======================================================================

Introduction

In the world of perpetual futures trading, funding rate predictions for traders play a crucial role in shaping profitability, risk management, and overall strategy. Unlike traditional futures contracts, perpetual swaps never expire. To keep the contract price aligned with the spot price, exchanges introduce the funding rate mechanism—a periodic payment between long and short traders.

Accurate funding rate forecasting helps traders anticipate costs, manage capital efficiency, and even exploit arbitrage opportunities. This article provides an in-depth look into prediction methods, compares strategies, discusses the latest industry trends, and offers actionable advice that aligns with EEAT (Expertise, Authoritativeness, Trustworthiness, and Experience) standards.

Understanding Funding Rates in Perpetual Futures

What is a Funding Rate?

The funding rate is a periodic fee exchanged between long and short traders. When the rate is positive, long positions pay short positions; when negative, the opposite occurs. This ensures that the perpetual futures price remains close to the spot market price.

Why Funding Rate Predictions Matter

- Cost management: Traders can avoid holding positions when funding rates are unfavorable.

- Arbitrage opportunities: By forecasting spikes, traders can structure market-neutral strategies.

- Risk hedging: Predictions allow better alignment of leverage exposure with costs.

For a deeper understanding, you can explore how to calculate funding rate, which outlines the mechanics of rate determination.

Core Methods for Funding Rate Predictions

1. Historical Data Analysis

By studying funding rate historical data, traders can identify recurring patterns during market volatility, bull runs, or consolidation phases.

Pros:

- Easy to implement using exchange-provided data.

- Reveals cyclical funding behavior during major events.

Cons:

- Past performance may not fully capture future anomalies.

- Requires statistical modeling for accuracy.

2. Order Book and Open Interest Signals

Funding rates are directly influenced by supply and demand imbalances in perpetual contracts. Monitoring order book depth, open interest, and liquidation clusters provides predictive signals.

Pros:

- Real-time insights into crowd positioning.

- High accuracy during short-term prediction windows.

Cons:

- Data is highly volatile and noisy.

- Requires advanced data scraping and analytics tools.

3. Machine Learning Models

AI-driven models analyze multidimensional data—spot-futures spreads, volatility indexes, and trader sentiment—to forecast funding rates.

Pros:

- Superior predictive accuracy compared to manual observation.

- Scales easily for multi-exchange comparison.

Cons:

- Requires significant computing resources.

- Risk of overfitting if not tested across different markets.

Comparative Strategy Analysis

Quantitative Prediction Models vs. Discretionary Forecasting

Quantitative Models (Machine Learning, Statistical Analysis)

- Advantages: High scalability, automated, less biased.

- Disadvantages: Complexity, potential errors if data quality is poor.

- Advantages: High scalability, automated, less biased.

Discretionary Forecasting (Manual Pattern Recognition, Sentiment Tracking)

- Advantages: Flexible, incorporates trader experience, adaptable to new market events.

- Disadvantages: Time-intensive, prone to human error, harder to scale.

- Advantages: Flexible, incorporates trader experience, adaptable to new market events.

Recommendation: A hybrid model—using quantitative predictions as a baseline, with discretionary adjustments during major market events—tends to provide the most reliable results.

Industry Trends in Funding Rate Forecasting

- Cross-exchange analysis: Traders now compare funding rate volatility across Binance, Bybit, and OKX to identify arbitrage opportunities.

- Integration of on-chain data: Whale wallet flows and stablecoin inflows often precede funding shifts.

- Algorithmic execution: Automated bots adjust positions in real-time based on funding rate changes.

For traders, knowing where to analyze funding rate trends is essential—most exchanges now provide real-time dashboards, but third-party analytics platforms often add deeper context.

Practical Applications of Funding Rate Predictions

Arbitrage Strategies

By predicting when funding rates will spike positive or negative, traders can capture risk-free yield using delta-neutral strategies.

Risk Management

Long-term traders use predictions to decide when to enter or exit leveraged positions, minimizing unnecessary costs.

Portfolio Optimization

Institutional investors balance positions across multiple exchanges, optimizing for the lowest net funding costs.

