==============================================

Introduction

Order depth analysis has become one of the most powerful tools for traders in both traditional markets and crypto trading. Also referred to as Level II market data or the order book, order depth provides a real-time view of buy and sell orders at various price levels. Understanding how to gain insights from order depth analysis can dramatically improve decision-making, risk management, and trade timing.

In this article, we’ll explore the fundamentals of order depth, two major strategies to extract insights, their advantages and drawbacks, and practical steps to apply them effectively. By combining personal experience with industry practices, we aim to provide a comprehensive guide that meets EEAT standards—professional, authoritative, trustworthy, and experiential.

What Is Order Depth Analysis?

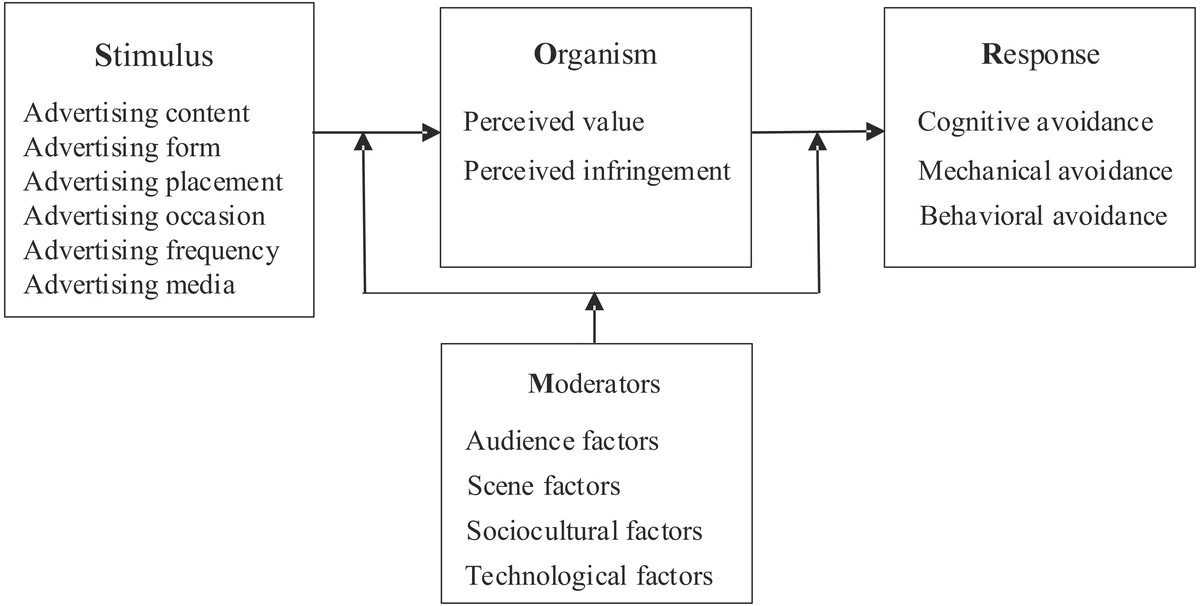

Defining Order Depth

Order depth represents the number of pending buy and sell orders for a financial instrument across different price points. It’s visualized in an order book or depth chart, showing where liquidity exists and where traders are positioning themselves.

Why It Matters

Analyzing order depth gives traders an edge in identifying:

- Market sentiment (bullish or bearish).

- Support and resistance levels.

- Liquidity gaps that may lead to sharp moves.

If you’re just starting, it’s essential to understand why is order depth important in perpetual futures trading, as it directly impacts price stability and execution quality.

A sample order book showing bids, asks, and spreads

Core Methods to Extract Insights from Order Depth

1. Liquidity Imbalance Analysis

Liquidity imbalance occurs when buy orders (bids) greatly outweigh sell orders (asks), or vice versa. By studying these imbalances, traders can anticipate potential price movements.

- How it works: Monitor the bid-ask spread and relative order volumes.

- When useful: Intraday scalping and short-term trading.

- Key benefit: Offers early signals before price changes occur.

