=========================================

Introduction

In the fast-paced world of cryptocurrency and derivatives, automated margin trading systems have become indispensable tools for traders seeking both efficiency and precision. Unlike manual trading, automated margin systems rely on algorithms, APIs, and risk management protocols to execute leveraged trades without constant human oversight. The main advantage lies in their ability to react faster to market fluctuations, reduce human error, and optimize capital allocation.

This article provides a complete guide to automated margin trading systems, exploring their structure, strategies, benefits, limitations, and practical applications. We will also compare different approaches, highlight best practices, and answer common questions to help both retail and institutional traders make informed decisions.

What is an Automated Margin Trading System?

An automated margin trading system is a software-driven platform or algorithm that executes leveraged trades in financial markets, typically crypto perpetual futures or traditional derivatives. These systems integrate trading logic, market data analysis, and margin monitoring to ensure risk control while seeking profit.

Core Functions:

- Automated Execution – Orders are placed without manual intervention.

- Leverage Management – The system ensures margin ratios are within safe limits.

- Risk Mitigation – Automated stop-loss, take-profit, and liquidation prevention features.

- Data-Driven Trading – Algorithms analyze trends, volume, and volatility in real time.

By combining automation with leverage, traders can achieve scale and speed that manual methods cannot match.

Why Use Automated Margin Trading Systems?

- Speed: Automated systems react within milliseconds, outperforming human reaction times.

- Discipline: Removes emotional biases that often plague manual trading.

- Consistency: Strategies can be backtested and applied systematically.

- Efficiency: Multiple markets and pairs can be traded simultaneously.

Automation is particularly crucial when dealing with perpetual futures, where margin requirements shift dynamically. Traders must constantly monitor exposure, making manual oversight inefficient.

Core Components of Automated Margin Systems

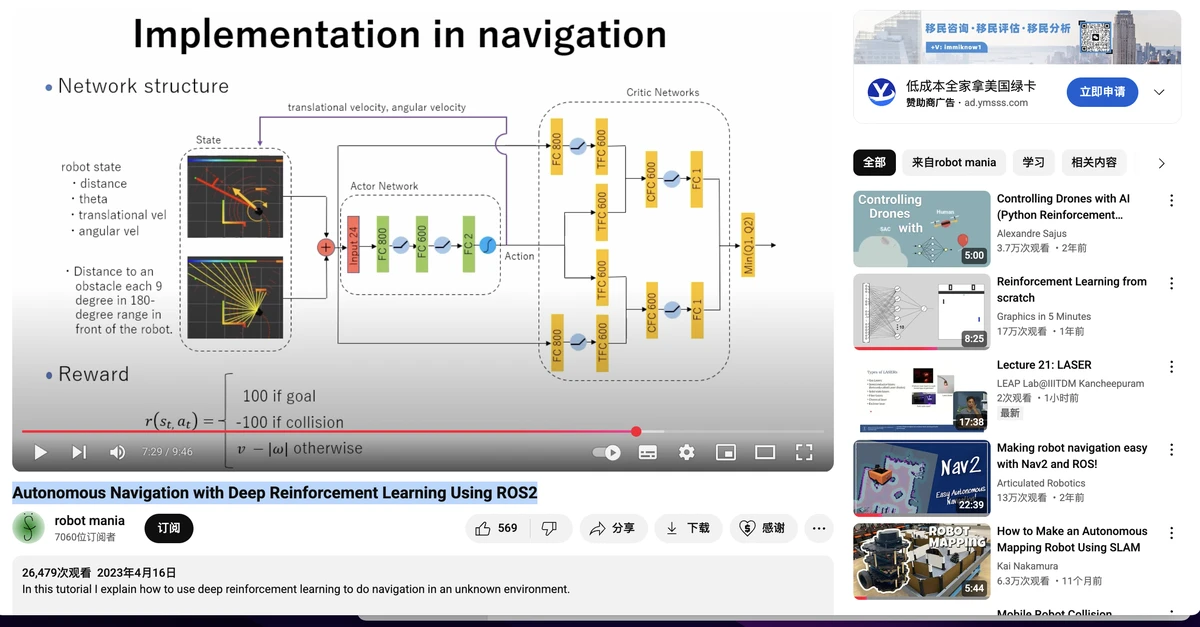

1. Trading Algorithms

Algorithms define when to enter, exit, or hedge a position. They can be simple moving average crossovers or complex machine-learning models predicting volatility.

