account equity changes.

Impact on Returns

Properly managed exposure allows traders to capture upside efficiently. A \(50,000 exposure on a 5% price increase yields a \)2,500 gain, whereas the same exposure on a 5% drop results in a $2,500 loss.

Risk Amplification

Overexposure often leads to margin calls or forced liquidations. Even small price reversals can wipe out accounts if leverage is too high. Why exposure is important in perpetual futures trading lies in its power to dictate whether a trade becomes a controlled investment or an uncontrollable gamble.

Two Primary Strategies for Managing Exposure

Professional traders employ various methods to balance exposure and risk. Here are two widely used approaches:

1. Static Leverage Management

This method involves maintaining a fixed leverage ratio regardless of market conditions. For example, a trader may always use 3x leverage on BTC perpetuals.

Advantages:

- Simple and consistent

- Easier to calculate margin requirements

Disadvantages:

- Less adaptable during high volatility

- May miss opportunities in trending markets

2. Dynamic Exposure Adjustment

Dynamic management adjusts leverage and position size based on market signals such as volatility, funding rates, and liquidity.

Advantages:

- Flexible response to market changes

- Reduces liquidation risk in turbulent markets

Disadvantages:

- Requires active monitoring

- Higher transaction costs

Recommendation: For most traders, a hybrid approach—starting with moderate static leverage and incorporating dynamic adjustments during volatile periods—offers the best balance of profitability and safety.

Personal Insights and Industry Trends

Drawing from my own trading experience and current industry practices, managing exposure in perpetual futures is increasingly aided by advanced analytics and automation. Tools like real-time volatility indicators and position-sizing algorithms are becoming standard for professional investors. Additionally, crypto exchanges are introducing built-in risk controls that automatically adjust leverage during periods of extreme volatility.

