======================================

In modern financial markets, spread analysis plays a critical role in evaluating trading opportunities, assessing risks, and optimizing execution costs. Whether you are trading equities, forex, crypto, or derivatives like futures and options, understanding spreads can significantly influence profitability. This comprehensive guide to spread analysis will explore fundamental concepts, advanced methods, and practical applications for traders at all levels.

What is Spread Analysis?

Spread refers to the difference between two prices, rates, or yields. In trading, it is most commonly associated with:

- Bid-Ask Spread: The difference between the price at which you can sell (bid) and buy (ask).

- Yield Spread: The difference between yields of two bonds, typically with different maturities or credit ratings.

- Calendar or Inter-Commodity Spread: The price difference between two related contracts (e.g., futures with different expiry dates).

Spread analysis involves studying these differences to detect inefficiencies, identify arbitrage opportunities, or optimize trade entries and exits.

Importance of Spread in Trading

Understanding and managing spreads is essential because spreads directly affect trading costs and profitability.

- Cost of Execution: A wider spread increases the cost of entering and exiting a position.

- Market Liquidity: Tight spreads usually indicate high liquidity, while wide spreads suggest low liquidity.

- Risk Assessment: Spread analysis helps in identifying risks such as credit risk in bond trading or volatility risk in options.

For instance, knowing how does spread affect perpetual futures can help crypto traders avoid hidden costs during high-volatility events.

Types of Spread Analysis in Different Markets

1. Bid-Ask Spread Analysis

Bid-ask spreads vary by asset class, liquidity, and market conditions. Traders analyze spreads to determine:

- Market depth

- Trading costs

- Short-term supply-demand imbalances

2. Yield Spread Analysis

Bond investors use yield spread analysis to measure credit risk, duration risk, and macroeconomic expectations. For example, the spread between corporate bonds and Treasuries often reflects investor confidence in the economy.

3. Futures Spread Trading

In futures markets, traders analyze spreads between contracts of different maturities or related commodities. This allows hedging, arbitrage, and speculation strategies.

4. Crypto Market Spread Analysis

Crypto traders face unique challenges due to fragmented liquidity. Comparing spreads across multiple exchanges provides opportunities for arbitrage and cost reduction.

Methods of Spread Analysis

Quantitative Models

- Statistical Arbitrage: Uses historical data to model expected spread behavior and trade deviations.

- Correlation and Cointegration Tests: Identify pairs of assets with historically stable relationships.

- Volatility-Adjusted Spread Models: Incorporate market volatility into spread forecasts.

Visual Tools

- Heatmaps: Show spread dynamics across exchanges or instruments.

- Time-Series Charts: Track spread movements for pattern recognition.

- Order Book Analysis: Helps in identifying temporary spread widening opportunities.

Two Key Spread Analysis Strategies

1. Calendar Spread Trading

Calendar spreads involve buying and selling futures contracts with different expiry dates. Traders profit from the difference in time-value decay and volatility expectations.

- Advantages: Lower directional risk, useful for hedging.

- Disadvantages: Sensitive to unexpected volatility and margin requirements.

2. Inter-Market Spread Trading

This involves trading two correlated assets (e.g., crude oil vs. heating oil futures). Traders benefit from price divergence and convergence.

- Advantages: Diversifies exposure, reduces outright directional risk.

- Disadvantages: Requires advanced correlation analysis and may suffer during structural shifts in markets.

Best Approach: A hybrid method combining calendar and inter-market spread strategies allows flexibility, improved hedging, and risk-adjusted returns.

Factors Influencing Spread Dynamics

- Liquidity: High-volume assets have tighter spreads.

- Volatility: Market uncertainty widens spreads.

- Trading Venue: Different platforms may offer varying spreads due to execution quality.

- Regulations: Market structure and regulations impact spread efficiency.

Knowing where to find best spread rates becomes crucial for minimizing trading costs, especially for day traders and high-frequency traders.

Advanced Applications of Spread Analysis

- Hedge Funds: Use spread analysis for statistical arbitrage and cross-asset relative value trades.

- Institutional Investors: Focus on yield spreads for credit risk management.

- Retail Traders: Apply spread monitoring for risk management and cost efficiency.

- High-Frequency Traders: Use microsecond-level spread dynamics to capture fleeting inefficiencies.