2. Margin Control Engine

The engine calculates available margin, leverage, and liquidation risk. It ensures that orders align with risk thresholds.

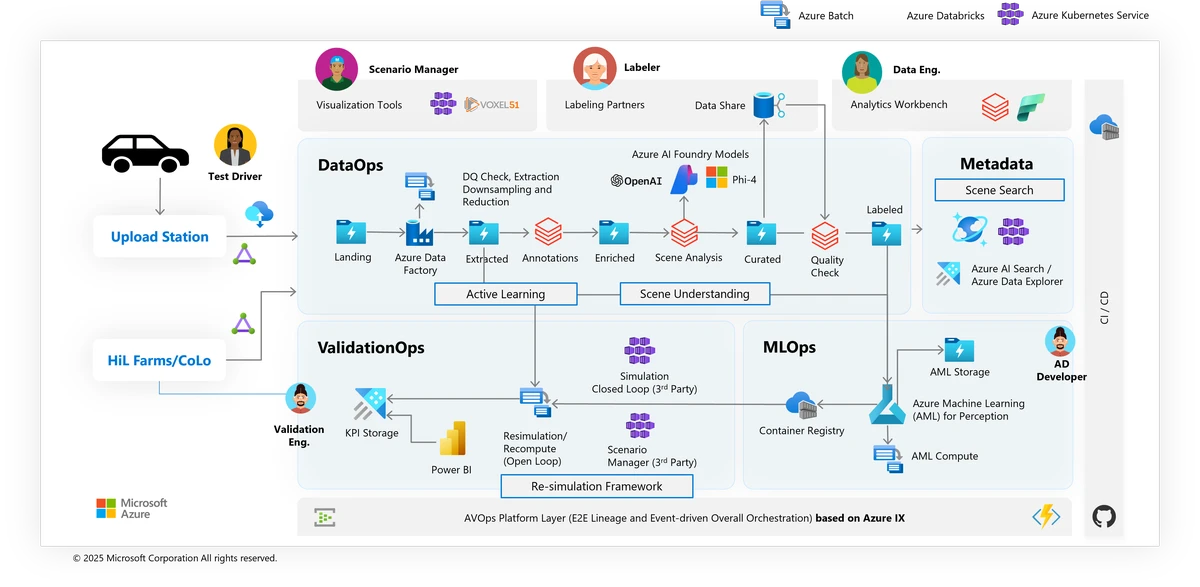

3. API Integration with Exchanges

APIs connect the system to exchanges like Binance, Bybit, or OKX, allowing programmatic order placement and real-time data streaming.

4. Risk Management Protocols

Includes automated stop-loss, trailing stop, and partial position closures to prevent margin calls.

Strategies for Automated Margin Trading

Strategy 1: Trend-Following Systems

Trend-following systems use indicators such as moving averages, MACD, or Ichimoku Clouds to capture long-term momentum.

- Advantages: Simple, effective in trending markets, scalable across assets.

- Disadvantages: Poor performance in sideways markets, susceptible to false signals.

Strategy 2: Mean-Reversion Systems

Mean-reversion systems assume that prices will revert to their average over time. Bollinger Bands and RSI-based algorithms are common tools.

- Advantages: Works well in range-bound conditions, captures short-term reversals.

- Disadvantages: Risky in strong trends, requires frequent adjustments.

Strategy 3: Arbitrage-Based Systems

Arbitrage algorithms exploit price differences between exchanges or instruments. For example, futures-spot arbitrage ensures risk-free returns when funding rates diverge.

- Advantages: Low directional risk, consistent small gains.

