===========================================================

Introduction

In the world of cryptocurrency trading, funding rate trading strategy has become one of the most intriguing methods for generating consistent returns. Funding rates are unique to perpetual futures contracts, designed to keep their prices close to the underlying spot market. Traders who understand how to capitalize on funding rates can develop powerful arbitrage, hedging, or directional strategies.

This comprehensive guide will explore how funding rates work, the principles behind funding rate trading strategies, and practical methods that both beginners and professional traders can apply. We will also compare different approaches, highlight their advantages and risks, and provide insights on how to optimize funding rate strategies with the latest tools and data sources.

What Is a Funding Rate?

Funding rates are periodic payments exchanged between long and short perpetual futures traders. They ensure perpetual futures prices remain in line with spot market prices.

- Positive funding rate: Long traders pay shorts when perpetual contracts trade at a premium to the spot price.

- Negative funding rate: Short traders pay longs when perpetual contracts trade at a discount.

By understanding this mechanism, traders can position themselves to earn predictable returns through funding rate arbitrage, or they can use it to hedge directional exposure.

Why Funding Rate Trading Strategy Matters

A well-structured funding rate trading strategy allows traders to:

- Generate passive yield by holding positions aligned with funding flows.

- Arbitrage mispricing between perpetual and spot markets.

- Hedge risk exposure without sacrificing potential income.

- Diversify income streams beyond price speculation.

For these reasons, many hedge funds, quant traders, and even retail investors now include funding rate strategies as part of their overall portfolio.

Core Methods of Funding Rate Trading

1. Funding Rate Arbitrage

Funding rate arbitrage is the most common method. Traders take opposite positions in the spot and futures markets to capture funding payments without exposure to market direction.

How it works:

- Buy spot Bitcoin.

- Short Bitcoin perpetual futures of equal notional value.

- Earn funding payments if the funding rate is positive.

- Buy spot Bitcoin.

Advantages:

- Neutral to market direction.

- Consistent returns when funding remains elevated.

- Works well in bullish markets where longs dominate.

- Neutral to market direction.

Risks:

- Costs of borrowing capital or maintaining margin.

- Sudden funding rate reversals.

- Execution risks in volatile markets.

- Costs of borrowing capital or maintaining margin.

Funding rate arbitrage: capturing yield from neutral market positioning.

2. Directional Funding Rate Strategy

This strategy combines speculation on price direction with funding rate flows. Traders enter futures positions not only for price exposure but also to benefit from funding.

How it works:

- Go long perpetuals when you expect both price appreciation and negative funding (you get paid to hold).

- Go short perpetuals when you expect a price drop and positive funding (you get paid again).

- Go long perpetuals when you expect both price appreciation and negative funding (you get paid to hold).

Advantages:

- Double reward: profit from both price movement and funding.

- Flexible in both bullish and bearish markets.

- Double reward: profit from both price movement and funding.

Risks:

- Losses can be magnified if funding flips against your position.

- Higher volatility exposure compared to arbitrage.

- Losses can be magnified if funding flips against your position.

Comparing the Two Strategies

| Strategy | Exposure | Income Source | Best For | Risks |

|---|---|---|---|---|

| Funding Rate Arbitrage | Neutral | Funding payments | Low-risk yield seekers | Margin requirements, funding reversals |

| Directional Funding Strategy | Directional | Price + funding | Active traders with strong analysis | Market volatility, funding unpredictability |

Recommendation: For consistent yield, arbitrage is safer. For experienced traders with strong market analysis, directional strategies can amplify returns.

Tools and Data Sources for Funding Rate Trading

To succeed, traders must continuously monitor and analyze funding rates. Platforms provide tools to track real-time changes, historical data, and predictions.

- Exchanges like Binance, Bybit, and OKX publish live funding rates.

- Analytics platforms such as Coinglass and CryptoQuant provide funding rate history and market insights.

- Custom dashboards built with APIs help professional traders design automated strategies.

For deeper understanding, see how to calculate funding rate and where to find funding rate data, as both are crucial steps in building a reliable trading system.

Risk Management in Funding Rate Trading

Even though funding rate trading can be lucrative, risks must be managed carefully:

- Monitor leverage – excessive leverage amplifies liquidation risks.

- Diversify across exchanges – funding rates vary, allowing cross-exchange arbitrage but also spreading risk.

- Watch liquidity – thin order books can increase slippage.

- Stay updated on funding trends – rates can swing sharply during high volatility.

