==============================================================

Introduction

In the fast-evolving world of cryptocurrency trading, funding rates play a critical role in shaping market behavior, especially in perpetual futures contracts. Understanding how funding rate impacts trading is essential for day traders, institutional investors, and hedgers who want to optimize their strategies, manage risks, and maximize profitability.

This article provides an in-depth analysis of funding rates, explores their direct and indirect influence on trading decisions, compares strategies for handling them, and offers actionable insights supported by industry trends and personal trading experience. By the end, you will clearly understand why funding rates matter, how to manage them, and how to integrate them into your trading strategy.

What Is a Funding Rate?

Funding rate is a periodic payment exchanged between long and short positions in perpetual futures contracts. Unlike traditional futures, perpetual contracts never expire, so exchanges use the funding mechanism to keep contract prices aligned with spot market prices.

- Positive funding rate: Longs pay shorts.

- Negative funding rate: Shorts pay longs.

This dynamic ensures market balance and incentivizes traders to take positions that reduce price dislocations between futures and spot markets.

How Funding Rate Impacts Trading Decisions

1. Influence on Trader Positioning

Funding rates can directly affect whether traders go long or short.

- High positive funding rates discourage long positions because traders must pay more to maintain them.

- High negative funding rates discourage short positions because shorts bear additional costs.

This mechanism naturally regulates market sentiment.

2. Impact on Trading Costs and Profitability

Funding rates are essentially an extra cost or income stream in perpetual trading. Over time, these payments can significantly alter profit margins.

- For scalpers and day traders, short-term volatility often outweighs funding costs.

- For swing traders or investors holding positions for weeks, cumulative funding can erode profits or generate consistent passive income.

For instance, during bullish markets, funding rates tend to be positive, which means longs pay shorts regularly. In such scenarios, shorting may provide steady income even if price movement is against the short-term bias.

3. Effect on Market Sentiment

Funding rates also serve as an indicator of crowd positioning.

- Extremely high funding rates suggest most traders are long, increasing the risk of a correction.

- Deeply negative rates imply a heavily shorted market, which often precedes a short squeeze.

This makes funding rates a sentiment barometer—a tool traders use alongside price action and volume analysis.

Two Key Strategies to Manage Funding Rate

Strategy 1: Funding Rate Arbitrage

Funding rate arbitrage involves capturing the funding payments by maintaining hedged positions. For example:

- Go long on the spot market.

- Go short on perpetual futures.

When funding is positive, shorts receive payments, effectively creating a low-risk yield strategy.

Pros:

- Low market risk due to hedged exposure.

- Can generate steady, predictable income.

Cons:

- Requires significant capital for margin requirements.

- Profits may be small compared to directional strategies.

Strategy 2: Directional Trading with Funding Consideration

Traders can use funding rates as confirmation signals in directional strategies.

- Entering short positions when funding is excessively positive may align with an upcoming correction.

- Entering long positions when funding is highly negative may anticipate a rebound or short squeeze.

Pros:

- Enhances timing and entry decisions.

- Combines technical and sentiment analysis for stronger conviction.

Cons:

- Still exposed to market risk.

- Requires careful monitoring to avoid false signals.

Recommended Best Approach

For most traders, the optimal strategy is a hybrid approach:

- Use funding rate arbitrage during prolonged bull or bear trends to generate passive yield.

- Apply directional trading with funding analysis for opportunistic entries and exits.

This combination balances risk management and profit opportunities, making it suitable for both retail and professional traders.

Funding Rate in Practice: Industry Insights

Why Funding Rate Changes

Funding rates change due to differences between perpetual futures and spot prices, influenced by supply-demand imbalances, leverage usage, and overall sentiment. In bull markets, positive funding dominates, while in bearish conditions, negative funding becomes more common.

Where to Find Funding Rate Data

Exchanges like Binance, Bybit, and OKX provide real-time funding rate updates. Additionally, aggregators like Coinglass allow traders to compare rates across exchanges, enabling funding rate comparison for exchanges to identify the best opportunities.