- Disadvantages: Requires large capital, competition with institutional players.

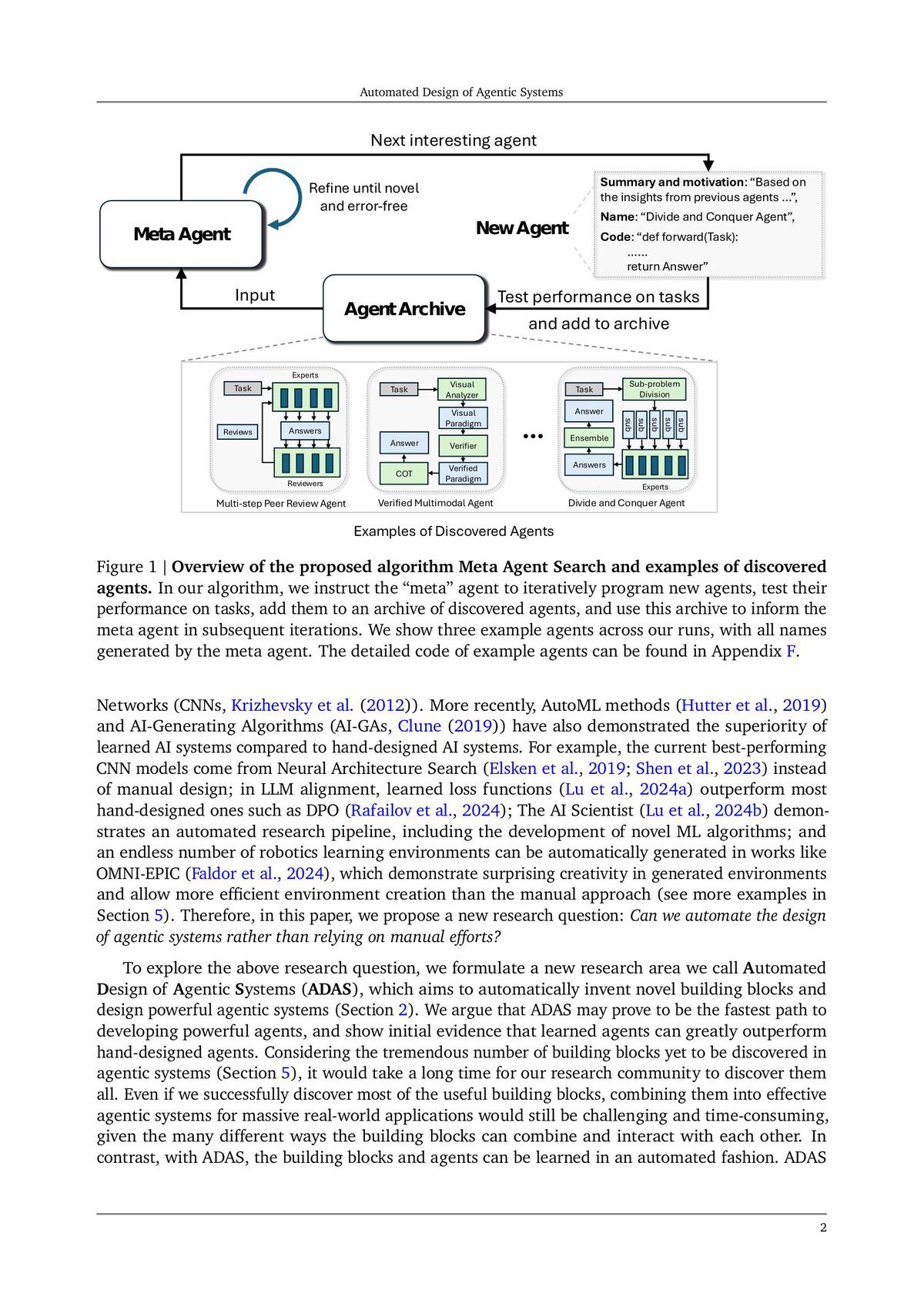

Strategy 4: AI-Enhanced Systems

AI systems leverage neural networks and machine learning for predictive analytics. They adapt dynamically to market conditions.