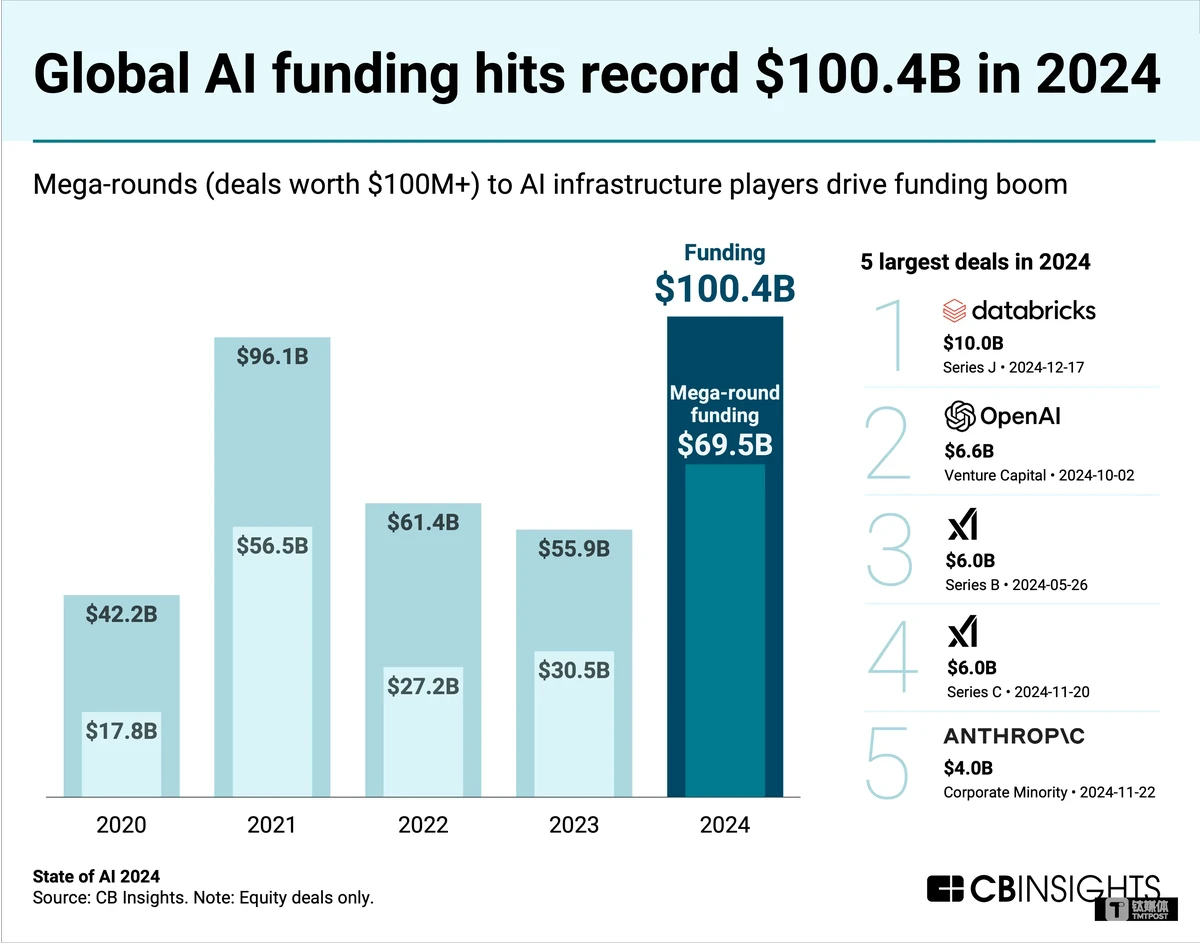

Exposure impact on perpetual futures returns

Advanced Methods for Exposure Optimization

Hedging With Offsetting Positions

Traders can open opposite positions in correlated assets (e.g., BTC and ETH perpetuals) to reduce net exposure while maintaining directional bias. This technique limits downside while keeping upside potential.

Funding Rate Arbitrage

Some traders exploit differences in funding rates across exchanges to hedge exposure and generate low-risk returns. While profitable, this requires precise execution and constant monitoring.

Integrating Exposure Management Into Your Trading Plan

Effective exposure management starts with setting clear parameters:

- Risk Tolerance: Define the maximum acceptable loss per trade.

- Position Sizing: Use position-sizing calculators to determine optimal exposure based on account equity.

- Stop-Loss Discipline: Always set stop-loss orders to cap potential drawdowns.

A step-by-step guide to exposure in perpetual futures often begins with evaluating your capital, determining target leverage, and continuously monitoring funding rates and margin usage.

Useful Resources for Exposure Control

For traders seeking deeper insights, resources like How to manage exposure in perpetual futures provide practical strategies for balancing risk and reward. Additionally, learning how exposure impacts perpetual futures returns can help you identify patterns that improve decision-making in volatile markets.

Frequently Asked Questions (FAQ)

1. What is the safest leverage level for perpetual futures?

There is no one-size-fits-all answer, but many experienced traders recommend keeping leverage below 5x to maintain manageable exposure and reduce liquidation risk.

2. How can I reduce exposure during a market crash?

You can reduce exposure by closing part of your position, lowering leverage, or hedging with an opposite trade. Setting stop-loss orders in advance also helps limit losses during sudden downturns.

3. Are there tools to calculate optimal exposure?

Yes. Most exchanges provide built-in calculators for position sizing and margin requirements. Third-party analytics platforms also offer exposure analytics for perpetual futures that incorporate volatility and funding rate data.

Key Takeaways

- Exposure is the cornerstone of risk management in perpetual futures.

- Balancing leverage, position size, and market volatility is critical to long-term success.

- Dynamic exposure strategies, combined with advanced analytics, offer the best protection against unpredictable market swings.

Final Thoughts: Trade Smart, Manage Exposure

Understanding how exposure affects perpetual futures investment can mean the difference between consistent profits and sudden liquidation. Whether you’re a retail trader or an institutional investor, controlling exposure is the foundation of a successful trading strategy.

Share this article with fellow traders, leave a comment with your own exposure management tips, and help others navigate the complex world of perpetual futures with confidence.