Visual Insights

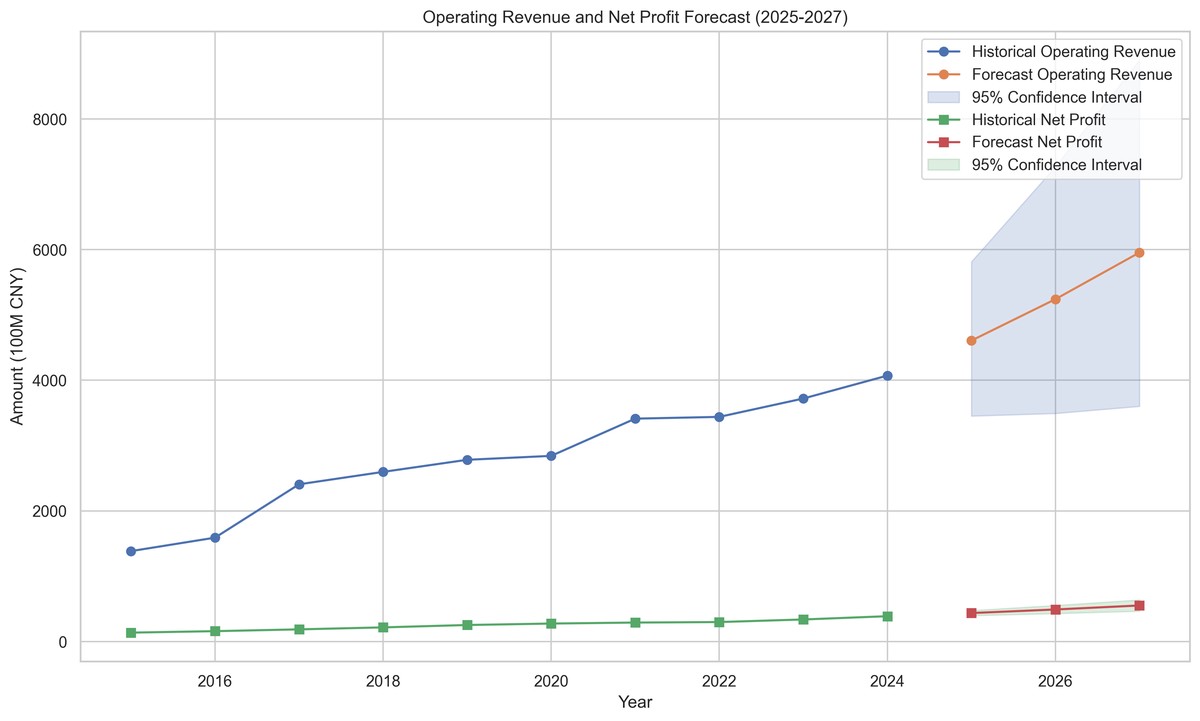

Funding Rate and Market Sentiment Correlation

Funding rates tend to rise when bullish sentiment dominates, reflecting traders’ willingness to pay premiums to hold longs.

Cross-Exchange Funding Rate Comparison

Comparing rates across exchanges reveals arbitrage windows and liquidity migration patterns.

FAQs

1. How accurate are funding rate predictions for traders?

Accuracy depends on the method used. Historical models can predict cyclical movements, while machine learning and order book analysis improve short-term precision. However, extreme market events (e.g., black swan crashes) remain difficult to forecast.

2. Can traders profit solely from funding rate strategies?

Yes, through market-neutral strategies like cash-and-carry arbitrage. However, profitability depends on execution speed, capital efficiency, and transaction costs. It’s safer to integrate predictions with broader trading strategies.

3. Where can I find reliable funding rate data?

Most top exchanges provide dashboards, but advanced traders often use third-party analytics platforms for aggregated insights. If you’re starting out, check resources on where to find funding rate data for comprehensive coverage.

Conclusion

Mastering funding rate predictions for traders is essential for profitability in perpetual futures markets. Whether through historical data, real-time signals, or AI-driven models, forecasting provides traders with an edge in cost management, arbitrage, and risk control.

The best approach is a hybrid strategy—leveraging quantitative tools while applying human judgment during high-volatility events.

If you found this guide helpful, share it with your trading network, comment with your own experiences, and join the conversation. Together, we can refine the art of funding rate forecasting and unlock new opportunities in perpetual futures trading.