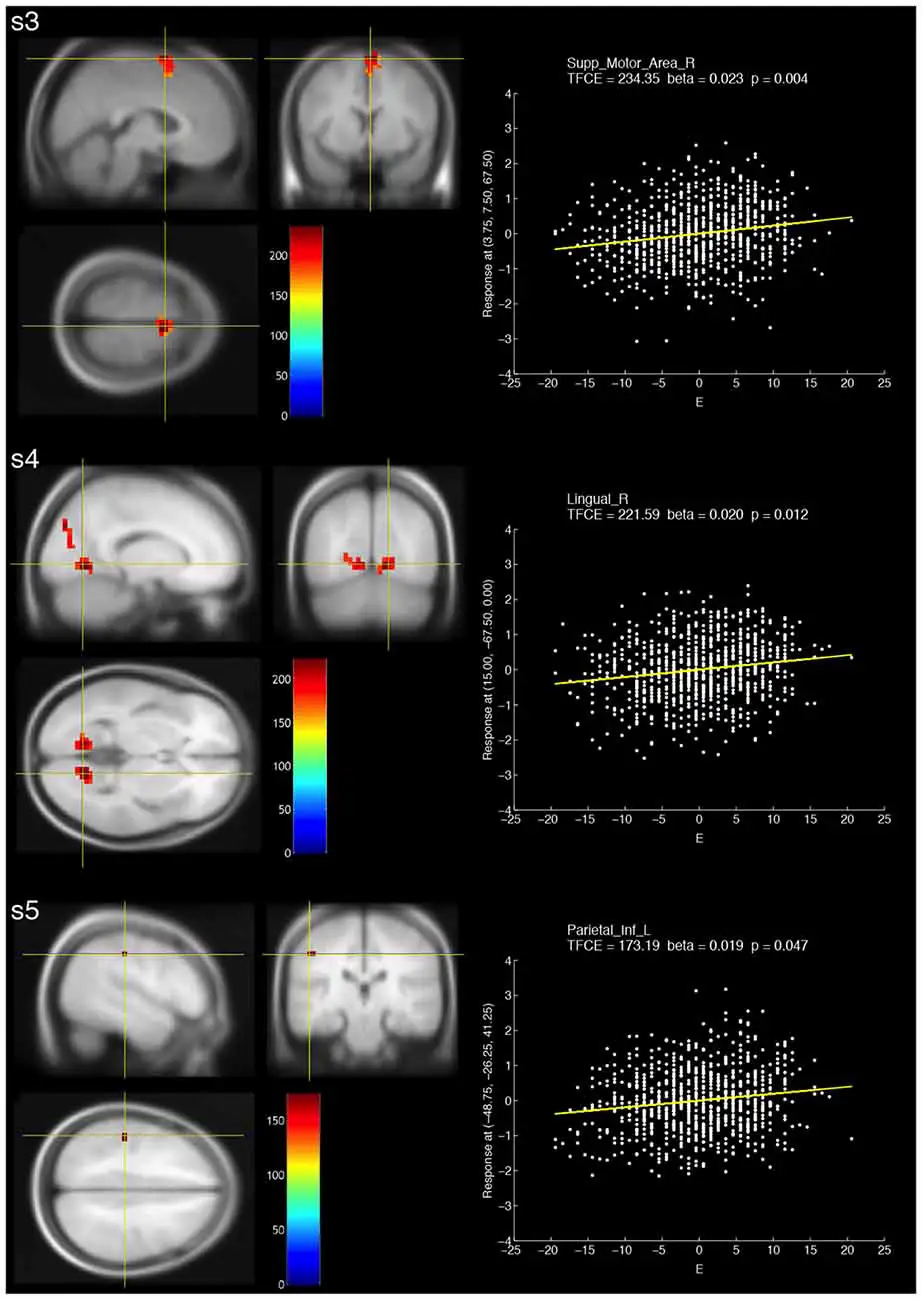

Visual Example of Spread Analysis

Spread dynamics in futures markets

FAQ: Spread Analysis in Trading

1. Why is spread important in trading?

Spread directly impacts transaction costs and profitability. A trader paying a wide spread consistently will lose more over time compared to a trader focusing on tight spreads. It also signals liquidity conditions and market efficiency.

2. How can traders lower spread costs?

Traders can reduce spread costs by trading during high-liquidity hours, using limit orders, and selecting exchanges with competitive fee structures. Leveraging data from multiple venues also helps in finding tighter spreads.

3. What factors influence spreads the most?

The primary factors are liquidity, volatility, and market microstructure. For instance, during macroeconomic announcements, spreads often widen due to uncertainty. In contrast, liquid blue-chip stocks or major forex pairs usually maintain narrow spreads.

Conclusion

Spread analysis is not merely a technical exercise; it’s a fundamental skill for improving profitability and managing risks in trading. From bid-ask spreads in equities to yield spreads in bonds and arbitrage spreads in crypto, traders who master spread dynamics gain a significant edge.

If you found this comprehensive guide to spread analysis useful, share it with fellow traders, leave a comment with your own spread trading experiences, and let’s continue the discussion on optimizing strategies for different markets.

Would you like me to also create a visual spread calculator template (Excel/Google Sheets) so readers can practice real-world spread analysis directly?