- Advantages: High adaptability, improved decision-making in volatile markets.

- Disadvantages: High development cost, requires quality data for training.

Comparison of Strategies

| Strategy | Best For | Pros | Cons |

|---|---|---|---|

| Trend-Following | Medium/long-term traders | Simplicity, scalability | Struggles in flat markets |

| Mean-Reversion | Short-term traders | Profits in ranges | Loses heavily in strong trends |

| Arbitrage | Institutions & pros | Low risk, consistent | High capital requirement, execution risk |

| AI-Enhanced Systems | Advanced developers | Adaptive, innovative | Expensive, data-intensive |

For retail traders, a hybrid of trend-following and mean-reversion often balances opportunity and risk. Institutional players usually lean toward arbitrage and AI-driven approaches.

Risk Management in Automated Margin Trading

Automated systems are powerful but must be controlled with robust risk protocols:

- Leverage Limits: Avoid over-leverage; 3x–5x is safer for most systems.

- Stop-Loss Automation: Mandatory to prevent catastrophic liquidation.

- Position Sizing: Allocate smaller portions of capital to each trade.

- Diversification: Run multiple strategies across assets to spread risk.

Understanding how margin affects perpetual futures trading is crucial here. Since margin amplifies both gains and losses, automation should focus on preserving account equity first, profits second.

Industry Trends in Automated Margin Trading

- Rise of AI Bots: Systems are increasingly using reinforcement learning to adapt to new conditions.

- Integration with DeFi: Decentralized exchanges are building margin-enabled smart contracts.

- Regulatory Oversight: More jurisdictions are requiring disclosures on algorithmic trading risks.

- Cloud-Based Trading Systems: Traders now run bots on cloud servers for uninterrupted performance.

These trends point toward greater accessibility but also higher complexity, requiring continuous education.

Practical Example of Automated Margin Trading

Imagine a trader using a trend-following bot on ETH perpetual futures:

- Initial Setup: Bot goes long ETH when the 50-day MA crosses above the 200-day MA.

- Margin Settings: Uses 3x leverage, with a stop-loss at -5%.

- Risk Management: Bot reduces exposure if unrealized losses exceed 10% of account equity.

Over time, this setup captures major ETH rallies while cutting losses quickly during downturns.

Automated trading systems manage data, risk, and execution seamlessly through APIs.

Related Learning Resources

For those asking how to minimize margin risks in perpetual futures, the key lies in strict automation of risk controls—stop-losses, leverage limits, and margin alerts.

If you’re wondering where to find margin requirements for perpetual futures, most exchanges provide detailed documentation in their support sections. Binance, Bybit, and OKX even offer margin calculators for estimating liquidation prices.

FAQ: Automated Margin Trading Systems

1. Can beginners use automated margin systems?

Yes, but with caution. Beginners should start with demo accounts or small allocations. Pre-built bots with simple strategies (like moving average crossovers) are safer than building complex AI systems without experience.

2. Do automated systems guarantee profits?

No. Automation ensures execution discipline but cannot eliminate market risks. Backtesting and forward-testing are essential to validate strategies before committing significant capital.

3. What are the biggest risks in automated margin trading?

- System bugs or API failures.

- Over-optimization (curve-fitting to past data).

- Excessive leverage leading to liquidation.

A robust monitoring system is necessary even with automation in place.

Conclusion

This guide to automated margin trading systems highlights their purpose: to provide speed, discipline, and risk management in leveraged trading. While strategies vary—from trend-following to AI-enhanced bots—the key lies in aligning automation with sound margin control.

Retail traders can benefit from hybrid strategies and strict stop-loss automation, while institutions may leverage arbitrage and AI-driven systems. As markets evolve, automation will only grow in importance.

If you found this article valuable, share it with fellow traders and leave your thoughts below—what automated strategies have you used, and how have they performed?

Modern algorithmic interfaces provide real-time monitoring of margin and risk exposure.