Advanced Optimization Techniques

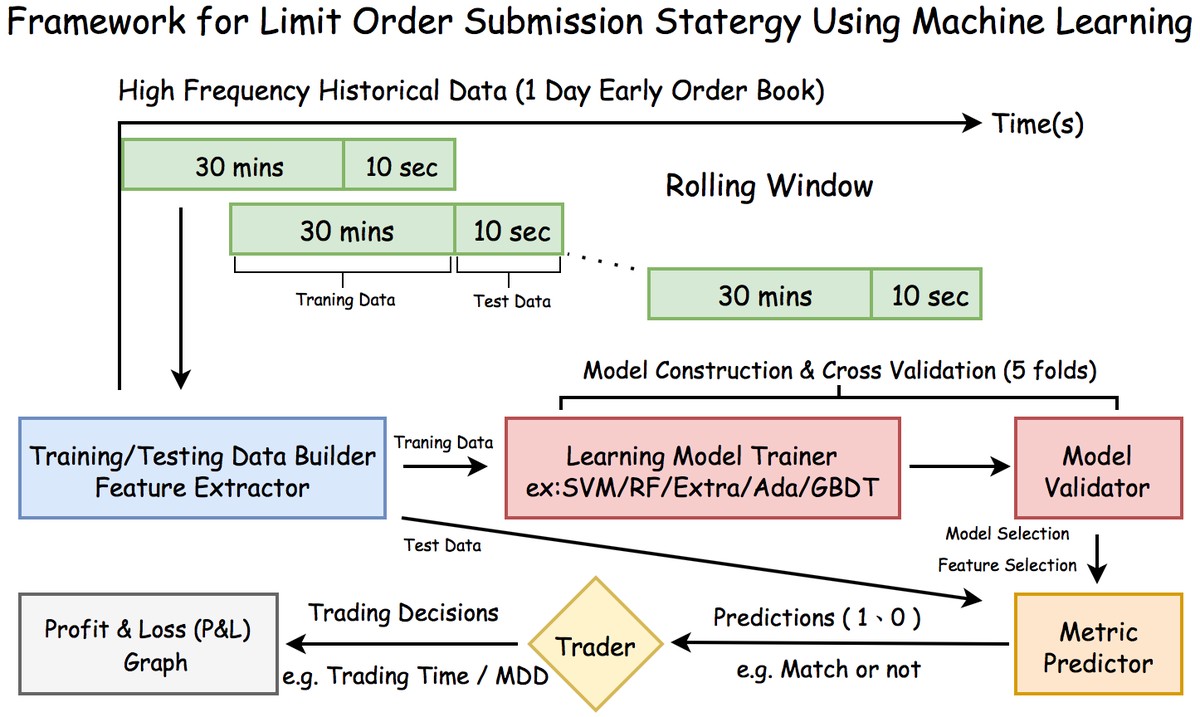

- Machine learning models to forecast funding rate changes.

- Cross-exchange arbitrage bots that automatically rebalance positions.

- Dynamic hedging that shifts between spot, futures, and options for maximum yield.

- Multi-asset strategies expanding beyond Bitcoin into altcoins with higher funding volatility.

Funding rate volatility can create arbitrage opportunities across exchanges.

FAQ: Funding Rate Trading Strategy

1. How much can I earn from funding rate trading?

Earnings depend on funding rate levels, position size, and leverage. In bullish markets, annualized yields from arbitrage can exceed 20–40%, but rates fluctuate and may turn negative.

2. Is funding rate trading risk-free?

No. While arbitrage reduces exposure to price direction, risks include margin calls, execution errors, borrowing costs, and sudden shifts in funding. Proper risk management is essential.

3. Can retail traders apply funding rate strategies?

Yes. Even small traders can use arbitrage or directional strategies with limited capital. Many exchanges offer low entry requirements. However, beginners should start with small amounts and gradually scale up.

Conclusion

A funding rate trading strategy is one of the most versatile tools in the crypto trader’s arsenal. From risk-neutral arbitrage to directional speculation, funding rates provide unique opportunities to earn yield or enhance trading profits.

By combining robust risk management, reliable data sources, and automation, traders can transform funding rate strategies into consistent profit engines.

If you found this guide useful, share it with your trading community, leave a comment with your experiences, and help spread insights about funding rate strategies to empower more traders in the ever-evolving crypto markets.

Would you like me to also prepare a ready-to-use strategy backtest template in Python for funding rate arbitrage so you can test it on Binance or Bybit data?