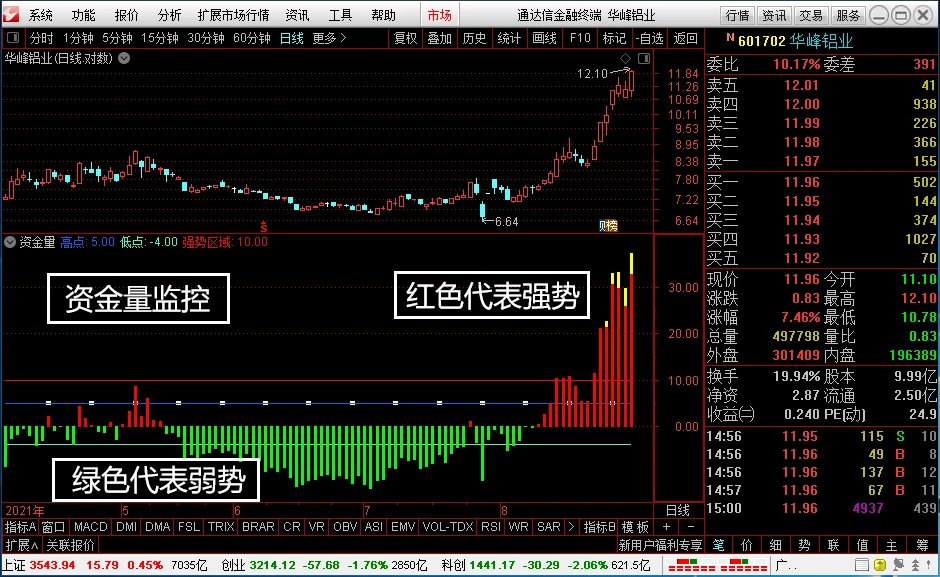

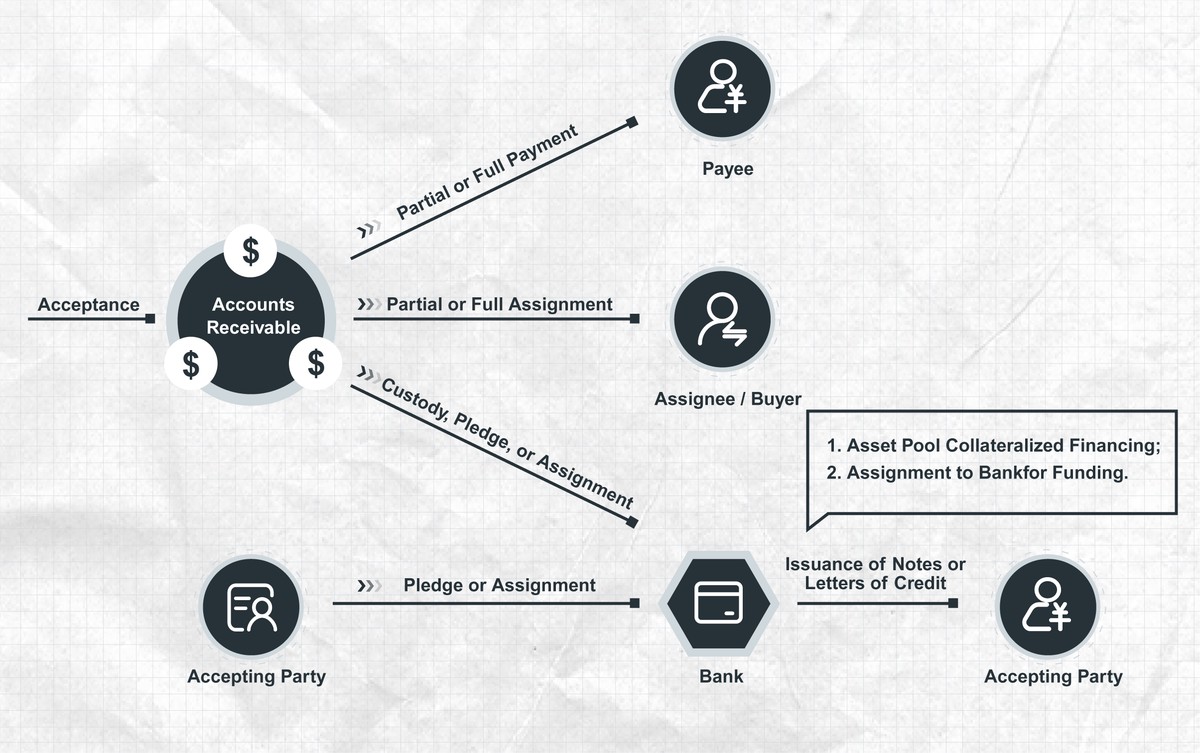

Visual Insights

Funding rate dynamics in perpetual futures

Advanced Considerations

Funding Rate and Risk Management

Funding payments can significantly impact portfolio performance. For risk-conscious traders, funding rate risk management is as important as stop-losses and leverage limits. Ignoring funding costs may lead to hidden losses even in correctly predicted trades.

Funding Rate and Hedging Strategies

Professional funds often use funding rates in their hedging playbooks. For example, a market-neutral strategy might involve balancing long and short positions across multiple exchanges with varying funding rates.

FAQs about Funding Rate

1. How is funding rate determined?

Funding rate is calculated based on the price difference between perpetual contracts and spot markets, combined with interest rate differentials. Each exchange uses its own formula, but the principle remains the same: funding aligns futures with spot prices.

2. Why is funding rate important for traders?

Funding rate directly impacts trading costs, profitability, and market sentiment. Ignoring it may lead to unexpected losses, while leveraging it can create unique arbitrage and hedging opportunities.

3. How to hedge with funding rate effectively?

The most common method is cash-and-carry arbitrage: buying spot assets while shorting perpetual futures. This setup earns funding payments when rates are positive, while neutralizing exposure to price fluctuations.

Conclusion

Understanding how funding rate impacts trading is not optional—it’s a necessity for anyone engaged in perpetual futures. Funding rates influence positioning, profitability, and market sentiment, making them one of the most powerful tools in modern trading.

By combining funding rate arbitrage with directional strategies, traders can balance risk and return while adapting to different market conditions.

Now it’s your turn—how do you manage funding rates in your trading strategies? Share your thoughts in the comments, and don’t forget to share this article with your fellow traders who want to master the art of funding rate optimization.

Would you like me to also create an infographic summarizing funding rate impacts and strategies (easy for social media sharing)? That could help boost engagement and readability.