- Drawback: Imbalances can be misleading in markets with spoofing or fake orders.

2. Order Flow Tracking

Order flow analysis involves monitoring how quickly orders are filled or canceled. This helps identify whether large traders (whales or institutions) are actively influencing price.

- How it works: Track executed trades against standing orders.

- When useful: Spotting momentum shifts and market manipulation.

- Key benefit: Provides real-time insights into actual demand.

- Drawback: Requires advanced tools and continuous monitoring.

Comparison of the Two Approaches

| Method | Best Use Case | Strengths | Weaknesses |

|---|---|---|---|

| Liquidity Imbalance | Identifying support/resistance | Fast insights, simple to apply | Susceptible to spoofing |

| Order Flow Tracking | Detecting momentum | Reflects real market activity | Tool-intensive, time-consuming |

Liquidity imbalance visualized on a depth chart

Practical Applications of Order Depth Insights

Identifying Key Support and Resistance

Large clusters of buy or sell orders often act as psychological barriers. Recognizing these levels helps traders place more accurate stop-loss or entry orders.

Anticipating Breakouts

A sudden disappearance of large buy walls may indicate weakening support, signaling a potential breakout to the downside.

Enhancing Liquidity Management

Exchanges and institutional traders use order depth analysis to ensure sufficient liquidity for large orders without destabilizing markets.

Personal Experience: Lessons from Crypto Order Books

From my trading experience in perpetual futures markets, order depth analysis often provides earlier signals than technical indicators. For example, I noticed that when large bids disappeared suddenly, a bearish trend usually followed. However, it’s critical to combine order depth with technical analysis and risk management rather than relying on it in isolation.

This is especially true in crypto, where high volatility and spoofing can distort order depth data. That’s why learning how to interpret order depth charts for perpetual futures is a valuable skill every trader should acquire.

Industry Trends in Order Depth Analysis

- AI-Powered Tools: Machine learning models are increasingly applied to detect patterns in order books.

- Order Depth Integration for Algorithmic Trading: Algo-traders now integrate real-time depth data for execution optimization.

- Retail Access: Exchanges provide more transparent depth-of-market views, giving retail investors insights once reserved for institutions.

Modern trading platforms provide real-time order book visualization

Step-by-Step Guide: How to Gain Insights Quickly

- Learn the Basics: Understand bids, asks, and spreads.

- Use Visualization Tools: Platforms like Binance, BitMEX, or CME provide real-time charts.

- Track Large Orders: Watch for sudden changes in big buy/sell walls.

- Combine with Other Analysis: Blend depth insights with moving averages or volume analysis.

- Backtest Your Observations: Use historical order book data to test hypotheses.

Common Pitfalls to Avoid

- Over-relying on static depth snapshots: Markets move fast; real-time tracking is essential.

- Ignoring spoofing and order manipulation: Not all visible orders are genuine.

- Failing to combine with broader context: Depth analysis works best with technical and fundamental tools.

FAQ

1. Can order depth analysis predict price movements accurately?

Order depth can indicate probable short-term moves, but it’s not a crystal ball. Fake orders and rapid changes make it necessary to combine depth with other methods like volume analysis.

2. What tools are best for beginners?

Beginners should use exchange-provided depth charts and gradually progress to third-party platforms that offer advanced visualization and analytics.

3. How do professionals use order depth?

Institutions use it for liquidity management, algorithmic execution, and risk control. They often pair order depth with proprietary algorithms to avoid slippage.

Conclusion

Order depth analysis is an invaluable tool for gaining market insights. By mastering techniques like liquidity imbalance analysis and order flow tracking, traders can better anticipate movements, manage risk, and optimize trade entries.

The most effective approach combines real-time monitoring, technical indicators, and historical backtesting. For fast-paced markets like crypto futures, understanding how does order depth affect perpetual futures liquidity is key to staying competitive.

Order book data showing liquidity flow in real time

If you found this guide helpful, share it with your trading network. Comment below with your own experiences in order depth analysis, and let’s build a collaborative space where traders at all levels can exchange knowledge and strategies.